Data indicates that in the last five years, more than 20% of the Centre’s indirect tax revenue is earned through excise duty on petrol & diesel. State Governments also have a similar reliance on VAT on fuel. Here is a detailed analysis.

After a 21-day continuous surge, the prices of fuel (petrol & diesel) in India came to a halt on 28 June 2020. During this period, the price of diesel has recorded a historic high and the prices of both petrol & diesel have crossed ₹80 per litre (in Delhi). The surge in fuel prices during this period can be attributed to the increase in the crude oil prices in the international market coupled with the increase in central excise duty in May 2020 and other state taxes.

However, this price rise is in continuation of the increase in fuel prices that can be traced back as far as April 2020. It ought to be noted that, there has been a record-fall in the global crude-oil prices during that period. This has resulted in reduced prices of Indian crude-oil basket, but there was no corresponding reduction in the fuel prices in India because of the steep increase in central excise duty.

With the adverse effect of COVID-19 induced lockdown on economy and incomes of people, there have been calls from the opposition asking to government reduce taxes to ease the fuel-price burden.

Central Excise duty and State Taxes form a key component of Retail fuel prices

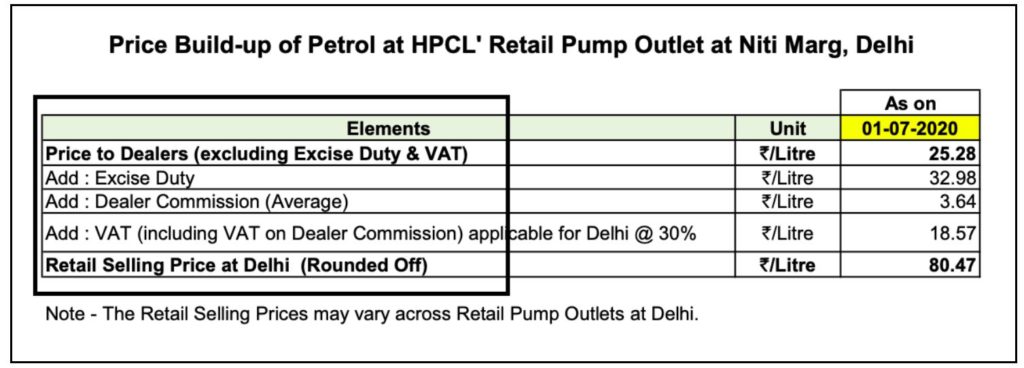

Retail Petrol/Diesel prices in India are an outcome of price build-up of four different components.

- Price to Dealers: This is the price charged by Oil Marketing Companies (OMCs) like HPCL, BPCL, IOCL to the dealers. This price is dependent on factors like Global crude oil prices, US dollar exchange rates etc.

- Central Excise Duty: This is a fixed amount that is levied by the Central Government of India.

- Dealer Commission: This is the commission paid by the OMCs to the dealers, within which the dealers have to manage their operating expenses.

- VAT & other duties imposed by States: The state governments levy VAT and Sales tax on the fuel. This is generally a combination of percentage and fixed amount.

As per the price build-up updated by one of the OMC’s, HPCL, the latest retail price of petrol in a HPCL retail Pump outlet is ₹ 80.47 in Delhi as of 01 July 2020. Of the retail selling price, the price charged to dealers by HPCL is ₹ 25.28 and the Commission being paid to the dealers is ₹ 3.64. The Central Excise Duty forms the major component with ₹ 32.98 i.e. nearly 41% of the total retail price at the petrol outlet. The States VAT charged in Delhi amounts to ₹18.57. The state VAT varies from state to state based on the tax rate in that state. The retail price of Diesel also has similar workings in its price build-up.

Nine-fold increase in Central Excise duty on Diesel since May 2014

As highlighted earlier, Central Excise Duty is a fixed amount that is levied by the Government of India. This duty is not a percentage on price of the fuel. Hence the amount of duty is not impacted by the price of crude oil in the international market.

When the NDA Government under PM Modi first came to power in May 2014, the Central Excise Duty on Diesel was ₹ 3.56 and the excise duty on Petrol was ₹ 9.48.

The first hike in Central Excise duty was made in November’2014 with the duty increased to ₹ 11.02 and ₹ 5.11 on petrol and diesel respectively with a further increase in December’2014. The excise duty was revised a further four times in 2015 and thrice in 2016. Each time there has been an increase in the duty on both petrol and diesel with it reaching ₹ 21.48 and ₹ 17.33 respectively.

On 04 October 2017, there was another revision, but this time the excise duty was reduced to ₹19.48 and ₹ 13.33 respectively. This was the first excise duty cut by the Modi Government. The cut in excise duty on fuel continued in 2018, with two more revisions. By end of 2018, the Central excise duty on petrol and diesel was ₹ 15.98 and ₹ 11.83 respectively.

In May 2019, the Narendra Modi government came to power for the second time. In July 2019, there was a revision with a ₹ 2 increase in excise duty on both petrol & diesel. In March’2020 there was a significant hike in the excise duty on fuel by ₹ 5 per litre on both petrol & diesel.

The latest revision of excise duty was on 06 May’2020 when the Central Government announced another major hike in the Central excise duty with an increase of ₹ 10 on petrol and ₹13 on diesel. As on date, the excise duty on Petrol is ₹ 32.98, while it is ₹ 31.83 in the case of diesel. Overall, in these six years of NDA government, the excise duty on petrol increased three-fold and it increased almost nine-fold in the case of diesel.

