[orc]Fiscal deficit is broadly the difference between government’s total revenue and its total expenditure. What about India’s fiscal deficit targets? Are we anywhere close to reaching them?

Fiscal deficit is broadly the difference between government’s total revenue and its total expenditure. The government tries to meet this deficit through borrowings from central banks or raising money from capital markets.

In this story, we explore the trends in India’s fiscal deficit, various factors influencing it and the current state of fiscal deficit in India.

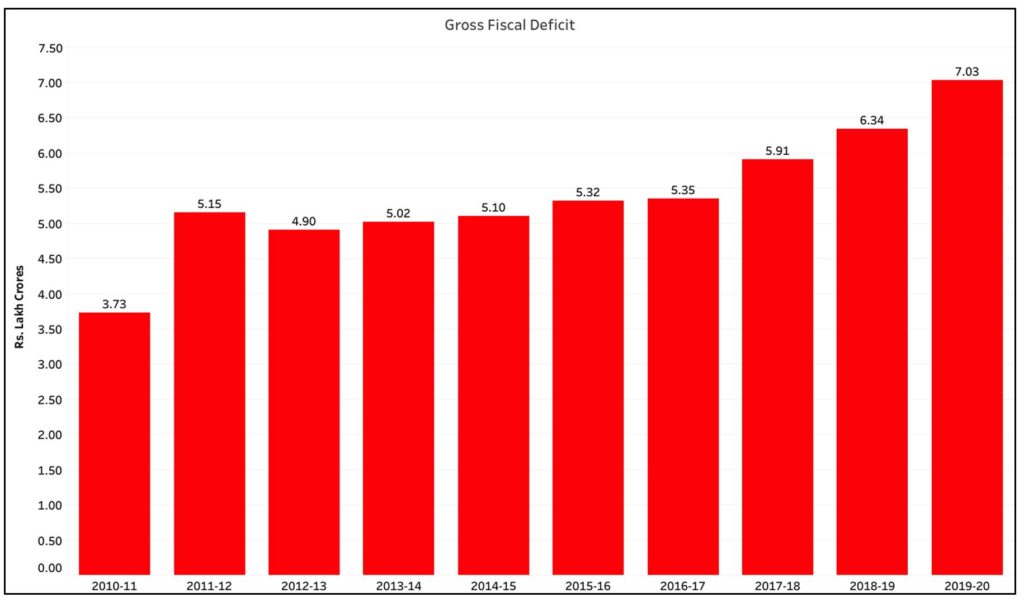

Increase in the absolute numbers relating to Gross Fiscal Deficit over the years.

The Gross Fiscal Deficit (GFD) is the excess of total expenditure (including loans net of recovery) over revenue receipts (including external grants) and non-debt capital receipts. In general, fiscal deficit occurs due to an increase in the government expenditure or a decrease in the revenue earned.

The estimated fiscal deficit for 2019-20 is ₹ 7.03 lakh crores. This deficit is the difference between GFD expenditure, which is estimated at ₹ 27.71 lakh crores, and the estimated GFD revenue of ₹ 20.67 lakh crores.

Over the years, government revenue has increased every year. However, the comparative increase in the expenditure in those years has resulted in an increasing trend in the Gross Fiscal Deficit year-on- year.

While these absolute numbers indicate the volume of the GFD, they do not offer a holistic perspective in reference to the economy. These numbers do not account for inflation and since the size of Indian economy has expanded over the years, these numbers have also increased proportionally. Therefore, analyzing GFD figures in context of GDP would offer better insights into the state of economy.

