The government notified the ‘Electoral Bonds’ scheme that enables anyone to make anonymous donations to political parties. But will this scheme improve transparency in political funding?

After announcing ‘Electoral Bonds’ in 2017-18 budget, the government notified the ‘Electoral Bonds’ scheme. Will this scheme enhance transparency in political funding or arrest the flow the unaccounted or black money into political parties?

What is an electoral bond?

It is a bond issued in the nature of promissory note which shall be a bearer banking instrument. It neither carries the name of the buyer nor the payee.

A bearer instrument is one where no ownership information is recorded and the holder of the instrument is presumed to be the owner. The one (eligible political party in this case) in possession of the electoral bond is entitled to encash the same.

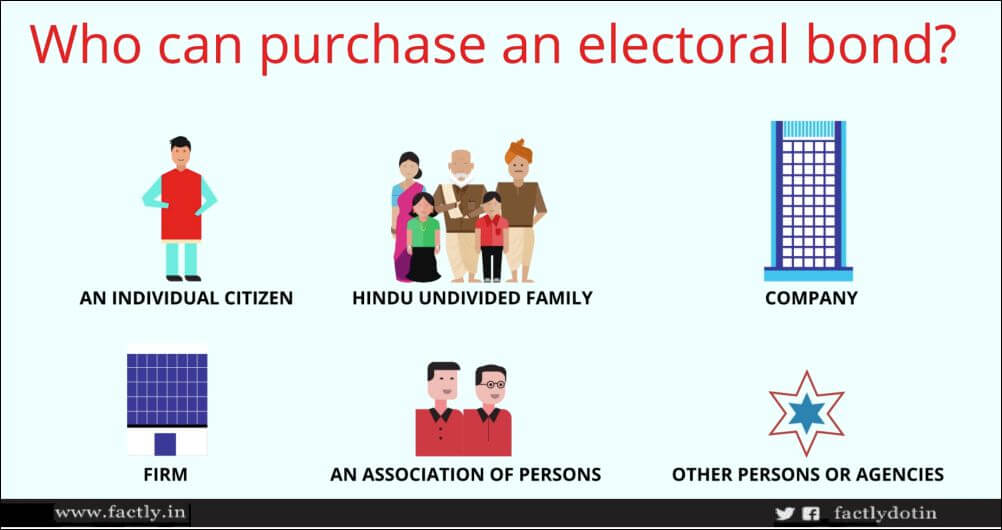

Who can purchase an electoral bond?

The bond can be purchased by any of the following categories of persons or organizations. In the case of a person, he/she should be a citizen of India while in case of organizations, it should be incorporated or established in India.

- An individual citizen

- A Hindu undivided family

- A company

- A firm

- An association of persons or a body of individuals, whether incorporated or not

- Other persons or agencies

An individual citizen can buy the bond, either singly or jointly with others.

Who can encash an electoral bond?

Only those political parties who fulfill the following criteria are eligible to encash the bond.

- A party should be registered under section 29A of the Representation of the People Act

- A party should have secured at least 1% of the votes polled in the last general election to the Lok Sabha or the State Assembly.

The bond can be encashed by an eligible political party only through a bank account with the authorised bank. Currently, only State Bank of India (SBI) is the authorized bank.

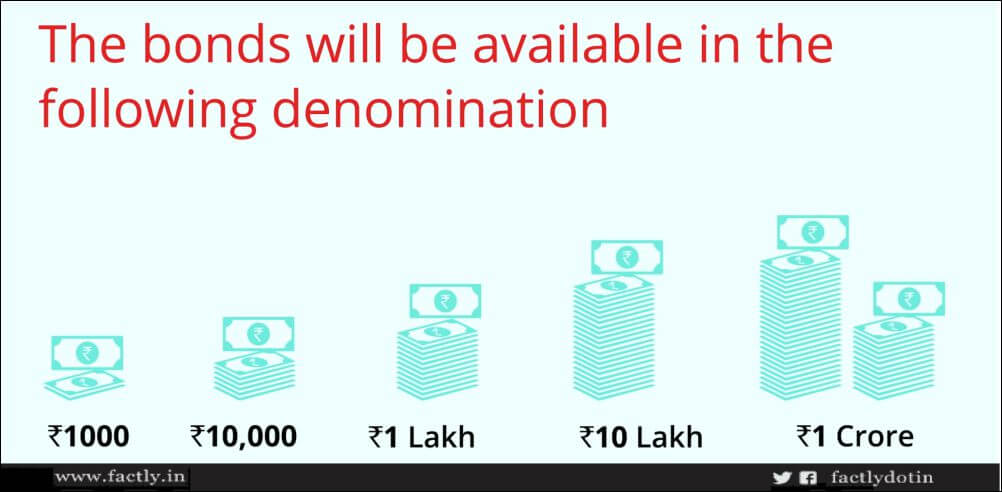

The bonds will be available in the denomination of Rs 1000, Rs 10,000, Rs 1 Lakh, Rs 10 Lakhs and Rs 1 Crore.

