[orc]Every year during budget, the government estimates both revenues and expenditure. But, how much of these estimated revenues turn into actual receipts for the government?

The Union Budget for the financial year 2019-20, was presented by Union Finance Minister Nirmala Seetharaman on 5th July 2019. There have been varying opinions expressed about the different aspects in the budget and the proposed allocations to different sectors, which underlines the priority of the current government and path they intend to take.

A Union budget not only provides the vision for the future with details about the proposed government spending and the prospective revenues, but also provides a reflection on the actual expenditure and revenues of the union. While most of the focus after presenting a budget is about the new proposals of the government in regard to budget allocation, schemes, taxes etc., it is also important to look into the actual government spending and revenues (also called as receipts) during the previous financial year.

Actuals provide an authentic reflection of the performance

Every year, in the budget, the government presents its proposed allocation of funds for various sectors and outlines the sources of revenue that would meet these expenditures. During the course of the year, various ministries and departments spend on different schemes and activities. There could be scope for revision in the allocation originally made in view of any new development or proposed scheme. At the end of financial year, the spending’s and the revenues are submitted for audit and these audited figures are included in the budget as “Actuals”.

Let us understand at the ‘Actual” figures presented in the union budget. It has to be noted that, these actual figures presented in a budget belong to previous financial year (FY), since the actuals can only be complied by any department only after completion of the financial year and also needs to go through an audit. Hence the Actuals provided in 2019-2020 budget belong to the financial year 2017-18. We will now look into the propose numbers in the FY 2017-18 budget and the Actuals being presented in the current budget for that year.

In the first part of the series, we will look into the Actual receipt’s vs Estimated receipts

Actual total receipts for 2017-18 is less than the estimates

As per the budget primer of PRS Legislative Research, Government Receipts consists of Revenue Receipts and Capital Receipts. Revenue receipts are considered as those government receipts which do not (i) create liabilities or (ii) reduce assets. Taxes, interest and dividend received on government investments, cess, receipts for the government services provided etc. are the sources of revenue receipts.

The Revenue receipts of the government includes:

- Tax Revenues

- Non-Tax Revenues

Capital Receipts are those receipts which (i) create liabilities (borrowing) or (ii) reduce assets (ex. disinvestment.)

