Every year after budget, complaints of favouritism to certain states either poll-bound or otherwise are common. However, there is no way to ascertain the truthfulness of these complaints since granular data on all Central transfers to States is not readily available in the public domain

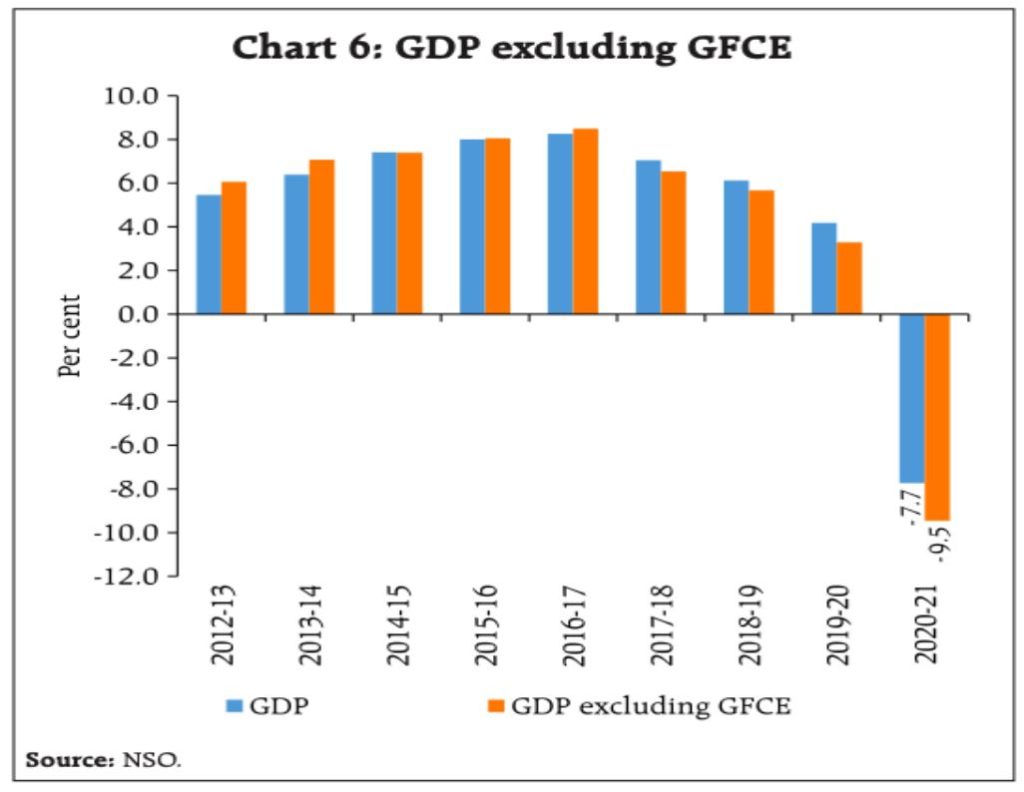

In its monthly bulletin for January 2021, the RBI estimates that India’s GDP for 2020-21 would contract by 7.7%. This is based on the NSO’s early estimates of the Indian economy. Earlier, in the “Nowcast” Report in November 2020, the RBI stated that India might have entered into a technical recession on the back of contraction in the economy in two successive quarters. These estimates offer a reflection on the current state of the Indian economy and the influence of the COVID-19 situation.

A contracting economy means a strain on the government resources due to the fall tax collections & revenue through other sources. This is true both in the case of centre as well as respective state governments who also face the prospect of a fall in tax revenues.

The shortfall in centre’s revenues can be further ascertained in its inability to pay GST compensation due to the states. Earlier, the centre has proposed that the states borrow from RBI to compensate for the loss in GST revenue. However, after opposition from a few of the States, the central government has changed its stand and has now proposed to borrow from RBI on behalf of the states.

