The World Bank Group recently released the ‘Migration and Development Brief’, which provides details of the trends in ‘Migration and Remittances’ around the world. Remittances to LMICs are set to increase by 7.3% to USD 589 billion in 2021. In India’s case, remittances are estimated to grow by 4.6% in 2021 as India maintains its position as the top destination for remittances.

Remittances are transfers of money by a person working in a foreign location to a person or family back home as household income. As per IMF, ‘Remittances are typically transfers from a well-meaning individual or family member to another individual or household. They are targeted to meet specific needs of the recipients, and this tends to reduce poverty.’

IMF’s Balance of Payments International Investment Position Manual (BPM6) provides a more comprehensive economic definition of what constitutes a remittance.

Remittances offer a constant source of income in the domestic country. Many developing & underdeveloped countries rely on foreign remittances as they generally result in domestic spending, thereby contributing to the growth of the economy. In a few instances, the remittances also offer a reliable source of income for countries that are experiencing economic challenges domestically.

The COVID-19 pandemic had a major impact on many countries across the world – including both developed and under-developed economies. While remittances continue to provide relief to families back home, there were challenges in the foreign countries that might have affected the flow & the volume of remittances.

Recently, the World Bank Group released the 35th edition of Migration and Development Brief, which provides details of the trends in ‘Migration and Remittances’ around the world. In this story, we look at the trends in remittances during 2020, which was majorly impacted by COVID-19 and the projections for 2021, the year in which many countries are on a recovery path.

Remittances to Low & Middle-Income regions estimated to increase by 7% in 2021

Out of the total global remittances, the major share is to the Low & Middle-income Regions. As per the estimates for pandemic hit 2020, the total remittances around the world were USD 706 billion. Out of this, the remittances to Low & Middle-Income regions were USD 549 billion.

This was lower than the previous year i.e., 2019, when it was USD 722 billion & USD 559 billion respectively. As per the forecast for 2021, the remittances across the world are expected to increase to USD 751 billion, out of which the remittances to Low & Middle-Income regions would increase by around 7.3% i.e., to USD 589 billion.

During 2020, while the remittances estimate for Low & Middle-Income regions fell, the trend is not the same across regions. The trend in 2021 also varies across these regions.

- The total remittances for East Asia & the Pacific fell from USD 148 billion in 2019 to USD 136 billion in 2020. The remittances are estimated to fall further to USD 131 billion in 2021. Excluding China, the remittances to the region fell to USD 77 billion in 2020 from USD 79 billion in 2019 and may recover slightly to USD 78 billion in 2021.

- In the case of Europe & Central Asia, the remittances fell to USD 64 billion in 2020 from USD 70 billion in 2019. In 2021, there is a slight recovery. The same trend is observed in Sub-Saharan Africa.

- On the other hand, three other regions recorded stronger growth in remittances even during 2020. The remittances to Latin America & the Caribbean have increased to USD 103 billion in 2020 compared to USD 97 billion in 2019. This is estimated to grow further by 22% in 2021 with USD 126 billion.

- Even in the case of South Asia, remittances increased even during 2020 to USD 147 billion compared to USD 140 billion in 2019. There is a stronger growth forecast for 2021 with USD 159 billion.

- The Middle East & North Africa has also shown an increasing trend despite the COVID-19 pandemic.

The Remittance flows to LMICs on track to be higher than the sum of FDI & ODAs

The receipts to countries are in different forms. Apart from remittances, the other sources of receipts from outside include – Foreign Direct Investments (FDI), Official Development Assistance (ODA) and Portfolio investments.

The remittances to the Low & Middle-Income countries (LMICs) have witnessed a gradual increase over the years, especially since the turn of the earlier decade (2010). On the other hand, the flow of FDI to these countries has seen a fluctuating trend, especially with a decline since the early 2010s.

The ODAs have seen a steady growth but not to the extent of the growth observed in Remittances. During 2020, the value of remittances overtook the total FDI inflows to LMICs. Despite an expected recovery in 2021, the remittances are projected to be higher than the FDIs.

If China is excluded, the volume of FDI falls further over the years.

As per the projections provided in the report, the remittances to LMICs (excluding China) are expected to surpass the sum of FDI & ODA in 2021. In these countries (excluding China), the remittances are more than 50% higher than FDI and three times more than the ODA levels.

