Household savings are the key to savings in India. RBI’s annual report for 2019-20 indicates that the Net Financial Savings of Households reached 7.6% of the Gross National Disposable Income (GNDI) in 2019-20. However, this was largely on account of the sharp decline in financial liabilities than an increase in gross savings.

The Household sector is the major contributor towards the gross savings in the Indian economy, and thus is the major supplier of financial resources for investments. As per an article ‘Quarterly Estimates of Households’ Financial Assets and Liabilities’ in the RBI’s June 2020 bulletin, nearly 60% of the gross savings in India is through household sector. Hence the dynamics of assets and liabilities of households can offer insights into the prevailing situation of the Indian economy.

In this story, we take a look at the trends in financial savings of the household sector based on RBI annual reports and other relevant data, to ascertain the trajectory of India’s economic growth.

Substantial increase in the Net Financial Savings of Household sector in 2019-20

As per data provided in RBI Annual Reports, the Net Financial Savings (NFS) in 2019-20 as per preliminary estimates is 7.6% of the Gross National Disposable Income (GNDI). This is a substantial increased compared to previous financial year, where in Household NFS was 6.4% of GNDI. In fact, the savings in 2018-19 was the lowest recorded during in the current GDP series (i.e. from 2011-12). The earlier lowest was in 2014-15 when Household NFS was 6.8% of GNDI. The preliminary estimate for 2019-20 at 7.6% will place it at par with 2017-18, which also happens to be the second-best year in terms of savings in the current GDP series after 2015-16’s NFS at 7.9% of GNDI.

Fall in bank deposits with no significant increase in Gross Financial Savings

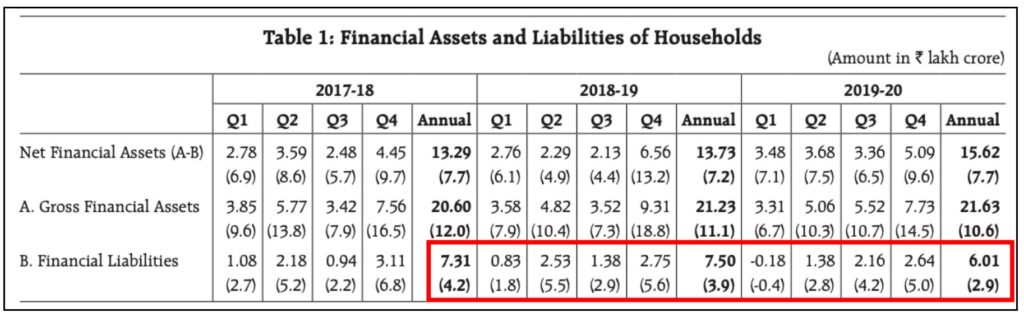

House Holds’ Net Financial Savings is derived as a difference of the Household Gross Financial Savings (GFS) during the year and Household Gross Financial Labilities. Hence the NFS is the result of two dynamics i.e. Gross savings and Gross liabilities. While, the NFS as a share of GNDI has seen a significant improvement in 2019-20 compared that of last year, it is not due to a proportionate increase in the Gross Financials Savings. As per RBI’s data, Household GFS for 2019-20 is 10.5% of GNDI. This is a marginal improvement over last year when it was 10.4 % of GNDI.

A deeper look into the various components of Gross Financial Savings indicates varying trends.

- Bank Deposits which have shown an improvement in the previous year with 4.1% of GNDI from the lowest point of 3.1% in 2017-18, fell to 3.6% of the gross disposable income. This preliminary estimate for 2019-20 is a reflection of people not preferring to make deposits in banks which could be due to the fall in deposit interest rates. Except for 2016-17, the bank deposits have generally seen a declining trend.

- Meanwhile, investments into insurance funds as a saving option is estimated to improve with 1.7% of GNDI compared to that of 1.3% in the previous year, which happened to be the record low. However, the share of disposable income being deposited into Insurance funds is yet to reach the earlier highs of over 2% of GNDI. Nevertheless, the reversal of the decreasing trend in 2019-20 indicates that people are more inclined to invest in Insurance and mutual funds compared to Bank deposits, which are offering lower returns.

- The preliminary estimates for other components do not indicate major changes in 2019-20. However, the savings in the form of currency marginally fell to 1.4% of GNDI compared to 1.5% in 2018-19. This was not as steep a fall as in 2018-19 when it fell from 2.8% in 2017-18 to 1.5%. The investment of disposable income into Provident & Pension funds has remained the constant over the last five years.

The increase in NFS is due to the fall in Household Financial Liabilities

As the data indicates, the increase in Household Net Financial Savings is not due to a relative increase in the Gross financial savings for 2019-20. The increase is the result of a major shift in the other factor i.e. Household Financial liabilities.

