[orc]As per the FRBM act, the fiscal deficit of the state governments is supposed to be less than 3% of the GSDP of the states. Is the fiscal deficit of the state governments under control? How are states financing the fiscal deficit? Here is an explainer.

India constitution declares India to be a ‘Union of States’, with the states having certain powers in respect to executive, legislative and financial matters. Chapter I of Part XII of Indian Constitution lays down the laws regarding Financial matters of the Union of States. Various articles provide for a certain degree of autonomy to the states to deal with its financial matters.

For e.g., Article 282 provides for financial autonomy in spending the resources available to the states for public purpose.

The Central government’s decisions have a significant bearing on the economy of the country, through its policies, taxation rules, spending etc. Similarly, even the state governments have an influence on the state economy through state level taxation, favourable policies for economic growth etc. which in turn has an impact on the national economy.

Factly had earlier published an article about India’s Fiscal deficit. In this story we look into the fiscal deficit of Indian States.

Lesser Fiscal Deficit estimated for 2019-20 for states compared to previous year

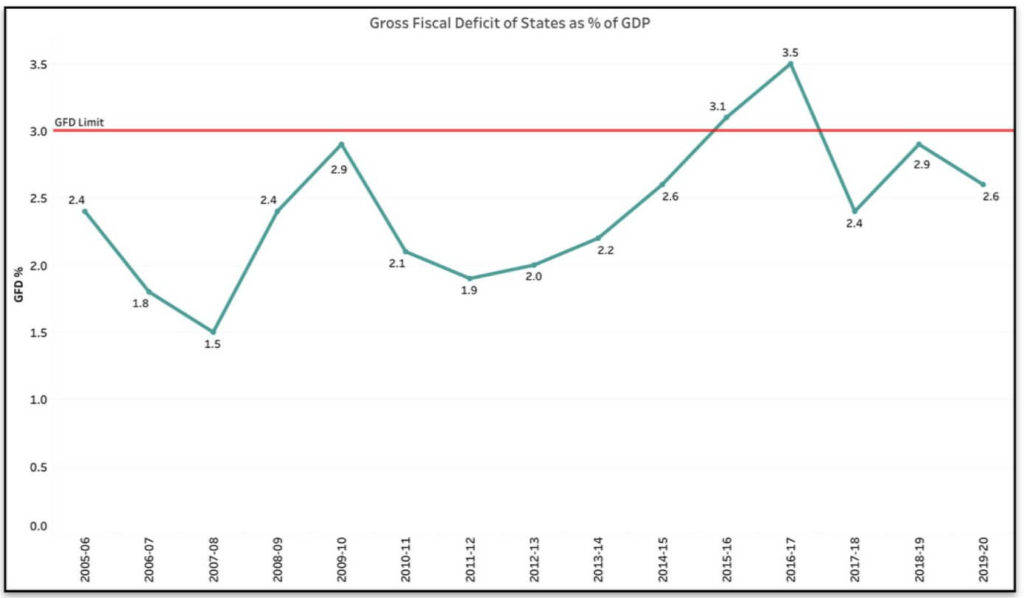

As per ‘State Finances A Study of Budgets of 2019-20 Report’, released by RBI recently, the budget estimates forecast the fiscal deficit of the states at ₹ 5.52 lakh crores for the year 2019-20. This constitutes 2.6% of the GDP.

The Budget estimate for fiscal deficit of states in 2018-19 was ₹ 4.90 lakh crores which was 2.4% of GDP. However, the fiscal deficit estimate for 2018-19 was revised to ₹ 5.55 lakh crores which is 2.9% of GDP.

One of the targets set as part of the Fiscal Responsibility and Budget Management Act, 2003 was to limit the Fiscal Deficit to 3% of GDP. Over the past 15 years, with the exception of 2015-16 & 2016-17, the Gross Fiscal Deficit (GFD) of the states remained at less than 3% of the GDP.

In 2015-16 the GFD was 3.1% which increased to 3.5% in 2016-17. It however fell to 2.4% as per the actuals for 2017-18.

