In this week’s review of Court Judgments, we look at the Supreme Court’s order that the Drawer of the cheque is liable even if details in it have been filled up by some other person if the cheque was issued in discharge of a liability, that Financial burden on the state is a valid reason to fix a cut-off date for payment of revised pension, that IBC would prevail over the Customs Act, among others.

SC: The drawer of the cheque is liable even if details in it have been filled up by some other person

Oriental Bank of Commerce vs. Prabodh Kumar Tewar is an appeal against the decision of the Delhi High Court with respect to a cheque bounce case. The respondent in this case was permitted by the Delhi High Court to engage a hand-writing expert to check if the details filled in the cheque were in his hand. The Trial Court had earlier dismissed the respondent’s application seeking to have the cheque and his specimen signature and handwriting examined by a government handwriting expert. The respondent’s appeal was allowed by the High Court.

The question before the Supreme Court was if the High Court was right in allowing the respondent to engage a handwriting expert to determine whether the details that were filled in the cheque were in the hand of the respondent. The respondent had admitted that he handed over a signed blank cheque to the appellant. The bench of Justices DY Chandrachud and AS Bopanna allowed the appeal referring to section 139 of the Negotiable Instruments Act, 1881 which presumes that a drawer handing over a cheque signed by him to the payee is liable unless the drawer adduces evidence trial that the cheque was not in discharge of a debt or liability.

The bench added that determining whether the respondent filled the details in the cheque using a hand-writing expert on whether the respondent had filled in the details in the cheque would make the purpose for which the cheque was handed over irrelevant. It noted that no purpose is served by allowing the application for adducing the evidence of the handwriting expert. To sum it up, the drawer of the cheque is liable even if the details in it have been filled up by some other person.

SC: Financial burden on state is valid reason to fix a cut-off date for payment of revised pension

The High Court of Tripura observed that Rule 3(3) of Tripura State Civil Services (Revised Pension) Rules, 2009 was arbitrary and violated Article 14 of the Constitution, and struck down the same. Consequently, it asked the state to pay the original writ petitioner the arrears of pension for a period of 22 months in 2007-2008. The State opposed the writ petition and filed a counter affidavit. It submitted that the State was under a financial burden and that it was not in a position to bear the additional burden of a revised pension. Further, it was submitted that a policy decision was taken to grant the benefit of the revised pension notionally from 2006 to 2008 and to grant the actual benefit of the revised pension from 2009. However, the High Court rejected the state’s submission.

The matter was taken to the Supreme Court in State of Tripura vs. Anjana Bhattacharjee where it was contended on behalf of the state that due to financial crunch and considering the heavy burden on the state if it has to pay the actual revision pension from 2006, the development of the state would be affected, because of which a policy decision was taken by the state as seen earlier. It also submitted that the High Court ought not to have interfered with it in the exercise of powers under Article 226 of the Constitution of India.

Referring to past judgements, the Supreme Court bench of Justices MR Shah and BV Nagarathna set aside the High Court’s judgement striking down Rule 3(3). It stated that there was no reason for the High Court to doubt the State’s financial constraints and policy decision even after the state provided specific statistics. Allowing the appeal, the Bench observed that the financial burden on the State can be a valid ground to fix a cut-off date for payment of the revised pension.

SC: IBC would prevail over the Customs Act

In Sundaresh Bhatt, Liquidator of ABG Shipyard vs. Central Board of Indirect Taxes and Customs, an appeal was filed against the order of the National Company Law Appellate Tribunal (NCLAT) which held that the goods lying in the customs bonded warehouse were not the Corporate Debtor’s (ABG Shipyard) assets as they were neither claimed by the Corporate Debtor after their import nor were the bills of entry cleared for some of the said goods. The Supreme Court Bench constituted by Chief Justice N.V. Ramana, Justices JK Maheshwari and Hima Kohli dealt with two questions in this case. These are

- Whether the provisions of the Insolvency and Bankruptcy Code (IBC) would prevail over the Customs Act? If yes, to what extent?

- Whether the customs could claim title over the goods and issue notice to sell the goods in terms of the Customs Act when the liquidation process has been initiated?

With respect to the first question, the Bench held that the IBC would prevail over the Customs Act. However, once a moratorium is imposed in terms of Sections 14 or 33(5) of the IBC, the respondent authority only has limited jurisdiction to assess/determine the quantum of customs duty and other levies.

On whether customs could claim title over goods, the Bench noted the following:

- Once a moratorium is imposed in terms of Sections 14 or 33(5) of the IBC, the Customs authority can only take steps to determine the tax, interest, fines, or any penalty which is due and not initiate recovery proceedings.

- Following the assessment, the customs authority must submit before the adjudicating authority its claims regarding customs dues or operational debt as per the procedures laid and stipulated timeline under the IBC.

- In any case, the IRP/RP/liquidator can immediately secure goods from the customs authority to be dealt with appropriately, as per the terms of IBC.

The Bench allowed the appeal stating that NCLAT ignored the mandate of Section72(2) of the Customs Act regarding the sale. The NCLAT’s interpretation was also criticized for ignoring the effects of the moratorium under IBC.

