[orc]In 2009, the Central Government launched a scheme to provide interest subsidy on educational loans taken by students from scheduled banks. Data of the last 6 years suggests that Tamil Nadu & Kerala alone account for more than 60% of the beneficiaries and close to 50% of the total amount claimed under this scheme.

The Central Government in the year 2009, launched a Scheme to provide Interest Subsidy on educational loans taken by students from economically weaker sections from scheduled banks under the Educational Loan Scheme of the Indian Banks’ Association (IBA), to pursue technical and professional education studies in India. The scheme would be applicable to students pursuing any of the approved courses of studies in technical and professional streams, from recognised institutions in the country.

How does the scheme work?

The central government would pay full interest subsidy during the moratorium period on educational loans for students belonging to economically weaker sections (with parental family income from all sources of less than 4.5 lakh annually). The interest subsidy under the Scheme shall be available to the eligible students only once either at the undergraduate or the post graduate level. The moratorium period as defined by the IBA is course Period plus one year or six months after getting job, whichever is earlier. Canara Bank has been designated as the nodal bank for this scheme. Students interested in availing the benefit under this scheme have to approach their respective bank and make an application.

Similar Schemes of other departments

There are similar schemes from other departments aimed at specific beneficiaries. The National Minorities Development and Finance Corporation (NMDFC), The National Safai Karamcharis Finance and Development Corporation (NSKFDC), National Backward Classes Finance and Development Corporation (NBCFDC), National Scheduled Castes Finance and Development Corporation (NSCFDC), and the National Handicapped Finance and Development Corporation (NHFDC) also provide educational loans to specific target beneficiaries. The interest subsidy is also applicable for these schemes. The interest subsidy is paid by the government to these corporations directly.

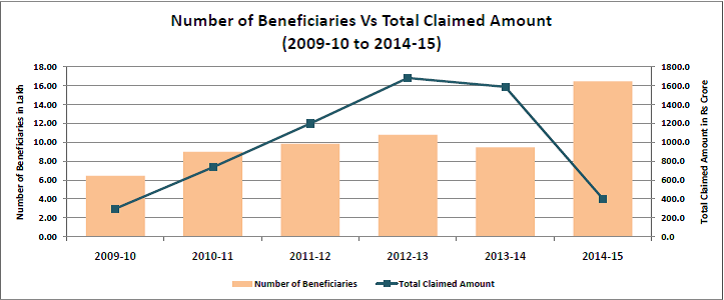

While beneficiaries increased, claim amount dropped in 2014-15

When the scheme was initially formulated, it was estimated that 2 lakh students will benefit each year through an average loan size of Rs.1.5 lakh per year. But the actual number of beneficiaries is five times the estimated number with more than 60 lakh students taking benefit of the scheme in the 6 year period from 2009-10 to 2014-15. In the inaugural year of 2009-10, the number of beneficiaries was 6.44 lakh. This increased continuously till 2012-13 when it reached 10.78 lakh. The number of beneficiaries went down in 2013-14 to 9.47 lakh, but increased substantially by over 70% in 2014-15. The number of beneficiaries under this scheme was the highest in 2014-15 at 16.45 lakh.

