As we highlighted earlier, the increase in the share of ‘Cesses & Surcharges’ in centre’s ‘Gross Tax Revenue’ has been a cause for concern. Data indicates that the centre is increasingly resorting to ‘Cesses & Surcharges’ to mop-up revenues as the utilization of these ‘Cesses & Surcharges’ is paltry.

In the earlier story, we looked at the history of Cess in India and explored the backdrop of the cesses not being included in the central divisible pool which meant that states did not get a share of cesses & surcharges. As per data available in the XV Finance Commission report (XVFC), there is a notable increase in the share of ‘Cesses & Surcharges’ out of the Total Gross Revenue, over the last decade.

Share of Cesses & Surcharges in ‘Gross Tax Revenue’ fell in the year GST was introduced only to increase sharply later

The total revenue generated through ‘Cesses & Surcharges’ during 2010-11 was Rs. 92.53 thousand crores, which was 11.1% of the total Gross Tax Revenue (GTR) collected that year.

In the ensuing years, there was not only an increase in the overall amount of cess & surcharge collections but also an increase in their share out of total GTR.

As per the audited figures for 2018-19, the total revenue through ‘Cesses & Surcharges’ was Rs. 4.13 lakh crores which was 19.9% of the GTR in that year. This amount includes GST compensation cess which is used to compensate states for GST revenue shortfall. Hence, we have excluded this from the volume of ‘Cesses & Surcharges’ collected since 2017-18. Accordingly, the total cess & surcharges proceeds for 2018-19, excluding GST compensation Cess was Rs. 3.18 lakh crores i.e., 15.3% of the GTR in the year. During the 10-year period 2011-12 to 2020-21, there was a fall in collection of ‘Cesses & Surcharges’ compared to the previous year only in 2017-18, the year when GST was introduced. The share of ‘Cesses & Surcharges’ in GTR (excluding GST) also fell to 10.6% in 207-18 from 13.5% in 2016-17. An earlier exception was in 2015-16, where the share fell to 12.2% from 13. 5% in previous year.

As highlighted in the earlier story, as per the revised estimates for 2019-20, the share of ‘Cesses & Surcharges’ is estimated to increase to 15.7%, while the budget estimates for 2020-21 forecasts them at 15.3% of GTR, as per the report submitted by XV Finance Commission.

Increase in Health & Education Cess on Income tax one of the reasons behind higher receipts

In its report, the XVFC quotes the concern raised earlier the XIVFC as well i.e., the problematic growth in the share of ‘Cesses & Surcharges’ in the GTR of the centre. The XVFC report further highlights the specific nature of cess and the role of Central government as a custodian of funds until they are appropriated for the mandated purpose.

As highlighted in the earlier story, majority of the ‘Cesses & Surcharges’ were subsumed into GST. The XVFC report notes that the major ‘Cesses & Surcharges’ thus subsumed into GST include – Additional duty of Customs & Excise on Motor spirit & High-speed diesel oil, surcharge on Pan masala & Tobacco products, cess on sugar, clean environment cess and infrastructure cess.

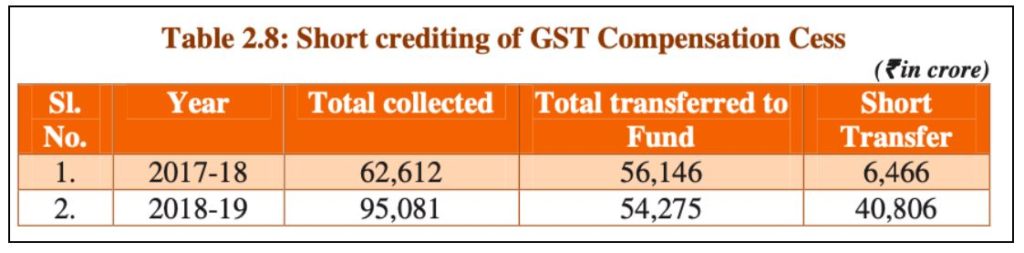

In the first year of introduction, the GST compensation Cess collection was around Rs. 62.6 thousand crores i.e., 3.3% of the total GTR. In the subsequent year, this increased to around Rs. 95 thousand crores, and the share within GTR has also increased to 4.6%.

It ought to be noted that the GST compensation cess is used to compensate the loss of revenue to States on account of the introduction of GST.

The XVFC it its report observes that the increase in collection of ‘Cesses & Surcharges’ can be attributed to three specific ‘Cesses & Surcharges’

- Increase in the ‘Health & Education Cess’ on Income Tax. It was 3% earlier but increased to 4% from 2018-19.

- Introduction of Road & Infrastructure surcharge.

- New Social welfare surcharge of 10% on aggregate duties of customs & imported goods. This has replaced the 3% on imported goods which was levied earlier as Higher education Cess.

Apart from these factors influencing the increase in 2018-19, the share of ‘Cesses & Surcharges’ in total GTR in 2019-20 might also increase due to the following factors.

- The surcharge on Income Tax for individuals with income between Rs. 2 crores and Rs. 5 crores has been increased to 25% from the earlier 15%.

- The surcharge on Income Tax increased to 37% instead of 15% for individuals with an income of more than 5 crores.

As could be seen here, the additional tax from high-income individuals is not in the form of a tax but is being collected as a surcharge. Therefore, the increased collection would not be a part of the divisible pool and hence states lose out on their share. This substantiates the argument that the Centre is increasing its share of revenue through ‘Cesses & Surcharges’ to avoid the same being shared with the States.

