Exemptions provided in the income tax act & rules are availed by most salaried employees. The HRA is one such common exemption used by many of them. However, the difference in the exemption based on an archaic rule is negatively affecting salaried employees residing in cities like Bengaluru & Hyderabad. Here is how.

The Union Budget for 2021-22 was presented in the Parliament on 01 February 2020. Among other things, one of the important aspects that most people look forward to during the budget is changes to income tax slabs, relevant deductions & rules.

In the budget for 2021-22, the finance minister has not proposed any major changes to the income tax slabs, rates, deductions and exemptions. This is in contrast to a major change introduced in the 2020-21 budget. Effective from the beginning of 2020-21, an individual was required to make a choice between the new and old tax regime. The new tax regime introduced in the 2020-21 budget had reduced tax rates for those who are willing to forego various tax exemptions and deductions.

House Rent Allowance (HRA), Leave Travel Allowance (LTA), Standard Deductions, Deductions under Section 80C & 80D are among the exemptions & deductions that are commonly availed under the older tax regime.

Both the regimes were allowed to co-exist with the taxpayer given the choice to opt for one of them.

The extent of taxpayers who have opted for the new tax regime foregoing the exemptions/deductions will be only be known once the returns for 2020-21 are filed. However, exemptions & deductions have been a staple in providing tax relief to the taxpayers.

Over the years, changes have been made to the rules governing few of these exemptions, while there are others which have not been changed in a long time. One such tax exemption is House Rent Allowance (HRA).

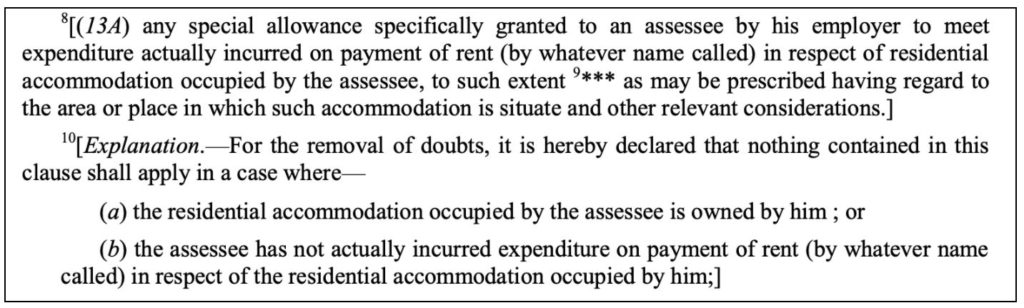

The provisions relating to HRA date back to Income Tax Act, 1961

The income tax Act -1961 came into force from 01 April 1962. Section 10 (13A) of the Income Tax Act-1961 lays down the provision for HRA and was introduced in 1964.

It refers to the allowance that is granted by the employer to the employee to meet the expenditure incurred towards the rent of a residential accommodation.

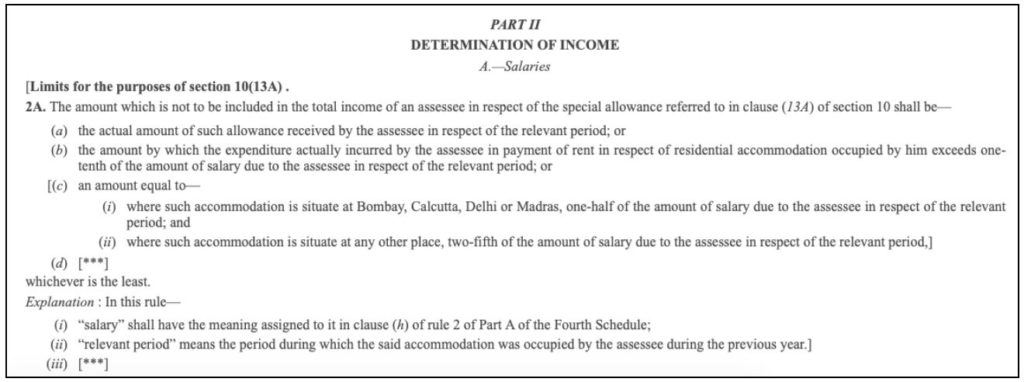

Rule 2A of Income Tax rules, further lays down the criteria to determine the extent of the amount not to be included in the taxable income i.e., exemption. Three criteria are laid down for the purpose of this calculation.

- Actual Rent paid minus 10% of Salary (basic + DA)

- Actual HRA offered by the employer

- Amount based on location of residential accommodation for which HRA is being claimed

The least value among the three criteria is considered for HRA exemption. For the location of the residential accommodation, there is a classification made as following.

- For accommodation situated in Bombay, Calcutta, Delhi and Madras- one half (50%) of the salary (basic + DA) due to the employee can be considered as HRA.

- For accommodation situated in any other place – the HRA can be 40% of the salary (basic + DA)

As per tax experts, the rationale for this classification is based on the cost-of-living expenditure when this provision was introduced. The four cities were the largest cities in India during 1960s. Although not highlighted in any official document, these four cities are referred to as ‘Metro’ cities in common parlance and the other cities are referred to as ‘Non-Metro’.

