[orc]The 26 Public Sector Banks (PSBs) have reported a steady rise in the amount involved fraud cases of loan disbursed (1 lakh rupees & above). For three years from 2011-12 to 2013-14, the PSBs have reported more than 10000 crore rupees involved in such cases of fraud. There is also a 86% rise in such amount in these 3 years. State Bank of India leads the pack with 1230 crore rupees.

Ask any middle class Indian or a farmer and they would tell you how difficult it is to avail a bank loan. While the norms for availing loans from Public Sector Banks (PSBs) look stringent, data with the Reserve Bank of India (RBI) shows that the fraud in loan cases is steadily rising in public sector banks and such amount run into thousands of crores.

86% rise in the forgery & cheating amounts in 3 years

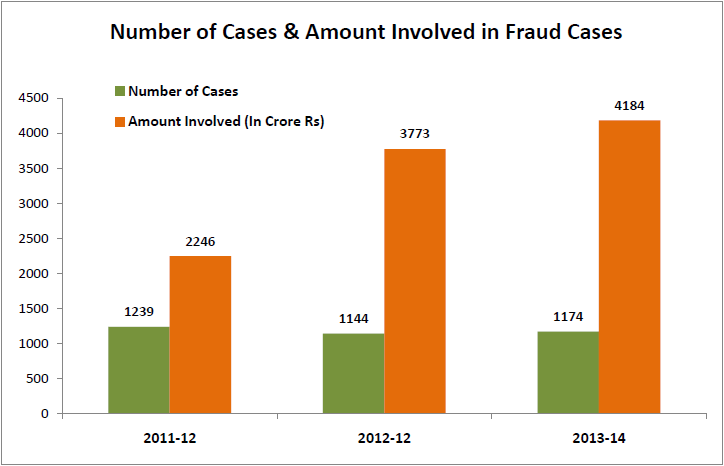

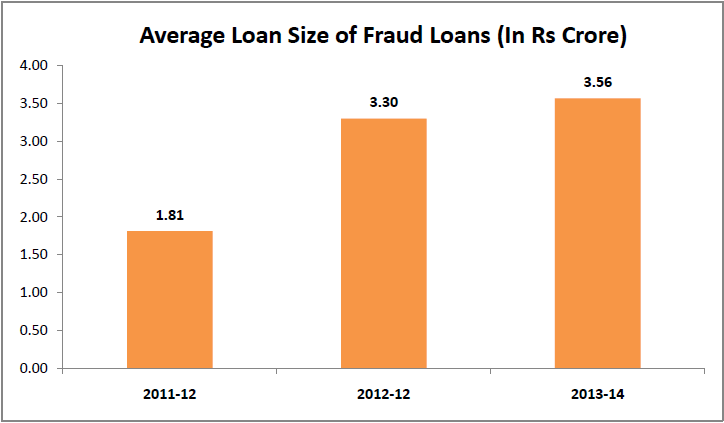

The 26 PSBs reported an average of 1200 fraud cases of loan per year during each of years from 2011-12 to 2013-14. These are cases related to fraud in loan of Rs 1 lakh and above. Between 2011-12 and 2013-14, there is a 86% rise in the amount involved in such cases. The amount involved for 2011-12 was 2246 crore rupees, for 2012-13 was 3773 crore rupees and for 2013-14 was 4184 crore rupees. The steady rise in the ‘amount involved’ while the number of cases is more or less the same is also indicative of increasing size of such loans. This trend is definitely alarming.

