[orc]Gold is an integral part of any Indian family, for many traditions & occasions. As a substitute to holding physical gold, the government introduced the ‘Sovereign Gold Bonds Scheme’ in 2015. What is this scheme and how can one subscribe? Here is an explainer.

Gold has a cultural significance in India and is an integral part of many traditions & occasions. Apart from its cultural significance, Gold is also considered as a good investment with many households inclined to invest their savings in the purchase of gold.

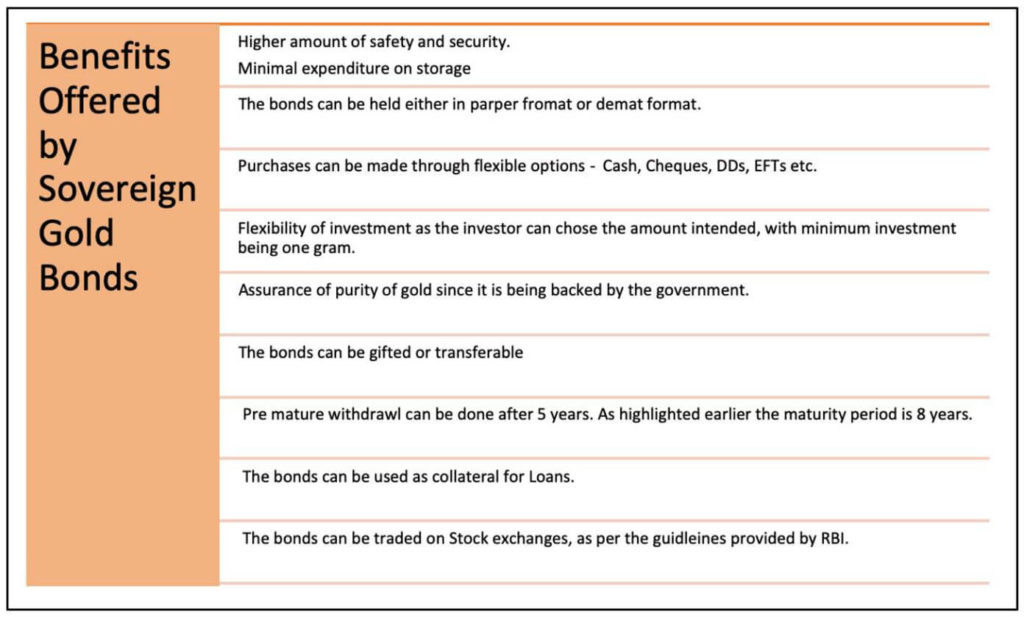

However, the storage of gold in physical form is a matter of concern due to safety reasons. Depositing gold in storage facilities like Bank lockers does attract some fees. In fact, availability of lockers is also an issue. Furthermore, most of the gold purchased is in the form of jewellery where full value of gold is realized due to the loss during the making process.

To take advantage of Indian citizens propensity to invest in gold and create an alternative saving option, Sovereign Gold Bonds were introduced.

What is a Sovereign Gold Bond?

