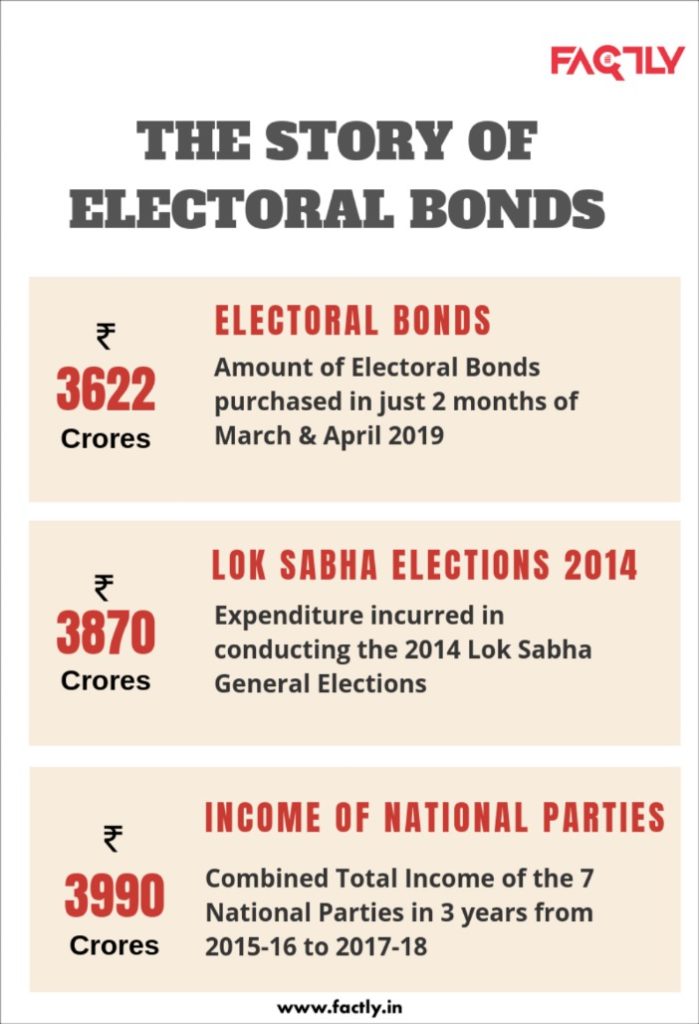

In just March & April 2019, electoral bonds worth ₹3622 crores were purchased, which is almost equal to the combined 3-year income of the 7 National Parties. This amount is also more or less equal to the expenditure incurred in conducting the 2014 Lok Sabha elections.

The Supreme Court (SC) had recently passed interim directions on the issue of ‘Electoral Bonds’ that mandates political parties to disclose in a sealed cover to the Election Commission of India (ECI), the names of donors of these bonds by 30th May, 2018. Data from March & April 2019 cycles indicates that a total of ₹ 3622 crores worth electoral bonds were purchased in just these 2 months.

This amount is almost equal to the combined 3-year income of National parties

This amount of ₹ 3622 crores almost equal to the combined 3-year income of the 7 national parties from 2015-16 to 2017-18. The 7 national parties reported a combined income of ₹ 3990 crores in the 3-year period between 2015-16 and 2017-18. On the other hand, this amount is also more or less equal to the expenditure incurred (₹ 3870 crores) on conducting the 16th Lok Sabha general elections in 2014. As noted before in one of our stories, such large amounts of anonymous donations to political parties severely vitiates the free & fair election process.

What are Electoral Bonds?

Electoral Bonds are bearer banking instruments that can be used to donate to political parties. One can read this Factly article to understand in detail about the electoral bond system. The biggest issue with electoral bonds is the anonymity. Except the banking system (SBI), hence the government, the donor & the political party, nobody else would know the identity of the donor.

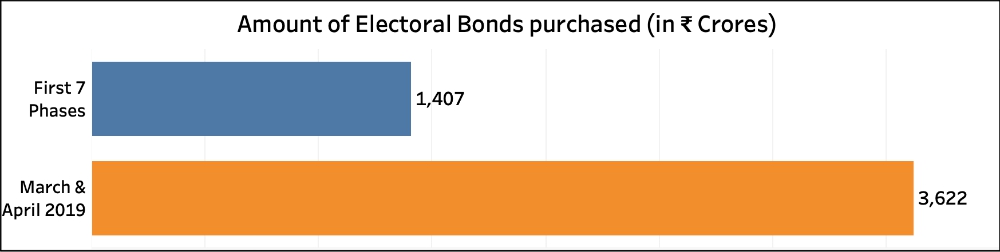

Bonds purchased in March & April 2019 are 2.5 times the amount purchased in earlier phases

Electoral Bonds have been on sale for 9 phases since their introduction. A total of ₹ 1407 crores worth electoral bonds were purchased during the first 7 phases. In contrast, a total of ₹ 3622 crores worth bonds were purchased in just March & April 2019 as per the data shared by SBI in response to an application under RTI. In other words, bonds purchased in March & April 2019 are 2.5 times the amount of bonds purchased in the first seven phases.