The performance in respect to GFD not consistent across the states

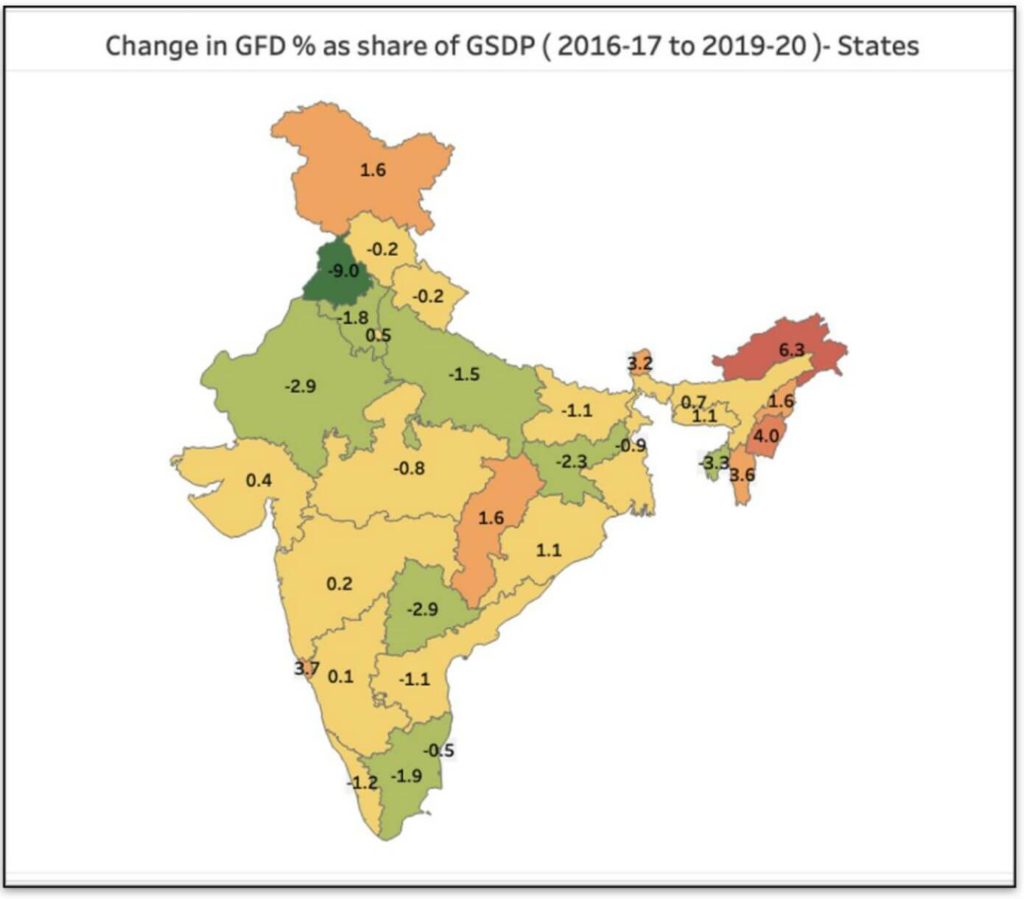

Over the four year period, the performance of each state in respect to GFD as share of GSDP ( Gross State Domestic Product) has been varied.

Punjab which reported a GFD of 12.4% of GSDP in 2016-17 was able to cut down GFD to 2.6% in the next year. The revised estimate for 2018-19 puts the fiscal deficit at 3.4% and the budget estimate for 2019-20 puts it at 3.4% of GSDP in the case of Punjab.

On the other hand, Arunachal Pradesh which reported a surplus in 2016-17 (-4.3% of GSDP) has estimated the GFD for 2019-20 at 2% of GSDP.

- Telangana, Rajasthan, Jharkhand and Tamil Nadu among states which have reduced their GFD over 4 years.

Apart from Punjab, there are other states which have managed to reduce their GFD as share of GSDP since 2016-17. Tripura had a GFD share of 6.1% which was gradually reduced, to an estimate of 2.8% for 2019-20. The revised estimate for 2018-19 is 2.1% of GSDP.

Among the larger states, Telangana showed consistent improvement where in the GFD which was 5.3% in 2016-17 is estimated to be only 2.4% for 2019-20.