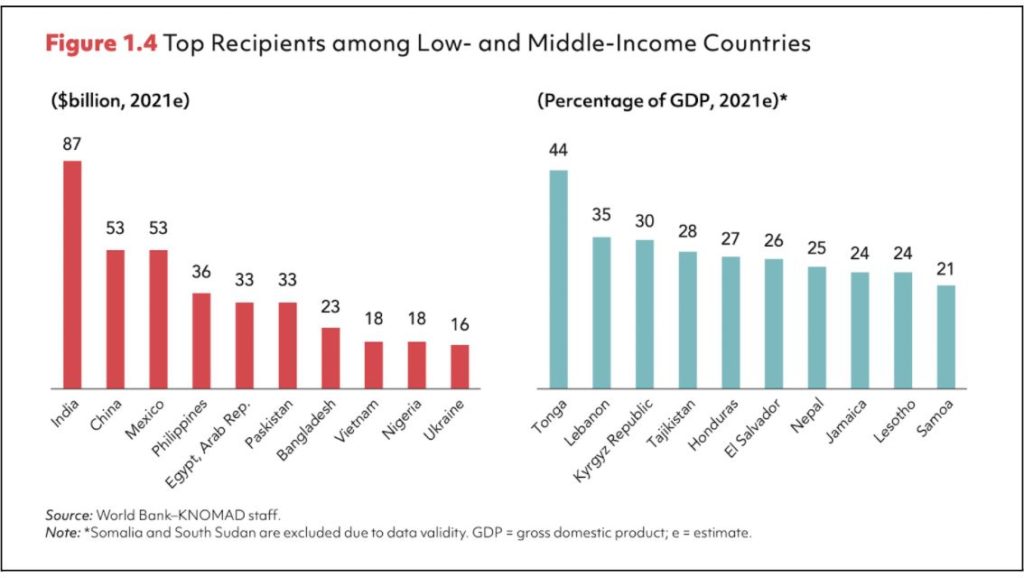

India is estimated to receive the highest remittances among LMICs in 2021.

As per the forecast for 2021 provided in the report, India is estimated to receive USD 87 billion in remittances in 2021. This is the highest among the LMICs. This is a 4.6% increase compared to 2020. As per the report, the increase is due to the increase in remittances from expatriate workers in GCC (Gulf Cooperation Council) countries. The GCC countries have benefitted from higher oil prices which translated to the Indian expatriates being able to send higher remittances.

China & Mexico are estimated to receive about USD 53 billion each through remittances in 2021, which is the second-highest. The report states that Mexico benefitted from the strong economic recovery in the USA.

Egypt is expected to record a 12% increase in remittances in 2021 compared to 2020. As is the case with India, it also benefitted from the stronger economic growth in the Gulf countries. It also benefitted from the increased economic activity in USA & Europe.

The economies of a few of the LMICs are hugely dependent on the remittances that they receive.

In 2021, Tonga has remittances accounting for 44% of its GDP, followed by Lebanon at 35% & Kyrgyz Republic at 30%.

An increase in Economic Activity has contributed towards an increase in remittances

During the pandemic-hit 2020, remittances to LMICs were resilient. The overall fall in remittances was by only 2% despite the pandemic. The report says that there was a sharp fall in Q2 of 2020, because of the widespread lockdowns across the countries. However, there was a recovery in the latter half of 2020, which has limited the fall in remittances to just 2%.

The recovery continued in 2021, and it is estimated that the remittances would increase by more than 7.5% compared to 2020. The Migration & Development brief opines that the migrants have stepped up the support to the families in low & middle-income regions through their remittances. This was aided by the economic activity picking up in the countries where the migrants are working. The fiscal stimulus and monetary policies of these countries in the aftermath of COVID-19 have enabled migrants to send remittances back to their countries.

The easing of the COVID-19 caseload in many of these countries in 2021 has also aided in the economic recovery.

As highlighted in the earlier part of the story, the value of remittances to the LMICs has surpassed the FDIs and ODAs received by these countries, making them a major source of revenue. For a few of the countries, remittances form a major part of their GDP. All these highlight the increased reliance on remittances in many of the LMICs. Even during the pandemic, while the inflow from other sources reduced, remittances continued in most countries providing an important lifeline to the respective domestic economies. The sentiment of sending back to their families for support during the crisis has helped in the resilience of remittances even during the pandemic. To couple with this, the timely recovery of economies in host countries also played a part, further strengthening the role of remittances in extending support to the LMICs.

However, challenges for remittances remain with the resurgence of COVID-19 in many of the host countries. Remittances could be affected if the host countries impose restrictive measures. Global fuel prices would also play an important role as remittances from GCC countries form a major share of remittances for many LMICs.

In the next story, we take a deeper look into the historical trends of remittances across the countries.

Featured Image: Inward Remittances to Low & Middle-Income countries