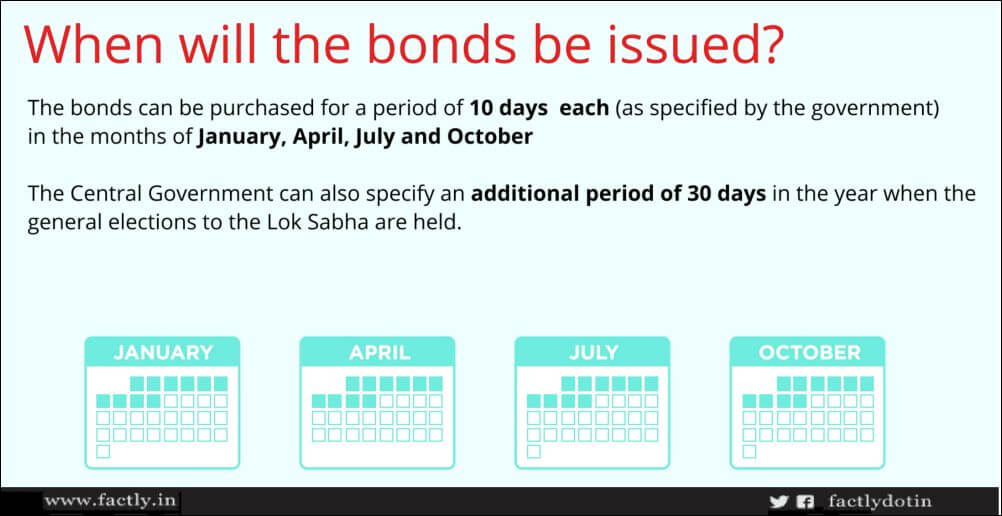

When will the bonds be issued & what is their validity?

The bonds can be purchased for a period of 10 days each in the months of January, April, July and October every year. These 10 days will be specified by the government. The government can also specify an additional 30 days for the purchase of the bond in the year of the general election to the Lok Sabha. The bond will be valid for 15 days from the date of issue. The bond will be invalid after the 15-day period and no payment will be made to any political party if it is deposited after the 15-day period. The bond deposited by any political party to its account will be credited on the same day.

The bond will be valid for 15 days from the date of issue. The bond will be invalid after the 15-day period and no payment will be made to any political party if it is deposited after the 15-day period. The bond deposited by any political party to its account will be credited on the same day.

The amount of bonds not encashed within the 15-day validity period will be deposited by the authorised bank (SBI) to the Prime Minister Relief Fund.

What is the procedure to purchase the bond?

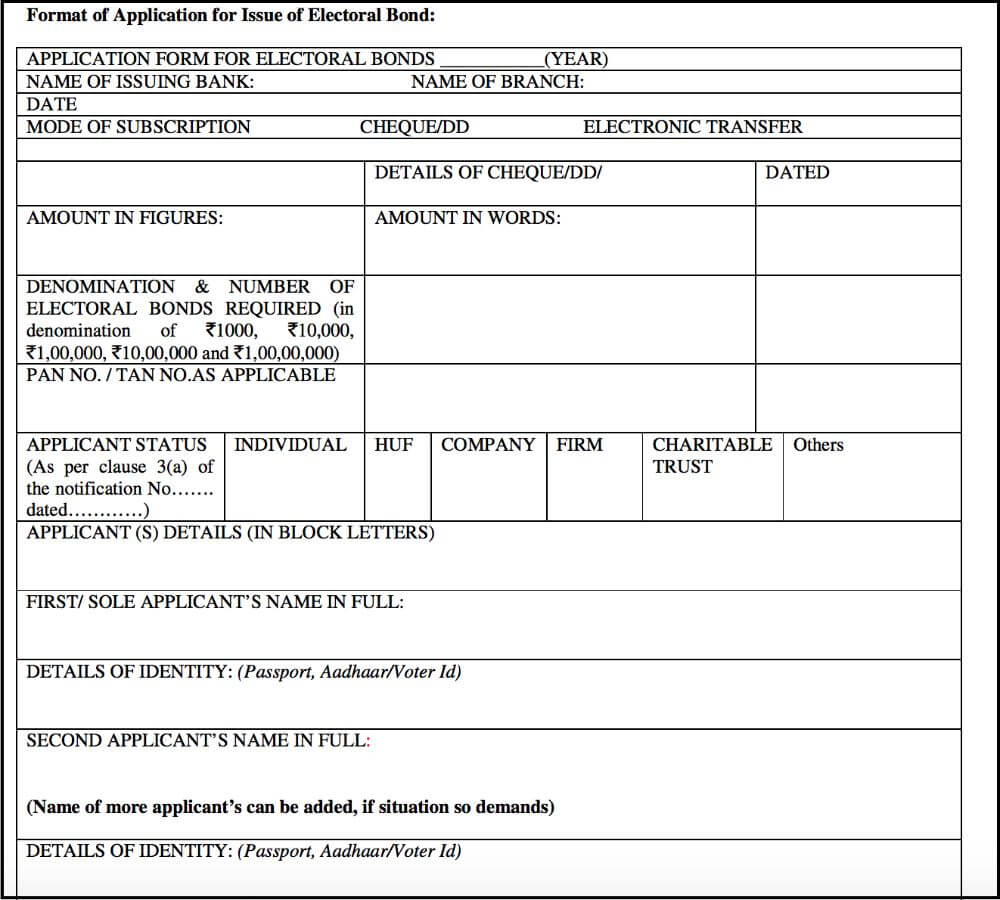

- The buyer has to apply in a physical form or through online application in the following format at the designated branches of SBI.

