Comprehensive Datasets on Business Responsibility and Sustainability Reports (BRSR)

In 2020, the Committee on Business Responsibility Reporting, established by the MCA presented its report recommending the replacement of BRR with BRSR, which stands for Business Responsibility and Sustainability Reporting (BRSR). Unlike BRR, which focuses solely on business responsibility, BRSR emphasizes sustainability as well. Changes were made to the format, types of questions, and indicators in BRSR, making it more comprehensive.

The evolving landscape of corporate reporting reflects shifting societal values and priorities. There is a growing emphasis on transparency and accountability, which are seen as essential business values that promote increased stakeholder engagement. Companies are now expected to provide clear disclosures regarding how their activities impact Environmental, Social, and Governance (ESG) aspects, reflecting a broader focus on non-financial information for evaluating company performance and value creation. Investors worldwide are demanding a comprehensive view of how organizations generate value and the measures taken by company boards to safeguard it. Adapting swiftly to these new demands is critical to driving change towards a more environmentally and socially responsible society. In response, there has been a proliferation of voluntary frameworks and governmental mandates prescribing diverse rules for ESG disclosure, with sustainability reporting gaining momentum as a market-driven approach over recent decades.

Global ESG/sustainability disclosures and frameworks, such as the Global Reporting Initiative (GRI), Integrated Reporting (IR) Framework of the International Integrated Reporting Council, United Nations Global Compact (UNGC), Sustainability Accounting Standards Board (SASB), and Carbon Disclosure Project, mandate businesses to disclose their sustainability performance based on specific key performance indicators (KPIs) and principles. Numerous countries worldwide, including India, have introduced and enforced various forms of ESG-related disclosures.

Evolution of ESG reporting in India

In 2009, the Ministry of Corporate Affairs (MCA) released the Corporate Social Responsibility Voluntary Guidelines, paving the way for ESG reporting in the country. Later, in 2012, the Securities and Exchange Board of India (SEBI) mandated that the top 100 listed companies by market capitalization file a Business Responsibility Report (BRR) aligned with the revised National Voluntary Guidelines (NVGs) released in 2011 with their annual reports. Corporate Social Responsibility was made mandatory for certain companies meeting certain financial criteria in 2014 following which, in 2015 SEBI extended mandatory BRR reporting to the top 500 listed companies.

SEBI released a circular in 2017 asking the listed companies to adapt to the IR Framework of the IIRC for disclosure voluntarily. In the same year, SEBI also made the disclosure of Green Debt Securities mandatory for those companies raising Green Debts or Bonds.

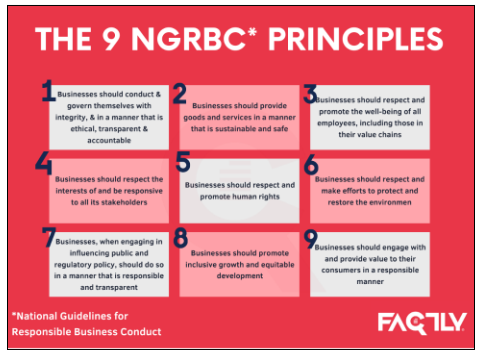

The National Voluntary Guidelines were again revised and released as the National Guidelines on Responsible Business Conduct (NGRBC) in 2019 to align with global concerns like the Sustainable Development Goals (SDGs) and the United Nations Guiding Principles on Business & Human Rights (UNGPs). BRR was extended to the top 1000 companies too.

In 2020, the Report of the Committee on Business Responsibility Reporting, established by the MCA was presented. The committee recommended replacing BRR with BRSR, which stands for Business Responsibility and Sustainability Reporting (BRSR). Unlike BRR, which focuses solely on business responsibility, BRSR emphasizes sustainability as well. Changes were made to the format, types of questions, and indicators in BRSR, making it more comprehensive. It was introduced in 2021.

Changes brought in corporate reporting by BRSR

The BRSR framework brings several significant enhancements to corporate reporting in line with international practices. Firstly, it places a strong emphasis on maximizing business impact by prompting companies to redefine their corporate purpose with a heightened focus on environmental, social, and governance (ESG) dimensions. This move is aimed at creating awareness around corporate sustainability. Moreover, investors are relying more on the ESG performance data of potential companies to guide their investment choices.

BRSR facilitates the alignment of reporting with Global Reporting Standards, allowing companies to cross-reference their sustainability reports with internationally accepted disclosure parameters such as those set out by GRI, SASB, and TCFD.

The framework also underscores the importance of training and awareness initiatives, necessitating the disclosure of details regarding employee health and safety measures, anti-corruption efforts, and promotion of human rights, among others. It also mandates the disclosures related to any Environmental or Social Impact Assessments conducted by listed companies following relevant laws.