Rajasthan which had a high GFD share of 6.1% of GSDP in 2016-17 is now projected at 3.2% for 2019-20. It has managed to achieve a GFD of 3% in 2017-18.

- J&K, Assam , Odisha & Chhattisgarh among the larger states with significant increase in GFD.

Apart from Arunachal Pradesh, which reported a surplus in 2016-17 and then is currently estimated to have a deficit, Sikkim and Mizoram are the other two states with a similar situation. Both these states had a surplus which was 0.4% and 1.5% of GSDP in 2016-17 are estimated to have GFD of 2.8% and 2.1% respectively in 2019-20.

Among the larger states, Chhattisgarh had an increase in GFD by 1.6% over the 4 years. In 2016-17, the GFD was a low 1.6% of GSDP which as per the estimate for 2019-20 has doubled to 3.2% of GSDP.

Jammu & Kashmir which had a high GFD share of 4.9% has shown variance over the last four years. While it managed to reduce the actual GFD in 2017-18 to 2%, the revised estimates for 2018-19 peg the GFD at 11% and the budget estimate for 2019-20 put it at 6.5%. The current situation in the state may only add to this increasing trend.

Odisha and Assam are the other two states whose GFD % is estimated to miss the target of 3% with 3.5% and 3.1% respectively in 2019-20.

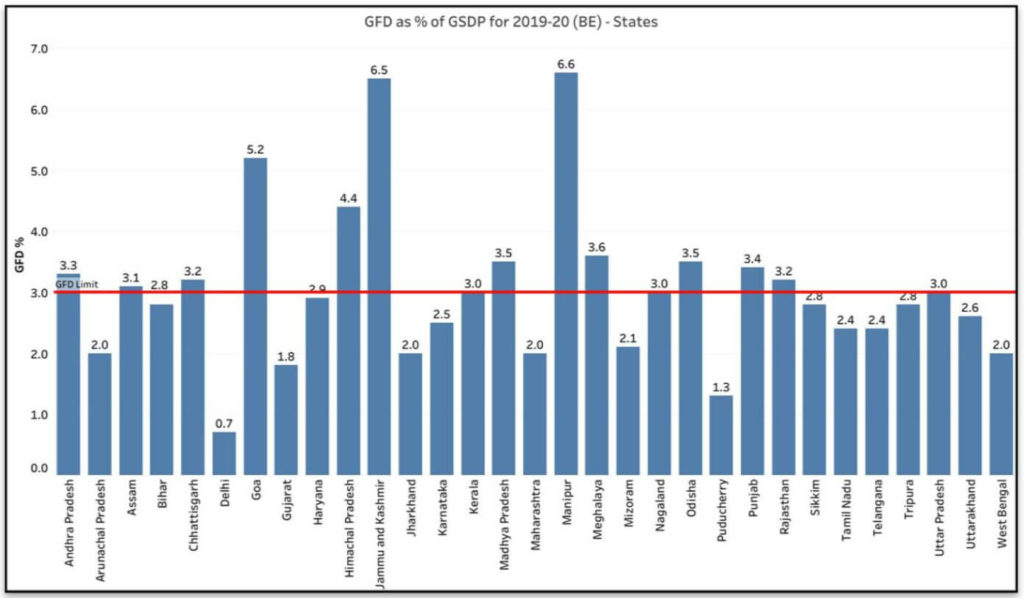

As per the Budget Estimates for 2019-20, 12 states are estimated to cross the FRBM mandated GFD limit of 3% of GSDP.