Residents staying in other cities losing out on additional HRA exemption

As per the 2011 Census, two of these four cities are not among the largest 4 cities in terms of population if the population within the municipal corporations is considered. While Mumbai and Delhi have the highest population in the country, they are followed by Bengaluru and Hyderabad. Chennai and Kolkata take up 6th and 7th places respectively following Ahmedabad at 5th place in terms of the population within the municipal corporation limits. If the population within the ‘Urban Agglomeration’ (UA) is considered, then the four metros occupy the first four positions followed by Bengaluru & Hyderabad. What is clear from this data is that India now has cities other than the four metros, which are similar to them in terms of the size of the population as well as economy.

If the size of population in a city was considered as the basis for categorization when these rules were made, questions do raise on the rationale of continuing with the same cities as a different category even after 2011 census when many more cities have comparable population.

The difference in HRA exemption (10% of the salary) between these two categories of cities makes a strong case for inclusion of other cities also in the 50 % HRA exemption category. The benefits accruing from HRA exemption are more visible for higher salaried employees, who might be living in a rental accommodation with higher rent.

Example:

Let’s consider a hypothetical situation, of two employees – Employee A residing in Mumbai & Employee B Residing in Bengaluru. For sake of comparison, the compensation Package and Rent is same for both. The details are as given below.

Salary (Basic + DA) – Rs.1,20,000 per month

HRA paid by employer – Rs. 55,000 per month

Actual Rent Paid – Rs. 65,000 per month

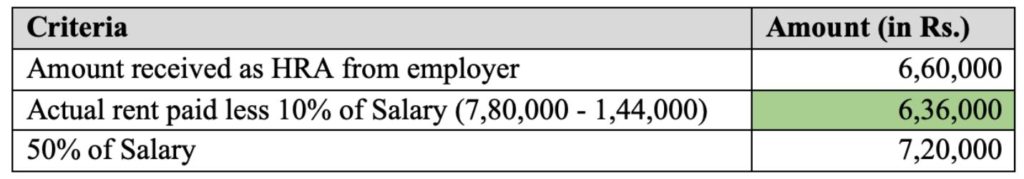

Scenario 1 – Employee A in Mumbai

The least of the three i.e. (Actual rent paid – 10 % of Salary) is considered for HRA exemption

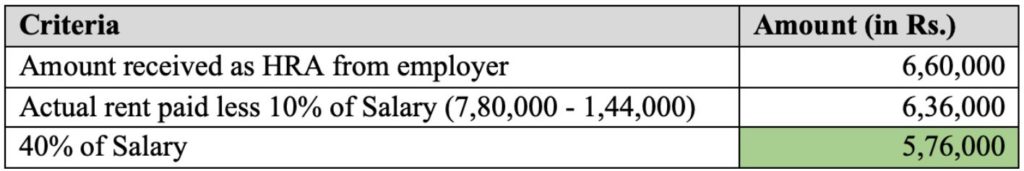

Scenario 2 – Employee B in Bengaluru

The least of the three i.e., 40% of Basic Salary is considered.

As we can see, ‘Employee B’ based in Bengaluru is eligible for a lesser exemption amount under HRA, which means he ends up paying more tax. He ends up paying more despite receiving the same salary only because he is not residing in one of the four metro cities.

Need to revisit the exemption criteria in line with current size of the cities

While a case could be made that higher salaried employees usually own a house, there could be instances where such persons migrate because of jobs and not necessarily own accommodation in the city of work.

This is truer of employees in cities like Bengaluru & Hyderabad, which have a large influx of the population over the past two decades owing to their place as the major centres for the IT & ITES industry.

One of the tax experts that we spoke to highlighted that the four cities considered as metros in the 1960s were the hubs of employment for – government jobs, banking sector, manufacturing sector, etc. These were among the higher-paying jobs in those times and a 50% of salary as HRA exemption benefited them.

However, over the last two decades, the profile of high salary employees has changed and many of them are IT & ITES sector employees. They are mostly concentrated in & around IT hubs like – Bengaluru, Hyderabad, Pune, Noida, Gurgaon etc.

A starker case can be made while comparing Delhi & Noida/Gurgaon. Although the three places are geographically close to each other, and many of the employees commute between the three cities i.e., there could be scenarios where two employees working for the same organization, one resides within the limits of Delhi and another in Noida (NCR). The employee residing in Delhi is eligible for 50% of salary as HRA exemption, while the one in Noida isn’t.

These anomalies have been highlighted by civil society on various forums. We were able to identify petitions on Change.org to this effect.

Tax experts that we spoke to felt that HRA is one of the aspects that need to be looked at in line with the current size of the cities & their economies. This is one of the many aspects of direct tax reforms required in the country.

Featured Image: Income tax act effect on effects salaried employees in cities