Like in the case of revenue, the expenditure estimates in the budget do not always translate into actual spending. Here is a look at the expenditure under various broad heads.

[orc]

In the previous article on Union Budget, we explored the actual figures of Union Government’s revenues for 2017-18 and compared them with the estimated figures. In this article, we would explore the estimates of expenditure provided for 2017-18, and the actual expenditure, especially among the various schemes funded by the central government.

Expenditure estimates are based on the recommendations from individual Ministries

The Ministry of Finance comes up with the expenditure estimates, based on the consultation with each individual ministry and department. Each ministry comes up with their estimates for expenditure, which is discussed with NITI Aayog. The finalized expenditure estimates are then shared by each of the ministries with the Finance ministry. These are termed as Demand for Grants. Apart from this, NITI Aayog and Finance ministry hold consultations with experts from various fields for recommendations on policies and schemes. The finance ministry takes into consideration these requests from the ministries along with the various recommendations. Based on the revenue estimates, they come up with the expenditure estimate for each of the ministries.

As we have discussed in the earlier article on the union budget, the actual values can only be ascertained after the completion of the financial year. The actual revenue and expenditure once ascertained are audited before they can be presented before the house. Hence, whenever a budget is presented, the actual figures are for the previous year i.e. in the budget for 2019-2020, the actuals are for 2017-18. These actuals offer a good insight to understand the actual performance in comparison to the estimate and gives an opportunity to reset the course as required.

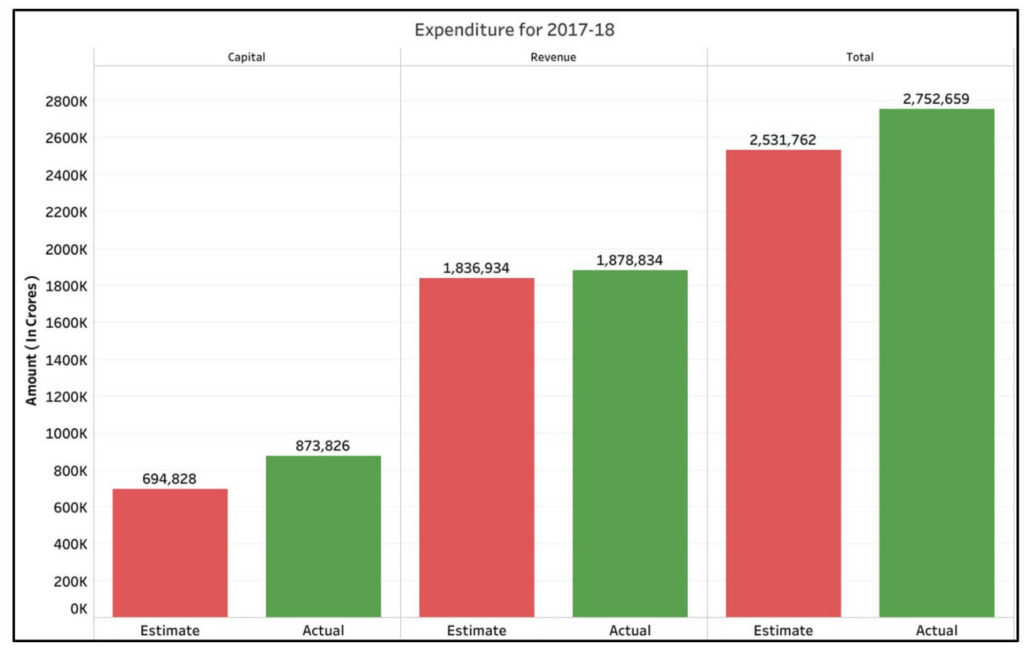

Actual expenditure for 2017-18 higher than the estimates

Like the case in receipts, even the expenditure is categorized as Revenue Expenditure and Capital expenditure. Technically, Revenue expenditure is that expense which neither created any new assets nor reduces the liabilities. These expenses are incurred in running government departments and services. They tend to be recurring and short term in nature. Salaries of the employees, pensions, subsidies, interest payments, grants are few of the examples of revenue expenditure.

