Data available with the CAG in the form of ‘Monthly Key Indicators’ indicates that while some states managed to surpass their budget estimates for revenue receipts in 2021-22, some states did not. Lower Non-Tax Revenues & Grants-in-Aid brought down the revenue receipts of certain states in 2021-22.

In the first of this two-part series, we analysed the trends for those States whose actual revenue receipts were more than 95% of the budget estimates for 2021-22. The data indicates that all these states had revenue receipts of more than or about the same amount as in budget estimates for 2021-22. There are, however, differences in the nature of these revenue receipts, with tax revenues, especially GST earnings of a few of the states still proportionately much lower than the estimates.

In this story, we look at the trends in actual revenue receipts of the remaining states.

Methodology: The data submitted by the states & as available on the website of the Comptroller & Auditor General (CAG) is considered for the analysis. The data is collated from the ‘Monthly Key Indicators’ report of the respective states as of March 2022 i.e., the end of the financial year 2021-22. Revenue Receipts of the States are used for the analysis. Revenue Receipts include – Tax Revenue, Non-Tax revenue and any Grant-in-aid & contributions received. The Tax revenues of the states include – GST, Land revenue, Sales Tax, State excise duties, State share in Union taxes & other taxes. The states are categorized based on the proportion of Actual Revenue receipts compared to the budget estimates. Northeastern States (except Assam) are categorized separately. Goa, Delhi & Puducherry are excluded from the analysis as there is no data available on the CAG website.

States Share in Union Taxes & Grants-in-aid contribute to higher Revenue receipts despite lower tax collection

During 2021-22, seven (7) states have reported revenue receipts of less than 95% but more than 85% of their budget estimates for the year. As seen in the case of other states with a higher proportion of actuals, the contribution of the different components of the revenue receipts varies from state to state. Here is a snapshot of these seven states.

- Jharkhand is among the states with a lower volume of revenue receipts. During the pandemic year of 2020-21, the state was able to earn only about 3/4th of the estimates for 2020-21. The situation improved in 2021-22, wherein Jharkhand improved the revenue receipts to 90.8% of the estimates. This is contributed by better GST collection as well as Land revenue. While its Non-tax revenue & Grants-in-aid were much lower than the estimates, a higher share in union taxes compared to estimates contributed to an increase in revenue receipts.

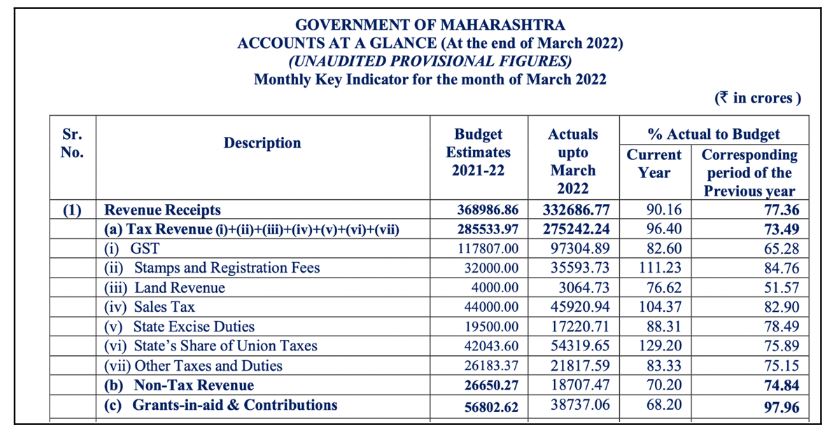

- Maharashtra is the worst affected state due to the pandemic in the country. It also happens to be the leading state in revenues. The impact of the pandemic on Maharashtra was visible in 2020-21, when the state’s revenue receipts were only 77% of the budget estimates. The Tax receipts were around 73% and GST collection was only around 6 % of the estimates for the year. The situation improved in 2021-22, where the overall revenue receipts were around 90% of the estimates. However, this is largely contributed by the state’s higher share of union taxes compared to the estimates at 129%. The GST collection was only about 80% of the estimates.

Assam’s revenue receipts improved in 2021-22 compared to the previous year both in terms of volume and as a proportion of the estimates for the year. Its revenue through taxes was 113% of the estimates but largely due to higher receipt of its share of union taxes compared to estimates. SGST was also better off than earlier with 94.6% collections compared to only 60% collected during the pandemic year. However, the state received only about 70% of the grants-in-aid that it estimated, which brought down the overall proportion of the actual revenue receipts in comparison to its estimates.