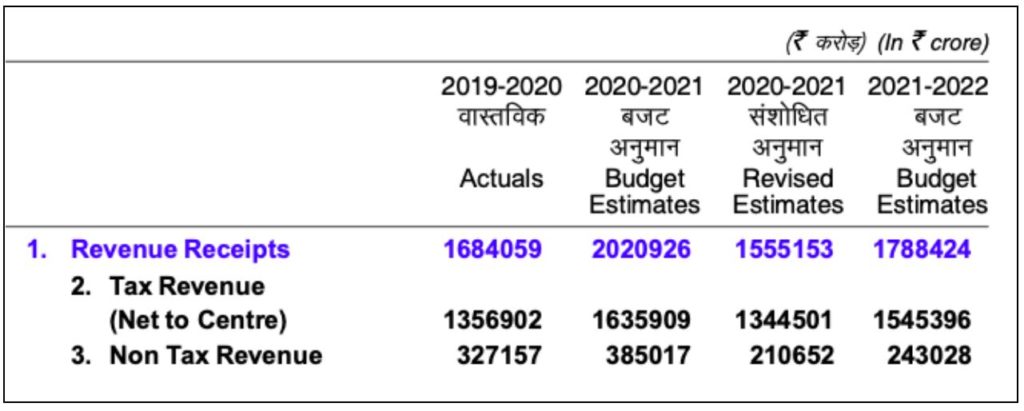

In the recently presented budget for 2021-22, the revised estimates for revenue receipts for 2020-21 was reduced to Rs. 15.55 lakh crores compared to the budget estimates of Rs. 20.2 lakh crores. Even the budget estimated for revenue receipts for 2021-22 is a more pragmatic Rs. 17.88 lakh crores, indicating that the government does not expect normal growth even in 2021-22. The budget estimates of revenue receipts in 2021-22 are just 6% more than the actual receipts in 2019-20, 3% less than the revised estimates of 2019-20, and about 10% less than the budget estimates of 2020-21

The actual revenue receipts for 2019-20 were Rs.16.84 lakh crores, about 9% less than the revised estimates of Rs.18.5 lakh crores, indicating a shortfall in revenues even before the COVID-19 pandemic took a toll.

