Governments across the world have announced major economic relief packages to tide over the COVID-19 crisis. Here is a look at the economic packages announced by some of the major countries.

WHO has declared COVID-19 as an Public Health Emergency of International Concern on 30 January 2020, because of its rapid spread across multiple countries. In an effort to contain the spread of the virus, most countries have resorted to containment measures like ban on air-travel, closing down the borders, lockdowns etc.

While these measures were necessary in wake of the prevailing situation, they caused enormous disruption to normal life. Most economic and commercial activities across the world were brought to a standstill because of these measures, resulting in loss of income for many.

To address these repercussions and alleviate the sufferings caused to the citizens, respective governments have announced relief measures and stimulus packages. Factly has earlier written stories on the relief measures announced by Government of India and the States, to provide relief and support to the disadvantaged sections of the society. On 26 March 2020, Government of India announced a COVID-19 relief package worth Rs. 1.7 Lakh crores.

In this story, we take a look at the various relief and stimulus packages announced in various counties affected by COVID-19.

USA has announced more than USD 2.5 trillion as Aid package in multiple phases

USA is the worst hit country by the COVID-19 pandemic. It has around 12.5 lakh COVID-19 positive cases and has reported more than 67 thousand deaths so far.

President Trump’s administration declared a Public Health Emergency on 31 January 2020, in regards to the spread of COVID-19. As the situation escalated further, a National Emergency was declared on 13 March 2020. The response of the individual states in the USA has varied, with each of them acting in accordance to the severity of the situation in the respective states. Most of the non-essential services and any sort of public gatherings have been banned in most of the larger states.

These restrictions have adversely affected travel, restaurant, retail and other industries along with the financial markets. As on 16 April, around 22 million Americans have filed for unemployment since National emergency was declared.

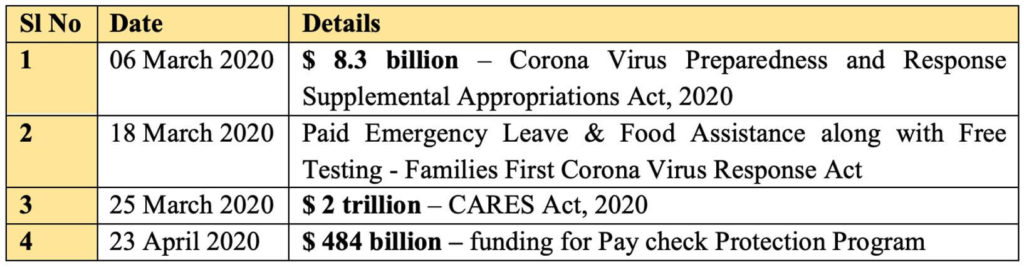

The United States Congress has come up with multiple aid packages to address the situation.

a. The first Aid package approved by US Congress was through the enactment of Corona Virus Preparedness and Response Supplemental Appropriations Act, 2020. As per this act, $ 8.3 billion has been provided. This includes:

- More than $3 billion for research & development of vaccines, therapeutics & diagnostics.

- $ 2.2 billion for CDC – Centers for Disease Control & Prevention

- $ 950 million – support for State & local health agencies

b. On 18 March, Families First Corona Virus Response Actwas approved in Senate. It provides for Paid Emergency leave, Food assistance and Free testing for all the affected employees.

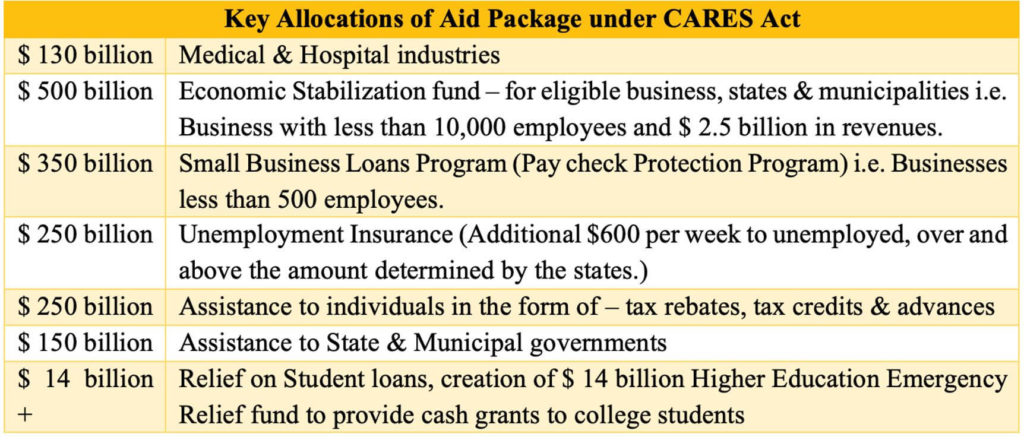

c. The largest ever Economic Stimulus package in US History was provided through Corona Virus Air Relief and Economic Security Act (CARES Act) , with the approval of $ 2 trillion. The highlights of this aid include:

d. A further $ 484 billion was approved on 23 April 2020. The amount would be used to further fund Paycheck Protection Program as well as to provide $75 billion as funding to hospitals.

