As per Rule 16(2) of the All-India Services (Conduct) Rule, 1968, every member of the service must annually declare their immovable property, whether inherited, owned, acquired, or under lease or mortgage, either in their name, their family members’ names, or others’ names. Data discrepancies are found in the SPARROW portal of the DoPT so much so that a standing committee recommended extensive purification of data.

Integrity in governance stands as a crucial and indispensable prerequisite for the smooth functioning of a robust system and the advancement of socio-economic development. With the evolving socio-economic landscape, public servants find themselves entrusted with expanding discretionary powers, particularly in the distribution of government resources in diverse forms. As a result of such discretionary powers, there is a high chance of collusion between different power centres of the administration, thereby promoting corruption.

The values of integrity and impartiality become more important as the distinction between the political and administrative framework is blurred. Adherence to the code of conduct and financial propriety is an important aspect of the integrity of the Civil Servants. Any information on properties acquired by holders of ‘public office’ requires the mandatory disclosure of property assets and liabilities.

In this context, we look at the trends in the immovable property returns (IPRs) filed by civil servants in India.

Genesis

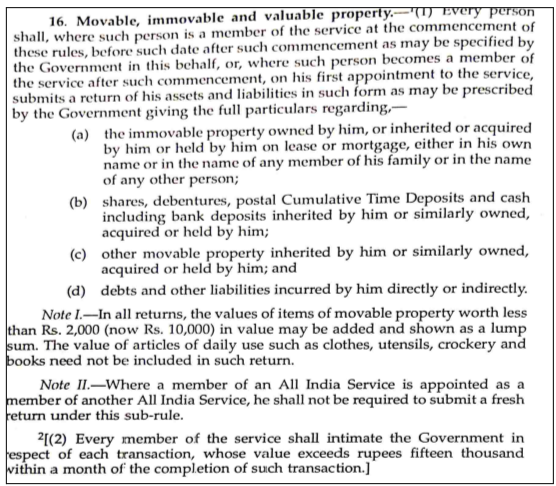

As per Rule 16(2) of the All-India Services (Conduct) Rule, 1968, every member of the service must annually declare their immovable property, whether inherited, owned, acquired, or under lease or mortgage, either in their name, their family members’ names, or others’ names. The government has introduced online filing of these property returns since 1 January 2017.

The Central Government evaluates vigilance clearance for AIS officers for various purposes, including inclusion in offer lists, empanelment, necessary deputations, appointments to sensitive positions, and participation in training programs. Failure to submit the annual immovable property return by 31 January of the following year results in denial of vigilance clearance, as per Government of India decisions under Rule 16 of the All-India Services (Conduct) Rule, 1968.

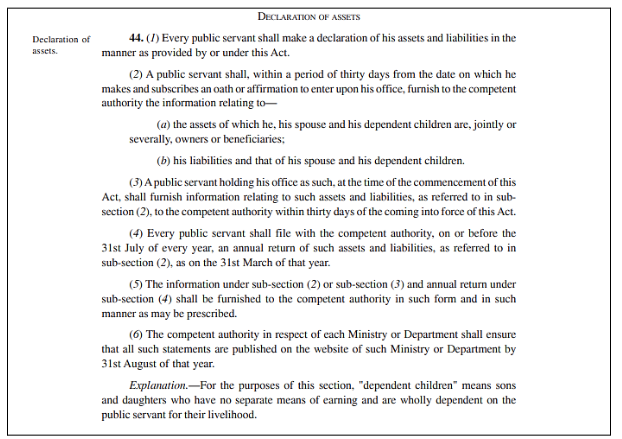

Further, Section 44 of the Lokpal and Lokayuktas Act, 2013 mandates the declaration of assets and liabilities of a public servant, who must submit an annual declaration of their assets and liabilities to the appropriate authority by 31 July of each year, reflecting their financial status as of 31 March of that year.

Section 45 of the same act declares that non-disclosure of such assets shall be presumed to be assets acquired by corrupt means. Accordingly, the Department of Personnel and Training notified the Public Servants (Furnishing of Information and Annual Return of Assets and Liabilities and the limits for Exemption of Assets in Filing Returns) Rules, 2014.

As a result, every member of the service is required to file a declaration, information and return indicating his/her assets and liabilities using Forms I, II, III, and IV. In 2017, a separate IPR module was developed for the online filing of IPRs to avoid problems with the hard copies of IPRs.

IPR filing by IAS Officers see increasing compliance over the years.

It is important for public servants to submit their Immovable Property Returns (IPRs) within the specified timeframe. The statistics on the submission of IPRs by IAS officers indicate a growing adherence to mandatory disclosure. Starting from 2011, when the IPRs of IAS officers began to be uploaded on the Department’s website, the total number of officers filing IPRs increased steadily, reaching 4859 in 2023. The annual growth rate in the number of IAS officers submitting IPRs averaged 8% during this period.

Decline in the number of IAS Officers still not complying with the IPR filing.

