The 15th Finance Commission submitted an interim report with its recommendations for devolution of the tax revenue for 2020-21. Since the criteria adopted by the 15th FC are significantly different from the earlier commissions, which of the states gain and which ones lose out? Here is an explainer.

The first report of the Fifteenth Finance Commission (15th FC) was tabled in the parliament on 01 February 2020. This report for the financial year 2020-21 was submitted to the President of India on 05 December 2019.

This is an interim report and contains the recommendations only for 2020-21. The final report of the 15th Finance Commission, that will make recommendations for devolution of tax revenue for the next five years, is expected to be submitted in October 2020. In her 2020-21 Budget speech, Union Finance Minister, Nirmala Seetharaman stated that the central government has accepted the recommendations of the first report in “substantial measure”.

This story explores the recommendations of the finance commission, especially the devolution of funds to the states for 2020-21.

What is the role of the Finance Commission?

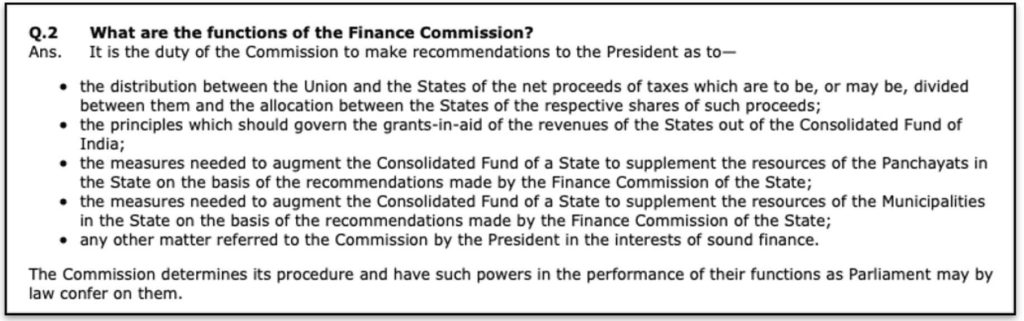

Article 280 of the Constitution requires the President to constitute a Finance Commission, whose main purpose is to make recommendations on the distribution of tax revenue between the Union and the States, and among the states as well. The functions of the Finance commission include:

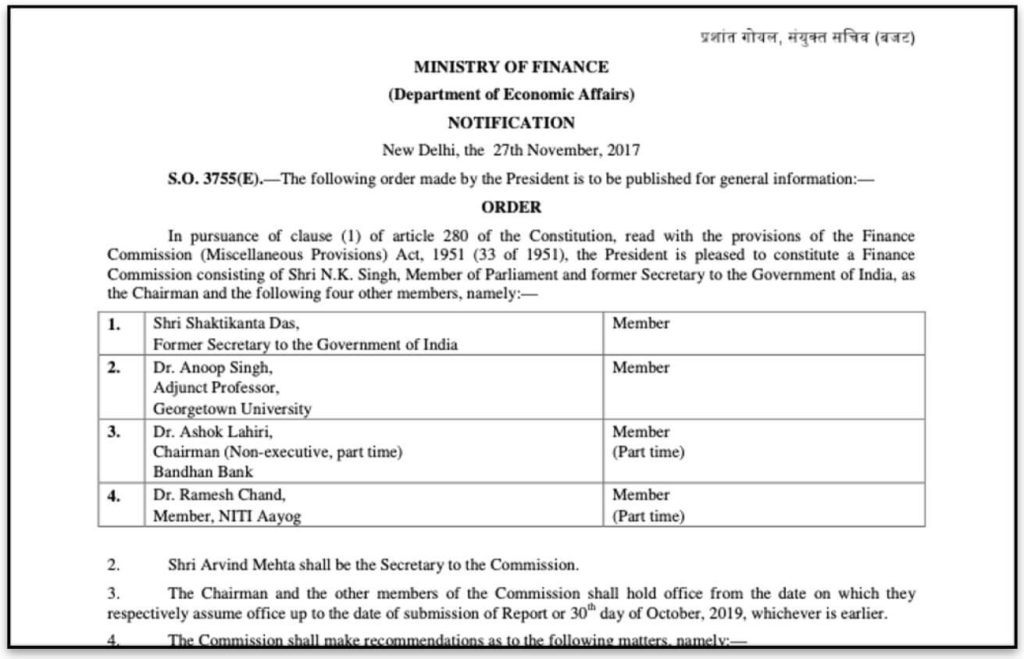

The Fifteenth Finance Commission was constituted on 27 November 2017, by an order of the President, with N.K. Singh as the chairman of the commission.