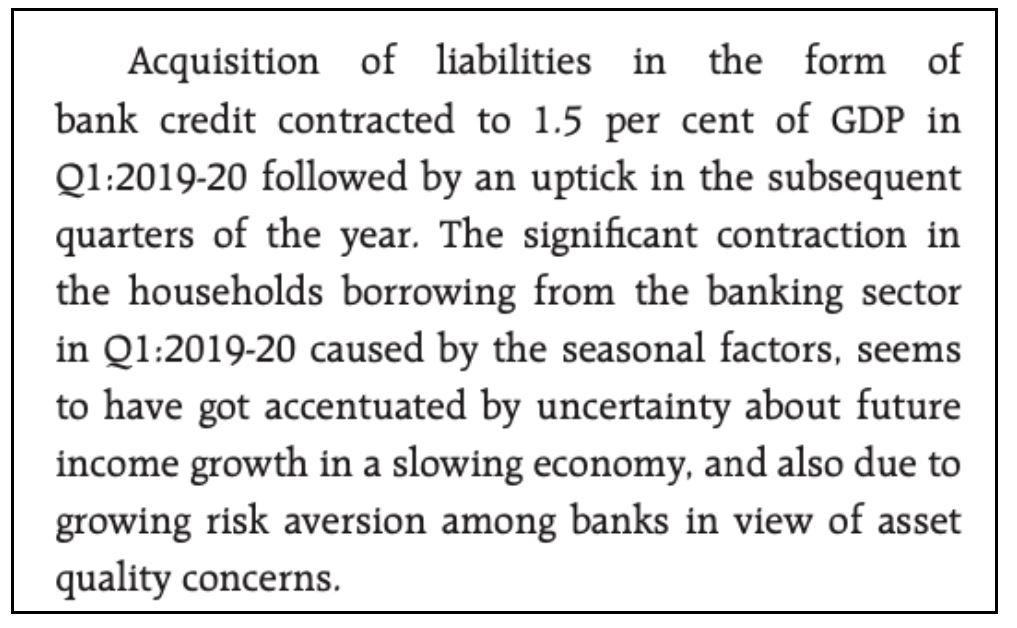

The preliminary estimates peg Household Financial liabilities at 2.9% of GNDI for 2019-20. This is a sharp fall from 4% the previous year. The estimate for 2019-20 is in continuation of the decreasing trend, wherein share of Financial liabilities in GNDI fell from 4.3% in 2017-18. The fall in liabilities indicates lesser propensity of people to borrow especially in view of a slowdown in the economy. In a growing economy, people are more encouraged to borrow as they have the confidence to pay it back.

On the contrary, uncertainty in the economy makes people to be more conservative with the money they have or less optimistic of future earnings, thereby avoiding the risks of borrowing.

The low consumer confidence is also evident from the quarterly surveys conducted by RBI earlier.

Lower consumer demand indicates slowdown in economy even prior to COVID-19

While the annual comparison shows a fall in the financial liabilities, the quarter-wise data indicates a different trend. As per the information provided in RBI’s article ‘Quarterly Estimates of Households’, the Financial labilities in Q1 of 2019-20 was in negative value. In terms of volume it was ‘-0.18 lakh crores’ i.e. -0.4 % of GNDI.

The article attributes this negative observed in Q1 of 2019-20 to the fall in the borrowings from commercial banks. However, post the first quarter of 2019-20, there is a gradual increase in the financial labilities in the subsequent quarters. The overall financial labilities increased from Rs. 1.38 lakh crores in Q2 and peaked to Rs. 2.64 lakh crores in Q4.

One of the reasons for the increase can be attributed to the seasonal trends, where in the borrowings tend to increase during Q4 and tend to moderate during the first quarter.

A quarter by quarter comparison with previous year does indicate a contraction, which further strengthens the argument that people are being risk averse.

In India, the COVID-19 induced lockdown was implemented during March-2020 and continued for the next couple of months. However, as noted earlier, the negative sentiment in the economy was there even prior to Q4 of 2019-20, indicating a slow-down in the economy before COVID-19.

The recently released GDP figures for Q1 of 2020-21 indicate a severe contraction of the economy. In this context, the impact on COVID-19 on the household sector is yet to be seen. With the fall in incomes, there could be a fall in the financial assets being created. We could also witness a scenario where in people are forced to go for borrowings in view of the COVID-19 related hardships. Decrease in savings and increase in liabilities could result in a fall in net financial savings for 2020-21.

Featured Image: Household financial liabilities

1 Comment

Pingback: Data: Household financial liabilities decline sharply in 2019-20 - ModiDynamics