[orc]For the first time in last 5 years, the tax revenue earned in the first four months of 2019-20 by 21 states is 2.3% less than the revenue earned during the same period in 2018-19. 13 of the 21 states have seen a fall in cumulative tax revenue in 2019-20 (till July 2019)

Government (both Central & State) spending has a significant bearing on the Indian economy. The salaries paid out to the government employees, spending on various government run schemes, payments to various services providers, huge capital expenditure of the government etc. greatly contribute towards economy & hence the GDP. The extent of revenue generated by the government has a significant bearing on this expenditure.

State governments need to invest in infrastructure, spend on different schemes etc. And to meet the increased expenditure year after years, it is critical that the tax revenues of states increase accordingly in addition to the central grants & devolution of tax revenue by the centre. Tax revenues form a key component of state government revenues with the sources being various state-level taxes and the state’s share in central taxes as decided by the finance commission.

About the Data

In this story we look at the tax revenue earned by states in the first four months of 2019-20 (till July 2019) and compare it with the tax revenues earned during the same period in the last financial year, to understand the trends. The data of tax revenue of states between April & July 2019 for financial year 2019-20 is compared with the tax revenue during the same period in 2018-19. The data for state tax revenues is taken from the account statements submitted by respective states with Comptroller and Auditor General of India (CAG).

The details for the states of Arunachal Pradesh, Assam, Bihar and Sikkim are not available for the current financial year 2019-20 on the CAG website and hence are excluded from the analysis along with Delhi and Goa which do not have reports for both the years. Data for few other states is not available on the CAG website for specific months which would be highlighted in the story as necessary. In all, data was completely available for 21 states.

Together in the 21 states for which data was available, tax revenue in the first four months of 2019-20 is ₹ 4.92 lakh crores compared to ₹ 5.04 lakh crores in 2018-19 i.e. fall of 2.3%.

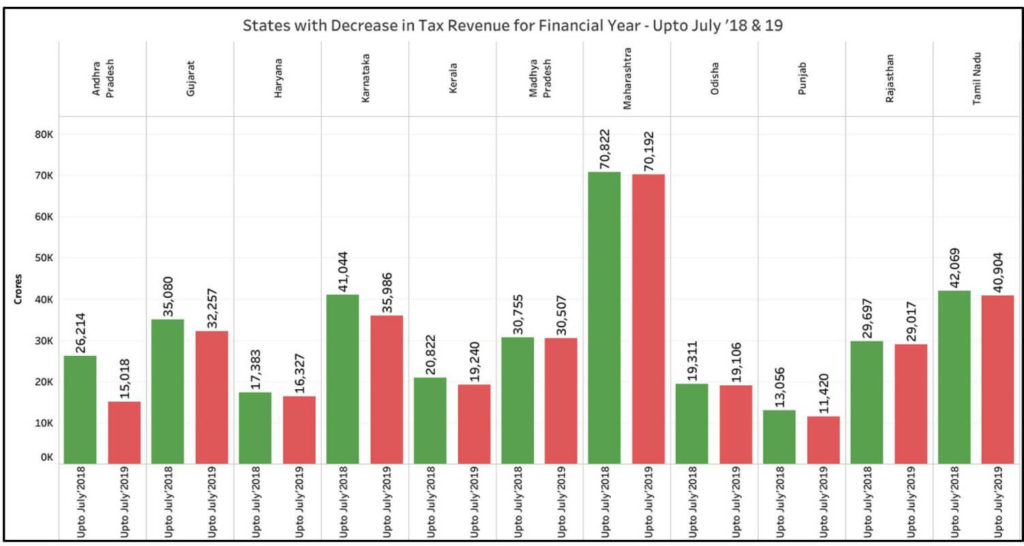

Andhra Pradesh, Karnataka, Kerala, Punjab, Gujarat among the states with reduced Tax Revenue during this period

Among the larger states, Andhra Pradesh, Gujarat, Punjab, Karnataka have reported a fall in the tax revenue for this period in 2019-20 compared to the same period in 2018-19. The total tax revenue earned by Andhra Pradesh during these 4 months in 2019-20 is ₹ 15,017 crores while during the same period in 2018-19, it was ₹ 26,114 crores i.e. fall of 42.7% in the tax revenue.

The other states do not have such a steep fall in the tax revenue, but the difference is significant. Gujarat and Karnataka, which are among the higher tax earning states by volume have also reported a fall in the revenue when compared to same period in 2018-19 by 8% and 12% respectively.

