NRIs & OCI card holders often acquire immovable property in India. But what are the rules guiding such acquisition? What are the restrictions on such transactions? Here is an explainer.

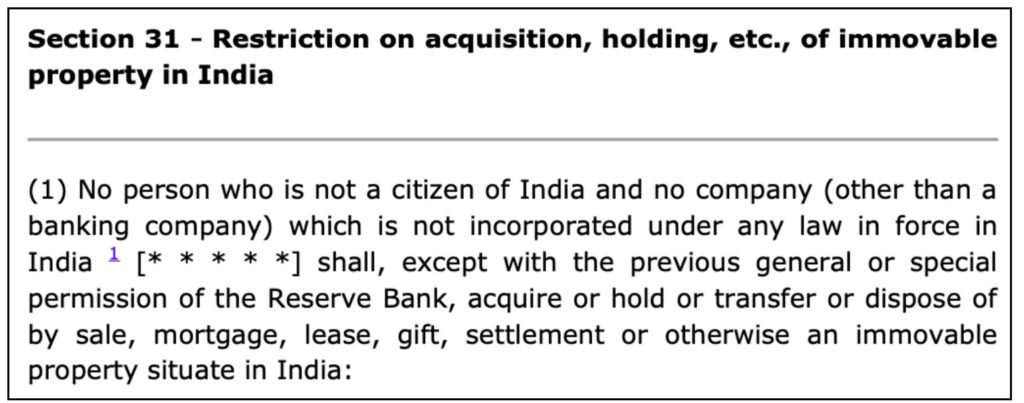

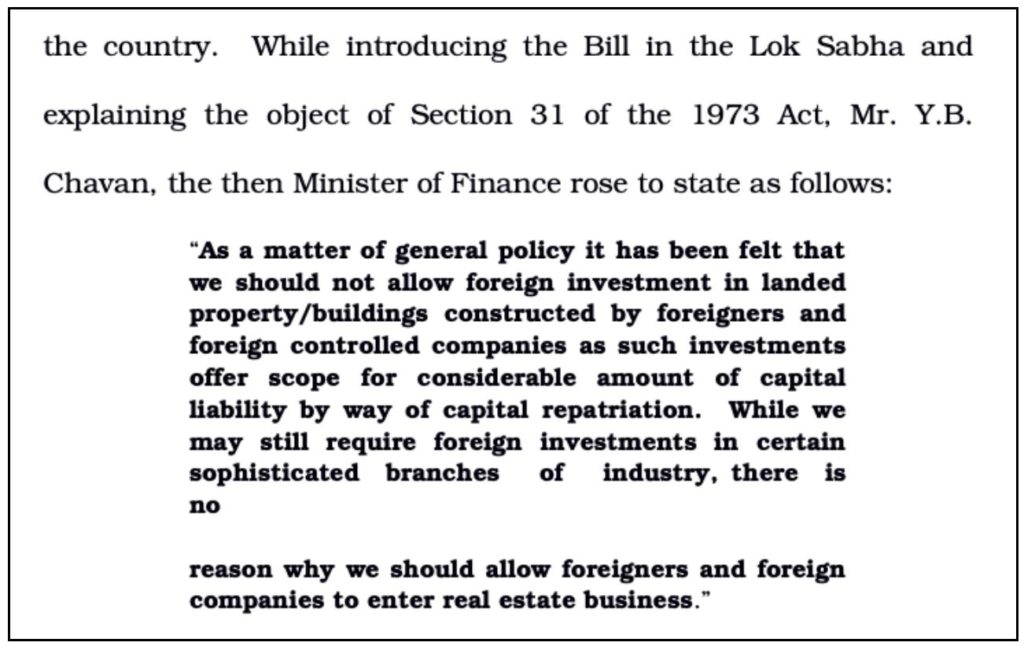

The Supreme Court (SC) recently delivered a judgment declaring that the sale or gift of property by a foreigner without the permission of RBI is illegal. In this case, the court was dealing with a suit relating to a property gifted by Mrs. F.L. Raitt, widow of Mr. Charles Raitt, who is a foreigner to Vikram Malhotra, without obtaining the permission of the Reserve Bank of India (RBI). The Supreme Court Bench observed that this was in contravention of Section 31 of the Foreign Exchange Regulation Act, 1973 (FERA, 1973). As per the 1973 act, any person who is not a citizen of India or any company which is not incorporated in the country is required to get permission from RBI to acquire, hold, transfer or dispose of an immovable property in the country.