Revised Estimates indicate an increase in Central Expenditure

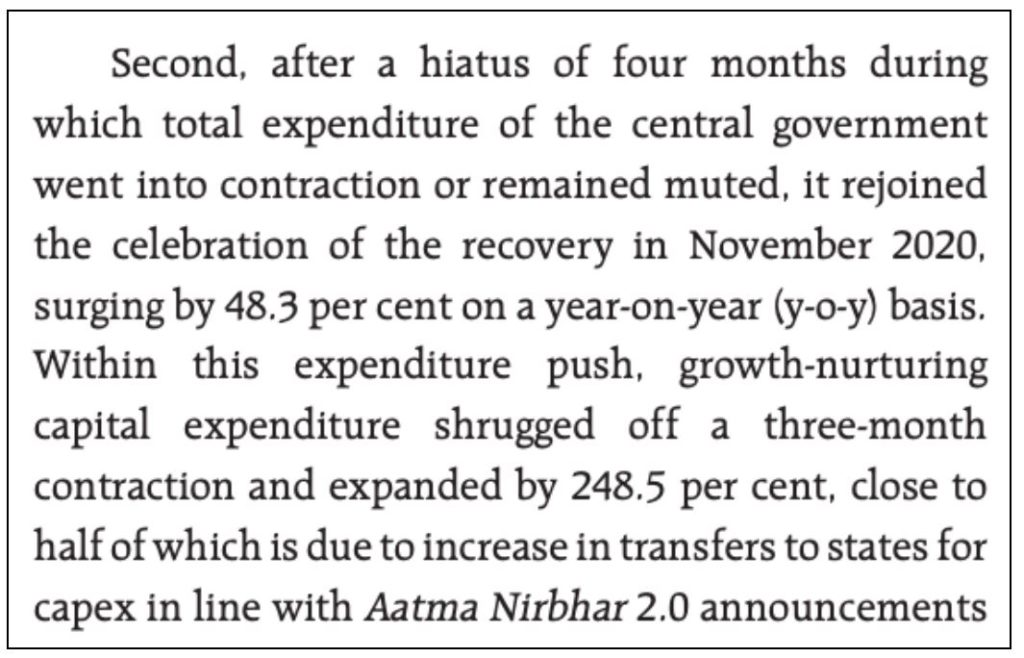

In the January 2021 monthly bulletin, the RBI also noted that after four months of contraction, there has been a surge in the Central Government’s spending in November 2020. It further highlights close to half of the capital expenditure is due to the announcements made under Aatma Nirbhar 2.0.

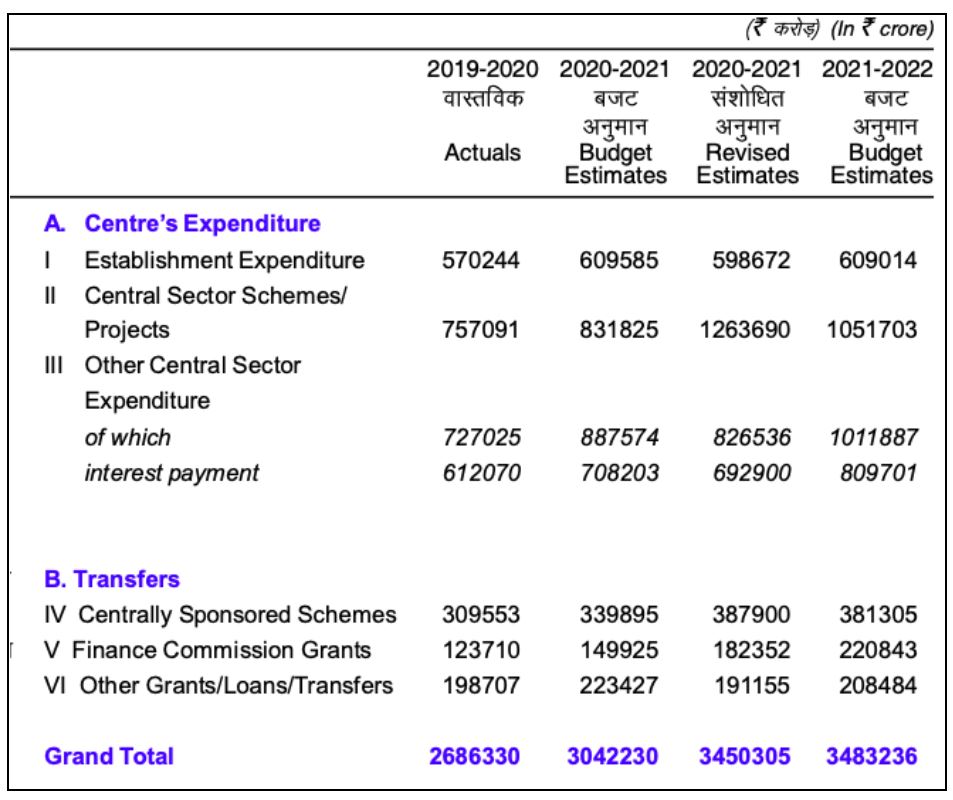

In the latest 2021-22 budget, the revised estimates for central expenditure for 2020-21 is pegged at Rs. 34.5 lakh crores, higher than the earlier budget estimates of Rs. 30.42 lakh crores. The budget estimates for 2021-22 at Rs. 34.83 lakh crores. is slightly higher than the revised estimates for 2020-21.

The major reason for the increase in revised estimates of 2020-21 compared to budget estimates is the substantial increase in the expenditure for Central Sector Schemes/Projects. The budget estimates for central sector schemes expenditure in 2021-22 is pegged at Rs.10.5 lakh crores, lower than the revised estimates for 2020-21. However, there could be an increase in this if things do not improve as anticipated, considering the fact that the Central government has announced another COVID-19 stimulus package in November 2020 i.e. Aatma Nirbhar Bharat 3.0 which included the launch of new schemes, extended support to existing ones, etc.

