Thousands of crores lie unclaimed in bank deposits. The RBI launched the Depositor Education and Awareness Fund Scheme in 2013 to make use of these unclaimed deposits. Here is a detailed explainer of the scheme.

The Depositor Education and Awareness Fund Scheme (DEAF Scheme) was established by the Reserve Bank of India (RBI) in 2014 for the promotion of depositors’ interest and for any other related purposes deemed necessary by the RBI.

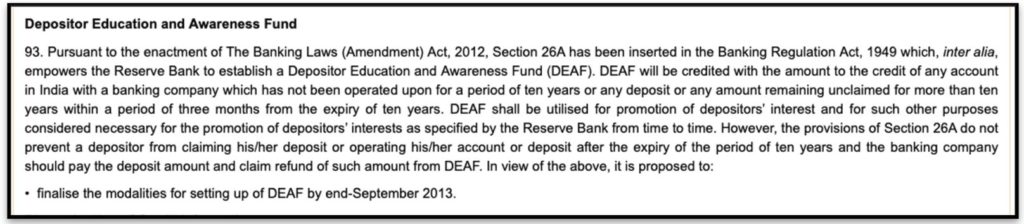

This fund was established pursuant to the Monetary Policy Statement 2013-14, announced by the Governor of RBI on 03 May 2013.

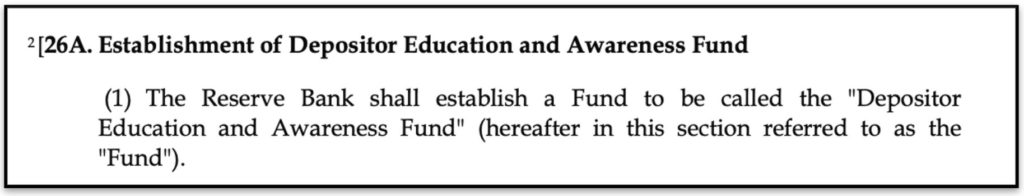

Accordingly, an amendment was made to Banking Regulation Act, 1949, and Section 26 A was inserted into the Act, authorising RBI to establish this fund.

Amount in Non-operative accounts to be transferred to the Fund

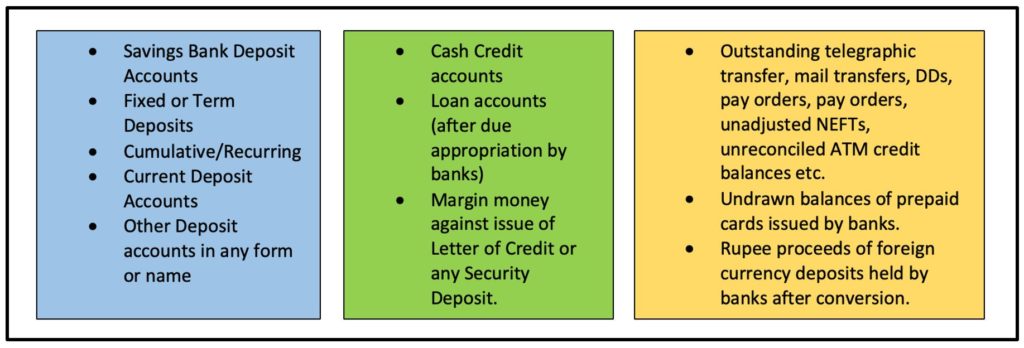

A specific account is maintained by RBI for Depositor Education and Awareness Fund (DEAF). RBI has directed the following types of amounts to be transferred to this fund.

- The credit balance of any deposit account that is maintained with the banks and has not been operated for ten years or more.

- Any amount remaining unclaimed for ten years or more.

These include :

RBI can specify any other accounts beyond those listed above, from time to time. The amount to be transferred also includes the accrued interests which the bank would have paid to the customer.

