Incidents of harassment leading to suicide of customers who availed loans from digital lending platforms have come to light in Telangana & other states. In this age of digitization, what all should customers be aware of while taking loans from digital lending platforms? Here is a detailed explainer.

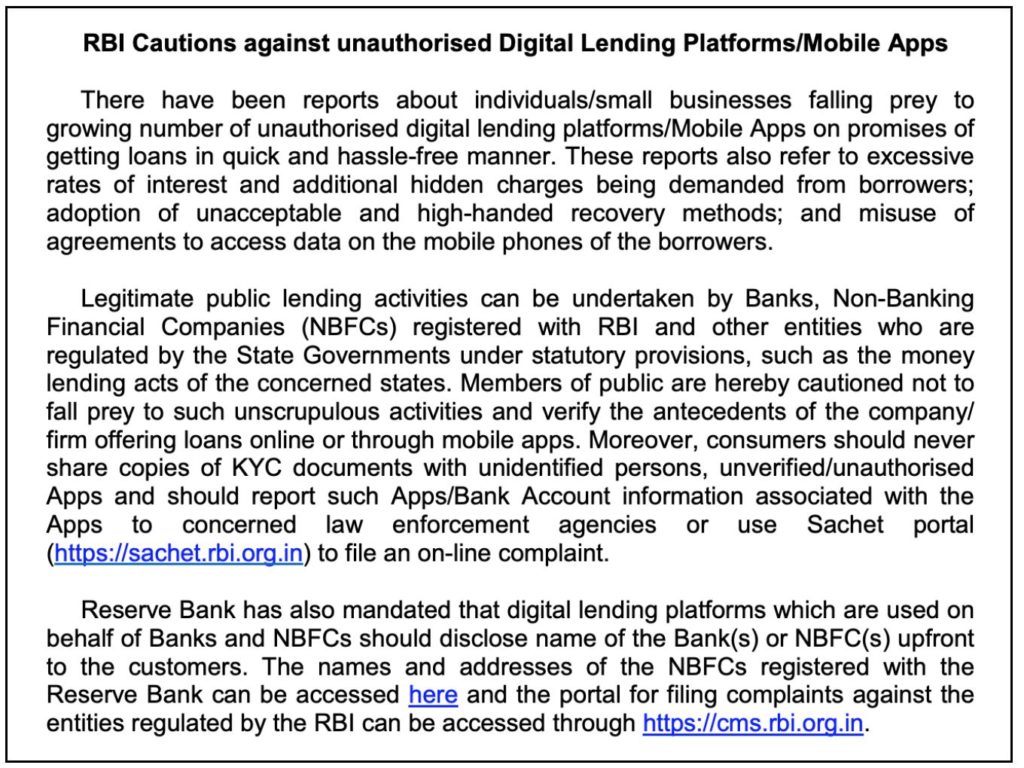

Taking note of multiple reports about individuals and small businesses falling prey to the increasing number of unauthorized digital lending platforms and mobile applications, the Reserve Bank of India (RBI) has cautioned the members of the public not to fall prey to such platforms. The RBI advised the public to verify the antecedents of the company or firm that is offering loans online or through mobile applications. The caution comes at a time when there have been incidents of suicide being reported from Telangana following harassment by such digital moneylenders over repayment. The state’s police department has launched a crackdown on call centers and loan app offices.

What is digital lending?

The practice of lending money through digital platforms such as mobile applications is known as digital lending. The entire process involved right from applying for a loan and its disbursement takes place through digital platforms. Digital lending is an emerging service and gained momentum during the lockdown because of easy access using smartphones without having to physically go to banks or other moneylenders.

The process of availing of loans is quick through mobile applications. One may be asked to fill out a form and upload certain documents and upon completion & verification, the persons have approved the loan in just a few minutes. There are multiple advantages for digital lending such as saving time, reduction in overhead costs, minimal paperwork, convenience, and financial inclusion. Those who cannot avail of loans in banks can avail through such online platforms. Such ease of access is what attracts customers. However, there are many loopholes & problems with these platforms which have been exploited by unscrupulous elements.

Online money lending applications may exploit customers

Online applications may have hidden charges and charge exorbitant rates of interest. While installing such applications, the user may give consent for the application to access their personal data which puts the customer’s data at risk. The possibility of data misuse also cannot be ruled out. Since digital lending platforms are gaining popularity, the number of unauthorized digital lending platforms and mobile applications are growing by the day increasing the scope of misuse & fraud. Going by the issues found by the Police in Telangana, such lending platforms also harass the customers over repayment.

RBI has issued notification for digital lending platforms earlier

Both banks and NBFCs are engaged in digital platforms for providing loans to customers. Some NBFCs are also registered with the RBI as ‘digital-only’ lending entities whereas some have registered themselves to work both on digital as well as brick-mortar channels (physical presence) of credit delivery. Both banks and NBFCs may lend money directly through their own digital platforms or may do so by outsourcing to other such platforms.