- Every application should contain particulars as per the format and has to be accompanied with the specified documents required for KYC.

- On receipt of an application, the relevant bond issuing branch will issue the bond for the requested value if all the requirements are fulfilled.

- The information furnished by the buyer shall be treated confidential by the authorised bank and shall not be disclosed to any authority for any purposes, except when demanded by a competent court or upon registration of criminal case by any law enforcement agency.

- The application has to meet the relevant KYC norms. A non-KYC compliant application will be rejected. The bond is issued to the buyer on non-refundable basis and no interest is payable on these bonds.

- All payments for the purchase of the bond have to be made through demand draft or cheque or through Electronic Clearing System or direct debit to the buyer’s account.

Will the bond amount be exempted from Income Tax?

The contribution made by an individual/company through an electoral bond will be exempt from income tax as per Sections 80GGC/80GGB of the Income Tax act. Further, the contribution received by any eligible political party in the form of electoral bonds will be exempt from income tax as per Section 13A of the Income Tax act.

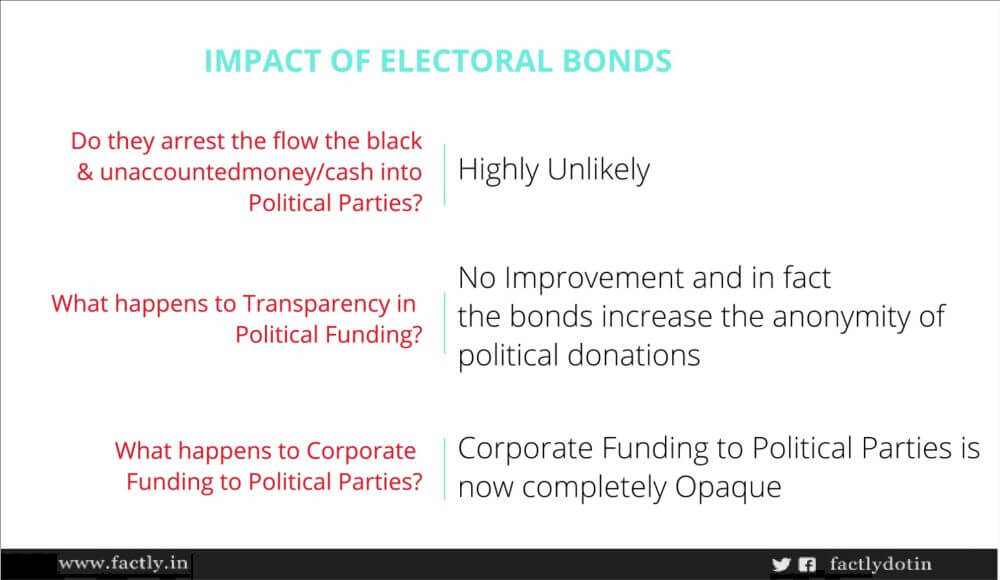

Do these bonds arrest the flow the black & unaccounted money/cash into Political Parties?

There is no doubt that these bonds have to be bought through the banking system and after fulfilling the relevant KYC norms. In that sense, the bonds cannot be bought through cash or unaccounted money.

But even after the recent amendments, donations below Rs 2,000 can still be received in cash. Hence political parties could just make more receipts for higher cash donations to break them up into donations of less than Rs 2,000 so that there is no trail of the donor.

In essence, the flow of unaccounted cash/black money into the political parties is unlikely to stop because of electoral bonds.

What happens to Transparency in Political Funding?

Political Parties are not required to disclose the name of the person/entity donating to a party through electoral bonds. Since the bonds are bearer instruments and have to be physically given to the political parties for them to encash, parties will know who is donating to them. It is only the general citizens that will not know who is donating to which party.

Hence Transparency in political funding will not be enhanced because of electoral bonds. In fact, the bonds increase the anonymity of political donations.

What happens to Corporate Funding to Political Parties?

The recent amendment to the companies act removed the ceiling of 7.5% net profit that can be donated to political parties. Companies are now free to donate their entire net profit to political parties. Further, the entire donation could be in the form of electoral bonds.

Not just that, the requirement to disclose in the profit & loss account, the name of the political party to which a donation has been made is also removed. Only the total amount of donations to political parties has to be disclosed without the name of the political party.

Hence, Corporate Funding to Political Parties is now completely Opaque

The net impact of electoral bonds is decreased transparency of political funding & greater anonymity with no guarantee of arresting the flow of unaccounted money.

1 Comment

Pingback: Understanding ‘Electoral Bonds’ – Tune IN’23