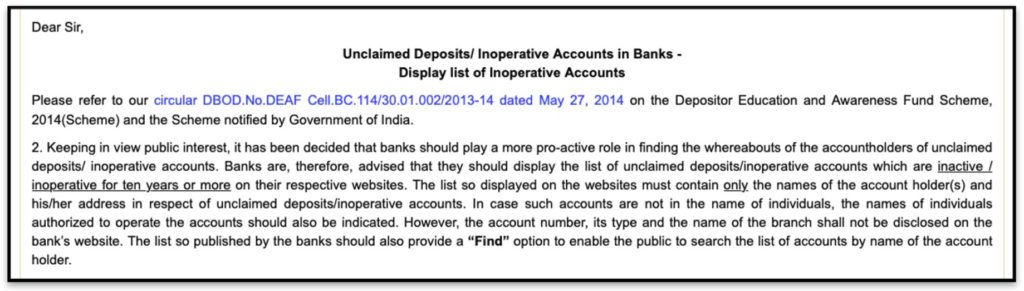

As per a RBI circular dated 02 February 2015, it is mandatory for banks to display on their websites, the list of unclaimed deposits/inoperative accounts which are inactive or inoperative for more than 10 years. This activity needs to be carried out every month by the banks and the unclaimed amounts are to be transferred to RBI by the end of each month.

Respective banks are required to submit returns of these unclaimed amounts which are deposited in DEAF account. Form I & II are used by the banks to submit these returns.

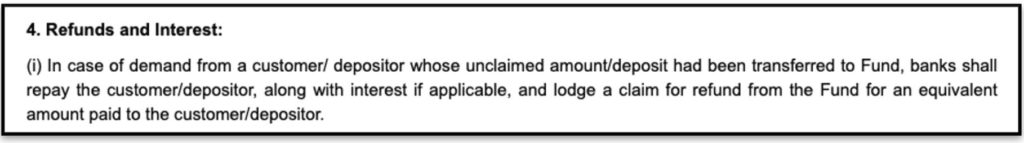

Provision for refund of the amount, if claimed by the depositor

The DEAF scheme provides the option for depositors to reclaim the amount, even after it has been transferred to DEAF.

- The depositors can check the details of the inoperative accounts/unclaimed amount transferred to DEAF on the website of the respective banks.

- The claimant is required to visit bank branch and submit the Unclaimed Deposits Claim Form of the respective bank.

- Required KYC details are to be furnished which serve as proof of the account and the amount being claimed.

- After verification of the claims, banks can transfer the claim to the customers and then file for a refund from RBI to the extent of the amount claimed by the customers.

- Any interest payable from the fund on a claim will accrue from the date on which the amount was transferred to the fund to the date of payment to the customer and is limited to those accounts for which the interest was payable by the bank. RBI determines the applicable rate of interest.

- In case only partial amount is claimed, the account is revived and made operative. The whole amount is transferred back to the now operative account along with the interest if any. The bank can claim refund for the whole amount along with interest.

- In case of banks under liquidation, the depositor can submit the claim to the liquidator. If the deposits are covered under DICGC Insurance, DEAF will pay the liquidator the amount which could have been claimed from DICGC. Even for the amounts which are not covered by DICGC, the fund does reimburse the liquidator for any amount being paid to the depositor.

- For any claims which are settled by the banks during a month, the reimbursement request is to be submitted on the last date of subsequent month.