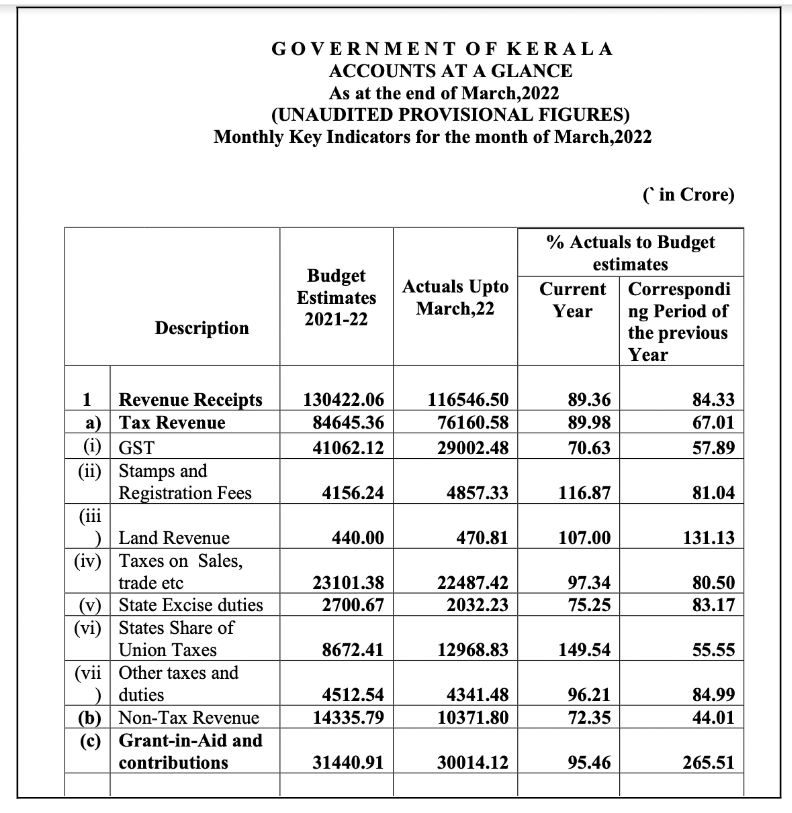

In 2021-22, a lower collection of SGST than estimates for Kerala was compensated by nearly 1.5 times higher actuals of the state’s share of union taxes compared to estimates and 95% actuals in grants-in-aid compared to the estimates. It ought to be noted that during 2020-21, the actual grants-in-aid received by Kerala were much higher at Rs. 31.04 thousand crores compared to the estimates of about Rs. 11.69 thousand crores. Meanwhile, it received only about 55% of its estimates in its share of union taxes for the pandemic year of 2020-21.

In the case of Haryana, the actuals for non-tax revenue and grants-in-aid were much lower than its estimates for year 2021-22. But this was compensated by the increase in GST collections as well as revenue through sales tax. Another key contributor to better revenue receipts (at 88.8% of the estimates) is its share of union taxes received for the year was 133% of what the state estimated.

Uttar Pradesh has the highest revenue receipts for 2021-22 in terms of volume. However, Rs. 3.57 lakh crores were about 85% of its estimates for the year. For the year 2021-22, the state’s GST collection was about 90% of its estimates. The overall Tax revenue of the state was just over its estimates which is largely contributed by the higher proportion in the share of union taxes compared to the estimates for 2021-22. Meanwhile, as is the case with the other states, the actuals for grants-in-aid received is much lower than the estimates.

Bihar’s actual revenue from the taxes was closer to its estimates. Unlike the states discussed above, the State’s share of Union taxes has only a limiting influence with the actuals matching the estimates. GST collection was also 97% of the estimates. This was a significant improvement over 2020-21. However, the overall revenue receipts of the state were only about 85% since the actual non-tax revenue and grants-in-aid were much lesser than its estimates.

