The last few years have seen many banks going bust. Is there any insurance cover for one’s deposits in banks? If yes, what is the amount? Here is a detailed explainer.

The Reserve Bank of India released a notice on 04 February 2020 stating that the Deposit Insurance and Credit Guarantee Corporation, abbreviated as DICGC, has raised the limit of insurance cover for depositors in insured banks from the current limit of ₹ 1 Lakh to ₹ 5 Lakh per depositor with effect from the same day.

Finance Minister Nirmala Sitharaman had proposed the same in her budget speech this year on 01 February 2020.

But what is DICGC? What is the insurance coverage on deposits offered by RBI?

What is DICGC?

Deposit Insurance and Credit Guarantee Corporation (DICGC) is a wholly owned subsidiary of Reserve Bank of India (RBI), which was set up to extend protection to those depositors who may lose their money when a bank fails and has no money to return to the depositors. DICGC was formed in July 1978 after merging Depositors Insurance Corporation (DIC) set up in 1968 and Credit Guarantee Corporation of India Ltd. (CGCI) set up in 1971. Deposit Insurance and Credit Guarantee Corporation Act of 1961 provided for establishing DICGC in order to insure deposits and guarantee credit facilities along with other matters.

All commercial banks including the branches of foreign banks in India, local area banks and regional rural banks, and co-operative banks are insured under DICGC. Savings, fixed, recurring, and current deposits are covered by DICGC. In fact, all deposits except that of foreign governments, central/state governments, and interbank deposits are covered by DICGC. Deposits of state land development banks with state co-operative banks are also not covered under the scheme. The scheme is mandatory for all banks and cannot be withdrawn.

Insurance limit has been extended to ₹ 5 Lakhs

Each depositor is covered for ₹ 5 Lakh including principal and interest. This amount was initially ₹ 1 Lakh and with effect from 04 February 2020, the limit was raised to ₹ 5 lakhs. This was notified by the RBI on the same day.

DICGC pays the amount to the liquidator who is responsible to pay the depositors. Based on the list of depositor wise claims submitted by the liquidator, DICGC scrutinizes the list and makes payment to the liquidator, who must then repay depositors. An individual or depositor can recover money only if the bank gets closed.

An individual who has deposited in a bank which has collapsed will be able to recover up to ₹ 5 Lakhs only even if they have more than ₹ 5 lakhs in the bank. This amount is calculated per depositor across all branches of the bank. Both individual and joint accounts are considered separate, thereby, insurance coverage is separate for both these accounts. The amount payable by the depositor to the bank is deducted. However, the individual’s deposits in other banks are not considered in this calculation.

Based on total deposit with banks, premium amount must be paid to DICGC

Banks are liable to pay a premium amount which is determined based on the total deposits with it as on the last day of the preceding half-year. That is, if a bank is supposed to pay the premium for the half year ending March 2019, amount is calculated as on 30 September 2018.

In order to make the payment to DICGC, banks are given two months’ time. In case of any delay, by even one day, banks will have to pay penal interest at 8% above the bank rate from the beginning of the financial year till the date of payment. In other words, banks should ensure that payment for half year ending in March should reach the corporation on or before 30 November and for the half year ending September, it should be before 31 May. Even if the payment reaches DICGC for the half year ending March on 01 December, then the bank will have to pay an interest of Bank rate + 8% for the period 01 October to 01 December.

Registration of banks can get cancelled on failure to pay premium for three years

If a bank fails to pay premium for three consecutive years, then DICGC can cancel the registration of the bank. This will be notified in newspapers. What this means is that the bank will not be able to receive fresh deposits. Its license can get cancelled and will no longer be recognized as a banking company or co-operative bank as per Banking Regulation Act of 1949. If the bank’s registration is cancelled, then deposits of the bank will be insured only till the date of cancellation.

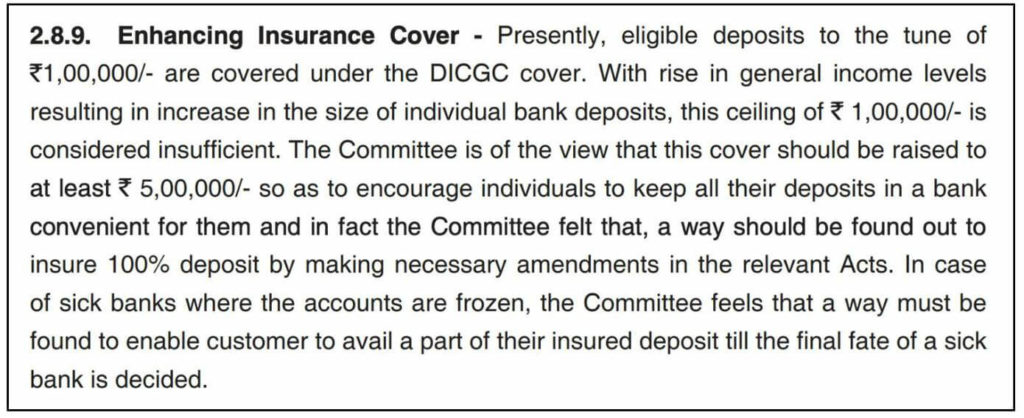

Damodaran committee constituted by RBI in 2011 had suggested increase in ceiling

The committee under the chairmanship of M Damodaran presented a report on banking services rendered to retail and small customers in 2011. This committee had recommended way back in 2011 that the insurance ceiling be raised five-fold from ₹ 1 Lakh to ₹ 5 Lakh. However, this ceiling was increased only after the Mumbai based urban co-operative, PMC Bank (Punjab and Maharashtra Co-operative Bank Limited) collapsed. This increase in the ceiling is aimed at giving more security and enhancing people’s confidence on banks.

DICGC paid ₹ 296 crores to Depositors while it collected ₹ 88,523 crores as premium

Since inception, DICGC has received premium payment of ₹ 88,523 crores. On the other hand, it paid out ₹ 296 crores to depositors of failed commercial banks based on claims, as on 10 December 2019.

Moratorium has been imposed by RBI on Yes Bank Private Limited

Recently, on 05 March 2020, Yes Bank Private Limited. made headlines as it was placed under moratorium by RBI because of the bank’s rapidly deteriorating financial position relating to liquidity, capital and other critical parameters. The absence of any credible plan for infusion of capital has necessitated the RBI to take immediate action.

What should you do – Keep track of bank’s activities

As a depositor, it is always good to keep an eye on the bank’s activities so as to get an idea of the bank’s stability. Since insurance is dependent on the bank, holding accounts in multiple banks or diversifying one’s savings will also be helpful. Further, insurance amount is based on type of ownership of account. Thus, depositing money in a bank in different types of ownership may also be considered.

For further details, click the links below.