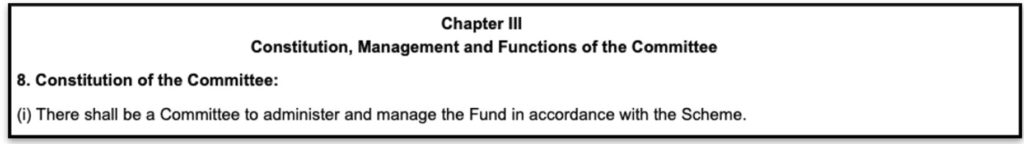

A Committee constituted to manage DEAF

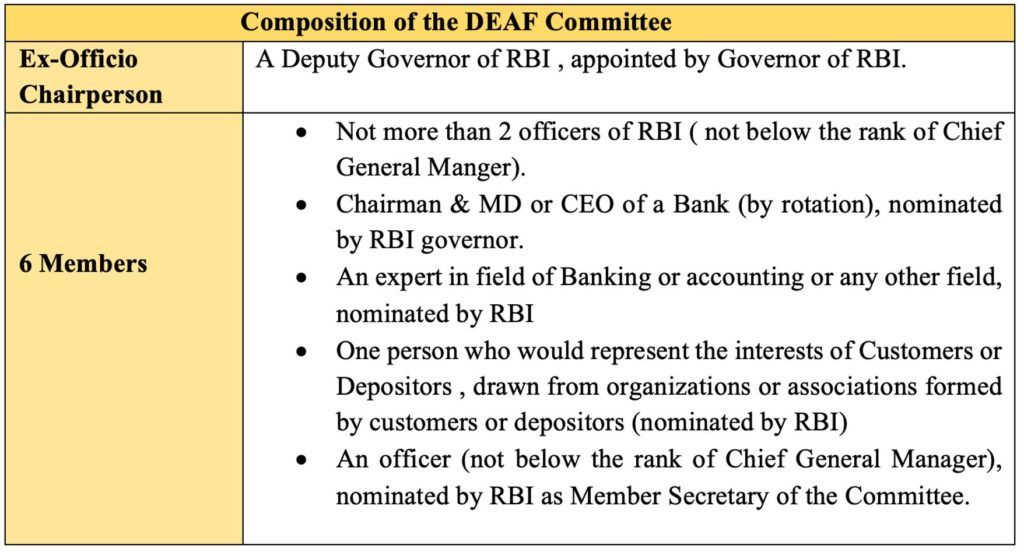

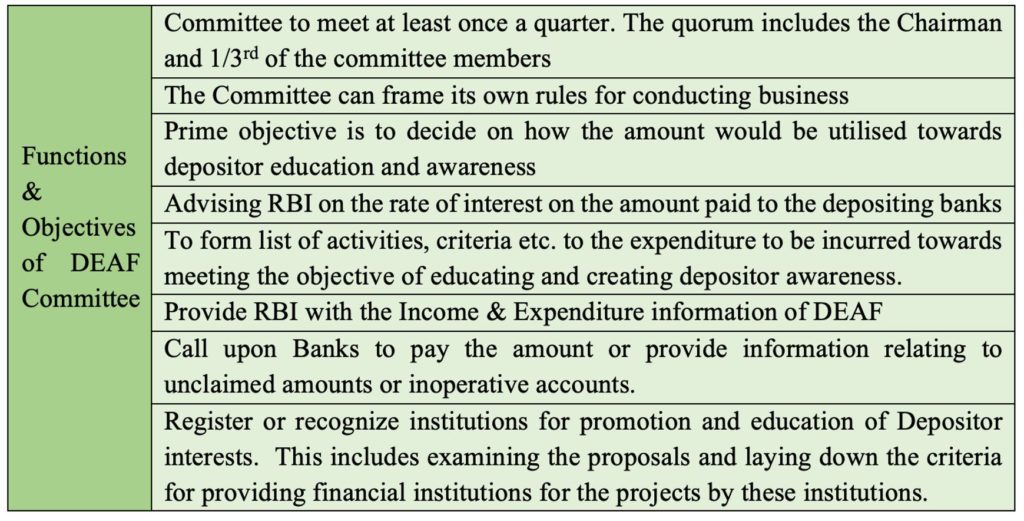

RBI’s notification about the constitution of the DEAF Scheme, provides for formation of a committee to administer and manage the DEAF.

As per the RBI notification, the Committee comprises of :

- Except for the ex-officio Chairperson, the rest of the committee hold the office for a period of two years. They continue in their position until the successors are nominated.

- Any retiring member is eligible for re-nomination.

- The committee can constitute sub-committees as deemed necessary.

- Any decision or proceedings would be considered invalid if there is a vacancy in the committee.

- RBI provides for a Secretariat for the committee along with the required infrastructure and manpower. Out of the members, the field experts and the representative of the customers are entitled for remuneration.