The actual extent of relief & fiscal burden on the centre yet to be ascertained. On the other hand, there have been apprehensions on equitable distribution of centre’s relief to states in the past where states had issues with the central government regarding the allocation and receipt of funds. Recent recommendations of the 15th Finance Commission, wherein there is a fall in the share in central taxes for four of the five Southern states add credence to such apprehensions since states are increasingly reliant on tax devolution & other central funding after the advent of GST.

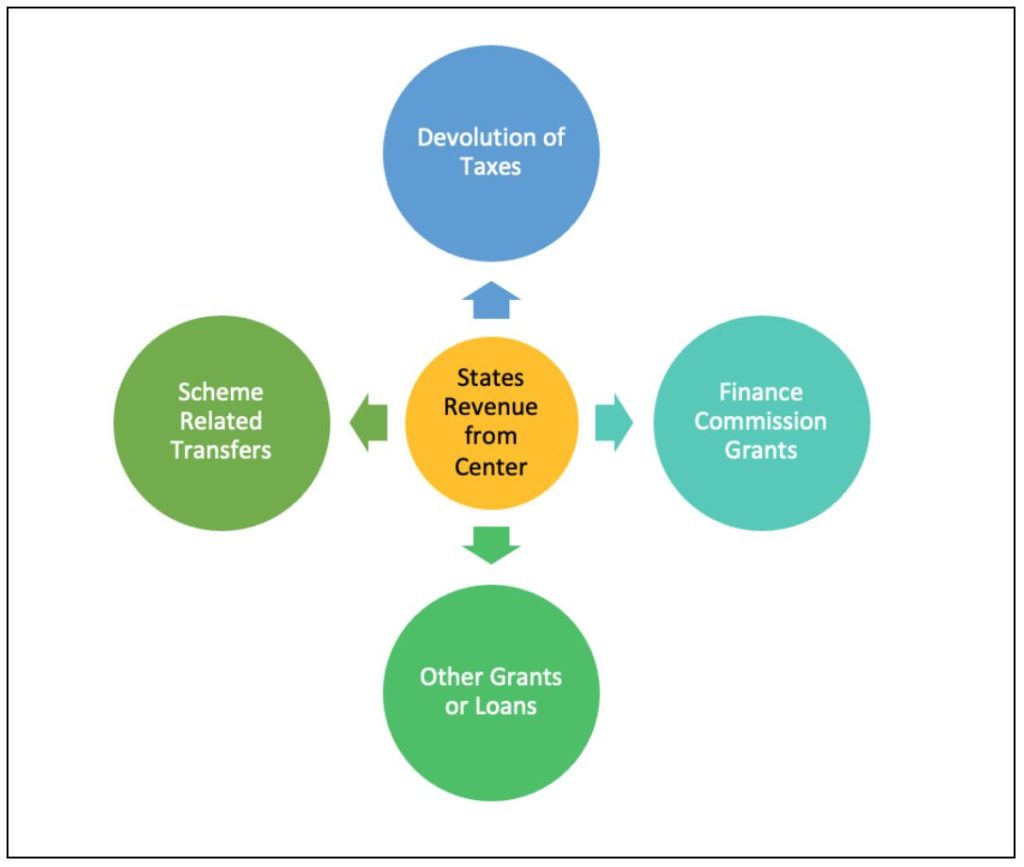

States receives funds from Centre through multiple means

Apart from State’s Own Tax Revenue (SOTR) and the various borrowings, a major portion of states’ revenue is received from the centre. The funds received from the centre is through various means.

- Devolution of Taxes i.e., States share of taxes in the overall tax revenue

- Scheme Related Transfer: For the Centrally Sponsored Schemes

- Finance Commission Grants: Transfers to the States (like local bodies, SDRF, etc.) based on Finance Commission recommendations.

