The government recently increased the daily minimum wage rate under MGNREGA by Rs. 20. What is minimum wage and what is the legislation that mandates such a wage? Here is an explainer.

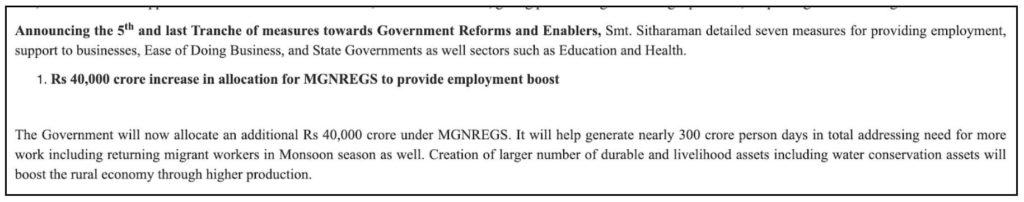

Addressing the nation on 12 May 2020, Prime Minister Narendra Modi gave a call for ‘Aatmanirbhar Bharath Abhiyan’- Self-Reliant India Movement. He further announced a Special economic package worth Rs.20 lakh crore to tide over the COVID-19 crisis. Following this announcement, the government had over the next few days provided details of the economic package in five tranches.

As part of the 5th and last tranche of measures, Finance Minister Nirmala Sitharaman has announced a Rs. 40,000 crore increase in the allocation for MGNREGS (Mahatma Gandhi National Rural Employment Guarantee Scheme). As per government estimates this would help generate nearly 300 crore person days of work and provide livelihood for the migrant workers who returned home during nationwide lockdown.

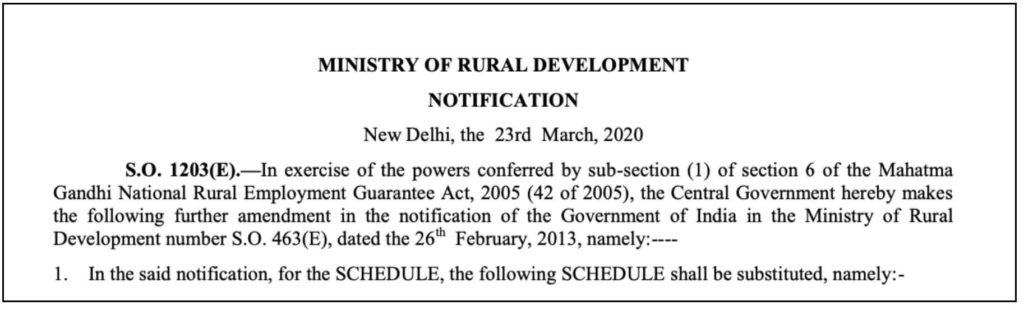

This follows an earlier announcement made as part of the Rs. 1.7 lakh crore relief package – ‘Pradhan Mantri Garib Kalyan Yojana’. The government of India had on 26 March 2020 announced an increase in the MGNREGA wage by Rs. 20. This would imply that those who find work under MGREGS would receive minimum daily wage of Rs. 202 instead of earlier wage of Rs.182. This amounts to increase in the annual income by Rs. 2000, provided they find 100 days of work. As per government’s announcement, this is expected to benefit 13.62 crore families.

The hike in NREGS wages is part of the regular yearly activity

However, the revision in NREGS wages is part of the routine yearly revision and is not a new relief & support measure announced by the government. It has to be mentioned that the increase announced this year is the highest in the recent years.

Since there is no guarantee on the availability of work, the increase of Rs. 20 and resultant addition of Rs. 2000 to annual income is not a given. Further, a review of the wage revision notification highlights the differences in the wages offered in respective states. Madhya Pradesh and Chhattisgarh offer the least i.e. Rs.190 per day whereas Haryana has the highest wage under NREGS with Rs.3 09 per day. The variation is dependent on various local factors. The rates provided in the notification is for unskilled labour.

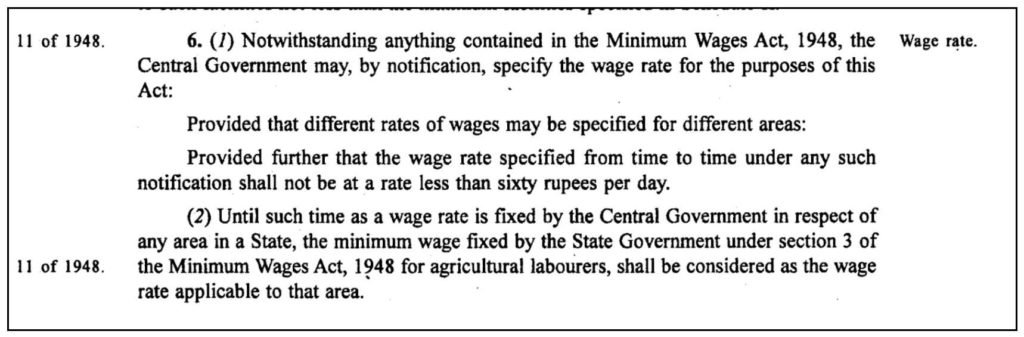

Few experts have also pointed out that the wages under MGNREGA are lower than the minimum wages earned by Agricultural labour in few of the states. It ought to be noted that MGNREGA was delinked from Minimum Wages Act as per the provisions in Section 6 of MGNREGA 2005.