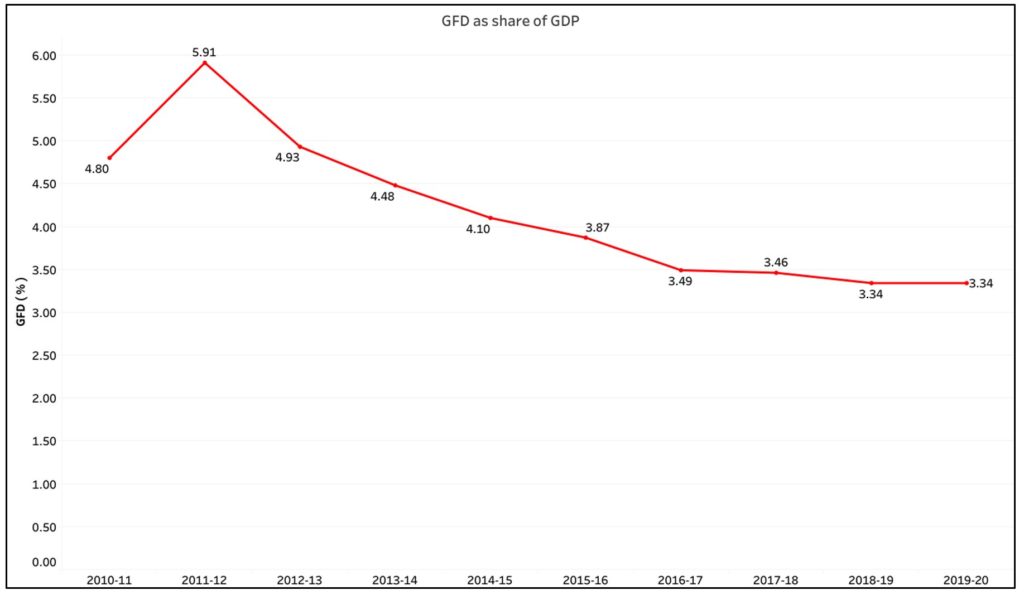

GFD as percentage of GDP has reduced over the years

As per the Annual Handbook of Statistics on Indian Economy, the government of India estimates GFD for 2019-20 to be at 3.34% of country’s GDP. The revised estimate for year 2018-19 was also 3.34%.

The estimates for these two years are lower than the actual GFD of earlier year i.e. 3.46 % in 2017-18. For the last decade, GFD as a share of GDP has been on a decreasing trend except for 2011-12, where it was 5.91% (higher than 4.8% of previous year). However, the rate of decline has slowed down over the last four years. With a bleak economic outlook and lower than expected tax revenues, the GFD target for 2019-20 may not be met.

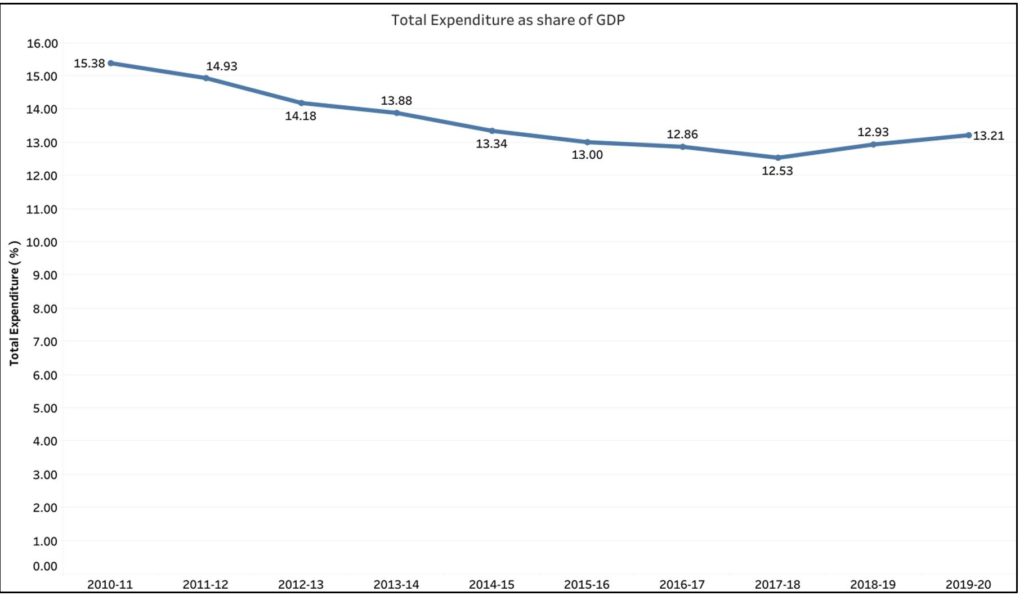

Estimate for share of Total Expenditure as a % of GDP is higher for 2019-20

A decade ago, in 2010-11, the total expenditure of the Central government as share of GDP was 15.38%. In the subsequent years, it has shown a gradual decline. The lowest being recorded are the actual figures of 2017-18 when the total expenditure was only at 12.93% of the GDP.