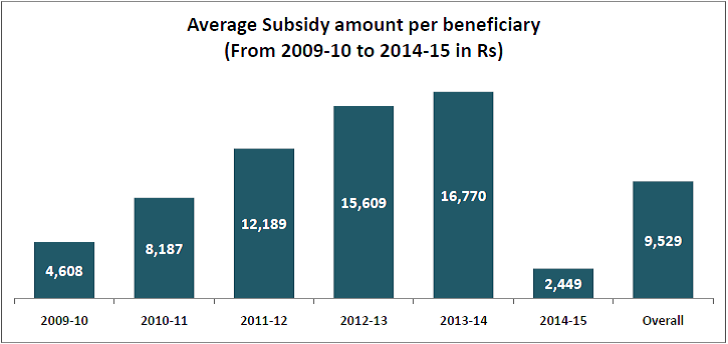

Surprisingly, while the claim amount followed a similar pattern till 2013-14, it dropped substantially in 2014-15. The claim amount in 2009-10 was Rs 296.9 crore and increased to Rs 1681.9 crore in 2012-13. The claim amount in 2013-14 was Rs 1587.7 crore. The total claim amount decreased by 75% in 2014-15 to Rs 402.9 crore. This was accompanied by more than 70% increase in the number of beneficiaries. This anomaly resulted in the average subsidy per beneficiary being the lowest in 2014-15. The overall average subsidy amount per beneficiary was Rs 9529 for this 6 year period. This was just Rs 2449 in 2014-15.

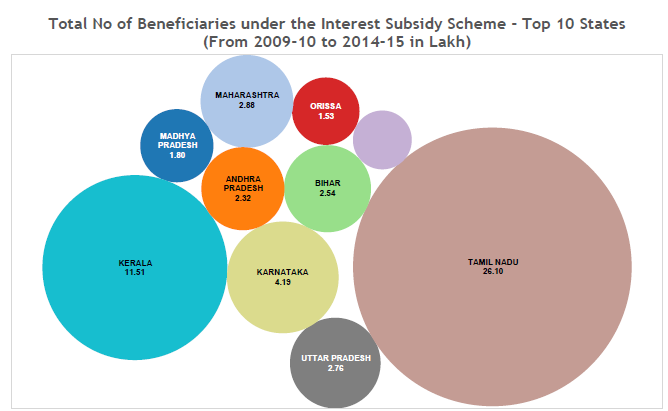

More than 60% of the beneficiaries from just 2 states (Tamil Nadu & Kerala)

Strange as it may sound, more than 60% of the 62 lakh beneficiaries in these 6 years were from the two states of Tamil Nadu and Kerala. Tamil Nadu accounted for 26.1 lakh beneficiaries (42%) while Kerala accounted for 11.5 lakh beneficiaries (19%). The other states in the top 10 include Karnataka (4.19 lakh), Maharashtra (2.88 lakh), Uttar Pradesh (2.76 lakh) etc. The top 10 states account for more than 90% of all the beneficiaries. Only the top 10 states have more than lakh beneficiaries each.

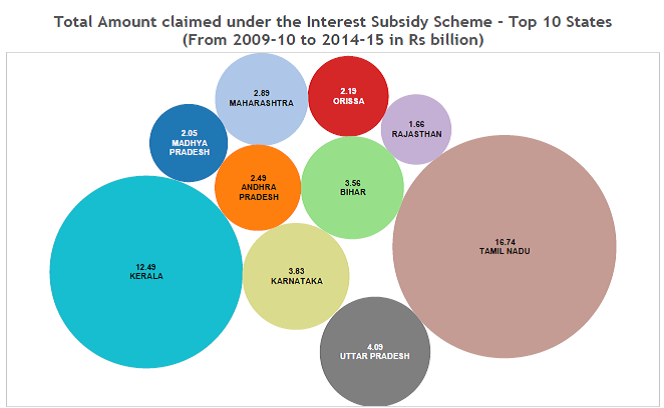

Tamil Nadu & Kerala account for 50% of the total claim amount

Out of the Rs 59 billion in total claim amount in the 6 years, Tamil Nadu (16.74 billion) and Kerala (12.49 billion) accounted for close to 50% of the total claim amount. The top 10 states again accounted for close to 90% of the total claim amount.

What explains this anomaly?

Though Tamil Nadu & Kerala have a large number of institutions offering professional education, this kind of skewed ratio is rather strange. If presence of such institutions is the reason, then the neighbouring Andhra Pradesh & Karnataka should be on par with Tamil Nadu & Kerala in both the number of beneficiaries and claim amount. Is this anomaly due to greater awareness among student population in those states Or Is there something more than that meets the eye?

1 Comment

Hi there,

Great information sir.

I just want to know that can we still have the benefit of this scheme, if we availed an education loan in the year 2009.

Kindly answer this, as it is much important to me.

Thanks and appreciation in advance.