While there is discussion around minimum wage and if that is sufficient, there are apprehensions by experts regarding the efficacy of Minimum Wages ACT,1948 in ensuring minimum wages.

In this context, we explain in detail the Minimum Wages act,1948 and its scope.

Fixing minimum wages for workers is a key part of Minimum Wages Act,1948

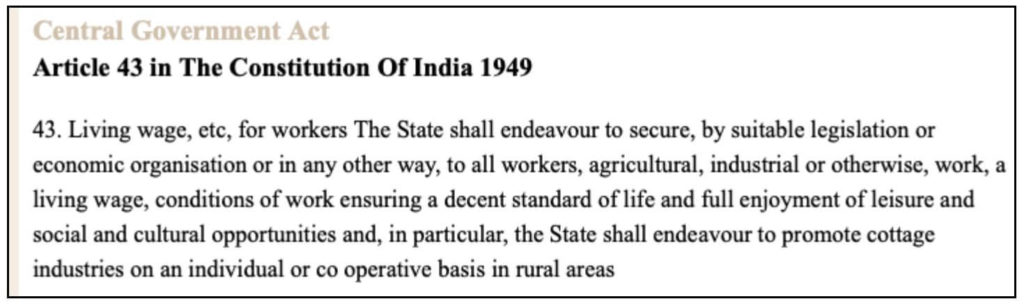

The concept of ‘Living Wage’ is enshrined in the Directive Principles of State Policy in the constitution. The Minimum Wages Act, 1948 thus is based on Article 43, of Indian Constitution.

The Central advisory council appointed a ‘Tripartite Committee of Fair Wage’, to provision for a law to be brought forward in the first session of the Constituent Assembly in November 1948. The committee came up with the concept of minimum wage which not only guarantees bare substances and preserves efficiency but also provides for education, medical requirements and some level of comfort.

Accordingly, Minimum Wages Act, 1948 was introduced which provided both the Central and State governments the jurisdiction to fix minimum wages for certain employment types.