Capital expenditure is any expenditure which results in the creation of an assets or reduction of a liability. All the asset creation activities like buildings, roads, purchase of land, investments etc. are considered as capital expenditure. Repayment of an existing loan would also be counted as capital expenditure as it leads to reduction in the liability.

The union budget for 2017-18 estimate the total expenditure at ₹ 25,31,762 crores, whereas the actual expenditure is higher at ₹ 27,52,659 crores. Both the actual revenue and actual expenditure is more than the estimated figures for the year 2017-18. These number include not just the expenditure through budget, but the resources of public enterprises also (commonly known as the Public Sector Undertaking or PSUs)

The estimated revenue expenditure was ₹ 18,36,934 crores, however the actual revenue expenditure was ₹ 18,78,834 crores. Bulk of the increase is seen in the capital expenditure, that too, from the resources of public enterprises. In fact, the actual capital expenditure through budget for 2017-18 is ₹ 2,63,139 crores compared to the estimated expenditure of ₹ 3,09,800 crores.

Higher actual spending on flagship Centrally Sponsored Schemes

Government schemes play a critical role in contributing towards the development story of the country. While each of the states have their own State Government sponsored schemes in accordance to their own priorities, there are few schemes that are sponsored by the Government of India (GoI). These schemes are aimed at fulfilling national goals like literacy, health, nutrition etc. GoI schemes are broadly of two types

- Centrally sponsored schemes

- Central sector schemes

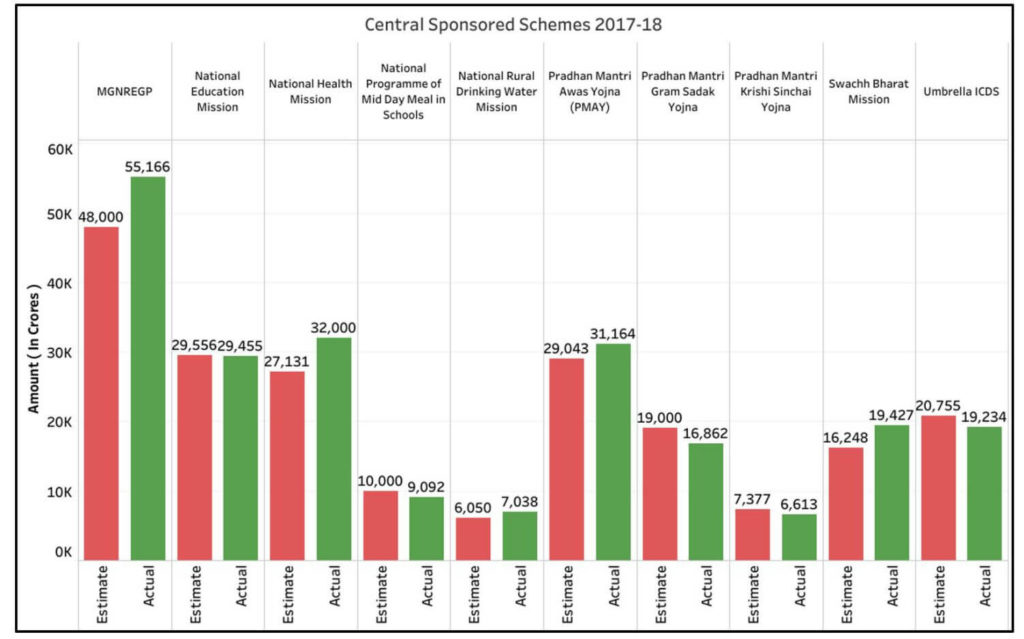

What about the Centrally sponsored schemes?

Centrally sponsored schemes are those schemes where the expenditure is shared between the GoI and the states. These are categorized as Core of Core schemes, Core schemes and optional schemes.