Although the FERA Act, 1973 is later replaced by Foreign Exchange Management Act, 1999 (FEMA, 1999), the court gave this judgment by exercising the plenary power under Article 142 of the Constitution of India.

For this, the court relied on the legislative intent and the spirit of enactment of Section 31 of FERA, 1973, as expressed in the statement of the then Finance Minister, while tabling the bill in Lok Sabha. Based on this, the bench stated that there is a requirement to seek the permission of RBI by a foreign national, before making a transaction relating to real estate. Any such transaction which is done without RBI’s permission is forbidden and unenforceable in law.

While the Supreme Court’s judgment is limited to this particular case and any other such pending cases under similar conditions, it has also stated that any other transactions that already been finalised by the decision of the court of competent jurisdiction, need not be opened and disturbed.

Based on the court ruling, it is apparent that the spirit of FERA, 1973 is upheld in relation to the investments (especially in the immovable property i.e., real estate) made by foreigners or foreign-controlled companies requiring RBI’s watch. The judgment will not have any impact on current transactions since the 1973 law is now repealed and replaced by a new law.

In any case, there are specific provisions in the law to facilitate the transaction of immovable properties by Non-Resident Indians (NRI) and Overseas Citizens of India (OCI) residing in other countries. The FEMA Act,1999 which has replaced FERA,1973 has made specific provisions for acquisition and transfer of property in India through Foreign Exchange Management (Acquisition and Transfer of immovable property in India) Regulations, 2000.

A NRI or OCI can acquire immovable property other than agricultural land

The RBI guidelines relating to FEMA regulations contain provisions for Indian Citizens residing outside India, otherwise known as Non-resident Indians, to acquire and transfer property in India. RBI has made amendments in 2018, which includes similar provisions to OCI (Overseas Citizens of India) as well. Earlier, there were separate guidelines for People of Indian Origin (PIO).

The guidelines place a restriction on acquisition is on any immovable property that is of the nature of agricultural/plantation or a Farmhouse.

The transfer of immovable property can be done to:

- A person resident in India

- A person resident outside India who is a citizen of India

- A person of Indian origin (PIO)/ Overseas Citizen of India (OCI) residing outside India.

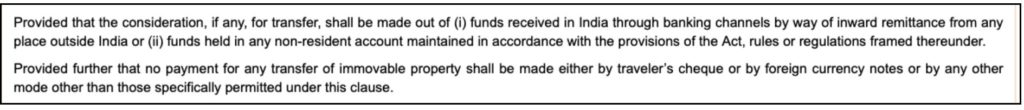

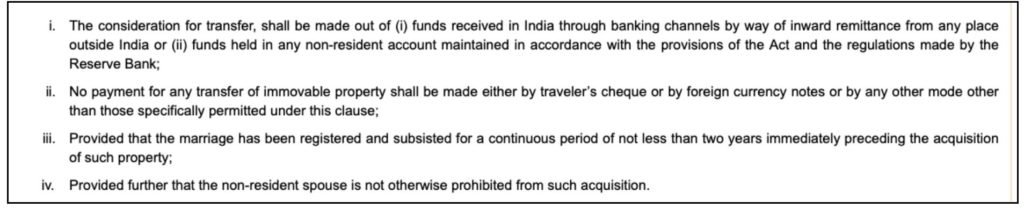

There are certain restrictions regarding the funds to be used for such transactions. The transaction can happen only using:

- Funds received in India through banking channels as a way of inward remittance into India.

- Funds held in any non-resident account that is maintained as per FEMA, 1999.

- No other mode, traveller’s cheque, or foreign currency can be used for the transaction.

There are also provisions for both NRIs and OCI for acquiring immovable property in the form of a gift or inheritance.

- An NRI/OCI can acquire any immovable property other than the aforementioned restricted land, in the form of a gift from (a) person resident in India (b) NRI/OCI who is a relative as defined under section 2(77) of Companies Act, 2013.

- An NRI/OCI can also acquire property in the form of inheritance. They can acquire it from a person who is resident outside India and if he has acquired property as per the foreign exchange law prevailing at the time of acquisition or from a person who is resident in India.

There is further provision for the spouse of an NRI or OCI to acquire one immovable property jointly with the respective NRI/OCI spouse.

