Recently, several news agencies (here, here, and here) reported that the Reserve Bank of India (RBI) has moved 100 metric tonnes (MT) of gold stored in the U.K. to domestic vaults in 2023-24. The RBI mentioned in its 2023-24 annual report that 100 metric tonnes of gold stored abroad had been relocated to domestic vaults. In this context, a video is being shared on social media with a claim that in 1991, when India was facing bankruptcy, the central government at the time led by the then PM Chandra Shekhar pledged about 1 lakh kg of gold to foreign banks. The claim further states that the Modi-led BJP government has now brought this gold back to India. Let’s fact-check the claim through this article.

Claim: In 1991, Chandra Shekhar government pledged about 1 lakh kg of gold to foreign banks. Recently, the Modi-led BJP government brought this gold back to India.

Fact: During the foreign exchange crisis of 1990-91, India secured a loan of $405 million from the Bank of England and the Bank of Japan by pledging 46.91 tonnes of its gold reserves. However, it repaid the loan between September and November 1991. Despite repaying the loan, the RBI kept the gold in England. The RBI has been buying and storing gold abroad for many years, both before and after 2014. According to the Reserve Bank of India (RBI) 2023-24 annual report, as of 31 March 2024, the RBI holds 822.1 tonnes of gold. Of this, 308 metric tonnes are held in India as backing for notes (notes are printed based on gold reserves) issued in the country. In 2023-24, the RBI moved 100 metric tonnes of gold stored abroad to domestic vaults, but still retains 413.79 tonnes of gold reserves abroad. Hence, the claim made in the post is Misleading.

Many countries store their gold in the Bank of England. India has also been storing gold in the Bank of England since before independence. The RBI’s practice of buying and storing gold is a normal process in the financial system. This purchase and storage of gold help expand foreign exchange reserves and curb inflation and currency volatility. The RBI reviews and decides periodically where to store the purchased gold. Gold stored abroad can be used for easy trading. The RBI buys gold from international markets and stores it abroad to facilitate transactions in gold.

However, storing gold internationally carries risks, particularly during times of geopolitical tensions. The recent freezing of Russian assets by the West has heightened concerns about the security of assets held abroad. This may also be a reason for the RBI’s decision to repatriate gold from the UK. Additionally, as central banks worldwide increase their gold reserves amid economic uncertainty, it serves as a signal to the world about the stability of India’s economy.

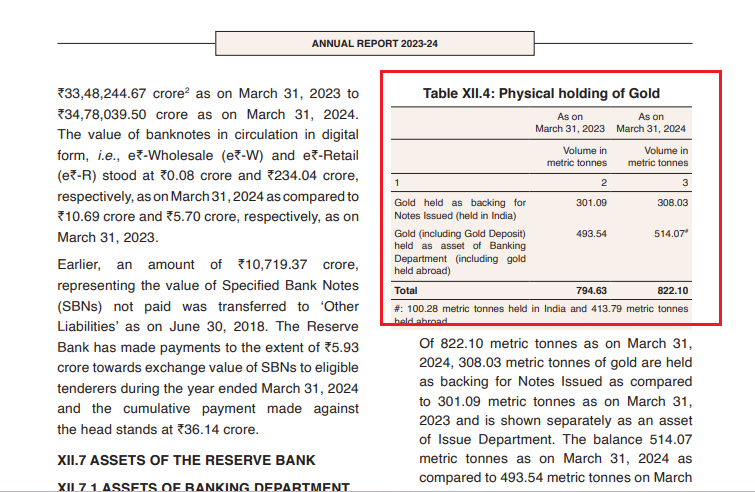

On 30 May 2024, the Reserve Bank of India (RBI) released its annual report for the year 2023-24, detailing its gold reserves. According to this report, the RBI added another 27.47 tonnes of gold to its reserves during the financial year (2023-24). As of 31 March 2024, the RBI holds a total of 822.1 tonnes of gold. Of this amount, 308 metric tonnes are held in India to back notes issued in the country. The report also states that 514.07 metric tonnes of gold held as an asset of the banking department and reserves held abroad. Of this, 100.28 metric tonnes are held in India, indicating that this gold was transported to India during the financial year. Consequently, the RBI holds 413.79 tonnes of gold abroad. According to the annual report, out of the 27.47 tonnes of gold acquired by the RBI in the financial year, 20.53 tonnes have been stored abroad.

Additionally, according to the RBI’s 2022-23 Annual Report, the RBI held 794.63 tonnes of gold as of 31 March 2023. Of this, 301.09 metric tonnes of gold served as backing for notes issued in India, while 493.54 metric tonnes were designated as assets of the banking department and gold reserves held abroad. Out of the RBI’s new purchase of 34.21 tonnes of gold in 2022-23, 28.94 tonnes of gold has been stored abroad and 5.27 tonnes of gold has been kept in India as a backing for printing notes.