15th FC – Significant changes to the made to the Criteria

The 14th Finance Commission (14th FC), whose recommendations were the basis for devolution for the period 2015-20, recommended that 42% share of the divisible pool of central taxes for the states. This was a 10% increase compared to the earlier share of 32%.

Based on the terms of reference, substantial changes were made to the criteria adopted and their respective weightage by the 15th FC.

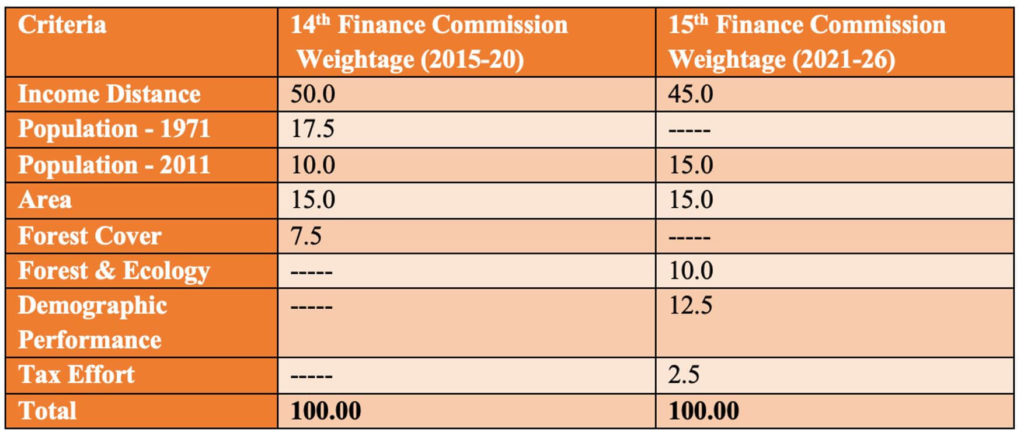

- There is a change in the criteria adopted by the 15th FC to determine the share of each state in the Central Taxes. Earlier there were 5 criteria, each of which had a different weightage- Income Distance (50%), Population from 1971 Census (17.5%), Population from 2011 Census (10%), Area (15%) & Forest Cover (7.5%).

- The 15th FC adopted 6 criteria in three broad categories – Need-Based (Population, Area, Forest & Ecology), Equity-Based (Income Distance), Performance-based (Demographic Performance, Tax Effort).

- A major change is that only the population figures from 2011 census are being considered by the 15th FC, unlike during the previous commissions where the data from 1971 Census and 2011 Census were both considered with varying weightage.

- The criterion of ‘Forest Cover’ is replaced by three new criteria– Forest & Ecology, Demographic Performance, Tax Effort.

- Weightage of ‘Income Distance’ is reduced from 50% to 45%. This criterion measures the distance of a particular state’s income with that of the state with the highest income. States with higher income distance are given preference in order to bring them on parity.

- Forest & Ecology is given 10% weightage by the 15th FC. The score for each state is derived by calculating the share of the dense forest of each state in the aggregate dense forest of all the states.

- The performance of states in population control is rewarded by the inclusion of Demographic Performance as a criterion (with 12.5% weightage). States with lower fertility rates are given a higher score.

- 2.5% weightage is provided for ‘Tax Effort’ in recognition of states efforts in effective tax collection.

The 15th FC recommended devolution of 41% from the divisible pool to the states. The difference of 1% is due to bifurcation of the state of Jammu and Kashmir into the Union Territories of J&K and Ladakh.