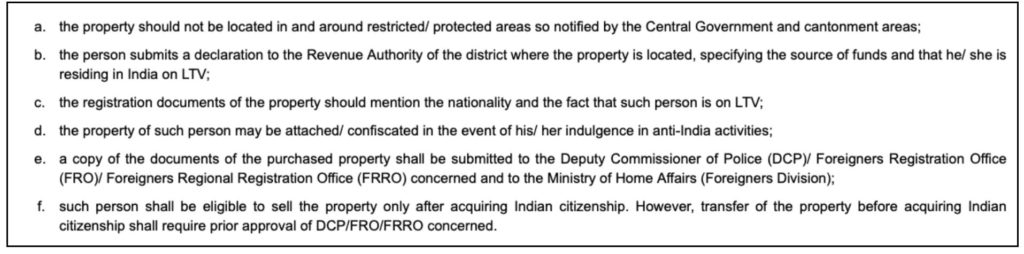

Provision of acquisition of Property by Long-term Visa holder

Apart from NRIs and OCI cardholders, the Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2018, provide for the acquisition of immovable property even by ‘Long Term Visa (LTV)’ holders.

LTVs are granted by the Indian Government to citizens of Afghanistan, Bangladesh, or Pakistan who belong to minority communities in those countries i.e., Hindus, Sikhs, Buddhists, Jains, Parsis & Christians and are residing in India.

They can acquire only one immovable property as a residential property for self-occupation and one immovable property for self-employment. However, there are certain conditions that need to be adhered to.

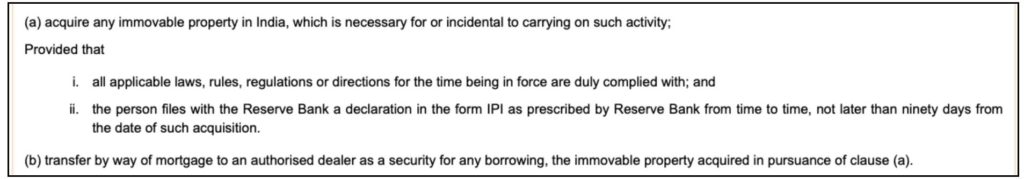

Land can be acquired by a person residing outside India for a specific permitted activity

The regulations also provide for a person resident outside India but have established in India a place of business, to acquire any immovable property in India and to carry out the specific purpose of the establishment.

However, this provision is not available for the citizens of – Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Hong Kong, Macau, Nepal, Bhutan, or North Korea. They can only lease a property not exceeding five years and acquire property only with the prior approval of RBI.

Meanwhile, Foreign Embassy/Diplomat/Consulate General can purchase or sell immovable property in India (other than agricultural land/plantation/farm house) after clearance from the Government of India, and the amount for acquisition of immovable property in India is paid out of funds remitted from abroad through banking channels.

Prohibition on acquisition of property by residents outside of India beyond the laid guidelines and exceptions

The latest guidelines categorically state that any acquisition or transfer of immovable property by anyone residing outside of India can only be within the framework of Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2018.

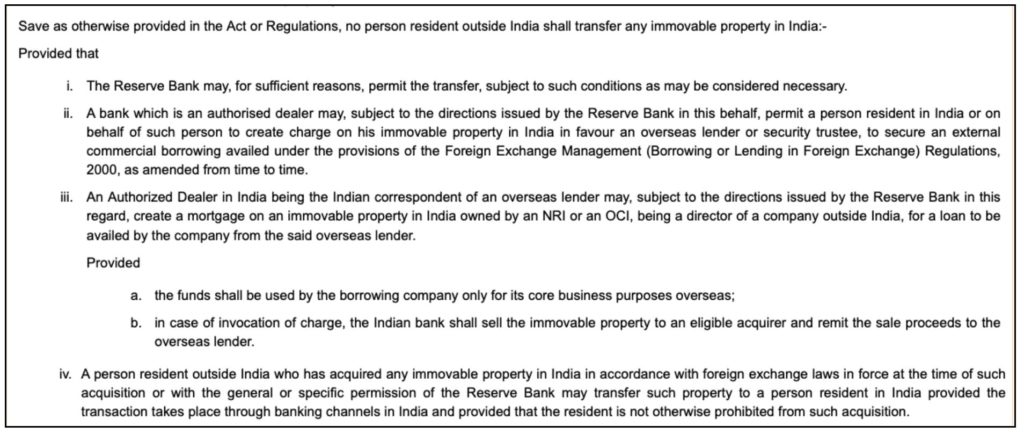

Any transaction beyond these regulations is prohibited, except under specific conditions as mentioned below.

- RBI permits a transfer under certain conditions.

- The bank which is an authorised dealer permits as per the directions from RBI

- Indian correspondent of an overseas lender in line with the direction issued by RBI.

- Acquired property as per the prevailing Foreign exchange laws and permission from RBI.

Featured Image: Acquisition of Immovable property by NRIs and OCI cardholders