The Government of India recently issued a notification for the new ‘Bharat’ or BH series for vehicle registration which is meant to reduce the difficulties of people who frequently get transferred or move from one state to another. Here are all the details of the new series and issues to watch out for.

Recently, the Ministry of Road Transport and Highways (MoRTH) introduced a new registration mark for vehicles – Bharat Series or the ‘BH’ registration series to ensure seamless transfer of personal vehicles across states. A vehicle registered in the BH series will not have to re-register when the vehicle shifts from one state to another. As per the current rules, if a person relocates to another state, they must re-register their vehicle within 12 months in the state if the vehicle is registered in another state. These new rules will be effective from 15 September 2021.

What is the new notification of MoRTH about?

Through a notification issued on 26 August 2021, the Ministry of Road Transport and Highways (MoRTH), has amended the Central Motor Vehicles Rules, 1989 which shall come into effect from15 September 2021. The new rules will be called the Central Motor Vehicles (Twentieth Amendment) Rules, 2021. The amendment has been made to make the process of re-registration of vehicles when relocating to another state, a hassle-free process by introducing the Bharat series, or the BH series. With the BH series registration mark, one will not be required to re-register their vehicle upon relocation to another state. However, the change in the state must be informed to the registering authority within 30 days, if relocating. This facility will be particularly helpful for those individuals who are frequently transferred to other states or union territories within the country.

Who are eligible for the new BH registration?

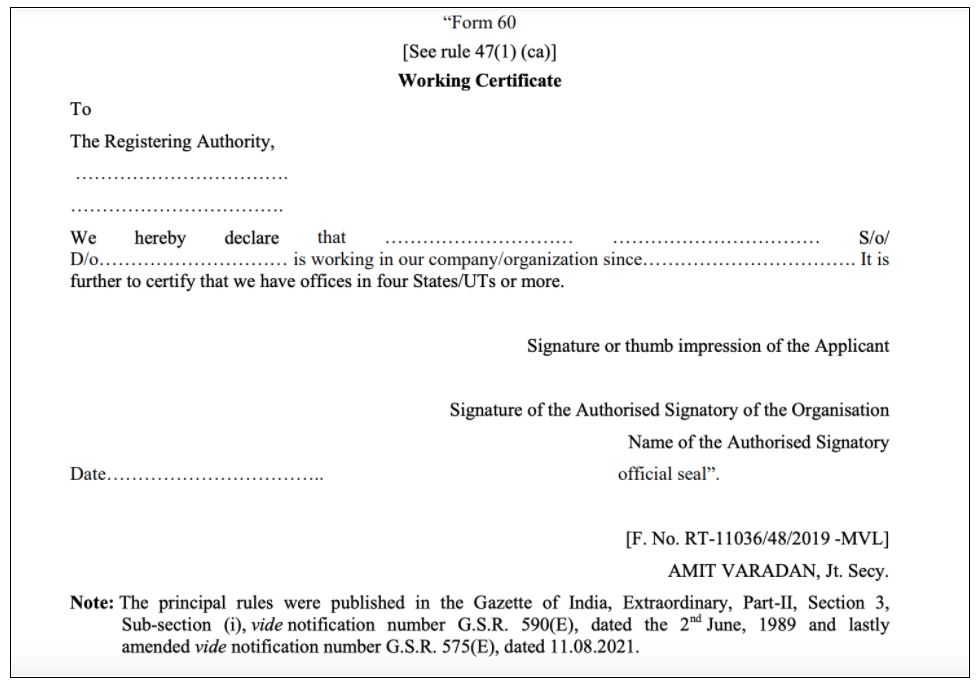

The BH registration will be available on a voluntary basis for anyone who is an employee of Central Government or State Government, or Central or State Public Sector Undertakings (PSUs), and Defence Personnel. In the case of the private sector, employees of those companies/organizations which have their offices in four or more States/Union territories are eligible to avail of the new registration mark. However, they will have to fill up ‘Form 60’ at the time of application for the registration. The ‘Form 60’ is a working certificate in which the company/organization declares that the applicant is working for them and that they have offices in at least 4 states/UTs. For government/PSU employees, valid employment ID/proof must be furnished. Apart from these, the sale certificate, insurance certificate, proof of address, and temporary registration must also be furnished at the time of registration.

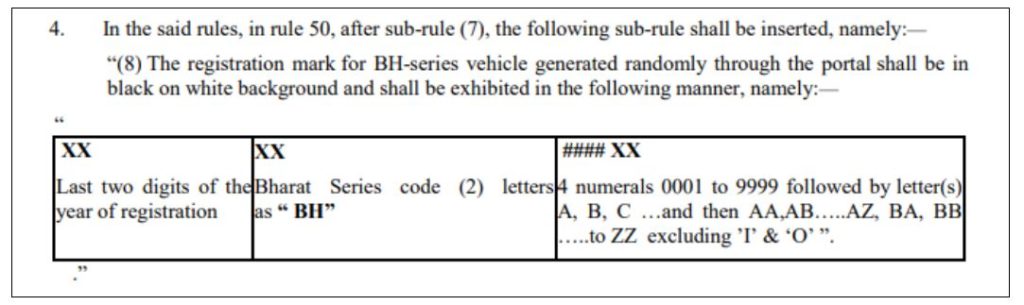

What is the format for the BH series registration mark?