CAG report highlights issues with accounting and usage of Cess & Surcharges

While the increase in the volume & share of ‘Cesses & Surcharges’ levied by the Centre is a concern, another important concern is about the utilization of the same. As highlighted earlier, ‘Cesses & Surcharges’ are currently being excluded from the divisible pool due to a constitutional amendment. Prior to that, various commissions have excluded them from the divisible pool based on the argument that these are being collected for a specific purpose, and including them as part of the divisible pool could mean misutilization of the funds for unintended purposes by the states.

In its ‘Account of Union Government’ financial audit report for 2018-19, the Comptroller & Auditor General (CAG) makes certain important observations regarding the various ‘Cesses & Surcharges’ being collected and their utilization by the Central government.

- Only Rs.1.64 lakh crores of the Rs. 2.74 lakh crores i.e., around 60% of the amount received in the form of around 35 cesses, levies & other charges during 2018-19 have been transferred to the respective ‘Reserve funds & boards’. Around 40% is still retained in the Consolidated Fund of India.

- Significantly Rs. 382 crores thus retained belongs to 17 cesses that were abolished or subsumed into GST.

The CAG further makes observations regarding the utilization of ‘Cesses & Surcharges’,

- Around 30% of the GST compensation Cess collected during 2017-18 and 2018-19 is not transferred to the Fund. The proportion of amount not transferred is significantly higher in 2018-19.

As rightly observed by the CAG, this short crediting is in violation of the tenets of GST Compensation Cess Act, 2017. Since it is retained in the ‘Consolidated Fund of India’ (CFI), it is available for the purpose not intended for, and the States also lose out on a share of the GST compensation Cess that they are entitled to.

The Ministry in its response stated that the amount not transferred thus would be transferred in the subsequent year.

- After due appropriation and adjustments, a total of Rs. 10.15 thousand crores of the Cesses collected as additional excise duties on petrol & diesel as part of Central Road Fund Act, 2000, have not been transferred/utilized yet. As per Finance Act, 2018, the Fund is re-designated as Central Road & Infrastructure Fund (CRIF) w.e.f from 01 April 2018.

- Rs. 8.87 thousand crores collected as ‘Social Welfare Surcharge’ on Customs, that was introduced instead of ‘Primary Education Cess & SHEC’ on imports has not been utilized since no dedicated new fund was established.

- Similarly, no new dedicated fund was established for the ‘Health & Education Cess’ which was introduced in the place of ‘Primary Education Cess & Secondary & Higher Education Cess’. The utilization for education related projects was done using the funds created for the now abolished cesses.

- Nothing from the total for Rs.1.24 lakh crores that were collected as Cess on Crude Oil from 2009-10 to 2018-19 has been transferred. This amount continues to be retained as part of CFI.

- In spite of observations made by CAG in multiple reports, only Rs. 879 crores out of the total Rs. 8.1 thousand crores collected between 1996-97 to 2018-19 under ‘R&D Cess’ is used so far. It ought to be noted that this Cess is abolished from April 2017. Even after abolition, a further Rs. 191 crores in 2017-18 and Rs. 45 crores in 2018-19 have been collected.

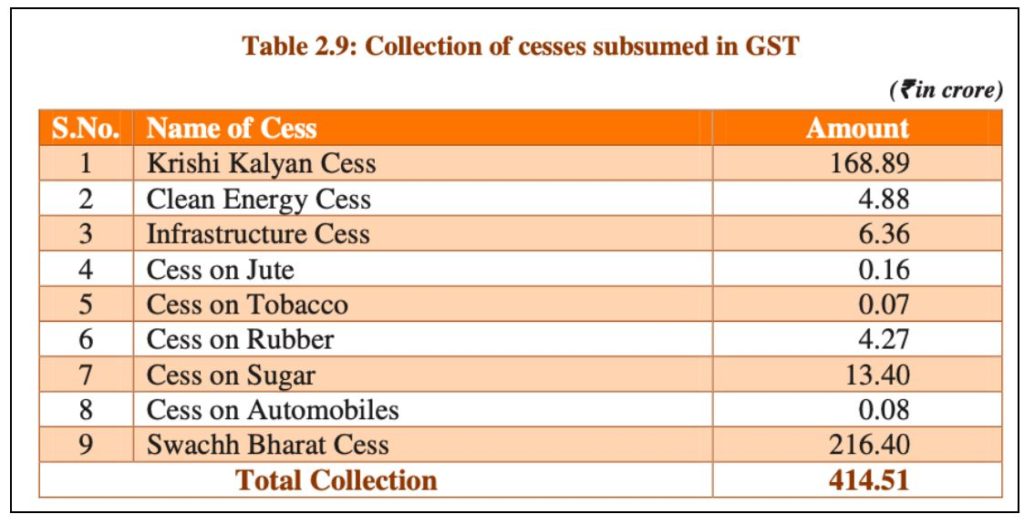

- In 2018-19, a total of Rs. 414.51 crores were collected for the abolished cesses that were subsumed under GST (w.e.f from July 2017). This amount is currently part of CFI.

These are few of the cesses where the collected amount has not yet been utilized for the intended purpose and continues to remain in the CFI.

As highlighted in this story, the following instances with regards to ‘Cesses & Surcharges’ are highlighted by multiple agencies.

- Increase in the levy of ‘Cesses & Surcharges’ by the Centre instead of taxes provides an advantage for the Centre to gain more revenue and denies the States from claiming a share

- Improper utilization of the Cess & surcharges collected.

All these raise important questions on the need to continue with the imposition of ‘Cesses & Surcharges’ by the centre and denying the States of much-needed funds. As the Chairman of XVFC observed, there is a need for a larger discussion on the inclusion of ‘Cesses & Surcharges’ in divisible pool and make any constitutional amendment as needed.

Featured Image: Cesses & Surcharges in India