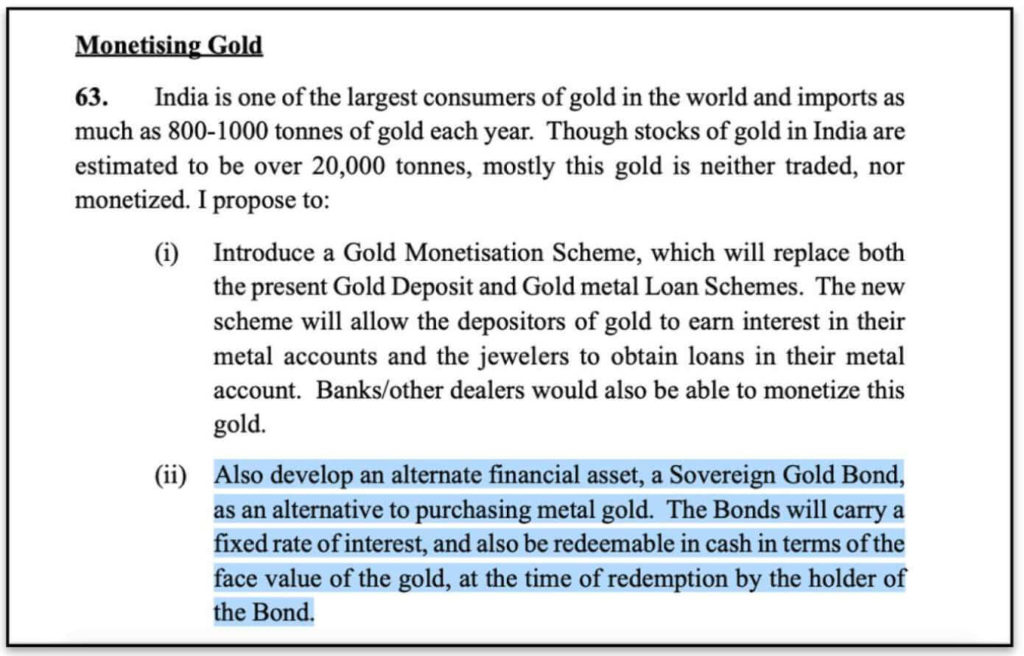

In his Budget – 2015-16 speech , the then Finance Minister Arun Jaitley, proposed ‘Sovereign Gold Bond’ as an alternative financial asset, which would also act as a substitute for physical gold.

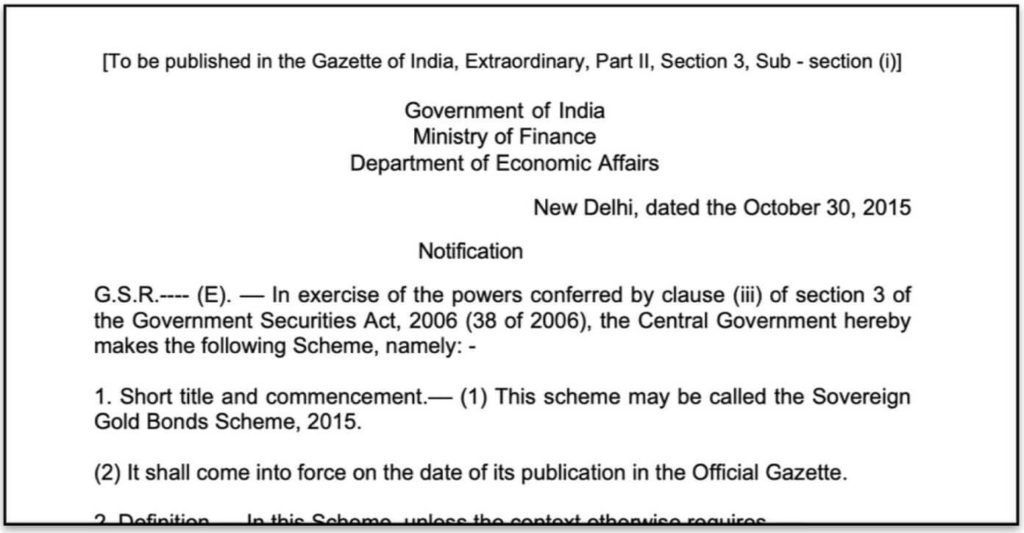

Further to this, Central government issued a notification on 30 October 2015, duly notifying the ‘Sovereign Gold Bonds Scheme – 2015’.