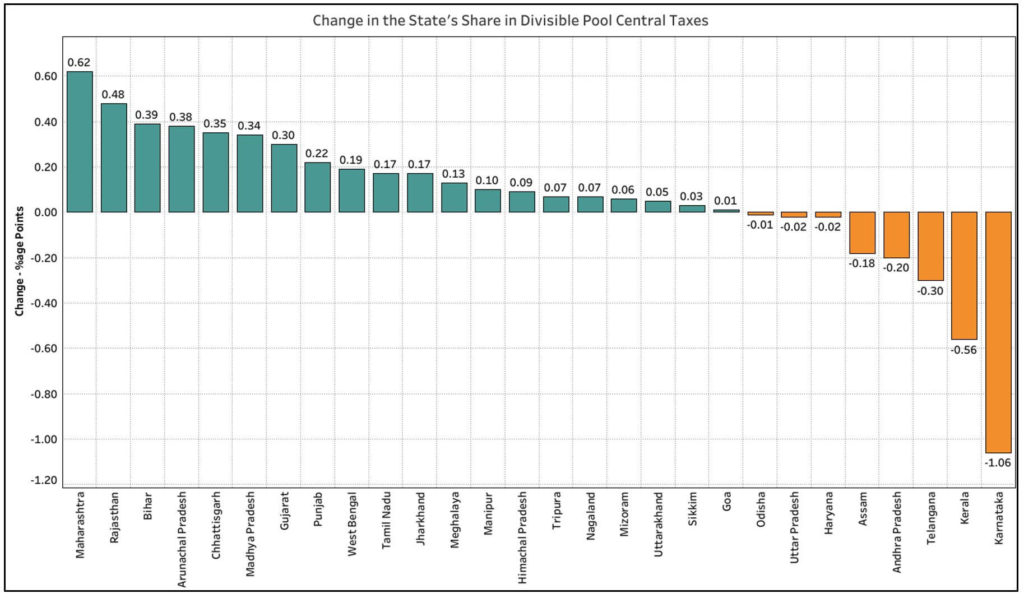

Karnataka, Kerala and Telangana see a reduction in their share

Out of the total divisible pool of Central taxes, Uttar Pradesh continues to have the highest share even as per the 15th FC. However, there is a marginal reduction in its overall share of the divisive pool of the taxes.

- During the 14th FC (2015-20), Uttar Pradesh’s share was 17.95%, whereas as for the year 2020-21, Finance commission has recommended a share of 17.93%.

- Bihar which had the second-highest share, not only continues to be in that position but also saw an increase in its share to 10.6% compared to the earlier share of 9.67% i.e. an increase by 0.38%.

- Maharashtra and Rajasthan have a greater increase in share than that of Bihar. Maharashtra has 0.62% increase in its share with 6.14% of the divisive pool recommended for the state. Rajasthan with 0.48% increase now gets 5.98%.

- Chhattisgarh, Madhya Pradesh, West Bengal, Tamil Nadu, Jharkhand and Punjab are among the larger states which saw an increase in their share.

- Except for Assam, all the North-Eastern states witnessed a marginal increase in their share

- The greatest loss as per the interim report of 15th FC is in the case of Karnataka which is now slated to receive 3.65% of the divisive pool as opposed to 4.71% i.e. a reduction by 1.06%.

- Kerala and Telangana also witnessed a fall in their share by 0.56% and 0.3% respectively. Among the southern states, only Tamil Nadu saw an increase in its share, by 0.17%.

- Andhra Pradesh and Assam are set to see a reduction in their share by 0.2% and 0.18% respectively.