Bank Wise trends

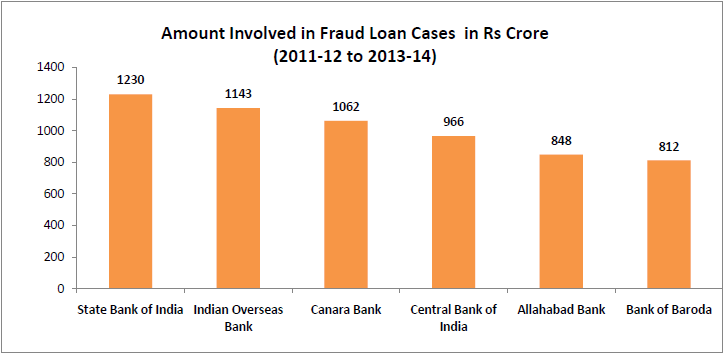

In terms of individual banks, State Bank of India leads the pack in terms of amount involved. In the 3 years from 2011-12 to 2013-14, an amount of 1230 crore rupees was involved in such cases of fraud in SBI (those of 1 lakh & above). Indian Overseas Bank comes is next with 1143 crore rupees & Canara Bank is third with 1062 crore rupees. Central Bank of India, Allahabad Bank & Bank of Baroda are next in the list. These 6 banks account for 59.4% of the total amount involved in such cases of fraud. Eight of the 26 banks have amounts less than 100 crore in such cases. These include State Bank of Mysore (6 crore), Bank of India (11 crore), United Bank of India (13 crore), Bank of Maharashtra (16 crore).

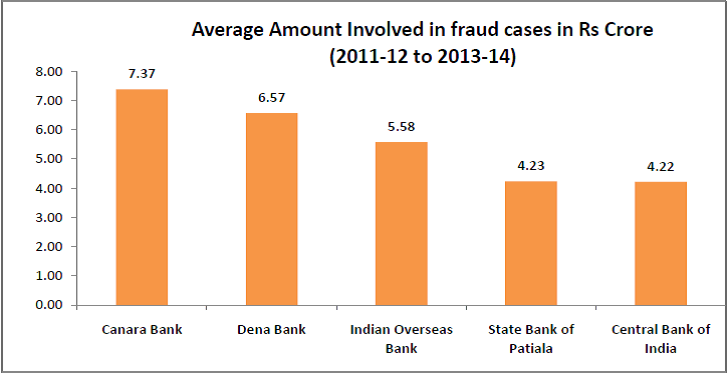

In terms of average amount involved in such cases, Canara Bank comes first with 7.37 crore rupees followed by Dena Bank (6.57 crore), Indian Overseas Bank (5.58 crore), State Bank of Patiala (4.23 crore) and Central Bank of India (4.22 crore). Though State Bank of India has the highest amount involved in such cases of fraud, the average amount per case for SBI is only 2.69 crore rupees. United Bank of India has the lowest average amount with 0.11 crore rupees followed by Bank of India with 0.12 crore.

Number of Employees Probed

A total of 6203 employees of the 26 banks were probed in these three years in relation to such cases of fraud. The highest number of employees were probed in SBI (789) followed by Allahabad Bank (479), Punjab National Bank (426) and Central Bank of India (392).

What is the RBI doing?

The RBI has issued detailed instructions through a circular in 2012 containing all the details relating to frauds. On receipt of fraud related reports from banks, various aspects related to the frauds are examined and concerned banks are advised to report the case to Central Bureau of Investigation / Police / Serious Fraud Investigation Office. They are also asked to examine staff accountability, complete proceedings against the erring staff expeditiously and take steps to recover the amount involved in the fraud. The circular also directs banks to claim insurance wherever applicable and streamline the system and procedures so that frauds do not recur.

Banks initiate & probe staff accountability and staff involvement in all the fraud cases and on completion of investigation, commensurate punishment is awarded to the delinquent employees based on the seriousness of the wrongdoings as per Bank’s disciplinary rules which includes censuring, administrative warning, suspension of the employees, reduction in scales of pay, monetary penalty and recovery of losses, Compulsory retirement, termination from service, dismissal with disqualification from future employment etc.

RBI as a part of its supervisory process also takes the following measures to prevent/reduce the incidence of frauds:

- Sensitizes banks from time to time about common fraud prone areas through issuance of modus operandi circulars on various types of frauds and the measures to be taken by them.

- Issues caution advices in respect of borrowers who have defrauded the banks.

- In order to make third parties and professionals accountable, who have played a vital role verification of the property/document or facilitated the perpetration of frauds, banks have been advised through a circular in 2009 to report to Indian Bank’s Association (IBA). IBA in turn will prepare caution lists of such parties for circulation among the banks.

The Government has set up the Central Registry, as the nodal agency for maintaining records of registrations relating to securitization, reconstruction of financial assets and security interest created over properties to minimize the frauds relating to multiple mortgaging of a property with different lenders.

But despite all these measures, the amount in such fraud cases is steadily rising and this is a definite cause for concern.

Source: Answer to Unstarred Question Number 2095, Ministry of Finance, on 05th December, 2014 in Lok Sabha.

1 Comment

Pingback: Bank Loan Scams In India | ci