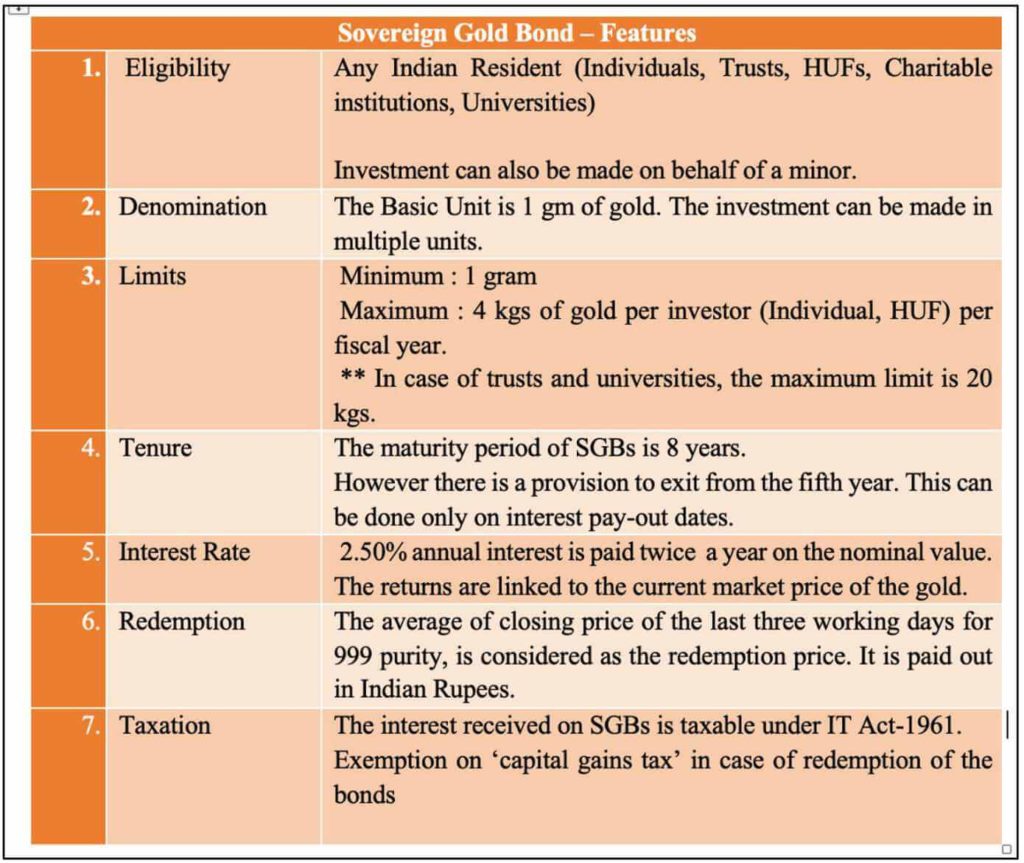

A Sovereign Gold Bond (SGB) is issued by Reserve Bank of India on behalf of the government. These are considered as government securities and are treated as a substitute for holding gold physically, hence the risks associated with storage are eliminated.

All residents of India (defined under Foreign Exchange Management Act-1999) are eligible to invest in SGB. This includes – individuals, HUFs, trusts, charitable institutions, universities etc.

How to buy Sovereign Gold Bonds ?