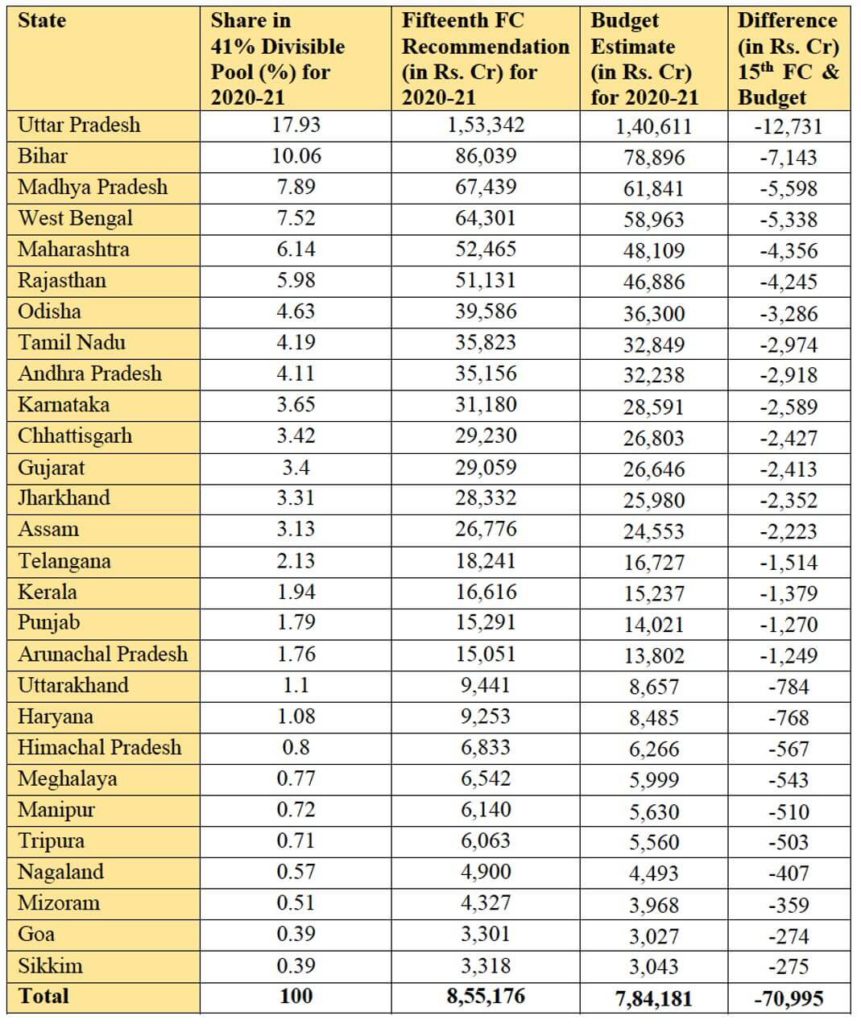

Budget allocation is Rs. 70000 crores less than 15th FC estimates

The 15th FC estimated a shortfall in the gross tax revenue compared to the budget estimates in July 2019. The initial assessment of the revenue for 2019-20 and 2020-21 was based on the provisional accounts of 2018-19, that amounted to Rs. 20.8 lakh crores. In view of the slowdown in sectors including automobiles, garments, construction etc. that contribute to GST, reduction in customs duty & excise collections, reduction in corporate tax collections etc. the 15th FC has reduced its estimate of gross tax revenue collection for 2019-20. The budget estimate was 24.64 lakh cores, but the 15th FC pegs it as Rs. 22.55 lakh crores.

Of this Gross Tax Revenue, few items such as – the cost of collection of taxes, cesses & surcharges, tax revenues of UTs, transfers to NDRF (National Disaster Response Fund) & NCCD (National Calamity Contingency Duty etc. are excluded from the divisible pool.

After these exclusions, the Finance Commission has pegged the amount available for the divisible pool at 82.2% of gross tax revenue which comes to Rs. 18.53 lakh crores for 2019-20 and Rs. 20.86 lakh crores for 2020-21.

With 41 % of the divisible pool recommended to be devolved to states, the total devolution amount to the states for 2020-21 is Rs. 8.55 lakh crores. As per the recommendations of the 15th FC, Uttar Pradesh is estimated to receive Rs. 1.53 lakh crores (17.93%) followed by Bihar which is slated to receive around Rs. 86 thousand crores.

Karnataka, Kerala and Telangana which are allocated a lesser share in lieu of the new criteria, would be receiving about Rs. 31 thousand crores, Rs. 16 thousand crores and Rs. 18 thousand crores respectively. The least amount of this divisible pool will go to Goa and Sikkim which is around Rs. 3.3 thousand crores each. Kerala would lose around Rs. 5000 crore and Telangana around Rs. 2500 crore because of the new allocation, compared to the 14th FC.