This has been the lowest share of Total Central Government expenditure as a % of the GDP in over 4 decades. However, the revised estimates for total expenditure for 2018-19 is now pegged at 12.93% of the GDP. The estimated share of total expenditure for the year 2019-20 is 13.21% of the GDP. This is the highest over the last five years. The last time the numbers were higher than the previous year was in 2009-10. In that year, the total expenditure share was 15.82%, which was higher than 2008-09’s 15.7%. These two years were part of a 3-year period (2007-2010), where the share of total expenditure was on the rise.

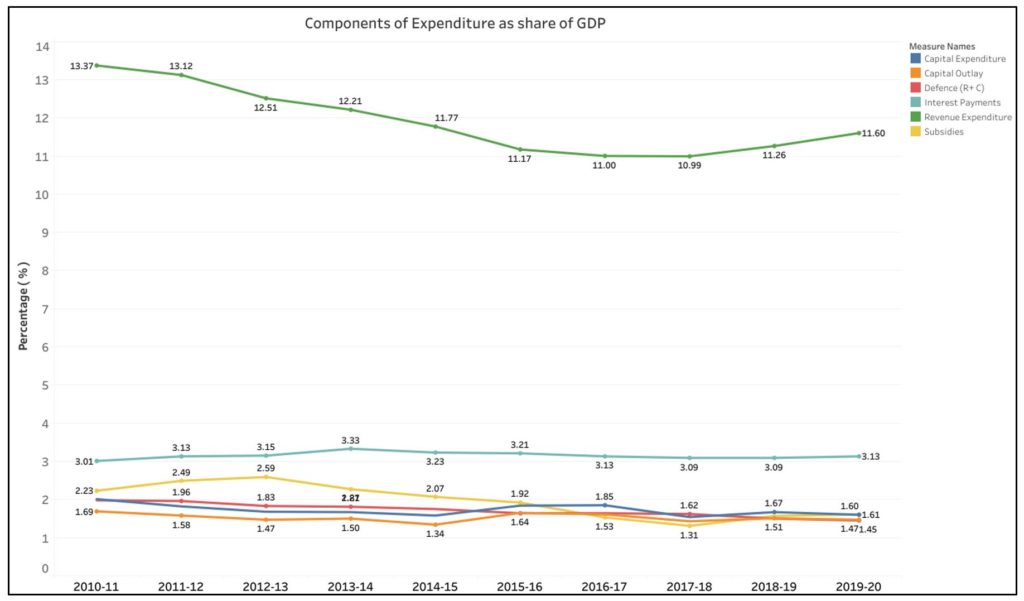

Increase in Revenue Expenditure in the last three years

Revenue Expenditure forms a major share of the total expenditure of the Central Government. An increase in the same has a corresponding impact on the total expenditure. For 2019-20, the estimate for Revenue expenditure as a share of GDP is 11.6%. In 2016-17 and 2017-18 it was 11% and 10.99% respectively with an increase in the revised estimate for 2018-19 and the estimate for 2019-20.

Meanwhile, the share of Capital Expenditure has witnessed a decline since 2015-16 except for the revised estimates of last year where it was 1.67% (in 2017-18 it was 1.54%). The estimates of other components of expenditure by Central Government have also witnessed an increase over the last two years. (the numbers for 2018-19 and 2019-20 are estimated figures and the real values could vary).

While, the increase in share of non-capital expenditure has pushed up the overall expenditure of the central government, let us look at the state of other influencing factor of GFD I.e. the Revenues.

Fiscal deficit is formed when the revenue of government is unable to match the expenditure. A growing economy would imply that the expenditure would also be on ascendance, however, increase in the revenues would help to cut down the fiscal deficit.

So, what is the state of revenues of Central Government?