The tax revenues of Karnataka fell by ₹ 5,057 crores in the first four months of 2019-20 compared to the same period in 2018-19. Among other states, Gujarat’s tax revenue fell by ₹ 2,823 crores, Punjab’s by ₹ 1,636 crores and Kerala’s by ₹ 1,581 crores, in the first four months of 2019-20 compared to the same period in 2018-19. Many other states like Haryana, Madhya Pradesh, Maharashtra, Odisha, Rajasthan & Tamil Nadu have also reported a marginal fall in tax revenue during this period.

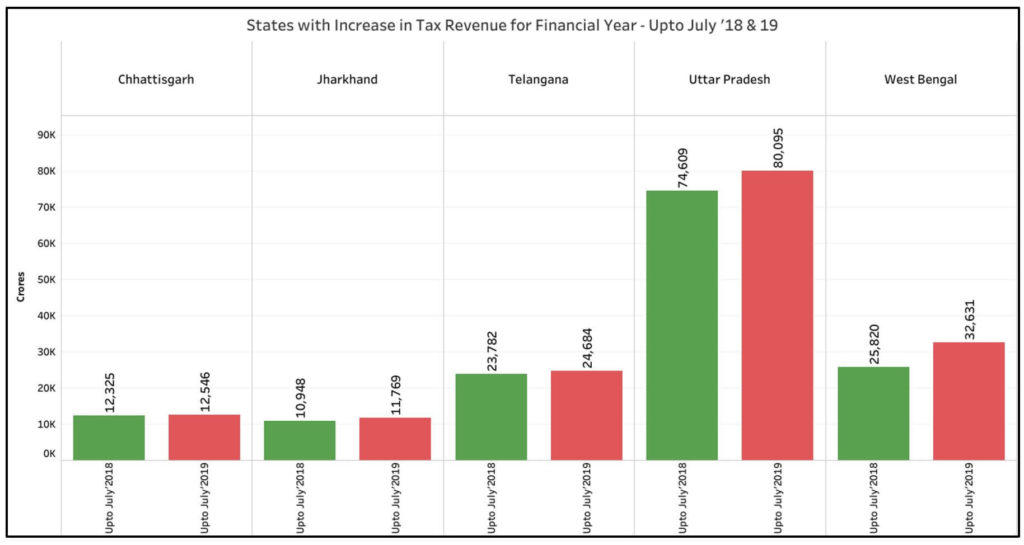

West Bengal, Uttar Pradesh, Telangana and Jharkhand among states with increase in Tax revenue during this period

West Bengal has reported a significant increase in Tax revenues during the first four months of 2019-20 compared to the same period in 2018-19. Tax revenue of West Bengal for these four months in 2019-20 has increased by ₹ 6,810 crores compared to 2018-19 i.e. an increase by 26.4%. Uttar Pradesh also reported an increase of ₹ 5,486 crores while Telangana has reported an increase of ₹ 902 crores during this period. Uttar Pradesh’s tax revenue increased by 7.4% while Telangana’s tax revenue increased by around 3.8% during this period.