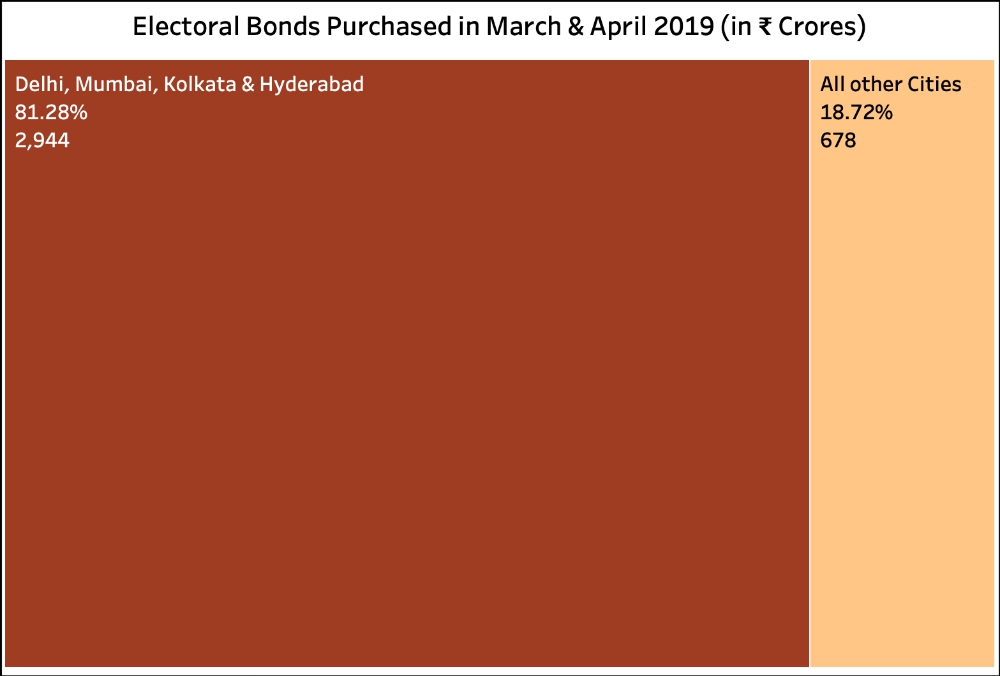

Four branches account for more than 80% of the bonds purchased in March & April 2019

Of the electoral bonds purchased in March & April 2019 across various branches of SBI, the four branches of Delhi, Mumbai, Kolkata & Hyderabad accounted for 81.28% or ₹ 2944 crores worth bonds. The remaining 12 branches (where bonds were purchased) accounted for 18.72% or ₹ 678 crores worth bonds.

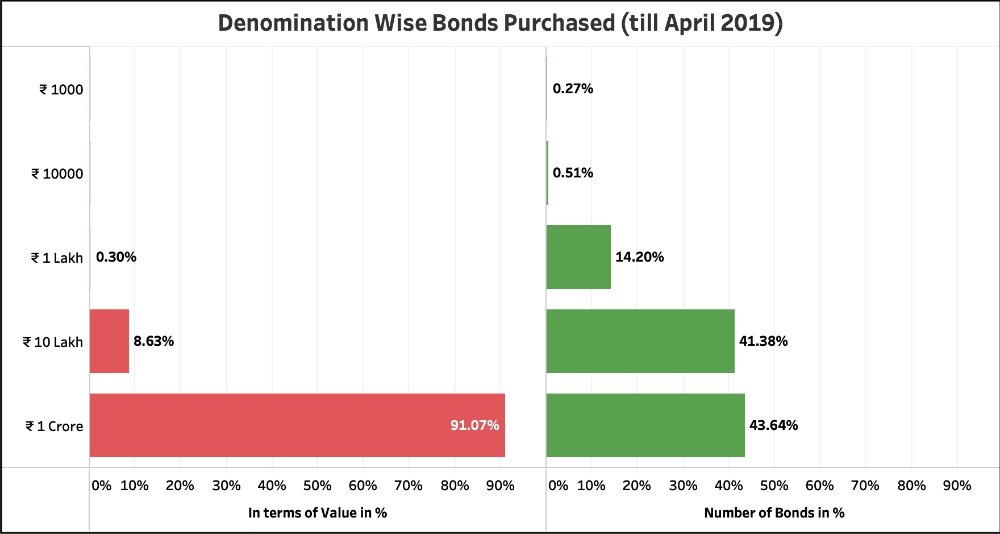

99.7% of the bonds purchased in the denomination of ₹ 10 lakh & ₹ 1 Crore

Together in all the 9 cycles till April 2019, bonds worth a total of ₹ 5029 crores were purchased. Out of these, bonds in the denomination of ₹ 1 crore accounted for 91.07% or ₹ 4580 crores. Further, bonds in the denomination of ₹ 10 lakh accounted for 8.63% or ₹ 434.2 crores Together, bonds in the denomination of ₹ 10 lakh & ₹ 1 crore accounted for 99.7% of all the bonds purchased so far, reinforcing the belief that only corporates are purchasing the bonds.