However, as per budget estimates for 2020-21, the total amount provided for devolution to states is only Rs. 7.84 lakh crores i.e. Rs. 70.9 thousand crores less than the total amount recommended by 15th FC based on its own estimates. This is due to less than estimated collection in taxes owing to the slowdown in the economy. In fact, the revised estimates of tax revenue in 2019-20 is almost 10% less than the budget estimates.

What about Grants-in Aid to states as per the 15th FC?

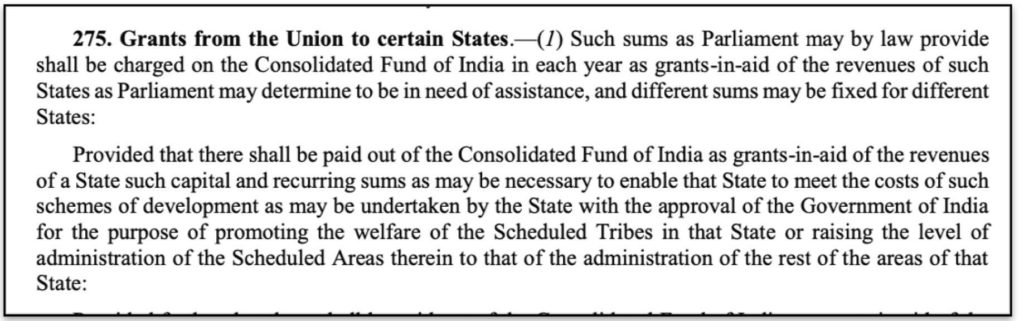

The Finance commission is also required to make recommendations regarding the principles which govern the grants-in-aid to states out of the Consolidated fund of India. This is as per Article 275 of the Constitution of India.

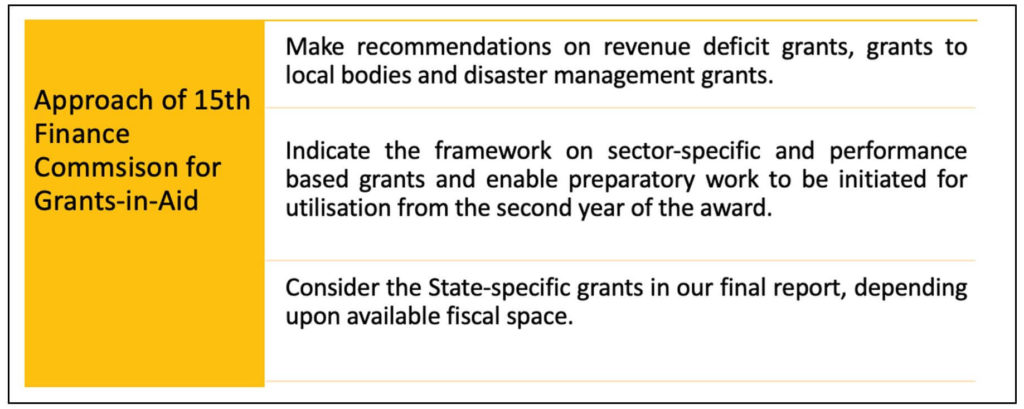

After consultations with the central and the state governments, the 15th FC decided to continue with the existing framework and legacy of the earlier Finance Commissions as far as Grants-in-Aid like Revenue deficit grants, local bodies grants and disaster management grants.

The approach of the Finance Commission in respect to grants is the following.

