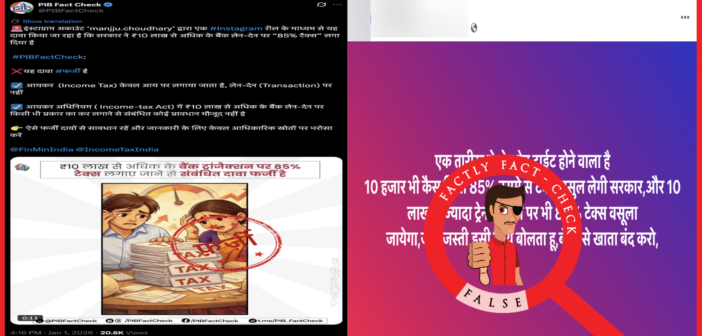

A post claiming that the Indian government will impose an 85% tax on transactions over ₹10 lakhs is being circulated on social media. Let’s verify the claim made in the post.

Claim: The Indian government will collect 85% tax on transactions over ₹10 lakhs from 1 January 2026.

Fact: No official notification or announcement was issued by the Income Tax Department about imposing or collecting tax on bank transactions. PIB Fact check also clarified this by stating that the viral claim is False and that “Income Tax is levied only on income, not on transactions. There is no provision in the Income-tax Act related to imposing any kind of tax on bank transactions exceeding ₹10 lakh.” Hence, the claim made in the post is FALSE.

On conducting a relevant keyword search related to the viral claim, we found no official notification or announcement from the Income Tax Department about imposing or collecting tax on bank transactions.

Income tax is levied on income earned, not on the transaction of money. The word “Income” is defined under Section 2(24) of the Income-tax Act, 1961, and it includes receipts such as salary, profits and gains from business or profession, dividends, capital gains, interest, and other specified earnings. Therefore, ordinary banking activities, such as depositing money, withdrawing cash, or transferring funds between accounts, do not automatically become taxable income unless they represent income as defined under the Act.

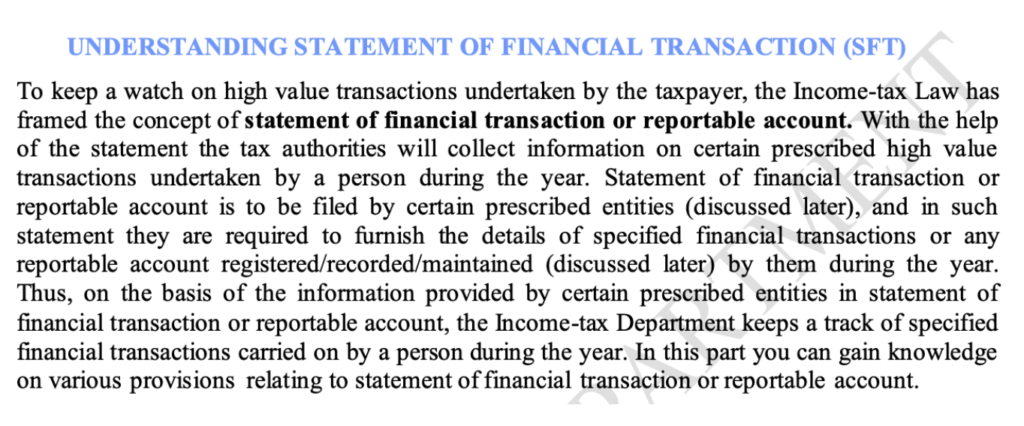

Under Section 285BA of the Income-tax Act 1961, banks and financial institutions are required to report certain high-value transactions, such as high-value cash deposits in a financial year, large credit card payments, big mutual fund investments, and high-value property deals, to the Income Tax Department through a Statement of Financial Transactions (SFT). These reports are for monitoring purposes and help the tax authorities check whether these transactions are in line with the income declared by a person. No tax is automatically charged on such transactions.

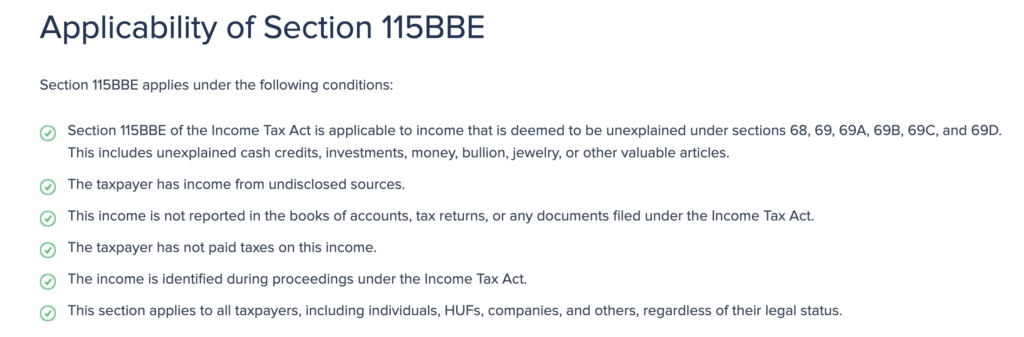

However, under Section 115BBE, if the Income Tax Department finds money or income for which a person cannot give a valid explanation or source, it is taxed at a very high rate if it remains as unexplained income. This applies only to cases such as unaccounted cash or credits with no proper source. The main purpose of introducing this provision was to curb black money and tax evasion.

PIB Fact check also clarified this by stating that the viral claim is False and that “Income Tax is levied only on income, not on transactions. There is no provision in the Income-tax Act related to imposing any kind of tax on bank transactions exceeding ₹10 lakh.”

To sum up, the Indian government will not impose 85% tax on transactions over ₹10 lakhs.