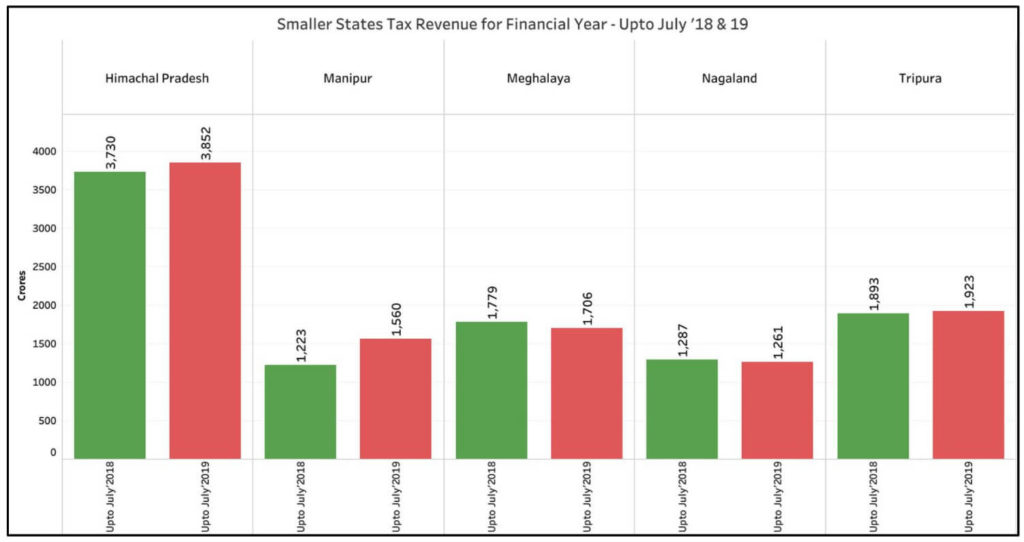

Among smaller states, Manipur reported a significant increase in Tax revenues

In the case of smaller states, tax revenue for Manipur has increased by ₹ 336.9 crores in the first four months of 2019-20 compared the same period in 2018-19. Even in the case of Himachal Pradesh, tax revenues have increased by ₹ 121.9 crores during the same period.

The figures for July’19 are not available for Jammu & Kashmir (J&K) and Uttarakhand. However, during the period April to June 2019, tax revenue reported by J&K is ₹ 5,231 crores which is ₹ 264 crores more than the revenue reported during the same 3-month period in 2018-19. Meanwhile, Uttarakhand has only a small variance with ₹ 4,486 crores during 2019-20 compared to ₹ 4475 crores during the same period last year.

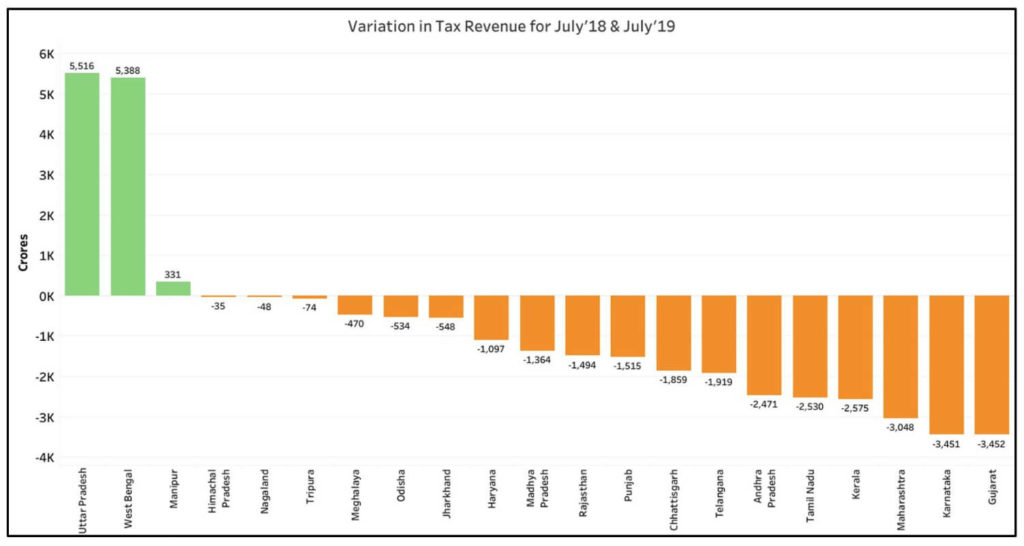

Except for Uttar Pradesh & West Bengal, all the other states reported drop in Tax revenue in July 2019 compared to July 2018.

The number of states with tax revenues less than the previous year up to a specific month have increased as the months progressed in 2019-20. The total number of states with a comparative negative tax revenue until the month of June 2019 compared to same month in 2018 was 5. This number increased to 13 states by July 2019. In other words, 13 of the 21 states for which data is available have reported fall in tax revenues in the first four months of 2019-20 compared to the same period in 2018-19. The increase in the number of states could be a reflection of the slowdown.

Except for Uttar Pradesh, West Bengal and Manipur, the rest of the states (18 of the 21) have reported fall in tax revenues in July 2019 compared to July 2018. For instance, Gujarat earned ₹ 3,451 crores less in July 2019 compared to July 2018. Maharashtra, which is among the highest tax earning states reported a revenue of ₹ 20,380 crores in July 2018, but only ₹ 17,332 crores in July 2019.