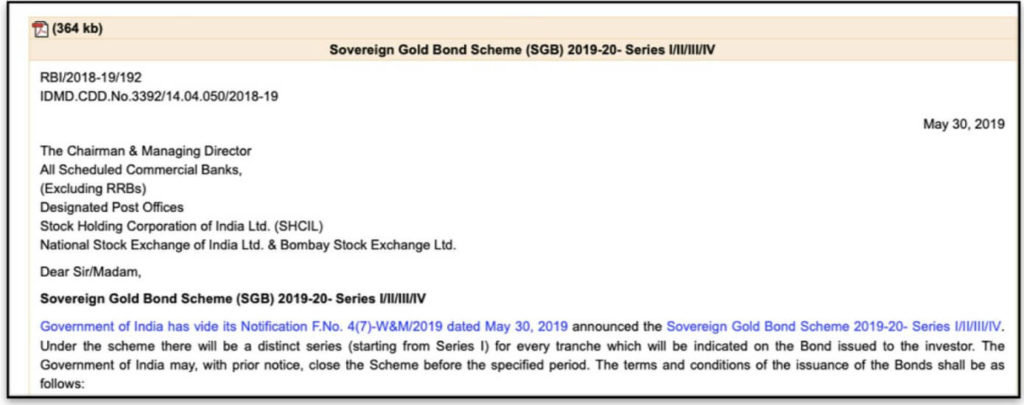

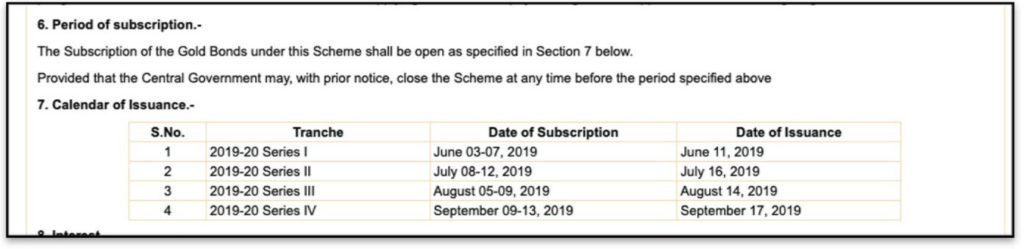

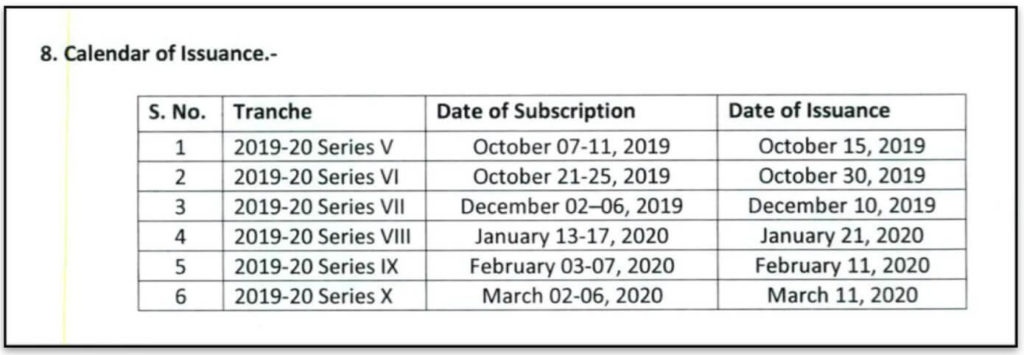

Sovereign Gold Bonds are offered by the RBI in tranches during specific window period. The scheme is not a continuous one and there are specific time periods during which the bonds can be purchased. Accordingly, from time-time, RBI issues notification announcing the Sovereign Gold Bond Scheme, with the details of the issue.

Specific dates during which the Tranches are open for subscription are provided.

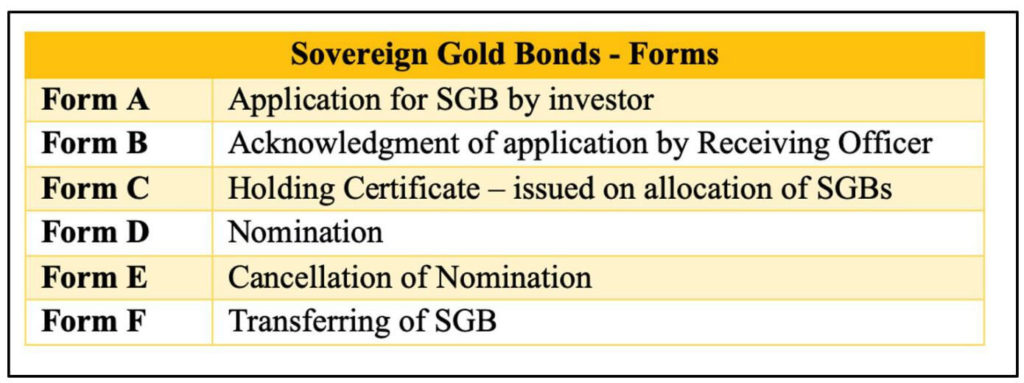

The bonds can be subscribed by filling up of the application form provided by the issuing banks, SHCIL (Stock Holding Corporation of India Limited ) offices, designated post offices, recognised Stock Exchanges i.e. BSE & NSE. Form A, used for the application purpose can be downloaded from RBI’s website and submitted at one of the specified places mentioned. Few banks also provide scope for applying online.