- Other transfers including various grants & loans

The 15th Finance Commission has recommended devolution of 41% from the divisible pool to states. The Central government makes provisions in the budget for the amount to be transferred to the states as part of devolution, but the actual transfer is based on the extent of tax collected. A shortfall in the tax collection would result in a fall in the actual amount received by the states through devolution as witnessed in 2020-21.

Based on Finance Commission recommendations, the Centre also transfers to the States various grants such as the Revenue deficit Grants, Sectoral grants, incentives, etc. These grants form part of the Union Budget.

Apart from these, there is another key component of the Centre’s transfer to States i.e., transfers for the Centrally Sponsored Schemes. These schemes are part of the support extended by the Central Government for the implementation of the central schemes at the state level. As per 2021-22 budget estimates, the expenditure on Central Sponsored Schemes is around 9% of the total central expenditure.

The assistance extended by the Centre could be in the form of – different grants through various schemes to departments at the state level, benefits to beneficiaries under various centrally sponsored schemes & benefits to beneficiaries under various central schemes.

The transfer to the beneficiaries can be through (i) direct transfer by the Centre (ii) transfer to the state treasury who then spends it on the scheme. For instance, in a scheme like PM-KISAN, the assistance is directly transferred to the beneficiary whereas, in few other schemes, the amount is transferred to the state for implementation of the scheme. In a few other cases, the states add their share to the central transfer before spending.

Non-Availability of granular Data in the Public Domain

One of the major apprehensions raised by various quarters regarding the Centre’s transfer of funds is that are disparities in central transfers to states barring the tax devolution. There have been complaints both in the past & present about preferential treatment to states where the same party is in power as in the centre. There have also been complaints about greater allocation to poll-bound states. Few reports also indicate the recent budget of 2021-22 is focused on poll-bound states, conforming to such apprehensions about central fund allocation. However, the true picture cannot be ascertained unless the data regarding all types of central transfers to states is analysed.

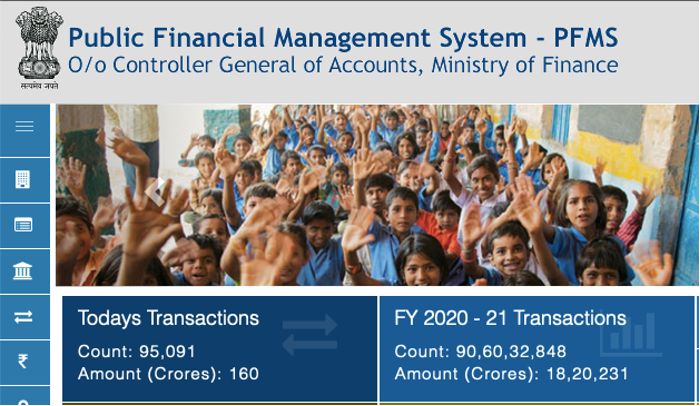

The major challenge for any such analysis is the lack of availability of this data in the public domain. The PFMS (Public Finance Management System), through which all central transfers, other than tax devolution takes place does not provide any such data state-wise and scheme-wise. The PFMS is an online system that was developed with the objective of tracking funds released by the Government of India for all the Schemes and real-time reporting of expenditure at all levels of programme implementation. All the direct payments to the beneficiaries under all the schemes are recorded in this database. However, in spite of such a mechanism being in place, the data & information is not made public except the total figure of transfers & transactions. Such lack of data limits the ability to carry out any meaningful analysis of central transfers to states.

We reached out to the Ministry of Finance to understand the rationale for not making this information public. However, we have not received any response as yet.

Using the Right to Information (RTI), Factly was able to obtain information regarding the transfer of funds by the centre to the states through various schemes over the last few years. We are launching a weekly series in the coming days that contains the analysis of this data ministry wise.