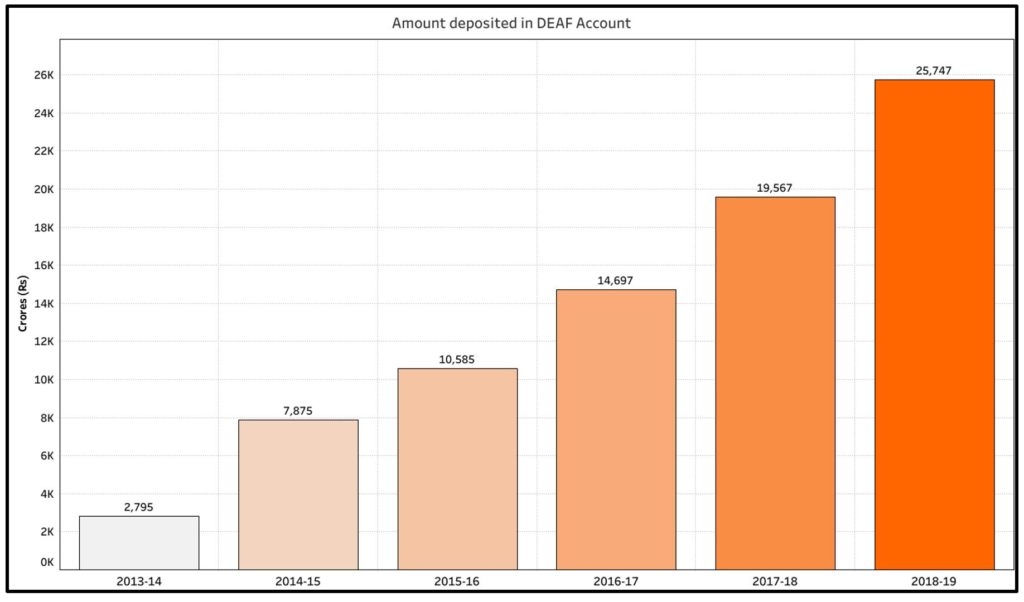

More than Rs. 25 thousand crores deposited in DEAF

As per RBI’s Annual Report for 2018-19, DEAF has a total of Rs. 25,747 crores in its account. The amount being deposited into DEAF account has consistently increased over the years. In 2017-18, this amount was Rs. 19,567 crores.

In 2013-14, the total amount deposited in DEAF account was Rs. 2,795 crores i.e. in the six years since the establishment of the fund, there has been an almost 10-fold increase in the amount deposited in this fund. (It has to be noted that there was no deposit into DEAF at the end of 2012-13 although the fund was constituted during that Fiscal year ).

All this amount, as is the specification of deposits into DEAF , is unclaimed or derived from non-operative accounts. The initiatives to drive the banks to recognise non-operative accounts and transferring the funds to DEAF are a major reason for the increase in the amount deposited in DEAF. However, it needs to be noted that most of this amount rightfully belongs to the depositors. This is an interest free deposit at the disposal of RBI, unless a claim is made.

There are multiple reasons cited for such a large amount in non-operative accounts. A single depositor may have multiple accounts and may not track all their accounts. It is also possible that depositors may not reveal the account details to family members or close kin. This becomes problematic in the wake of death or other emergency situation of the depositor making it impossible for the family members to withdraw amounts. There could be many other reasons for unclaimed deposits and inoperative accounts.

While KYC reforms have helped in better tracking of the depositors, special efforts are required in reaching out to beneficiaries of older deposits which lay unclaimed. Banks could look at proactively encouraging its customers to check for their accounts in the non-operative accounts list published on the website. Search option could be enabled on the bank websites to make this easier. Creating awareness among the depositors encouraging them to disclose the Bank account information to the nominees etc. can help in reducing the amount in unclaimed deposits.

Featured Image: Depositor Education and Awareness Fund Scheme

1 Comment

Pingback: जमाकर्ता शिक्षा और जागरूकता कोष योजना क्या है? | बहादुरगढ़ सिटी पत्रिका