The total estimated expenditure for centrally sponsored schemes was ₹ 2,78,433.23 crores, while the actual expenditure for 2017-18 is ₹ 2,85,447.8 crores. MGNREGA occupies a significant portion (nearly 20%) of the expenditure incurred for Centrally sponsored schemes.

The estimated expenditure for of MGNREGA for 2017-18 was ₹ 48,000 crores, however the actual expenditure was more by nearly 15% i.e. ₹ 55,166.04 crores. Swachh Bharath Mission also has an increase in the actual expenditure with nearly 20% more being spent on the actual estimate of ₹ 16,248.27 crores. National Health Mission, National Rural Drinking Water Missions and Padhan Mantri Awas Yojna also have recorded actual expenditure more than the estimated expenditure.

On the other hand, schemes like Pradhan Mantri Krishi Sinchai Yojna (Irrigation), Pradhan Mantri Gram Sadak Yojna (Rural roadways) etc. have actual numbers less than the estimated numbers. Schemes focussed on child nutrition, health and education have also taken a back seat with the actual expenditure less than the estimated expenditure.

The total estimated expenditure for the three schemes of – National Education Mission, National programme of Mid-day meals in Schools, and ICDS is ₹ 60,310.86 crores, whereas the actual expenditure of these three schemes is ₹ 57,780.5 crores.

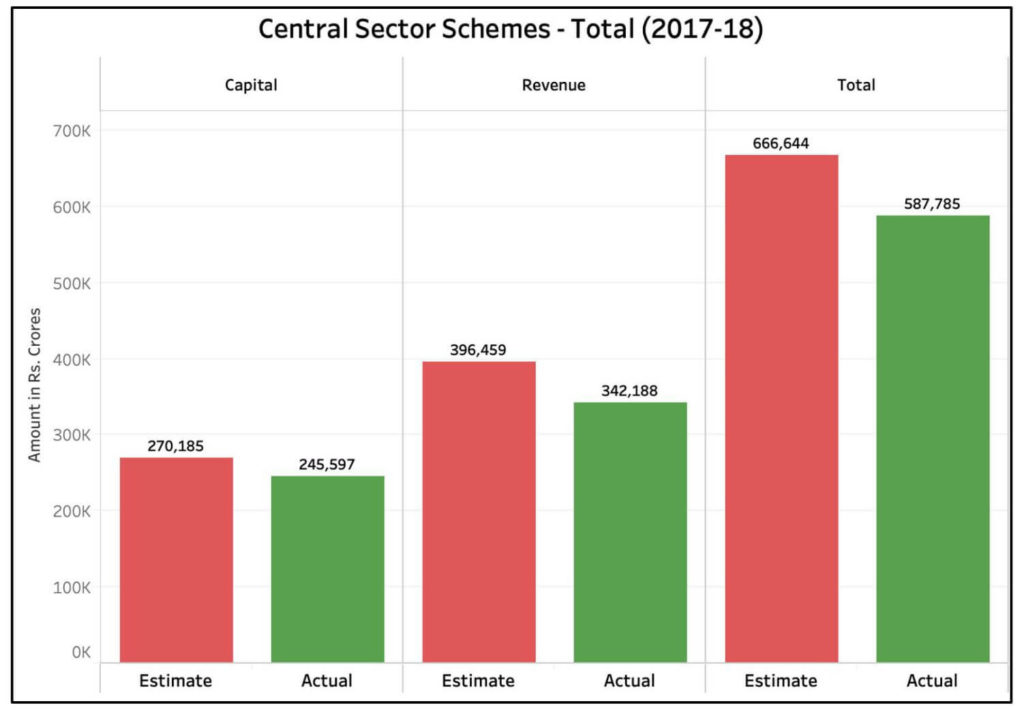

Less actual spending on many of the Central Sector Schemes

Central Sector schemes are completely funded by the central government unlike Central sponsored schemes which have state funding collaboration.