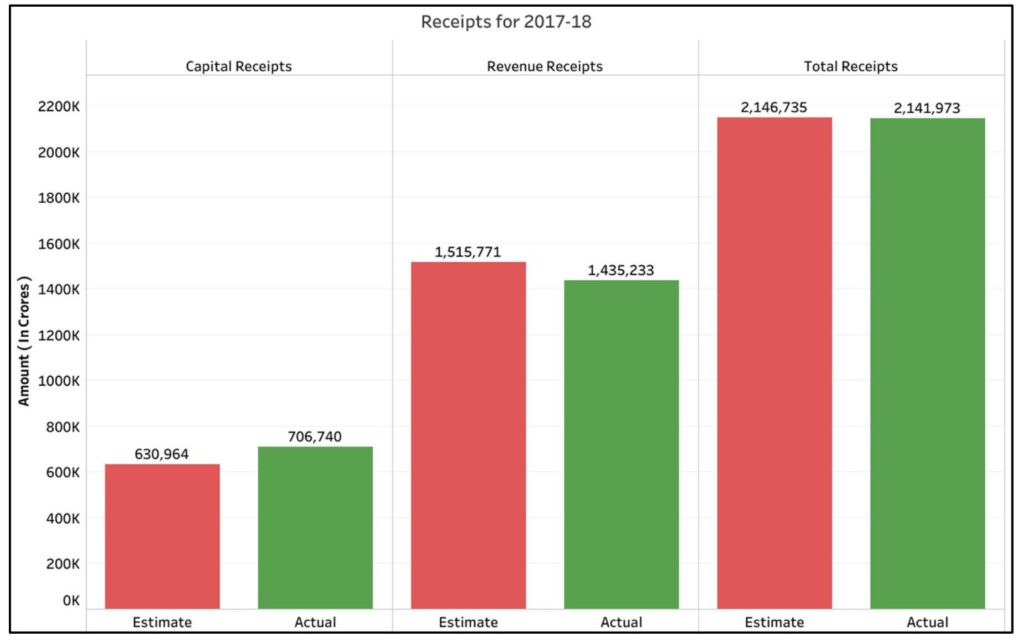

As per Budget at a glance 2017-18 document, the estimate for total receipts was ₹ 21,46,735 Crores, whereas the actuals for FY 2017-18, released with the current year budget is ₹ 21,41,973 Crores. This is a deficit of ₹ 4762 crores when compared to the estimates or a shortfall of less than 0.5%. But this deficit has breached the 5% mark for 2018-19, going by the provisional numbers presented in the Economic Survey of 2018-19.

Compared to the estimates, actual figures suggest a deficit in Non-Tax receipts with marginal increase in Tax receipts

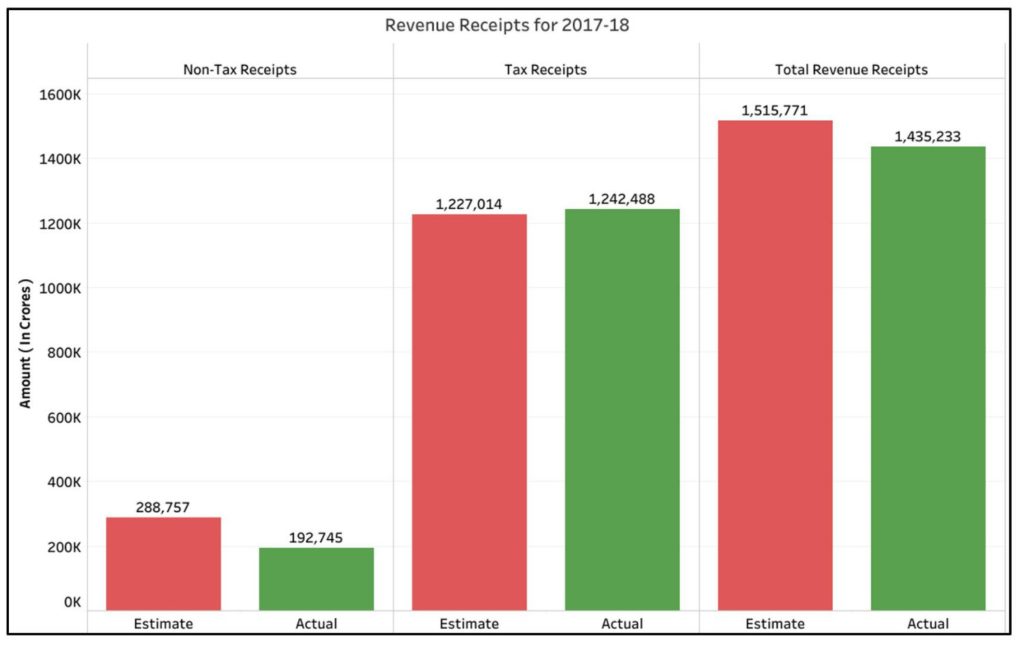

The actual revenue receipts for 2017-2018 are less than the estimated revenue receipts by ₹ 80,538 crores. The estimated Revenue receipts for 2017-18 was ₹ 15,15,771 crores, whereas the actual revenue receipts for 2017-18 is ₹14,35,233 crores.

The actual tax revenue for 2017-18 is ₹ 12,42,488 crores, which is higher than the estimated Tax revenue of ₹ 12,27,014 crores i.e. difference of ₹ 15,474 crores. It has to be remembered that 2017-18 was the first year of GST implementation.

However, this increase in actual tax revenue could not cover up the deficit of total revenue, due to the larger difference in the Non-Tax revenue.

The actual non-tax revenue is ₹ 1,92,745 crores compared to the estimated revenue of ₹ 2,88,757 crores i.e. a difference of ₹ 96,012 crores.

