The Report on ‘Trend and Progress of Banking in India 2022-23’ is an annual performance report released by the RBI that offers a comprehensive analysis of the Indian banking sector, covering SCBs, NBFCs among others. The report underscores the robust state of India’s banking system and NBFCs while highlighting some shortcomings.

The Report on Trend and Progress of Banking in India 2022-23 is an annual performance report released by the Reserve Bank of India (RBI) in accordance with Section 36(2) of the Banking Regulation Act, 1949. This statutory publication offers a comprehensive analysis of the Indian banking sector, covering cooperative banks and Non-Banking Financial Companies (NBFCs). The report provides insights into the achievements and challenges of the sector, offering a detailed overview of their contributions to the country’s economic framework. In this story, we look at some of the key findings of the report.

Consolidated balance sheet of SCBs grew by 12.2%, highest in 9 years

As of March 2023, India had 140 commercial banks, including 12 Public Sector Banks (PSBs), 21 Private Sector Banks (PVBs), 44 Foreign Banks (FBs), and others. Out of these, 136 were Scheduled Commercial Banks (SCBs). The consolidated balance sheet of these banks grew by 12.2% in 2022-23, the highest in 9 years. There has also been a shift in the composition of the banking sector’s consolidated balance sheet, with a 1% decrease in the share of PSBs and a corresponding increase in the share held by private banks.

The report underscores the robust state of India’s banking system and NBFCs. This is evident from the high capital ratios, improved asset quality, and substantial earnings growth. Further, it noted that this financial resilience has facilitated a double-digit credit expansion, playing a pivotal role in supporting domestic economic activities. In short, the report states that the country’s banking system is in good shape due to improvements in some parameters. Two key parameters have been discussed below.

CRAR of PSBs increased while that of PVBs dropped marginally

Capital to Risk-Weighted Assets Ratio (CRAR) is a key financial metric used to assess the financial strength and stability of a bank. A higher CRAR indicates a stronger financial position and a better ability to withstand economic downturns or financial shocks. The report noted that the CRAR of PSBs reported an increase from 14.6% in 2022 to 15.5% in 2023 while that of PVBs witnessed a marginal drop from 18.8% to 18.6%. Meanwhile, the CRAR of Foreign Banks remained at 19.8%. These figures indicate that PSBs have strengthened their capital position, while PVBs experienced a slight decrease even though they are well capitalised while FBs have consistently maintained a strong capital position.

GNPA of SCBs in 2022-23 was lowest in the last decade

Gross Non-Performing Assets or GNPA is the total value of all non-performing assets before factoring in any provisions or deductions. The metric is used to assess the quality of a bank’s assets. A lower GNPA ratio indicates that a smaller proportion of a bank’s loans is classified as non-performing or not being repaid, suggesting healthier asset quality. The report revealed that there was an improvement in the asset quality as the GNPA continued to fall.

The GNPA ratio of SCBs fell to a decadal low of 3.9% by the end of March 2023 and further down to 3.2% by the end of September 2023. This trend has been ongoing since 2018-19. The report further highlighted that recoveries (money received from previously non-performing loans) and upgrades (improvement in the status of certain loans) accounted for around 45% of the reduction in GNPAs of SCBs during 2022-23. The agricultural sector had the highest GNPA ratio, while retail loans had the lowest. Among different banks, PSBs saw a fall in GNPA from 7.3% to 5%, PVBs saw a decline from 3.8% to 2% and FBs registered a fall from 2.9% to 1.9% between 2021-22 and 2022-23.

The asset quality of NBFCs has also improved over the years. The GNPA ratio fell to the lowest in five years in 2022-23 from 6.4% in 2019 to 4.6% in 2023.

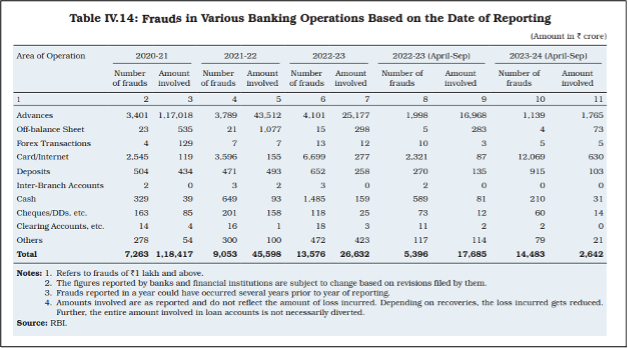

Cases of frauds have increased but amount involved has dropped

The report has highlighted two major issues that hinder the smooth functioning of banks. One issue is the rising cases of fraud. Between 2020-21 and 2022-23, the number of cases of frauds reported (those involving Rs. 1 Lakh and above) has increased from 7,263 cases to 13,576. However, the amount involved in fraud dropped. The amount involved was over Rs. 1.18 Lakh crores in 2020-21 which dropped to nearly one-fifth to Rs. 26,632 crores during 2022-23. During 2022-23, the total amount of frauds reported by banks declined to a six-year low while the average amount involved in frauds was the lowest in a decade. Between April and September 2023 (first half of 2023-24), the number of cases of fraud reported was 14,483 involving an amount of Rs. 2,642 crores as compared to 5,396 cases during the same period last year involving Rs. 17,685 crores. That is, the amount involved in frauds was only 14.9% of the previous year’s amount. The report also highlighted the growing threat of fraud and data breaches originating from cyber threats.

Source: RBI

Data shows the reduction in the total amount involved in fraud is primarily because of the reduction in the amount involved in fraud in the case of advances by banks. However, the number of frauds involving Rs. 1 lakh & above in the case of card/internet transactions has increased significantly from 2545 in 2020-21 to 6699 in 2022-23 and to 12069 in just the first 6 months of 2023-24.

Customer service provided by banks is poor and needs to be inclusive

The other issue pointed out is the quality of customer service offered by banks. The efficiency, promptness, and cost-effectiveness of the grievance redressal mechanism are identified as critical for customer protection. Despite the advancements in banking technology, banks are falling short of providing timely solutions to customer grievances. The report noted the inefficiency in addressing customer grievances, noting a lag in adapting to evolving technology and diverse product offerings. The emphasis on monitoring turnaround time (TAT) and management information systems (MIS) on complaints may be overshadowing the importance of the quality of grievance redressal, pointing to a need for a more holistic approach, it noted. Data revealed that over 3.04 lakh complaints in 2022 and over 2.34 lakh complaints in 2023 (excluding CrPC cases) were registered. Nonetheless, over 98% of the cases were addressed in the same year.

To deal with the issues highlighted, the report emphasized the need for enhanced customer-centric approaches in both banking and non-banking sectors. It called for a more adaptive, customer-focused, and technologically-inclusive banking environment. Top of Form The RBI is also focused on the mitigation of systemic risks by assessing the extent of reliance on specific IT service providers.

India’s banking sector is resilient; robust governance and risk management can help improve the sector

To sum up, the report noted that the Indian banking sector and NBFCs continue to be sound and resilient which is characterized by elevated capital ratios and improved asset quality, as seen earlier. Noting the growing interconnectedness between banks and NBFCs, the report suggests that NBFCs should diversify their funding sources to end the reliance on bank funding. Furthermore, the report calls for a concerted effort from all stakeholders to strengthen the financial and payment systems against cyber threats. Acknowledging the risks in banking, the report also calls for bolstering balance sheets through robust governance and risk management practices for banks and NBFCs and building additional buffers to align with the escalating aspirations of the Indian economy.