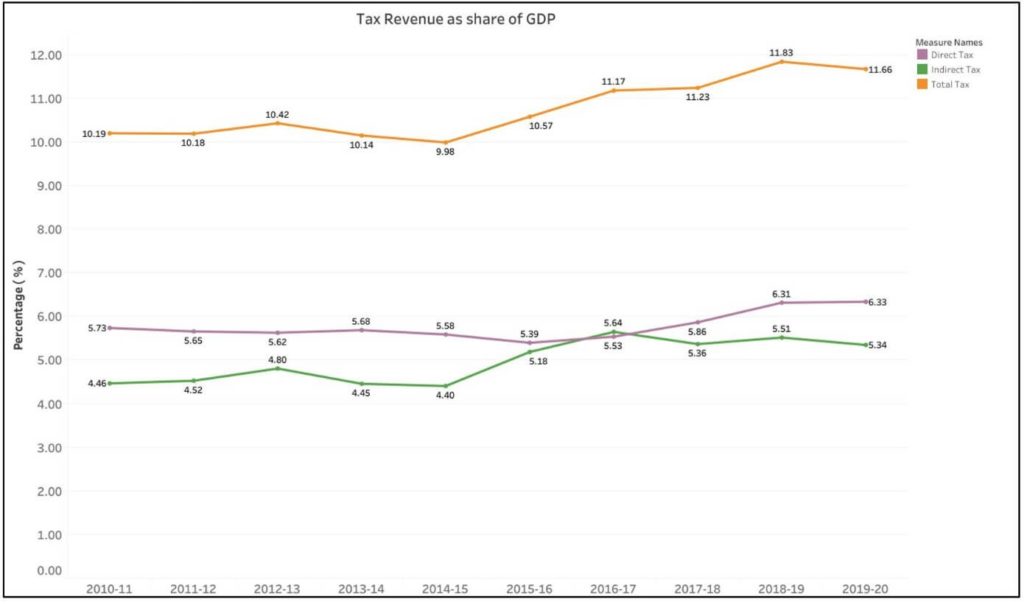

As per government estimates, share of Tax revenue in GDP to reduce in 2019-20

Tax revenue (both Direct and Indirect) is a major source of Revenue for the Central Government. The government figures peg the estimate share of Total Tax Revenue at 11.66% of the total GDP for 2019-20.

Meanwhile, the revised estimate of Total Tax Revenue for 2018-19 is 11.83% of GDP. Within the Tax Revenue, the share of Direct Taxes has witnessed an increase over the years and the government estimates an increase for both 2018-19 and 2019-20.

However, a major concern is with the share of Indirect Tax revenue. The Goods and Services Tax (GST) is an indirect tax. After two years of implementation of GST, government itself pegs the share of Indirect taxes at 5.34% of the GDP, less than the revised Estimate of 5.51% of last year i.e. 2018-19.

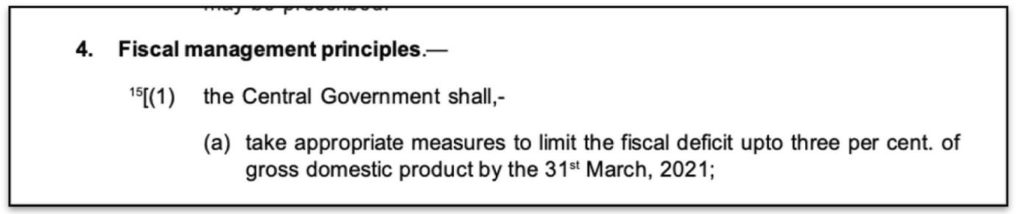

Reducing Fiscal Deficit to 3% of GDP is a recommendation of FRBM Act

The Fiscal Responsibility and Budget Management Act, 2003 was passed by Parliament of India to institutionalize Financial discipline, reduce Fiscal Deficit, improve macroeconomic management and the overall management of Public funds in India.

One of the targets set as part of the act was to reduce the Fiscal Deficit to be 3% of the GDP by 31st March 2021.

For 2003-04 the Fiscal deficit was 4.34% of GDP which then eventually reduced to 2.54% by 2007-08. However, during the global recession of 2008, the Fiscal deficit increased to 5.99% in 2008-09 and further increased in ensuing years. Since 2012-13, when the Fiscal deficit reduced to 4.93%, there has been a gradual decrease towards the 3% target.

For 2019-20, the fiscal deficit estimate is pegged at 3.34%, same as that of 2018-19. In absolute terms, government’s estimate of Fiscal Deficit is ₹ 7.03 lakh crores for 2019-20. However, by the end of first quarter of 2019-20, the Fiscal deficit is ₹ 4.32 lakh crores. This is already 61.45% of the fiscal deficit estimated for the whole year. This can eventually impact the 3.34% estimated for the entire year and the deficit could eventually be much higher by the end of the financial year.

The concessions given in Corporate tax, and with GST revenues not picking up, we are potentially staring at a larger fiscal deficit this fiscal.

Featured Image:India’s Fiscal deficit

2 Comments

Pingback: Explainer: India’s Fiscal deficit - Fact Checking Tools | Factbase.us

Pingback: Explainer: Is Fiscal Deficit of State Governments under control? - Fact Checking Tools | Factbase.us