Rajasthan, Karnataka and Telangana among states which levy highest VAT % on Fuel

VAT & other taxes levied by the states has large variances in terms of type of charges, calculation as well as the extent of charges. Each individual state has autonomy in fixing these charges.

- Few states & UTs like Karnataka, Odisha, Telangana, Puducherry, Arunachal Pradesh etc. levy VAT as a direct % on the petrol & diesel.

- Delhi uses a different logic for petrol & diesel, with a direct % being levied on petrol and while on diesel, it is a percentage on fuel + additional charges (air ambience charges).

- Few states use a combination of % on fuel price plus a fixed additional charge.

- For example, as on date Andhra Pradesh charges 3% VAT + ₹ 2.76/litre VAT on Petrol and 22.25% VAT + ₹ 3.07/litre VAT for diesel.

- Chhattisgarh, Kerala & Maharashtra are among the states which use this mixed formula of a % and a fixed charge.

- Gujarat, Punjab, Rajasthan, Goa, J&K have levied additional charges like Road Cess, Green Cess, Education Cess, Cess on town rate etc. apart from fixing a % VAT on fuel.

- Assam, Haryana, Jharkhand, UP, Uttarakhand etc. apart from levying a % rate on the fuel, have also set a floor limit to ensure that the VAT on fuel is not less than the set value.

In terms of the VAT % on Fuel, Rajasthan levies the highest with 38% & 28% VAT on petrol & diesel. Telangana charges 35.2% and 27%, while Andhra Pradesh charges 31% and 22.5% on petrol & diesel respectively. Karnataka charges a Sales Tax of 35% and 24%. While Maharashtra charges comparatively less VAT %, it has a higher fixed rate per lite with approximately ₹ 10 for petrol & ₹ 3 for diesel.

Central Excise Duty on fuel contributed to more than 20% of the revenue through Indirect Taxes

As per the information provided by Petroleum Planning & Analysis Cell (PPAC) of the Ministry of Petroleum, contribution of Excise duty on Crude oil and Petroleum products towards Central exchequer was ₹ 2.14 lakh crores in 2018-19.

As per the update provided in Lok Sabha on 03 February’2020, revenue from Indirect taxes amounted to ₹ 9.37 lakh crores i.e. Central Excise on Fuel was around 23% of the indirect tax revenue. This Central Excise revenue on fuel in 2018-19 was lesser than the previous year 2017-18 which was 2.29 lakh crores, which further fell from ₹ 2.42 lakh crores in 2016-17. The share of Central Excise on fuel in the total revenue through indirect taxes also fell from 28.17 % in 2016-17 and 25.2 % in 2017-18 to 23% in 2018-19.

However, the quantum of revenue through Excise duty on petrol and its share in Indirect taxes in 2018-19 is significantly higher than the numbers in 2014-15, where in it was ₹0.99 lakh crores and 18.9% respectively. The provisional revenue through Excise duty on fuel is estimated at ₹2.23 lakh crores for 2019-20. This might increase substantially in 2020-21 because of the steep rise in excise duty on petrol & diesel.

Revenue earned by States through VAT & Sales Tax has increased over the years

In 2014-15, the States together earned a combined ₹1.37 lakh crores as revenue from VAT & Sales Tax on fuel, with an increase in the subsequent years. In 2016-17, there was an increase by 23 thousand crores compared to that of previous year. In 2018-19, the revenue generated by states through VAT and other taxes on fuel crossed 2 lakh crores with total revenue amounting to ₹ 2.01 lakh crores.

Maharashtra earned the highest revenue in 2018-19, with more than ₹ 27 thousand crores followed by Uttar Pradesh & Tamil Nadu with ₹ 19 thousand crores and ₹18 thousand crores respectively. The information provided by PPAC, further states that Gujarat has earned over ₹16 thousand crores followed by Karnataka at ₹14 thousand crores in 2018-19. All these amounts contribute to a significant share in the respective state tax revenues.

Share of excise revenue in Central’s revenue can increase further

Trends over the past few years suggest a fall in the Union revenues compared to the budgetary estimates, which is leading to a higher fiscal deficit and not enough funds to meet the budgeted expenditure. The situation of the states is no different with the revenues of states shrinking over the past few years especially with the economy slowing down.

Experts opine that the lockdown imposed in wake of COVID-19, could further have a detrimental effect on the economy. The lack of economic activity and the challenges in revival of various sectors of economy could mean a severe shortfall in the estimated tax revenues of both the centre & states. The GST revenues have also fallen compared to previous years.

As the data indicates, the share of revenue earned through excise duty in overall indirect tax revenue has increased considerably over the years. States also have a similar dependence on VAT on petrol & diesel with the VAT share ranging from 10% to 20% of the State’s own tax revenue (SoTR).

The huge increase in the central excise duty by ₹10 and ₹13 on petrol and diesel respectively could further increase the overall revenue earned through duties and taxes levied on fuel. With declining revenues from other sources and prospective increase in the revenues from taxing fuel, the reliance on tax revenue from fuel would further increase both for the centre & the states. The governments have a difficult choice to make whether to reduce taxes on fuel or not miss the opportunity to increase tax revenue.