Several regulations mandate the timely submission of annual Immovable Property Return (IPR) forms. However, data from the SPARROW portal of the Department of Personnel and Training (DoPT) indicates a significant number of IAS officers who have not yet submitted their IPRs. In 2011, the number of IAS officers who had not submitted their IPRs was 454, a figure that gradually increased to 894 by 2016. Since 2017, when IPR submission was transitioned to an online process, there has been a decreasing trend in the number of IAS officers failing to submit their IPRs. In 2023, a total of 241 IAS officers were yet to submit their IPRs as of date.

Significant discrepancies in the data reported regarding the filing of IPRs.

Ideally, there should only be two categories of IAS officers: those who have filed their Immovable Property Returns (IPRs) and those who are yet to file. The total of these two categories should match the total strength of the IAS. However, when examining data from the SPARROW portal on IPR filings, a significant discrepancy is evident.

For instance, in 2011, 1845 IAS officers had filed their IPRs, while 454 officers had not. However, the actual strength of IAS officers in 2011, according to the Department of Personnel and Training (DoPT) annual report for 2021-22, was 4456. This means that there is a difference of 2157 between the actual strength and the combined number of officers who had filed their IPRs and those who had not filed.

This discrepancy persists in subsequent years as well, with 2022 reporting a difference of 392.

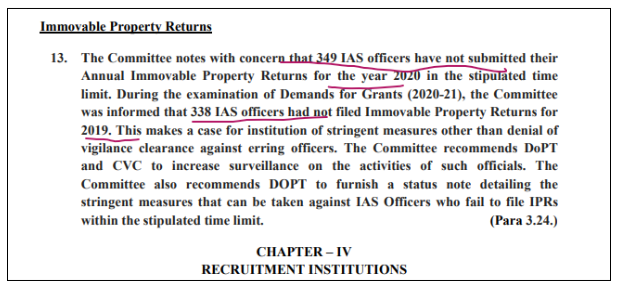

There appears to be a notable disparity between the data presented by the same department in different contexts. For instance, in the 106th Report of the Standing Committee on Personnel, Public Grievances, Law, and Justice, the number of IAS officers who had not filed their IPRs for 2020 and 2019 was reported as 349 and 338 respectively. However, the online portal indicates higher numbers at 585 and 666 for the same years.

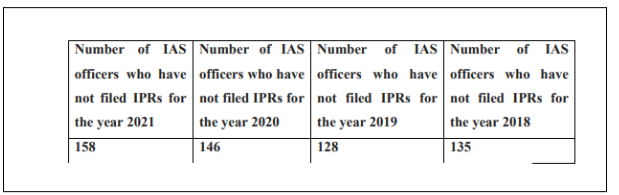

In the 112th report of the Standing Committee on Personnel, Public Grievances, Law and Justice, the number of IAS Officers who have not filed IPRs for 2021, 2020, 2019 and 2018 were 158, 146,128 and 135 respectively. However, the data on the online portal show that the numbers are 500, 585, 666, and 754 respectively.

The inconsistency in the data reported for 2019 and 2020 by the same Standing Committee raises questions about the department’s interpretation of non-filing of IPRs within the stipulated time frame versus non-filing IPRs altogether. Clarity is needed regarding whether the department treats these instances similarly or if there are distinct criteria for each. This discrepancy raises concerns about the consistency and accuracy of the data on the online portal, especially considering the broader implications of corruption in public administration.

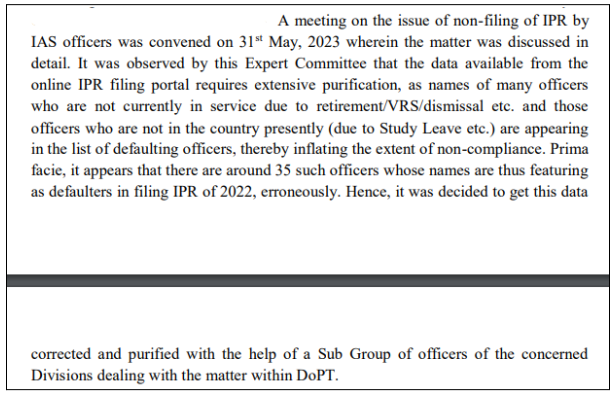

Further, the Expert Committee, established based on the recommendation of the Standing Committee in its 122nd report, emphasized the importance of ensuring the accuracy of data available on the online IPR filing portal.

Considering the discrepancies highlighted by the Standing Committee regarding the data reported in the online portal, it is imperative for the department to address and clarify the issue of non-filing of IPRs. There is a pressing need for the department to provide a transparent and accurate assessment of the non-filing of Immovable Property Returns (IPRs) by public servants. Additionally, it is crucial to establish a mechanism that verifies the authenticity of the property return statements filed by public servants, as recommended by the Standing Committee. This step would ensure accountability and integrity in the process and help address concerns regarding corruption in public administration.