Upon verification of the ID Proof or Form 60, the registration mark will be generated randomly through a computer portal. The format for the BH series registration mark is YY BH #### XX where YY is the Year of first registration, BH is the Code for Bharat Series, #### is the four-digit number which will be randomly assigned by the computer portal ranging from 0000 to 9999, and XX are two letters of the English Alphabet which will follow the A, B, C…. sequence and then AA to ZZ sequence. It will be written on a black on white background, just like the number plate of private vehicles seen on road.

How much tax will be levied?

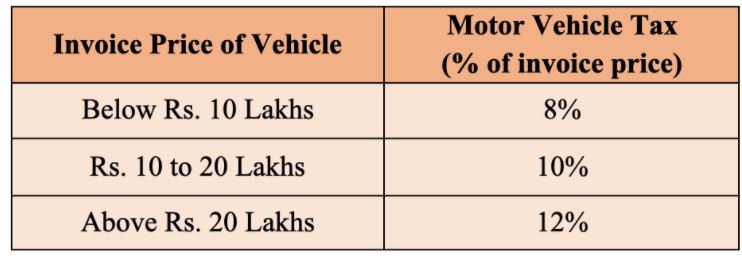

The Motor Vehicle Tax will be levied by the States/UTs at the time of registration and will be calculated electronically through a portal based on the invoice price of the non-transport vehicle excluding the GST. The Motor Vehicle Tax varies from 8% to 12% for petrol vehicles. The price slab and tax levied is given in the following table. For Diesel vehicles, a 2% extra charge will be levied. For Electric vehicles, 2% less tax will be charged.

How will the tax be collected?

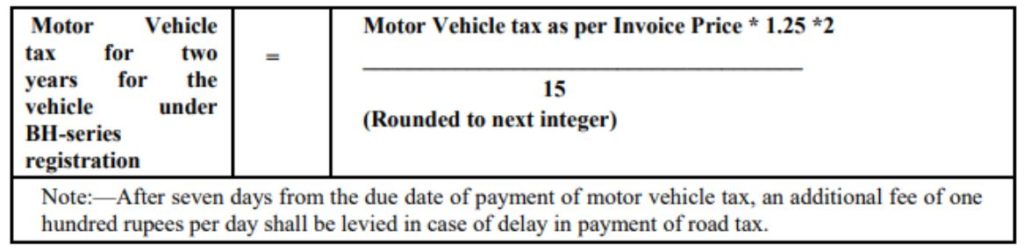

The owners of vehicles registered under the BH system will be levied Motor Vehicle Tax electronically through a portal for two years or in multiples of two. After the fourteenth year from the date of first registration, the Motor Vehicle Tax will be levied annually which shall be half of the amount which was charged earlier for that vehicle.

The formula for calculation of the Motor Vehicle Tax for two years is

How about for vehicles that do not have BH registration mark?

The above-discussed rules are applicable only for those vehicles which will bear the BH registration mark. For other vehicles, the rules have not been changed. Those who do not have the BH registration mark are permitted to keep the vehicle for a maximum period of 12 months in any state other than the state where the vehicle is registered.

If they wish to keep the vehicle for a longer period, the vehicle has to be re-registered in the relocated state within the stipulated 12 months period for which a no-objection certificate must be obtained from the parent state. This is mandatory for the assignment of a new registration mark in the new state. The new state would then assign a new registration mark after the road tax is paid on a pro rata basis. Then, the owner must apply for a refund of the road tax in the parent state also on a pro rata basis. This is because, while registering a vehicle, the owner pays a road tax upfront for a period of 15 years in the state where was the vehicle was first purchased. So, when relocating within these 15 years, they will have to pay the tax for the remaining period in the new state and can collect the refund from the parent state for the leftover period. The refund process also varies from state to state.

What about the implementation?

This move is helpful to people who frequently get transferred or move to a new state by reducing the need for visits to the RTO office for re-registration. Further, it has also made the process online which also relieves people from dealing with excessive administrative procedures. It centralizes the system of re-registration of vehicles when relocating between states.

However, the implementation on the ground remains to be seen as the modalities of payment of motor vehicle tax every two years are not specified yet. Since the motor vehicle tax goes to the state governments, this could be a sticky issue if owners do not pay on time. Since the motor vehicle tax is an important revenue source for the states, how the state authorities force the owners to pay every two years remains to be seen. In the case of e-Challans issued for violating traffic rules, not everyone regularly pays the penalty amount. Police officers make people pay all the dues during inspections of vehicles plying on roads. One has to wait for the actual implementation to understand how this plays out.

Has the issue been raised before?

In 2014, a Bengaluru resident started an online campaign ‘Drive without borders: one nation – one road tax’ demanding uniform tax for all passenger vehicles pan India, abolishment of Lifetime tax and start taxing period as per the convenience of people, and establishment of a system which automatically transfers the remaining road tax between the states upon relocation. The campaign began following the Karnataka government’s move making it mandatory for vehicles from other states to pay the Lifetime tax levied by the Karnataka government if the vehicle has been plying continuously in Karnataka for more than 30 days.

Featured Image: BH Series for Vehicle registration