Receipts through Corporate Taxes and GST cover the fall in actual receipts from other tax sources

Revenue through taxes forms a major share of the total revenue receipts of the government. Nearly 85% of the revenue receipts are through taxes. Corporate tax, Customs, Excise, Tax on income other than corporates and Service tax etc. are the major sources of Tax receipts.

Furthermore, since 01 July 2017, Goods and Services Tax (GST) was implemented and hence does not have any estimates figures for 2017-18. However, it does reflect in the actuals.

The estimates for revenue through Taxes was ₹ 12,27,014 crores, while the actual receipts through taxes amount to ₹ 12,42,488 crores. i.e. ₹ 15,474 crores more than the estimate.

However, the scenario of higher actuals than the estimates is not across the sources. The actual tax receipts for Income Tax, Customs, Excise etc. are less than the estimated figures for 2017-18. The combined actual receipts of these three sources is ₹ 8,18,635.57 crores against the estimate of ₹ 10,93,155.27 crores. This deficit of 2,74,519.7 crores is covered up in the higher actual receipts of (i) Corporate tax (ii) newly introduced GST.

The Government of India earned ₹ 4,42,561.43 crores in 2017-18 through the newly introduced GST. This coupled with actuals of Service Tax (₹ 81228.37 crores) is more than the estimated receipts through service tax i.e. ₹ 2,75,000 crores.

Actual less than the estimates across major heads under Non-Tax receipts

Non-Tax revenues are other sources of revenue receipts for the government. These receipts include:

- Interest

- Dividends and surpluses

- Fiscal services

- General Services – Administrative services, Police, Printing & stationery, Public works, Defence services etc.

- Social services – Education, Family, Housing, Urban Development, Broadcasting, Information & publicity etc.

- Economic Services – Agriculture, Animal Husbandry, dairy, Forestry & Wild life, Irrigation, Power, Petroleum, Coal, Shipping, Civil aviation etc.

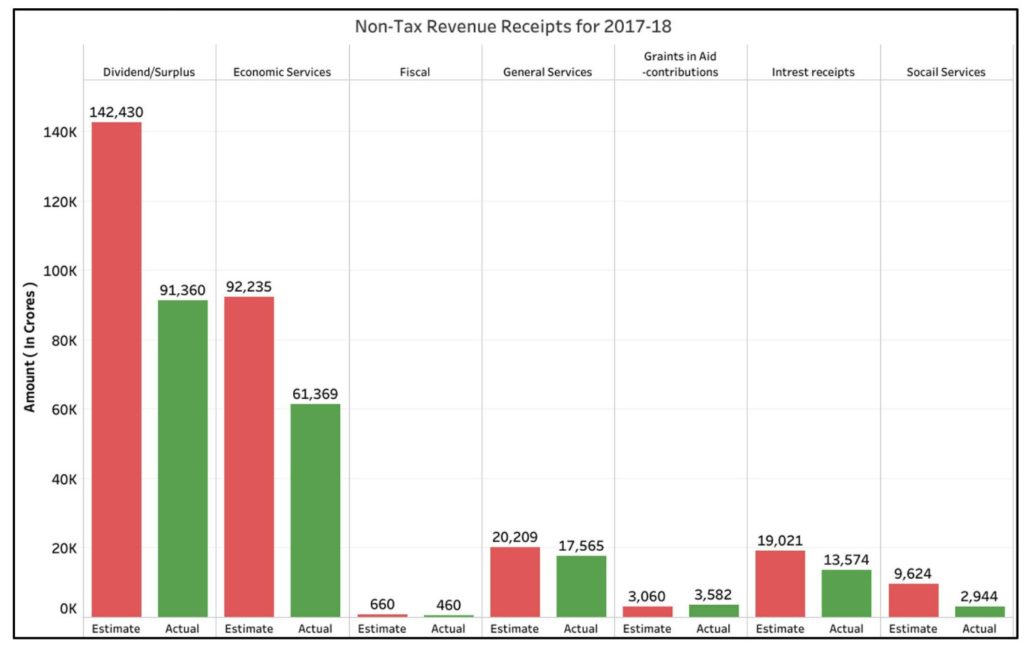

The estimated Non – Tax revenues for 2017-18 amount to ₹ 2,88,757.07 crores, whereas the actual Non-Tax Revenues for 2017-18 is ₹ 1,92,745.