The total estimate for expenditure on Central Sector Schemes was ₹ 6,66,644.02 crores, while the actual spent for 2017-18 is ₹ 5,87,784.99 crores. Of the total expenditure, the estimated revenue expenditure across various Central sector schemes was ₹ 3,96,459.2 crores while the actual revenue expenditure was ₹ 3,42,187.87 crores.

Even the actual capital expenditure on Central Sector schemes is less than the estimated capital expenditure. The actual capital expenditure for 2017-18 is ₹ 2,45,597.12 crores, whereas the estimated expenditure was ₹ 2,70,184.78 crores.

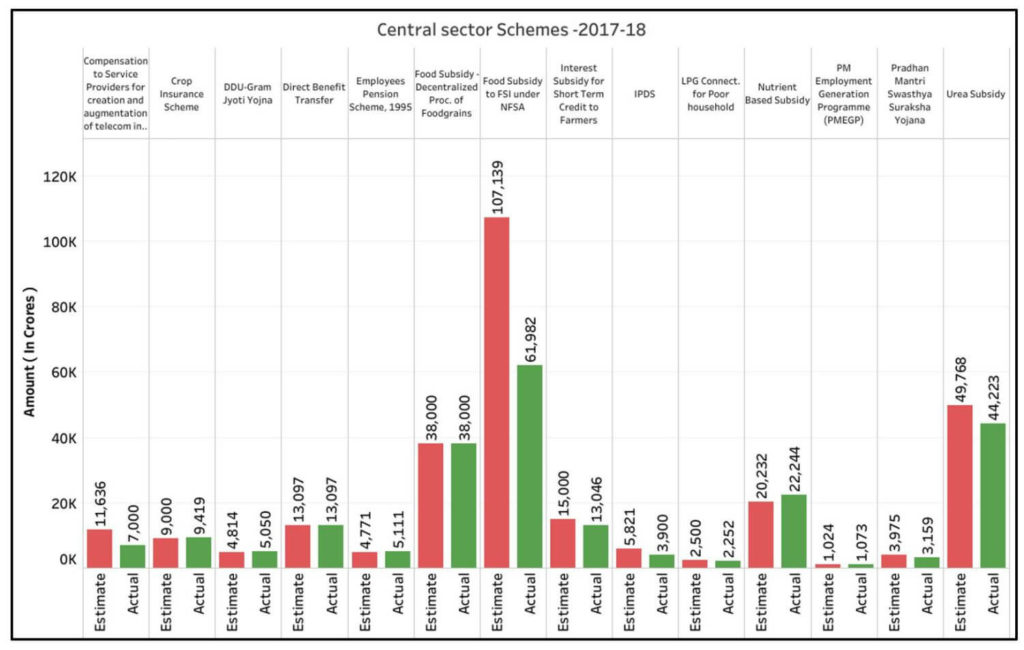

The actual expenditure on many of the key Central sector schemes for 2017-18 is less than the estimated expenditure as can be seen from the following chart.

Central Government’s actual spending is less than the estimated spending for 2017-18

As discussed earlier, the actual spending figures give an insight into the real picture. The estimate expenditure on various schemes provided in any budget reflect the government’s intent to spend on those particular schemes. It has to be remembered that these estimates are allocations made based on the requests received from various ministries/departments and also depend on the priority. These allocated funds if not spent might not fulfil the purpose of the scheme.

While the government did spend more than the estimate on few of its flagship and highly promoted schemes like Swacch Bharath and Pradhan Mantri Awas Yojana, equal impetus on spending ought to be laid on other key schemes.

The spending on schemes related to education and health of children are few of such schemes where if the actual spending is as per the allocation, could have a positive impact on the development in the longer run. Interest Subsidy for Short Term Credit to Farmers, Food Subsidy, Pradhan Mantri Swasthya Suraksha Yojana etc. were such key schemes which could have done well if the actual spending was on par with the estimates.