Budget estimates are an important of planning for various initiatives in the year ahead. A huge shortfall in actuals compared to the estimates hampers those plans. Data from 2017-18 to 2021-22 indicates that Actual Tax Revenues of 15 States including 6 Northeastern states were more than 90% of the estimates.

Taxes form a major component of the revenues earned by the governments. In the earlier stories, we analysed the trends in the revenue receipts of the States in view of the COVID-19 pandemic. The data from few states indicates that non-tax revenue and grants-in-aid came to the rescue despite lower than estimated tax revenues. However, the revenues from these sources are not recurring & guaranteed revenues unlike the tax revenues earned by the states. Being the regular source of revenue, tax revenues also present a reliable picture on the economic situation of the respective states, since the taxes are levied on a multitude of economic activities.

In this story, we analyse the trends in tax revenues of the states over the past five years i.e., from 2017-18 to 2021-22, to ascertain the situation prior to, during and post the pandemic.

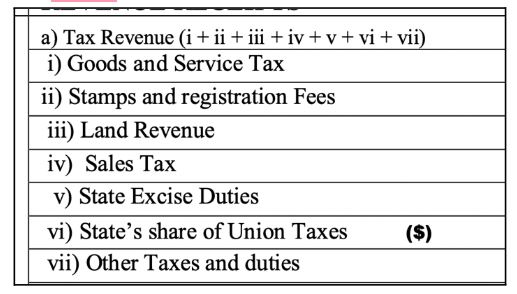

Methodology: ‘Accounts at Glance’ reports submitted by the respective states to the Comptroller & Auditor General (CAG) are considered for analysis. These reports are for the four-year period 2017-18 to 2020-21. For the recently ended 2021-22, we have considered the data from ‘Monthly Key Indicators’. For those states where the ‘Accounts at Glance’ reports were not available for a particular year, ‘Monthly Key Indicators’ reports were considered. Tax Revenue includes the revenue earned by the states directly through various taxes i.e., States own Tax Revenue and their share of Union Taxes. Thus, Tax Revenues include – GST, Sales Tax, Excise Duties, Land Revenues, Stamps & Registrations Fees, Other Taxes & duties along with State’s share of Union Taxes.

For the purpose of categorization, the cumulative tax revenues (Budges estimates & Actuals) are calculated for five years i.e., 2017-18 to 2021-22. The States are then categorised based on the percentage of cumulative actuals earned vs. the cumulative budget estimates for these five years. A yearly analysis is also done to understand the trends.

Actual Tax Revenue of Madhya Pradesh exceeded its estimates during the pandemic.

If the cumulative tax earnings over the past five years are considered, three states in India have managed to have earn at more than 95% of their budget estimates. Even among these three states, Madhya Pradesh stands out by being the only state with actual tax revenue exceeding the estimates.

While the general trend at national level and across the states during the pandemic was a shortfall in the tax revenues compared to estimates, Madhya Pradesh has managed to earn more than its estimates. During 2019-20, the actuals were 101% of estimates. During the pandemic hit 2020-21, the estimates were slightly lower than previous year. The actual collection in 2020-21 was 105% of the estimates. In 2021-22, despite a higher estimate, the actuals were 116% of the estimates. State’s share of Union taxes is the major contributor towards the overall tax revenue earned by the state in 2021-22. It is 133% compared to the estimates. Trends in recent years show a higher proportionate increase in ‘State’s Own Tax Revenue’ (SOTR) compared to the revenue it receives as its share of Union taxes.

Odisha and Himachal Pradesh are the other two states with more than 95% of actual tax revenues compared to the estimates during these five years. Odisha’s actual tax revenues were more than its estimates prior to 2019-20. During 2019-20 and 2020-21, the actuals were only 87% & 83% of the estimates. In 2021-22, the tax revenues are 116% of the estimates. While its share of union taxes was a contributor to this, the SOTR of Odisha during the year was also higher than its estimates for the year, especially in case of GST & Sales Tax. These were lower during the pandemic. In the case of Himachal Pradesh, which comparably has lower volume of tax revenues, the actuals more than the estimates during and post pandemic, as in case of Madhya Pradesh.

Karnataka, Maharashtra, Tamil Nadu among the higher earning states whose actual tax collections were affected during the pandemic

There are 6 states whose actual cumulative tax revenues were between 90-95% during the five-year period (2017-18 to 2021-22). While the amount of tax revenues varies from state to state, a common trend observed is that these states have a higher ratio of actual earnings compared to the estimates but were affected during the pandemic year of 2020-21.