An investor can have only one Investor ID which is linked to the PAN number. Once the application is received, the receiving officer would issue Form B as acknowledgement of the receipt.

Nomination form (Form D) can also be filled for the purpose of payment in case of death of the applicant. The nomination can be cancelled through Form E.

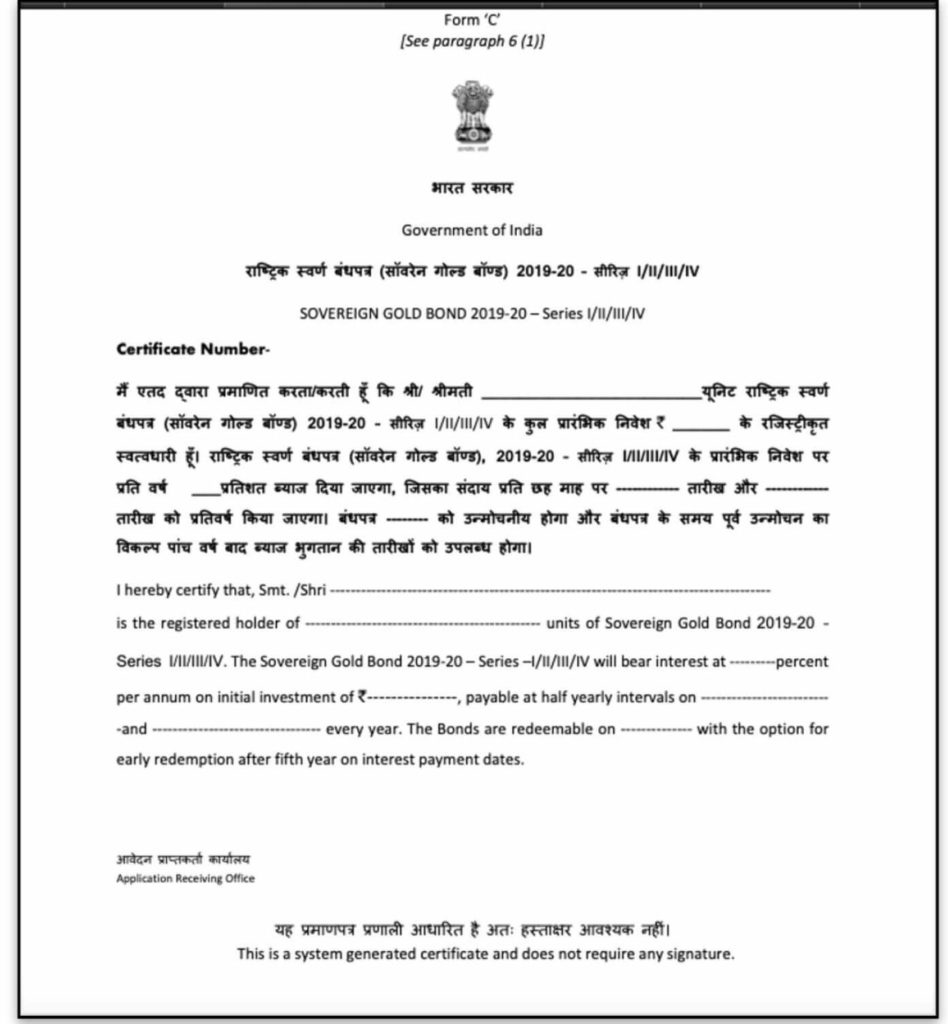

Application for subscription does not guarantee the issuance of the SGBs. The application is verified and SGBs are allotted. A Holding Certificate i.e. Form -C is issued to the investors. This is issued in the form of Government of India Stock as per Section 3 of Government Securities Act -2006.

These bonds can also be transferred as per the provisions provided under Government Securities Act – 2006 & Government Securities Regulations, 2007. Form F needs to be used for transferring of the bonds.

The last window period for subscription was during 02 December 2019 – 06 December 2019.

The next issue would be during 13 January -17 January 2020, which is the series VIII for 2019-20. RBI has issued the latest operational guidelines on 30 September 2019.