United Kingdom (UK) provides for Individual and business relief measures

UK currently has the second highest number of deaths due to COVID-19, after USA. The response and imposition of a lockdown were delayed in comparison to other countries. Lockdown on the whole population was imposed on 23 March, and Corona Virus Act 2020 was passed to provide the government with Emergency powers.

Relief measures announced to mitigate the socio-economic effects of lockdown include the following.

- Coronavirus Job Retention Scheme announced on 20 March. It provides grants to the companies to pay 80% of a staff wage each month to the tune of £2,500 per person, if the companies kept staff on their payroll. This scheme is currently extended until June 2020.

- Self Employed Income Support Scheme was announced to provide support for Self-employed individuals/partnerships. If they suffered a loss due to COVID-19, a taxable grant would be paid worth 80% of their profits with a limit of £2,500 per month.

- Corona Virus Business Interruption Loan Scheme was announced by the government on 23 March to aid small & medium businesses, whose business & cash flows are affected due to lockdown.

- Corona Virus Large Business Interruption Loan Scheme was also announced on 03 April, to aid Medium and large Size business (turnover of over £ 45 million) affected due to COVID-19.

- On 20 April 2020, the launch of a £1.25 billion coronavirus package to protect firms driving innovation in UK was announced. This includes: a £500 million investment ‘Future Fund’ for high-growth companies impacted by the crisis, made up of funding from government and the private sector and a £750 million grants and loans fund for SMEs focusing on research and development.

Tax and Unemployment benefit a key part of Italy’s relief measures

Italy was one of the first epicentres for COVID-19 outside. A nationwide quarantine was announced on 09 March 2020. Subsequently, Italy has announced various relief measures in the form of aid and tax benefits for its citizens affected due to lockdown.

- On 16March, Italy announced a €25 Billion package to tackle Covid-19. As part of this package, €10.3 billion is to boost unemployment benefits and to support self-employed and provided for a €600 allowance for month of March 2020. This could benefit around 5 million workers & self-employed individuals.

- Parents can claim €600 as Baby sitting costs or take 15 days off at 50% salary to take care of children while schools are closed.

- The package also provides €3.2 billion towards Health-care system to hire 1000 additional doctors and resources.

- Extension of Tax deadlines until 31 May. Tax credits to companies that have suffered a 25% drop in their revenues.

- Companies to receive 50% tax credit for sanitation expenses – daily cleaning services, masks and other precautionary measures.

- Allowed for delay in filing VAT returns of April-May until 30 June, for small businesses with 33% decline in revenues and large businesses with 50% decline.

- Moratorium on loan repayments of small & medium sized businesses until 30 September

- €100 bonus for employees working during the pandemic.

- Businesses given 60% tax credit on commercial rents.