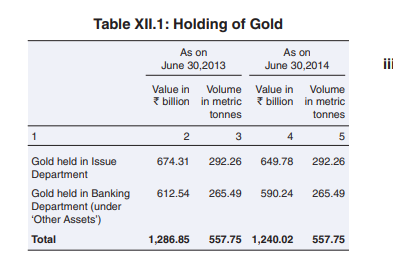

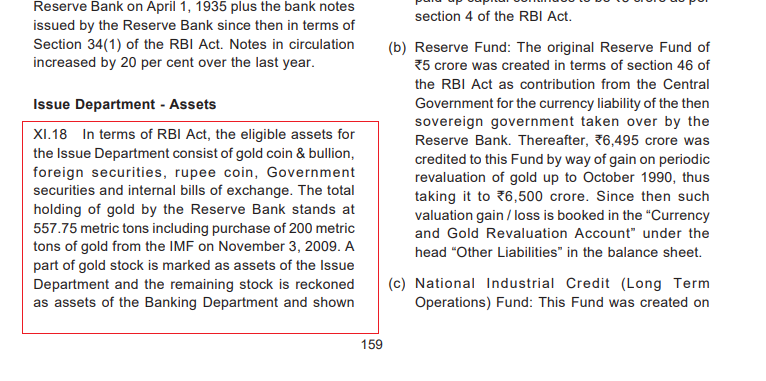

Furthermore, examining the RBI Annual Report for 2013-14 indicates that the RBI held 557.75 tonnes of gold as of 30 June 2014. Out of this total, 292.26 metric tonnes of gold were held in India as backing for notes issued in the country, while 265.49 metric tonnes were designated as an asset of the banking department and gold reserves held abroad. It is noteworthy that the RBI did not increase its gold reserves in the fiscal year 2013-14.

According to the annual reports of RBI, no new gold reserves were added between FY2011-FY2018. In FY2018, 8.46 tonnes of gold was purchased. Out of this, 8.44 tonnes of gold has been stored abroad and 0.2 tonnes of gold has been kept in India as a backing for printing notes. This pattern confirms that the RBI has been buying gold and storing it abroad for many years.

Examining the RBI 2009-10 annual report reveals that India, under the then UPA government, during Prime Minister Manmohan Singh’s tenure, purchased a significant 200 tonnes of gold valued at around $6.7 billion. Further inspection of RBI’s annual reports indicates a consistent rise in gold reserves over the past few years due to the Reserve Bank’s gold acquisitions. Since December 2017, the RBI has been consistently procuring gold from the market.

In 1991, did the Indian government pledge about one lakh kg of gold to foreign banks?

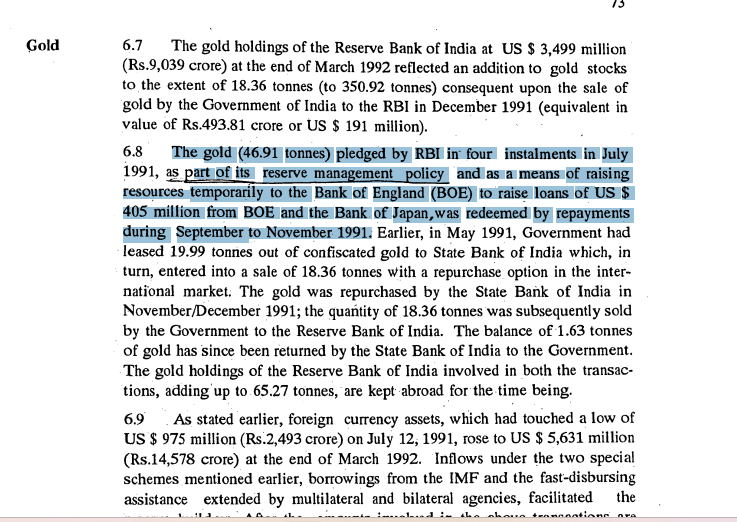

A response by Pankaj Chaudhary, Union Minister of State for Finance, to a question raised by members in a debate in Rajya Sabha on 27 July 2021, and as per RBI 1991-92 annual reports, during the foreign exchange crisis of 1990-91, India pledged part of its gold reserves i.e. 46.91 tonnes of gold and received a $405 million loan from the Bank of England and Bank of Japan. Also, the loan was repaid between September-November 1991. Even though the loan was repaid, the RBI kept the gold in England. Apart from this, during November/December 1991, the RBI made a fresh purchase of 18.36 tonnes of gold. This gold is also kept in the UK.

Based on the above information, it is clear that the gold that has been repatriated now (100MT) is not the gold that was pledged in 1991 since the loan was already repaid. From this, we can confirm that some amount (100 MT) of gold purchased and stored abroad by RBI over the years has been moved to domestic vaults in 2023-24.

We have written to the RBI seeking clarification; this article will be updated once we receive a response.

To sum up, although the RBI moved 100 MT of gold stored abroad to domestic vaults in 2023-2024, it still has 413.79 tonnes of gold reserves abroad.