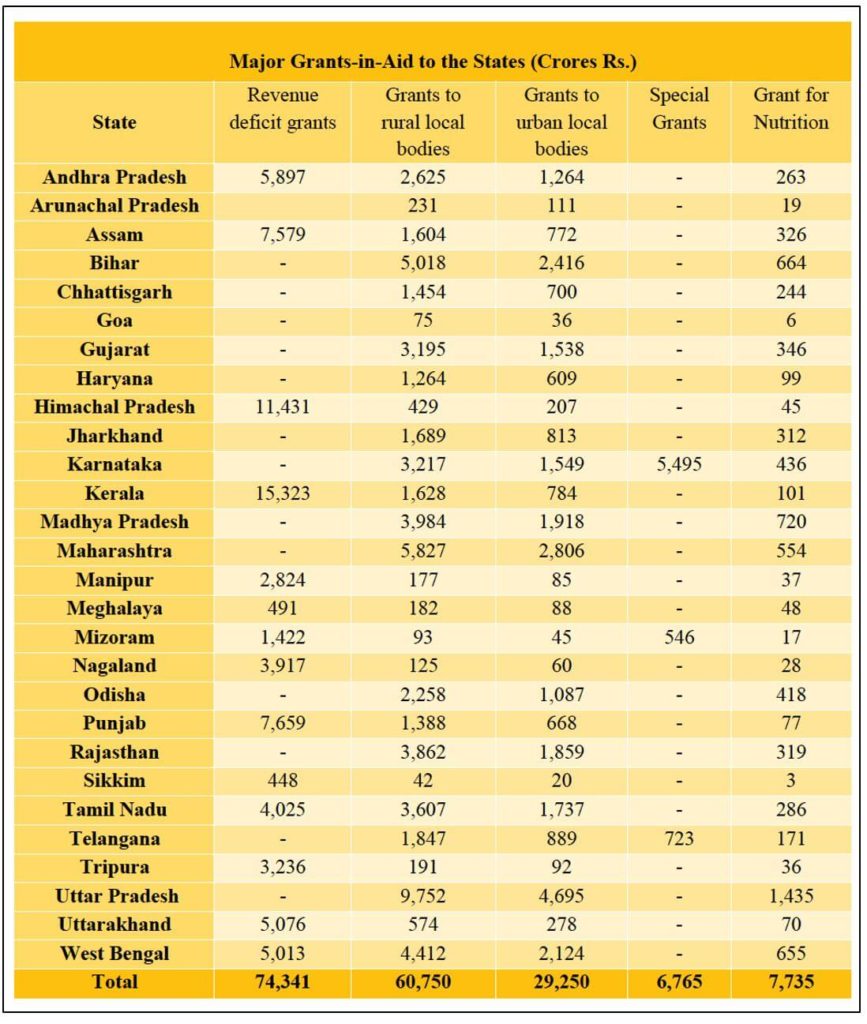

Revenue Deficit Grants, Grants to Local Rural and Urban bodies, Special Grants to few states (Karnataka, Telangana & Mizoram) , Grant for Nutrition across the states etc. were the major grants recommended by 15th FC in its report. Special grants were recommended for states losing out on account of the new tax devolution formula.

Around Rs. 74 thousand crores is recommended by Finance Commission to be provided as Revenue Deficit Grants for 14 states. A further Rs. 60 thousand crores as Grants to Rural Local Bodies and Rs. 29 thousand crores as grants to Urban Local bodies was recommended.

However, as per the estimates provided in the union budget for 2020-21, only Rs. 30 thousand crores were set aside as ‘Revenue Deficit Grants’. A total of around 99 thousand crores is provided as budget estimate towards Grants to local bodies, of which 69 thousand crores is for rural local bodies and 30 thousand crores is urban local bodies.

Area and Population are still the major drivers for the Tax devolution formula

Kerala (1.79), Andhra Pradesh (1.6), Karnataka (1.81), Tamil Nadu(1.58) and Telangana(1.67) are among the states which have a lower fertility rate and hence score better on the Demographic Performance criteria, scoring better than states like Bihar which has a high fertility rate of 2.93.

Since the 15th FC considered only the population of states as per 2011 census unlike the previous commissions which also considered the 1971 census, states that have controlled population lose out on this criterion. States like Uttar Pradesh, Bihar and West Bengal have large population compared to many other states and score high on this criterion. This couples with larger geographical area (U.P, Maharashtra) would mean that the score they achieve on these criteria would be more than what a state like Kerala which scores high on development- based criteria.

The larger Income Distance of under-developed states and the higher weightage implies that these states continue to get a higher share in the funds available for the states from the divisible pool.

Reducing the weightage given for Income Gap and introducing development-based criteria like demographic performance is a step in the right direction encouraging the good performance of the states.

The utilization of higher share by less-developed states to achieve various development targets should also be a primary driving force for future allocation. Target-based performance review of the states that receive higher funds to determine the future allocation of funds can be a way forward to balance the twin objectives of providing impetus as well as rewarding performance.

Featured Image: 15th Finance Commission

.