A major portion of the difference between the estimates and the actuals is due to the deficit of revenue from Dividends and Profits. The total receipts estimated for 2017 -18 through dividend and profits was ₹ 1,42,430.49 crores, whereas the actual amount was ₹ 91,360.47 crores i.e. shortfall of ₹ 51,070 crores from the estimated receipts. The surplus from RBI is the highest source of non-tax revenue for the government of India. Few experts cite that the costs incurred due to demonetization to be one of the reasons for the low surplus when compared to the estimated figures.

The actual receipts for Economic services (₹ 61,368.74 crores) is also less than the estimate (₹ 92,234.63 crores).

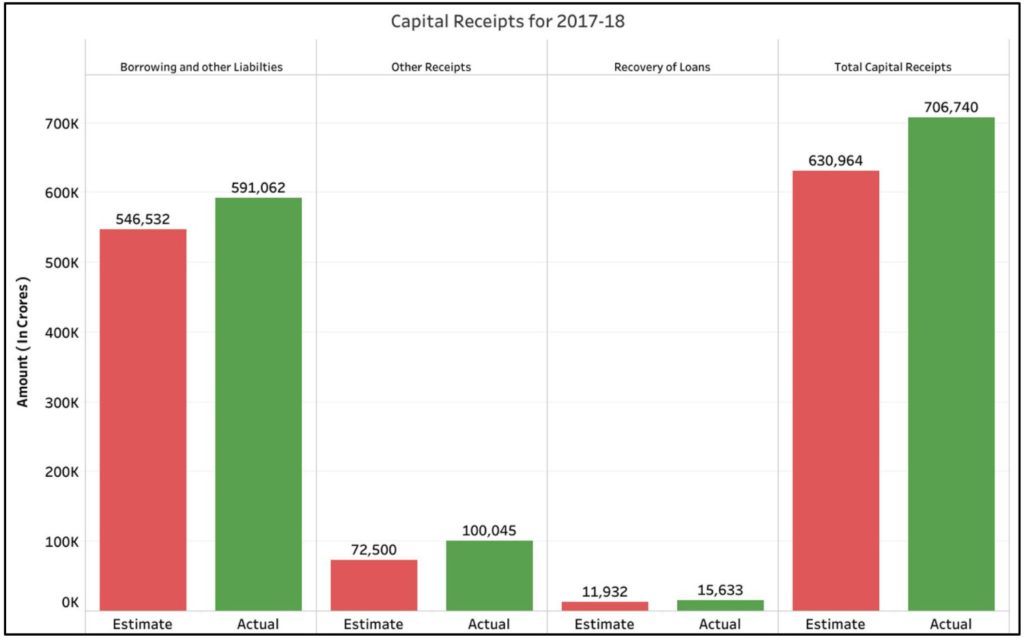

Actual Capital Receipts are higher, but due to borrowings & other liabilities

The estimated Capital receipts for 2017 -18 were ₹ 6,30,964 crores and the actual capital receipts are ₹ 7,06,740 crores i.e. 75,776 crores more than the estimated figures. While the recovery of loans has fared better than estimate, the major contribution towards higher actual figures for capital receipts compared to the estimated, is due to “Other receipts” and “Borrowings & other liabilities”. The actual capital receipts through Saving Bonds (₹ 25,208.52 crores) is significantly higher than the estimates (₹ 2,970.66 crores) which has contributed towards increase in the numbers for “Other receipts”.

What does all this mean?

To summarize, the insignificant deficit of less than 0.5% is largely due to two factors. One is the higher GST earnings in 2017-18. Since 2017-18 was the first year of implementation and that too only for 9 of the 12 months in the financial year, there were no estimates for GST in the original budget for 2017-18. This led to an increase on this front. Two is the increase in borrowings and other liabilities. Both these factors dwarfed the fall in other areas of tax revenue such as customs & excise duty and non-tax revenue under ‘dividends & profits’. A better picture would emerge when we have the numbers for 2018-19.