SGBs are government securities denominated in grams of gold and issued by the Reserve Bank of India (RBI) on behalf of the Government of India. These bonds are substitutes for holding physical gold and can be redeemed on maturity. These were issued in 64 tranches since their inception in 2015. Here is a look at what the numbers indicate.

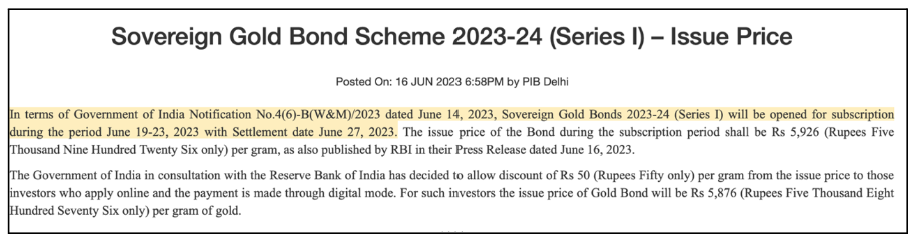

The most recent tranche of issues of ‘Sovereign Gold Bonds’ (SGBs) was opened for the period 19-23 June 2023. This is the 64th tranche issued since the inception of the scheme. This tranche is also the first for the year 2023-24. The issue price of the bond during this period was Rs. 5,926 per gram.

SGBs are government securities denominated in grams of gold and issued by the Reserve Bank of India (RBI) on behalf of the Government of India. These bonds are substitutes for holding physical gold and can be redeemed on maturity.

Our explainer on ‘Sovereign Gold Bonds’ can be read here. In this story, we look at the trends in the SGBs scheme since its inception. The data is obtained from the Dataset on SGBs available on Dataful, which is compiled from data provided by the Reserve Bank of India.

Highest number of tranches in 2017-18, with a decline in recent years

The first tranche of the SGBs was issued on 30 November 2015. This was the only series (Series -I) in that calendar year. In 2016, two more series (Series-I & Series-II) were issued, during February and March. Overall, 3 tranches were announced during 2015-16.

Since 2016-17, the ‘Series’ are numbered within the financial year. Hence in 2016-17, the scheme was announced in 4 tranches, and the units subscribed belonged to Series I, II, III & IV respectively. In 2017-18, the units were issued in 14 different tranches. This also happens to be the highest number of tranches in a single financial year. After that, the most tranches were in 2020-21, with 12 tranches. There is a decline in the number of tranches at 10 and 4 respectively in the subsequent years.

More than 11 crores units subscribed under the SGBs scheme since introduction

Any resident of India defined under FEMA, 1999 is eligible to invest in this scheme. Eligible investors include individuals, Hindu Undivided Family (HUFs), trusts, universities, and charitable institutions. The bonds are issued in denominations of one gram, which is counted as a unit. The maximum limit for subscription is 4 kg for Individuals and HUFs and 20 kg for trusts and other similar entities.

In the first tranche issued in November 2015, more than 9.14 lakh units were subscribed. This increased to 28.7 lakh units in the next tranche. In 2016-17, the subscriptions per tranche were around the same number with the highest in the third tranche with 35.98 lakh units. Overall, a total of 113.88 lakh units were subscribed in 2016-17.

In the first three issues of 2017-18, the subscriptions were round about the same levels as in 2016-17. However, there was a sharp decline in the number of units subscribed in the rest of the tranches for the year.

The trend of low subscriptions continued even during 2018-19 and 2019-20. Recovery was observed since the beginning of 2020-21. A new high was achieved in the fourth issue of 2020-21 with 41.3 lakh units. In the next tranche, 63.5 lakh units were subscribed, making it the highest. The total subscriptions for the year 2020-21 were 323.5 lakh units, which remains to be the highest number of subscriptions in a year. Following this, there have been a series of ups and downs in the subscriptions. The greatest number of subscriptions in a single tranche was the most recent one. In the recently concluded 64th tranche i.e., the first for 2023-24, a total of 77.7 lakh units were subscribed, the most for any tranche till date.

Around 13 lakh units were redeemed pre-maturely till now

The tenor of the bond is 8 years. The bonds bear an interest rate of 2.5% per annum on the amount of initial investment. This amount is credited semi-annually. The bonds matured after 8 years, and the redemption price is the average price of gold of 999 purity for the last three days from the date of repayment.

However, early encashment/redemption is allowed after the fifth year from the date of issue. The bond is also tradable on exchange if it is held in demat form. There is also a provision for transferring the bonds to any other eligible investor. The first tranche of bonds was issued in November 2015. Hence, the bonds issued in this tranche will only mature by the end of 2023. This implies that as of date, none of the bonds subscribed are matured. However, many investors have exercised the option of pre-mature redemption over the years. Data indicates that, so far around 13 lakh units were redeemed pre-maturely.

The greatest redemption in terms of units was from Series-1 of 2016 i.e., the second tranche of the scheme. A total of 2.21 lakh units were redeemed prematurely from this tranche, which accounts for 7.7% of the units subscribed in this tranche. A similar proportion of units were redeemed from the immediately following tranche as well.

Overall, from the first three tranches i.e., in 2015-16, a total of 3.61 lakh units were redeemed. This is around 7.4% of the subscribed units in these tranches. This proportion was reduced in the ensuing tranches. The latest tranche eligible for redemption pre-maturely is the Series-1 of 2018-19. A total of 2.12 crore units are yet to be redeemed from the 22 tranches that are eligible for a pre-mature redemption. There is no data on when particular units were redeemed or the value of period-wise redemption.

The units from the first three tranches would be mature during 2023-24. As per the latest update, 45.4 lakh units would mature, if not redeemed prematurely in the next few months.

Latest issue price is more than double the issue price in the first tranche

The value of the gold bonds is the simple average of the closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Limited, for the last 3 business days of the week preceding the subscription period.

In the first issue of the scheme, the issue price was Rs. 2,684 per unit i.e., per gram. The issue price breached Rs. 3 thousand mark in the first issue of 2016-17, when it was Rs. 3,119. After increasing to Rs.3,150 per unit, in the next issue, the issue price remained less than Rs. 3,000 until the end of 2017-18.

Since 2018-19, the issue price once again crossed Rs. 3 thousand per unit and continued to increase in the subsequent issues. In the eighth series of 2019-20 i.e., in January 2020, the issue price was more than Rs. 4 thousand. This further increased and in the 42nd issue i.e., in August 2020, the issue price was Rs. 5,334. The issue price fell in the subsequent issues, even falling below Rs. 5 thousand. However, for the last year, the issue price has once again started to increase. The issue price of the latest tranche i.e., in June 2023, is the highest at Rs. 5,926 per unit.

The increase in the value of gold, reflected in the more than doubling of the issue price since the first issue, indicates SGBs could be a gainful investment. The highest subscription in the latest tranche despite a high issue price means that the scheme is being looked at as a preferred investment option by many.

While there is an increase in the gold prices compared to the initial issue price, the pre-mature redemption remains only about 7.5%. However, with the initial tranche of subscriptions set to expire at the end of this year, and more units getting matured in the subsequent years, it remains to be seen if the same level of enthusiasm continues in the subsequent issue tranches.

Featured Image: Sovereign Gold Bonds Scheme