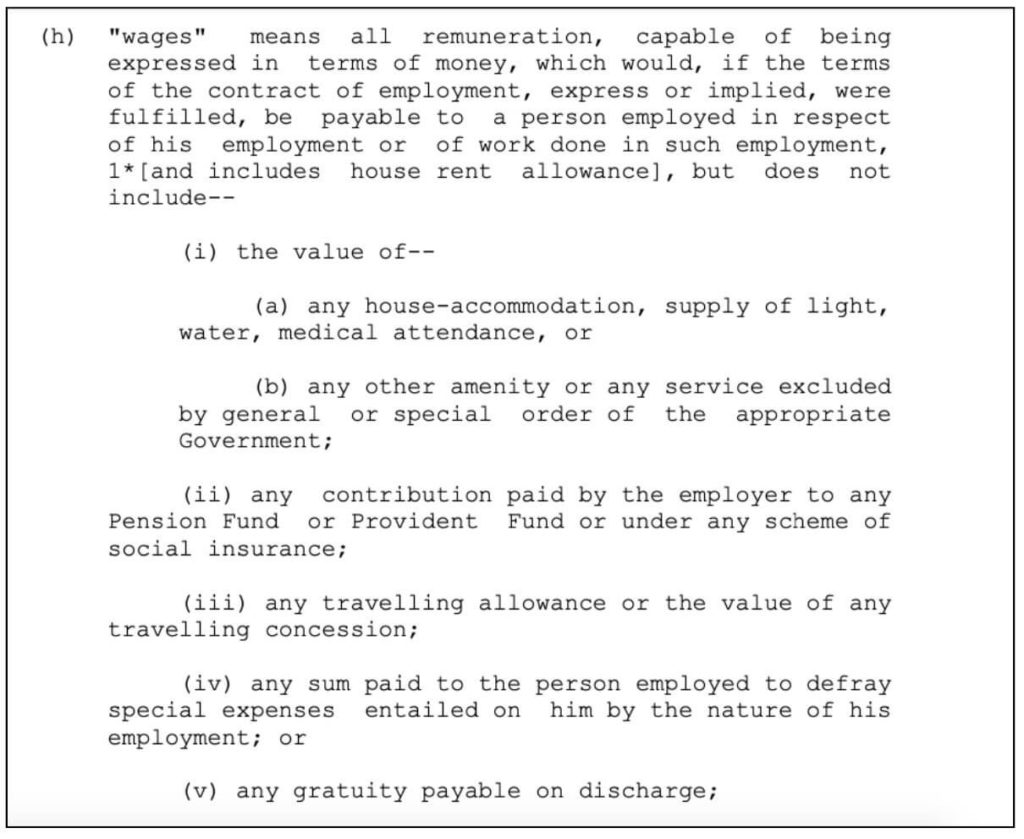

The act provides for the definition of a wage under Section 2 (h), which refers to all the remuneration that can be expressed in terms of monetary value. It also highlights the exclusions that cannot be considered to be wages.

Section 3 of the act provides for

- Appropriate government to fix the rate of minimum wages payable to employees for different types of employment.

- Government to review the minimum rate of wages at intervals as it finds fit, provided that it does not exceed a period of five years.

The Act further specifies the scope of the government to fix different types of rates:

- Minimum rate of wages for time work i.e. Minimum Time Rate

- Minimum rate of wages for piece work i.e. Minimum Piece Rate

- Minimum rate of remuneration for employees being employed on a piece work over a period of time i.e. Guaranteed Time Rate.

- Minimum rate in respect to the overtime done i.e. Overtime Rate.

The scope of the government extends to fixing varied rates for – different types of scheduled employment, different classes of works, localities, age group etc. The wages can also be fixed for varied periods – hour, day, month & larger wage periods.

Detailed Provisions included under Minimum Wage Act, 1948

The Minimum Wage Act, 1948 lays down in detail the various provisions concerning fixing of the Minimum Wages and the tenets to ensure the implementation of the same.

A snapshot of the provisions is given below.

Provision | Section | Details |

Fixing of minimum Wages | 3 |

|

Minimum Rate of Wages | 4 |

|

Fixing & revising Minimum wages | 5 |

|

Wages in Kind | 11 | Although Minimum wages under the act needs to be paid by cash, payment can be done wholly or partly in kind, by notifying in the official Gazette. |

Payment of Minimum Rate of Wages | 12 |

|

Fixing hours – Normal working day | 13 | Government can:

|

Overtime | 14 |

|

Wages for two or more classes | 16 | In case an employee is engaged in work relating to two or more classes, the payment would be made in different rates as per the time occupied in each of the class of work. |

Maintenance of Registers and Records | 18 | Every employer is required to maintain register & records of – Particulars of employees, work performed by them, wages and other details required. |

Inspection | 19 | Respective government can notify through an Official Gazette, appoint inspectors and determine on their functions and local limits. |

Claims | 20 | The Government may appoint Labour Commissioner or Workmen’s Compensation or any officer (not below the rank of Labour commissioner) with experience of judge of civil court to hear any claims regarding payment less than minimum wages or for only part of the days for which work was done. |

Penalties | 22 | Any employer who contravenes any of the provisions will be punishable with:

|

Issues exist in implementation

The Minimum Wages Act,1948 was one of the first legislations made after India gained Independence. This stems out of the need to provide safeguards to the workers, in contrast to the exploitative conditions which existed prior to independence. The act was a result of earlier initiatives which helped to lay foundation to provide minimum wages to workers, especially those in the unorganized sector who constitute a major portion of the workforce. Labour and fixing of minimum wages are part of the concurrent list, which has provided scope for both the central government and State governments to identify the various types of employments across the country and to combine them with varying local and national factors in determine decent minimum wage for the works done. This act provides for the basic framework and mechanism to determine the minimum wages in the country.

There are other acts also which affect labour & their wages like

- The Trade Unions Act, 1926

- The Industrial Disputes Act, 1947

- The Equal Remunerations Act, 1976

- The Payment of Wages Act, 1936

- The Contract Labours (Regulation and Abolition) Act, 1970

The Code of Wages, 2019, was enacted recently to combine similar legislations and simplify procedures under various wage legislations. The code replaced the following acts

- Payment of Wages Act, 1936

- Minimum Wages Act, 1948

- Payment of Bonus Act,1965

- Equal Remuneration Act, 1976

In spite of all these efforts, there are quite a few issues in enforcement of Minimum wage laws and the support extended , especially to the workers in unorganized sector. The new wage Code pegs the Minimum wage at Rs.178 per day, which is considered as insufficient in current times, leaving a large section of the unorganized workers in a lurch.

In the next story, we analyse the current minimum wage rates across the states as well as the national standard for various sectors and types of employments and compare the same from a global perspective.

Featured Image: Minimum Wage & related legislation