Lower Non-tax revenue than estimates affects total revenue receipts

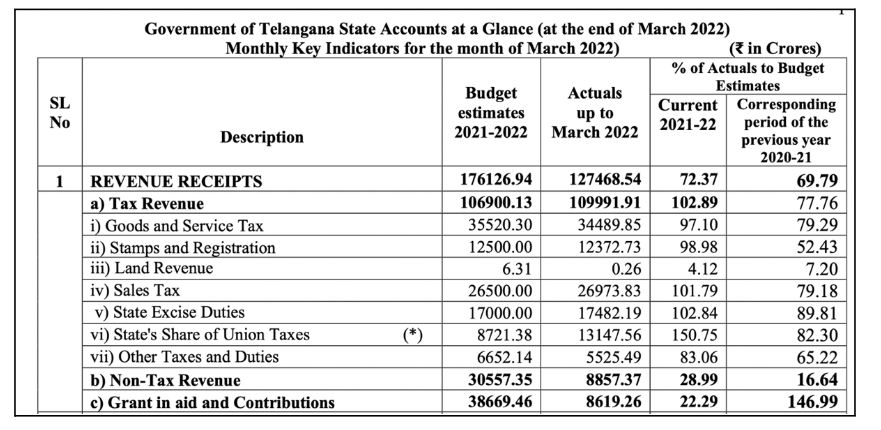

Among the large states, three states have total actual revenue receipts for 2021-22 less than 85% of their estimates – Andhra Pradesh, Telangana & Punjab. A common trend across these three states, especially in the case of Telangana is lower non-tax revenue compared to estimates, which has resulted in the overall shortfall of revenue receipts, despite better tax revenues in accordance with the estimates. Here is a snapshot of these three states.

- Telangana’s revenue receipts were only about 72% of the estimates in 2021-22. In the previous year of 2020-21, it was 69% of the estimates. In both years, the lower non-tax revenue compared to the estimates has contributed to an overall shortfall in the revenue receipts. This is despite more than 100% collection in tax revenues compared to the estimates. The non-tax revenue was only about 28.9% of its estimates. Even actual grants-in-aid received was only about 22% of what the state estimated for the year.

In 2020-21, the revenue receipts of Andhra Pradesh (AP) were about 72% of the estimates. Within this, the tax revenues were around 79% of estimates while the state’s GST was around 73% of estimates. This has improved in 2021-22, in terms of volume as well as the proportion of the estimates. The actual GST for the year was 86.3% of estimates. The overall tax revenue was near 95%. As was the case with few other states, a higher receipt of states’ share of union taxes was a key contributor. However, the non-tax revenue was only about 71% and grants-in-aid were about 67% of the estimates, resulting in overall lower actual revenue receipts compared to estimates for the year.

The trend for Punjab is similar to Andhra Pradesh. The actual tax revenue, GST in specific was close to the estimates. But a lower non-tax revenue and grants-in-aid compared to the estimates have contributed to lower revenue receipts.

For most of the Northeastern States, an increase in Tax Revenues has helped manage the shortfall

The quantum of revenue receipts for most of the northeastern states is lower compared to the other states in the country. And hence, slight variation in any of the revenue components may have a disproportionate impact on the overall revenue receipts. While the trends are similar across these states, there are certain outliers.

A general trend across the states (with the exception of Manipur) is that the actual tax revenue of the states is higher than the estimates in 2021-22. This is a key contributor to the overall revenue receipts. Better tax revenues are a combination of both higher than estimated tax revenues of the states including GST, Sales Tax, Excise, etc. as well as the higher amount received as States’ share of Union taxes compared to the estimates. Manipur is an exception with the lower State’s own tax revenue, which is reflected in the shortfall of the revenue receipts. The northeastern states also received lower grants-in-aid than estimates in general.

Trends in Revenue Receipts do not present a complete picture of the respective State’s performance

As highlighted in the methodology, the Revenue Receipts of the States include – State’s Tax revenues, Non-Tax Revenues, Grants-in-aid, etc. The Tax revenues of the states being reported include their share of Union taxes apart from SOTR (State’s Own Tax Revenue). Apart from SOTR & Non-tax revenue, the grants-in-aid from the union government also have a significant impact on the overall revenue receipts.

Even in the case of the individual components where only the state has a role, the non-tax revenues influenced overall revenue receipts. For instance, in the case of Telangana, the state has managed to meet its estimates in terms of SOTR but fell short of overall revenue receipts due to significantly lower non-tax revenue & grants-in-aid. In other words, though the state managed to meet its tax revenue targets, the other components brought it down. On the other hand, Gujarat managed to compensate for its lower GST collections with a higher proportion of grants-in-aid. Similarly, Odisha is another state which managed to earn a higher revenue due to non-tax revenue, which might not be the case in the coming years.

While actual revenue receipts of the States compared to estimates provide an indicative trend of the recovery in the post-pandemic period, the extent of the shortfall is not necessarily a reflection of the performance of states.