Among the higher tax revenue states, Karnataka’s tax revenue for July 2019 was only ₹ 8,756 crores compared to ₹ 12,207 crores in July 2018. Kerala’s tax revenue for July 2019 was ₹ 3698.8 crores i.e. 41% less than July 2018’s tax revenue. Punjab, Andhra Pradesh and Chhattisgarh also reported a substantial fall in July 2019 tax revenue compared to July 2018 with 34.6%, 38.6% and 39.8% respectively.

Maharashtra, Tamil Nadu, Telangana are among the other states with higher volume of negative tax revenues compared to July 2018 with a short fall of ₹ 3,047 crores, ₹ 2,530 crores and ₹ 1,919 crores respectively.

On the other hand, West Bengal and Uttar Pradesh have earned more revenue in July 2019 compared to July 2018. West Bengal’s tax revenue for July 2019 was 150% more than ₹ 3,586 crores earned in July 2018.

What about the previous years?

To analyse if this decreasing trend is specific to 2019-20, we looked at the cumulative tax revenue data for these 21 states starting from 2015-16. This is the first time in these 5 financial years that the cumulative tax revenue of the 21 states up to the month of July has decreased when compared to the same period in the previous year. The revenue in 2019-20 in these four months is ₹ 4.92 lakh crores compared to ₹ 5.04 lakh crores in 2018-19 during the same period. This decline follows an increasing trend in the previous years where the tax revenue up to July of the respective years was ₹ 3.76 lakh crores, ₹ 4 lakh crores and ₹ 4.65 lakh crores for 2015-16, 2016-17 & 2017-18 respectively.

The decline in cumulative tax revenue up to July in this financial year is a reflection of the fall in tax revenues compared to previous years across most of the states.

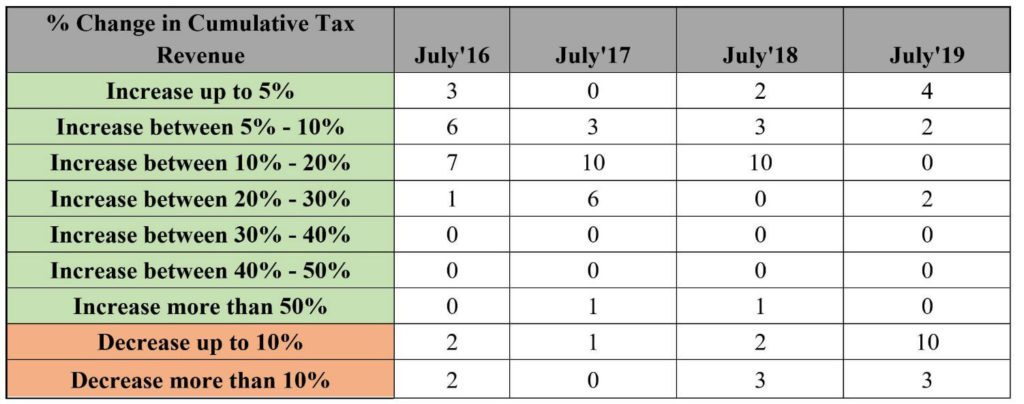

The number of states whose cumulative tax revenue increased by more than 10% in the first four months of the financial year was 8 in 2016-17, which increased to 17 in 2017-18. In 2018-19, a total of 11 states reported an increase of more than 10% in cumulative tax revenue in the first four months. In a sign of the slowdown in the current financial year, only 2 states have reported an increase in cumulative tax revenue of more than 10% in the first four months of 2019-20.

On the other hand, the number of states with a negative growth in the first four months of a financial year was only 4 in 2016-17. This has now increased to 13 states in 2019-20, states which have reported a negative growth or a decrease in cumulative tax revenues in the first four months of the financial year.

Clear sign of slowdown?

The month on month comparison of 2019-20 with 2018-19 shows an increasing short fall in the tax revenues earned by the states. The comparative shortfall for July 2019 has impacted a greater number of states resulting in the fall of cumulative revenues earned by 13 of the 21 states.

As can be seen from the data, the trend of fall in tax revenue is more prominent in June & July 2019. If this trend continues, even those states which are on the positive side of tax revenue in 2019-20 compared to 2018-19, could see a fall in their cumulative revenues impacting government spending and thereby the economy. The fall in tax revenue could be a clear sign of the slowdown.

Featured Image: Fears of economy slowdown

1 Comment

Pingback: Amidst fears of a slowdown in the Economy, Tax Revenues of many States shrink in the first four months of 2019-20 - Fact Checking Tools | Factbase.us