RBI also has a detailed FAQs section on the Sovereign God Bonds on its website.

Storage feasibility and flexibility are advantages of SGBs.

Although, SGBs would not substitute the physical necessity of purchasing or holding gold, they are aimed at maximising the benefit achieved through investing in gold. The SGB scheme is formulated to provide greater benefit to investors compared to physical gold or Gold ETFs (Exchange Traded Funds).

SGBs, however, also carry few of the risks associated with physical gold, like drop in the gold rates due to market fluctuations.

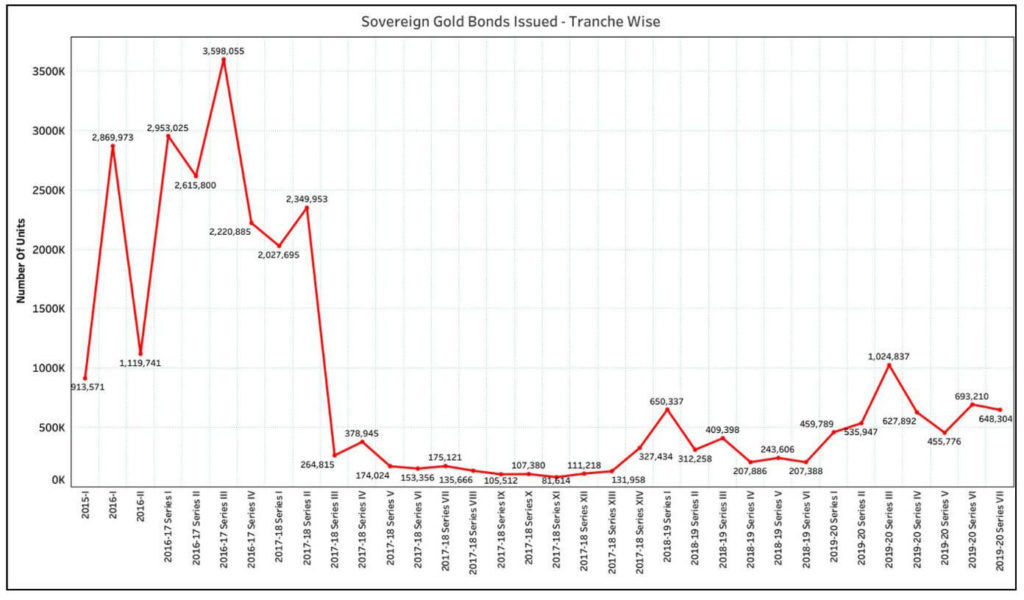

2.92 crores units of SGBs issued since inception

Since the inception of the scheme in November 2015, there have been a total of 34 tranches of issues so far. A total of over 2.92 crores units have been subscribed and issued so far.

The first tranche i.e. in 2015 had more than 9.13 lakh SGB units purchased at Rs. 2684 per unit.

The highest purchase of SGBs was in the 6th tranche i.e. Series III of 2016-17, where 35.98 lakh units were purchased at Rs. 2,957 per unit.

There has been a steep fall in the number of units bought for Series II of Fiscal 2017-18, with only 2.64 lakh units purchased. The price was Rs. 2,956 per unit. The drop in the number of SGBs bought continued through the whole of 2017-18 and 2018-19 with couple of exceptions.

In recent times, series III of 2019-20 i.e. 5th-9th August 2019 had the highest number of SGBs bought with 10.24 lakhs at Rs. 3,499 per unit, with subsequent fall in further tranches.

Fall in the demand for SGBs compared to the initial period

Compared to the initial years between end of 2015 and beginning of 2017, when high number of SGB units that were sold, the previous couple of years has seen a huge fall in the numbers.

Few industry experts cite the lack lustre movement in the gold prices to be one of the major reasons for the fall in demand. The data provided by RBI, does indicate almost stagnant gold price during the period where the demand for SGBs was low.

The recent rally seen in few of the tranches could be attributed to the considerable increase in price of gold.

Featured Image: Sovereign Gold Bonds