Structure of BRSR

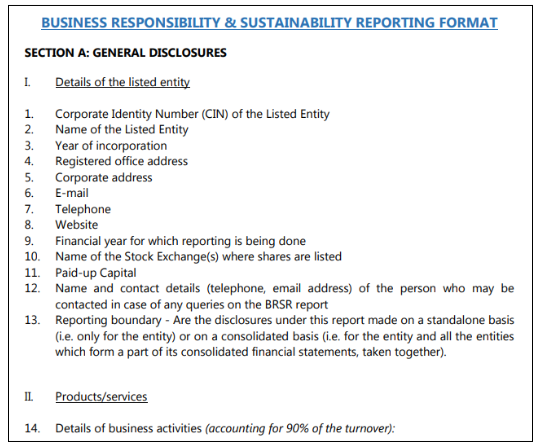

There are three sections in the reporting questionnaire– Sections A, B, and C. There are around 140 questions, with the majority being mandatory.

Section A or ‘General Disclosures’ seeks basic information about the entity such as their products and services, operations, employees, holdings, CSR details, and transparency and disclosure compliances.

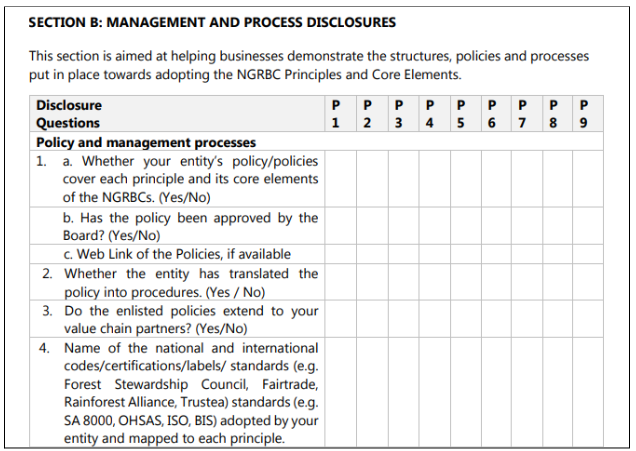

Section B of the questionnaire deals with management and process disclosures. This section helps businesses demonstrate their adoption of NGRBC Principles and Core Elements through policies, processes, and governance. It covers areas such as policy formulation, adoption of national and international standards, commitments, goals, and targets, and governance oversight. The 9 principles are given in the next section.

Section C: Principle-wise performance disclosures help entities showcase their performance by integrating Principles and Core Elements into key processes and decisions. It requires disclosure of “Essential” indicators by all mandated entities and allows voluntary disclosure of “Leadership” indicators for entities aiming for higher levels of social, environmental, and ethical responsibility. The indicators for each of the 9 principles are given below:

The BRSR disclosures are published in the form of an annual report as well as in XBRL format. These are available on the Bombay Stock Exchange and National Stock Exchange websites.

Recent modifications made by SEBI

Based on the recommendations of the ESG Advisory Committee and pursuant to public consultation, the SEBI decided to introduce the BRSR Core for assurance by listed entities in 2023. The Board further decided to introduce disclosures and assurance for the value chain of listed entities, as per the BRSR Core.

The BRSR Core is a subset of the broader BRSR framework, comprising key performance indicators (KPIs) across nine ESG attributes. Additional KPIs relevant to the Indian/emerging market context include job creation in small towns, business openness, and gross wages paid to women, aimed at providing assurance. Intensity ratios based on revenue adjusted for purchasing power parity (PPP) have been included to enhance global comparability.

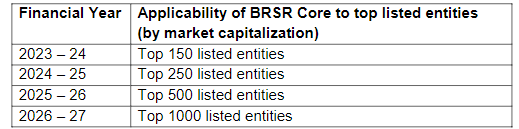

SEBI has provided a timeline for the mandatory compliance of listed entities with the BRSR Core.

Not just India, Governments of several countries have introduced disclosures on sustainability reporting. These include China, Denmark, South Africa, Malaysia, and the Philippines. Several countries require reporting on specific issues such as Australia and the USA where climate change-related reporting is prevalent. Similarly, in Australia and the UK, companies should report on modern slavery.

The introduction of the BRSR framework by SEBI has played a pivotal role in this transformation, aligning Indian corporate reporting practices with international standards. Moving forward, as SEBI introduces the BRSR Core for assurance by listed entities, and with the timeline set for mandatory compliance, it is expected to strengthen corporate reporting practices in India further. Stay tuned for Factly’s upcoming data stories based on these disclosures.