Maharashtra, one of the leading states with highest tax collections managed actuals at 107% of the estimates in 2017-18. In the ensuing year, it was around 99%. The impact of pandemic was visible in the next two years, with actuals only around 87.5% and 73.5% in 2019-20 and 2020-21 respectively. In 2021-22, the actual amount of tax collections improved and were around 96.4% of the estimates for the year. Its share of Union taxes being a major contributor to the increase in 2021-22. The state which had the highest number of COVID-19 cases and impact had a fall in its SOTR during the pandemic from which it is to yet to fully recover.

Karnataka, Tamil Nadu & West Bengal are the other higher tax earners in terms of volume, which witnessed a similar trend. The tax revenues in these states were more than 95% of the estimates prior to the pandemic. The actuals fell to less than 80% of the estimates during the pandemic. The actual tax revenues in all these states exceeded estimates in 2021-22. Another common trend that observed in these states is a lesser variance in the yearly estimates despite the pandemic.

A similar trend is observed in case of Telangana, where an improving trend in the actual earnings was affected by the pandemic. In 2020-21, the state’s actual tax earnings were only 77% of its estimates. The actuals in 2021-22, not only increased in volume but are also higher than the estimates for the year.

For most of the states, pandemic has further affected their inconsistent actual tax revenues

COVID-19 pandemic affected nearly all the states. While for most, the estimates remained nearly the same, the lower actual earnings have resulted in shortfall of their estimated revenues.

In the states discussed above, the shortfall in the tax revenues due the impact of pandemic was mitigated to an extant due to the better performance pre-pandemic and a faster recovery in 2021-22.

However, those states which had lower actual tax revenues compared to their own estimates even prior to the pandemic, have had to face a further shortfall due to the pandemic. Nine large states have their cumulative tax receipts at less than 90% of their estimates. A common trend among them is the inconsistent and lower tax earnings even prior to the pandemic.

Gujarat was among the most impacted during the pandemic, with its actual tax receipts only at 80% & 67% of the estimates in 2019-20 & 2020-21. Its tax receipts were above 90% of estimates during the non-pandemic years.

Uttar Pradesh, Bihar, Andhra Pradesh, Rajasthan, etc. are among the other states whose actuals were more than 90% of the estimates but fell to less than 90% due to the pandemic. These states have shown better actuals to estimates ratio in 2021-22.

On the other hand, Punjab & Assam reported inconsistent and lower tax receipts compared to the estimates even prior to the pandemic. The situation went further south due the pandemic. An improvement is observed in 2021-22, especially due to increase in the share of union taxes received by these two states.

Major fall in tax revenues during the pandemic severely affected Kerala

Among the large states, both Kerala & Jharkhand have the actual cumulative tax revenue during 2017-18 to 2021-22 at less than 85% of their budget estimates. The tax revenues of Kerala were just about 90% of their estimates prior to the pandemic. The short fall increased further with actuals at 75% and 63% in 2019-20 and 2020-21 respectively. Even in 2021-22, the actual tax revenue was only about 89% of the estimates. GST collection has been lower in Kerala during these years. Though the state’s share of union taxes were 150% of the estimates in 2021-22, the overall actuals did not cross 90% in 2021-22. Even Jharkhand is characterised by lower actual tax revenues compared to the estimates, even prior to the pandemic.

Except for Manipur, Tax Revenues of most Northeastern States are more than 90% of estimates

The quantum of tax revenues of Northeastern States excluding Assam) are generally lower than the other states because these states are smaller in comparison. However, these states have better tax estimate realization with the cumulative actual tax revenues of all these states at more than 90% of the estimates with Manipur being the only exception. But even in case of Manipur, it is the major shortfall in 2020-21, that has affected the overall figures. The actual tax revenue in 2020-21 was only 35% of its estimates.

While pandemic’s impact cannot be discounted, more prudent estimates can help the states plan better

As the data suggests, the impact of the pandemic on various states’ tax collections cannot be denied. Except for a couple of states, there has been a shortfall in the tax revenues for most of the states during the pandemic hit 2019-20 and 2020-21, compared to their estimates.

The higher actuals in the case of state’s share of union taxes compared to estimates, for most of the states contributed to the reduction in shortfall of actual tax revenues for many states. While the economy is on the path of recovery as visible from the higher tax revenues in 2020-21, more prudent estimates of tax revenues can help the states plan better.

Featured Image: Actual Tax Revenues of States