Market borrowings from a major part of financing Gross Fiscal Deficit of the States

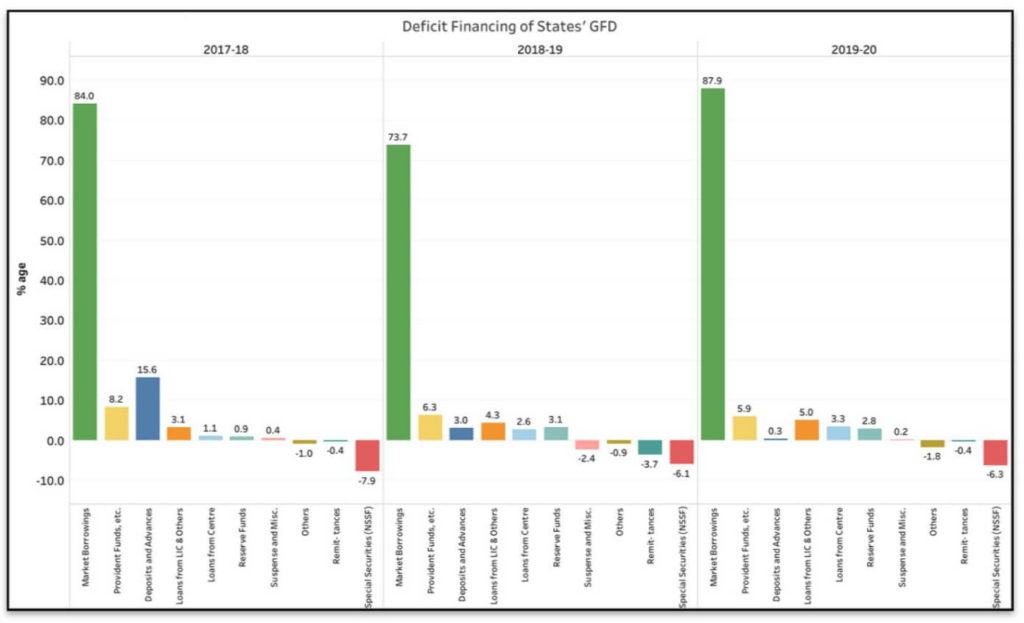

As per the actual accounts for 2017-18, 84% of the states’ GFD is financed through Market borrowings. As per one of the recommendations from 14th Finance Commission Report, most of the state governments have opted out of National Small Savings Fund (NSSF), and have opted for Market borrowings as an option to raise funds for the fiscal deficit.

Deposits and Advances constituted 15.6% of sources in financing GFD for 2017-18, followed by Provident Funds at 8.2%. These are average shares for all the states and the sources through which each of the individual states finance their fiscal deficit varied in 2017-18.

Loans from LIC, NABARD, NCDC, SBI and other banks constituted 3.1% of deficit financing. The loans from Centre constituted only 1.1% of the state deficit financing.

As per the revised estimates for 2018-19, the share of Market Borrowings is estimated to be reduced to 73.7%, followed by provident funds which is estimated to account for 6.3% of deficit financing. Loans from LIC, NABARD, NCDC, SBI and other banks are estimated to account for 4.3%. Deposits and Advances which was the second highest source for 2017-18, is estimated to have only 3% share of deficit financing.

However, as per the Budget estimates for 2019-20, 87.9% of the deficit financing is estimated to be from Market Borrowings. Meanwhile, the loans from Centre are estimated to constitute 3.3% of the deficit financing.

While GFD is moving towards the set target, rise in market borrowings is a concern

The GFD of the states for 2019-20 is estimated to be within the 3% of GDP limit recommended by Fiscal Responsibility and Financial Management Act, 2003. The RBI report on Fiscal Position of State Government observes that this deficit financing is done to a large extent through market borrowings. As per the report, market borrowings financed 52.8% of the fiscal deficit of the states in 2001 which has over the past few years has rapidly increased to around 88% as per the budget estimates of 2019-20. States with GFD equal to or less than 3% are almost entirely financing their fiscal deficit through market borrowings.

A look at the expenditure of states, would reveal that major portion is non-capital expenditure. Such expenditure is not productive for the economy as it is not an investment for the future. Borrowings from the market to financé such fiscal deficit would not augur well for the economy in the longer run.

So, while the efforts by the states to reduce the fiscal deficit are appreciable, finding more reliable and less burdensome sources to finance the expenditure and identifying ways to reduce the non-capital expenditure would be a prudent way to reduce fiscal deficit of the states.

1 Comment

Pingback: Explainer: Is Fiscal Deficit of State Governments under control? - Fact Checking Tools | Factbase.us