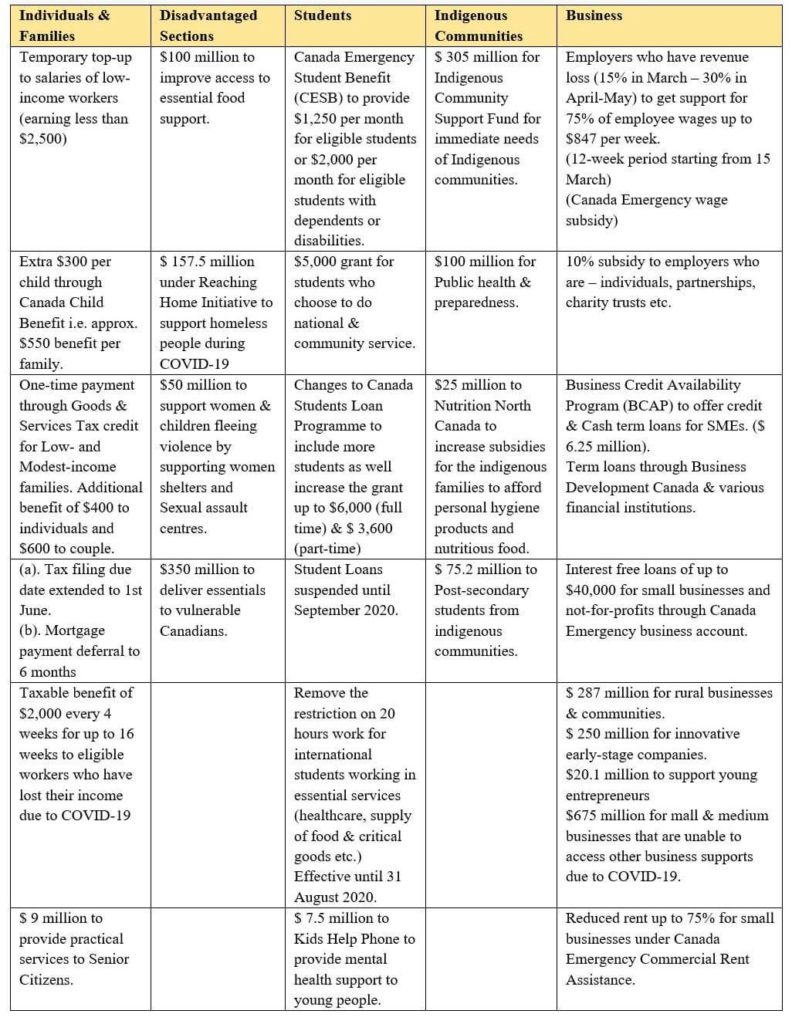

All-round coverage in Canada’s Covid-19 relief package

Canada is being hailed as one of the countries which has managed COVID-19 epidemic more effectively than others. Especially, the relief & support measures announced by Canadian government have received appreciation for covering individuals from various walks of life as well as various businesses. (Note : the monetary values expressed are in Canadian Dollars)

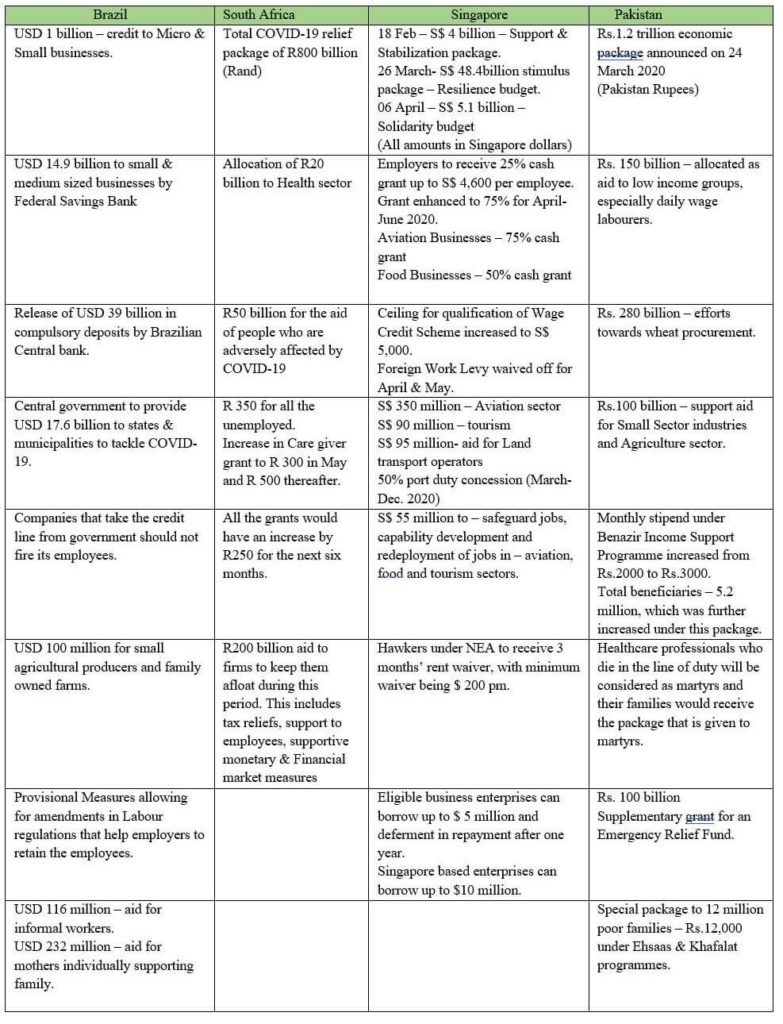

Financial support to unemployed and relief for business part of most Economic relief packages

Local and in-country specific demands influence the financial packages across the countries. Countries which are among the developing and poor countries have laid emphasis on providing financial and benefits-in-kind support to the marginalized sections of the society. Whereas, more developed countries have laid emphasis on providing tax reliefs for the work forces and incentives for employers to sustain in the business.

Providing assistance to the unemployed who might have lost their jobs due to COVID-19 features primarily in any of the relief & stimulus packages announced by the governments. Key emphasis is also laid on providing assistance to businesses, especially small and medium scale ones which have lost revenue and do not have the resources to stay afloat. This would ensure that the businesses survive this period.

Here is a look at few important economic relief measures taken by select countries(Brazil, South Africa, Singapore and Pakistan)

Featured Image: COVID-19 relief packages