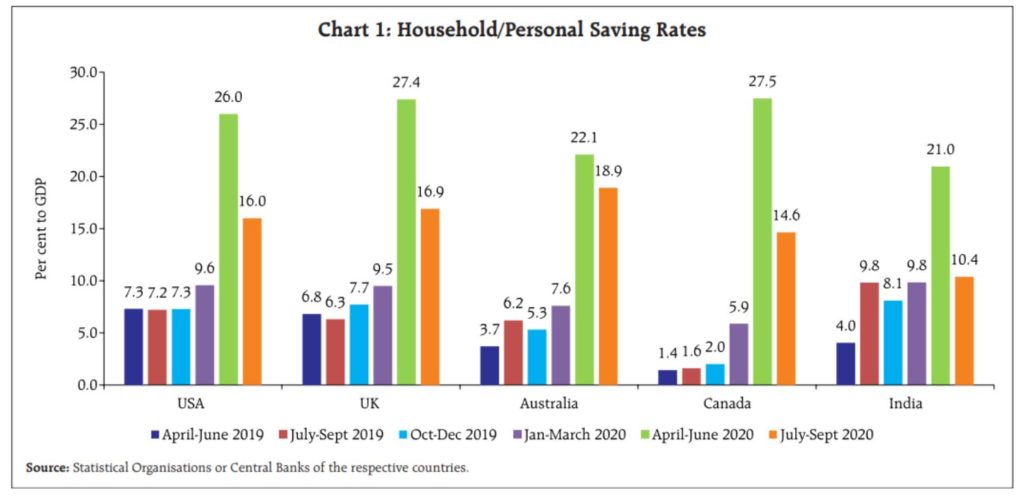

As per the statistics released by RBI, the household savings rate increased in most major economies in the (April – June) quarter of 2020. In India, the aggregate deposits of Scheduled Commercial Banks increased significantly in the first and third fortnights of 2020-21 and 2021-22, unlike previous years.

Preliminary indications suggest that the COVID-19 pandemic has induced a spike in the financial savings of households around the world. For the Indian context, we look at household financial savings rate, and deposit and borrowings from Scheduled Commercial Banks (SCBs) to understand the changes brought about by the pandemic as compared to previous years. The Reserve Bank of India (RBI) publishes ‘Weekly Statistical Supplement’ that provides data on a variety of indicators including deposits & credit. We look at data from these publications for the purpose of this story.

Household savings witnessed a significant rise in Q2 & Q3 of 2020 globally

Globally, the quantum and composition of spending witnessed visible changes as the pandemic induced mobility restrictions and resulted in forced and precautionary savings. As many advanced economies faced hiccups in their journey to recovery, inflicted by the second wave of the virus and fear of more virulent strains, their household/ personal savings in (April-June) and (July-September) quarters of 2020 remained far higher than the pre-pandemic levels, as per a recent bulletin of the RBI.

The household/personal savings rates in the US, the UK, Australia, and Canada, moved up to more than 20 percent mark in April-June 2020. The rate of savings corrected significantly in the next quarter i.e., July-September quarter but sustained at a much higher rate than the pre-pandemic levels. In contrast, financial savings of Indian households reverted closer to the pre-pandemic levels in the next quarter i.e., July-September quarter.

In India, the COVID-19-induced spike in the household financial savings rate in Q1:2020-21 waned substantially in Q2 in a counter-seasonal manner. According to a recent RBI bulletin, India appeared to be faster in raising spending probably on account of the approaching festive season demand along with the release of pent-up demand, thereby reaching closer to the pre-pandemic levels of household financial savings in the third quarter (July-Sept) of 2020.

Aggregate deposits of SCBs in India increased during 2020 & 2021

The trends in aggregate deposits and borrowings from Scheduled Commercial Banks (SCBs) showed an increase on account of the COVID-19 pandemic. In comparison to previous years, the deposits in SCBs increased by a staggering Rs. 2.8 lakh crore in 2020-21 & in 2021-22, it has already increased by Rs 1 lakh crore till 07 May 2021.

The households’ deposits and borrowings picked up significantly in 2020-21 and show signs of an increase in the first few fortnights of 2021-22. Typically, bank deposits and credit offtake decline in April and May, according to SBI Research Report (May 2021). Therefore, this is an unusual increase for the months of April and May in both 2020-21 and 2021-22. With lockdowns in force, experts believe it could be a sign of precautionary savings, compounded by the need to hold disposable cash to counter health and economic uncertainties.

Another interesting point to note is that deposits have shown alternate periods of expansion and contraction in 2021-22 in the first 3 fortnights. The report explains that it is possible that such expansion followed by contraction could indicate household stress as people getting salary credits in the first fortnight are withdrawing it in the second fortnight for health expenses/stocking up currency for precautionary motive and an uncertain scenario and the trend continues. However, this pattern would be understood better once the data for subsequent fortnights is published.

Although the aggregate deposits increased during the pandemic, it, however, might conceal the unequal impact in terms of household savings and consumption expenditures of non-essential items as several households in the unorganized sector suffered from loss of employment, income, and borrowing opportunities.

Going forward, with the optimism on progress in mass vaccination, household financial savings are expected to recede further to the pre-pandemic levels in India as well as in other countries. With the gradual reopening/unlocking of the economy, households have switched from an ‘essentials only’ approach to discretionary spending, as per the RBI.

Featured Image: Scheduled Commercial Banks