Andhra Pradesh HC: Explanation should be given by the corporation if a person’s explanation on why deviations in construction could not be removed is rejected

In E V Rama Rao vs. The State of Andhra Pradesh, Revenue, the petitioner filed a writ petition under Article 226 of the Indian Constitution. He was granted permission to construct a building of G+5 floors in his plot and raised only G+4 floors as per the sanctioned plan. However, he was issued a notice under AP Municipal Corporation Act, 1965 and A.P.Metropolitan Regional and Urban Development Authority Act, 2016 citing the deviations and violations. The petitioner was asked to submit reasons why those could not be altered or removed. If not, it would be considered a continuous and intentional offence. The petitioner submitted a reply that these deviations were for ‘Vastu’ reasons and that he was ready to pay for the regularization of such deviations as per the legislations. Despite the petitioner submitting a response, the respondents had issued a notice which stated in the first paragraph that no response was submitted. On the contrary, in the last paragraph of the order, it was mentioned that the response was unsatisfactory.

Justice Ravi Nath Tilhari of AP High Court held that with respect to the deviations in the construction of the building, the permissible percentage to be regularized or not or the effect on the public at large, cannot be decided by the Court at this stage as it requires consideration by the competent authority considering various aspects with a due opportunity of hearing to the concerned, at the first stage. Nonetheless, the Court referred to the following cases to decide the case.

In ACES Hyderabad vs. Municipal Corporation of Hyderabad (1994), AP High Court issued certain guidelines to the Corporations that in instances where deviations or violations are minor, trivial, or minimal, and do not affect the public at large, then the Corporations should not resort to demolition.

In Poonamchand vs. Greater Hyderabad Municipal Corporation (2012), the AP High Court held that the explanation offered by the owner of the building cannot be rejected with a cryptic observation. The commissioner should also give reasons as to why the explanation is not satisfactory.

The AP High Court stated that the expression “found not satisfactory” is reflective of the conclusion but, not the reason, in K. Ashok Kumar vs. Greater Hyderabad Municipal Corporation (2012). That is why the explanation offered by the petitioners is not satisfactory, also forms part of their process of reasoning.

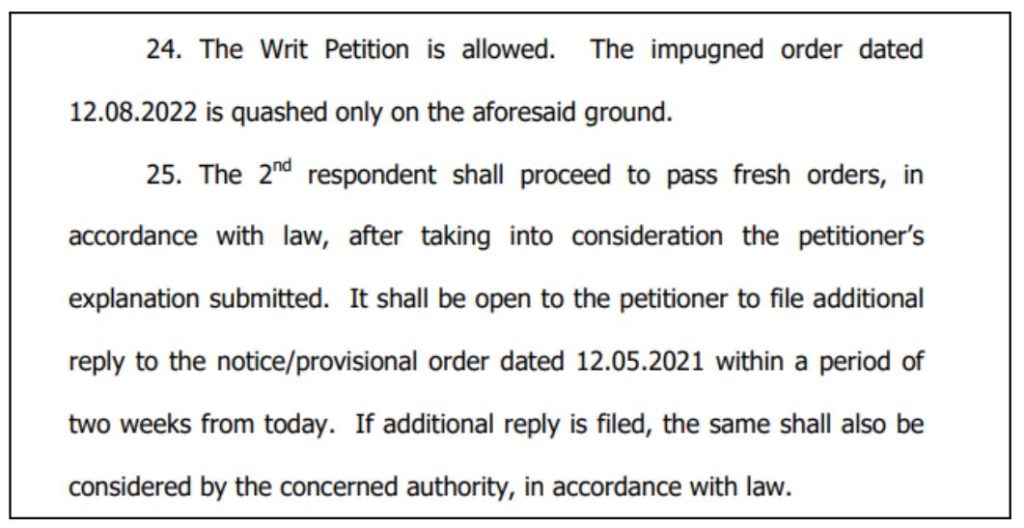

In the present case, the High Court noted that no cogent reason was given as to why the petitioner’s explanation was rejected. Allowing the petition, the High Court directed the respondent to issue fresh orders taking into consideration the response submitted by the petitioner.

Patna HC: Systemic discrimination against the transgender community is not cured merely through employment opportunities

The writ petition in Veera Yadav vs. The Chief Secretary, Government of Bihar and others highlighted the inhumane conditions faced by the transgender community in Bihar during the pandemic such as denial of ration. The Patna High Court Bench of Chief Justice Sanjay Karol and Justice S. Kumar noted that the Court had issued several directions earlier for the welfare of the transgender community. It also noted the state government’s measures like free ration, employment in the police force, and financial assistance.

It noted that the systemic discrimination against the members of the transgender community that has been in existence in society for a long time shall not be cured only by employment opportunities. It added that measures should also be taken like sensitization, awareness, etc. to root out discrimination from the general public.

Adding that it is the State’s duty to ensure the wellbeing of its citizens, the Court directed the Additional Chief Secretary, Social Welfare Department, Government of Bihar to convene a meeting, seek updates on the welfare measures and issue appropriate directions to ensure that all possible steps are taken for benefit of this community without any further delay.