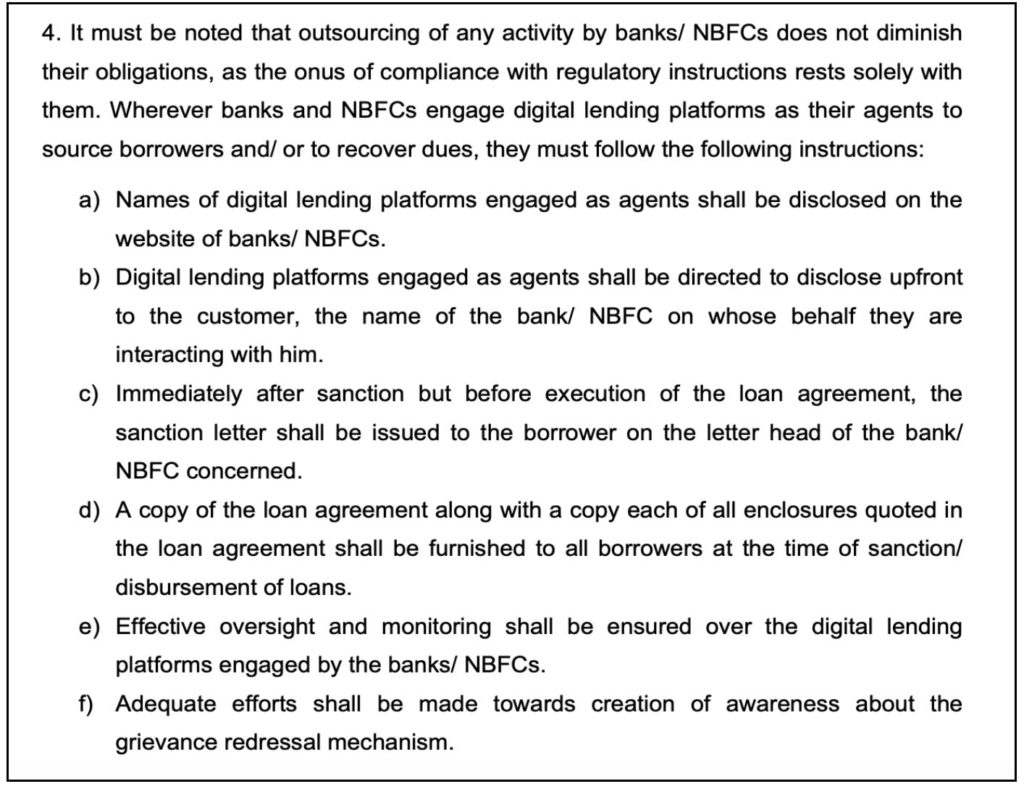

Earlier, in June 2020, the RBI, observing that lending platforms tend to portray themselves as lenders without disclosing the name of the bank or NBFC at the back end, issued the fair practices code and outsourcing guidelines. The RBI felt that such behaviour by the digital platforms prevents customers from accessing the grievance redressal mechanism which is available under the regulatory framework. The RBI urged banks and NBFCs to adhere to fair practices and outsourcing guidelines in loans sourced through the digital lending platforms. The RBI issued the following instructions to be followed by banks & NBFCs when they engage digital lending platforms.

- Names of digital lending platforms engaged as agents should be disclosed on the website of banks/ NBFCs.

- Digital lending platforms engaged as agents shall be directed to disclose upfront to the customer, the name of the bank/ NBFC on whose behalf they are interacting with him.

- Immediately after sanction but before the execution of the loan agreement, the sanction letter shall be issued to the borrower on the letterhead of the bank/ NBFC actually issuing the loan.

- A copy of the loan agreement along with a copy of each of all enclosures quoted in the loan agreement shall be furnished to all borrowers at the time of sanction/ disbursement of loans.

- Effective oversight and monitoring shall be ensured over the digital lending platforms engaged by the banks/ NBFCs.

- Adequate efforts shall be made towards the creation of awareness about the grievance redressal mechanism

Banks, NBFCs, and other entities registered with RBI or State level authority can provide loans digitally

As per the latest RBI press release in December 2020 with respect to digital lending platforms, only banks and NBFCs registered with the central bank, and other entities that are regulated by State Governments under the legal statutes in the state such as money-lending acts, can undertake legitimate public lending activities. The bank has advised the public to verify the antecedents of the company or firm that is offering loans through digital platforms. There are several digital lending applications that are not authorized by financial regulators to which people may fall prey to. Since these are unauthorized, it will be difficult for the central banks to monitor such lending applications. The public can access the list of scheduled commercial banks & NBFCs registered with the RBI from the RBI website. Details of names and addresses of the NBFCs are available which may be used by the public to cross-check the authenticity of NBFCs lending money through digital platforms. To file complaints against the entities that are regulated by the RBI, one can use the RBI’s compliant management system website.

Customers to report unauthorized applications to the RBI

The RBI has also advised consumers not to share copies of KYC documents with unidentified persons and unverified/unauthorized applications. In case people come across such applications, the details of the application and bank account information associated with the application should be reported to the concerned law enforcement authority. One also has the option to report it online by filing a complaint online through the SACHET portal.

DLAI has also given pointers to identify unreliable applications

Following RBI’s caution notice, the Digital Lenders Association of India, which is an industry body of ‘Digital Lenders’ has also issued the following checklist to identify unorganized and unreliable apps.

- Minimal or no KYC– If the loan is offered without a background check, the application can be shady

- The noticeably short tenure of the loan- Loan offered for less than 30 days is to exploit a customer’s urgent need for money

- The loan agreement is not signed with an RBI registered entity- One must look out for loan agreement parties for the RBI registration of the entity.

- Upfront procedure fees- The procedure fees should not be deducted from the disbursal amount

- Repayment mechanism– There should be an option of digital re-payment.

- Late fees details and structure- Customer should look out for interest rate and other hidden charges

- Income verification of customer not stringent- The verification of income details must be looked into by the application to see if the customer is capable of repayment. Or else, it can be a trap.

Customers have to be watchful

Online lending platforms are commonplace in this age of digitalization and hence cannot be banned. But the experience of the last few years shows that there has to be a legal code of conduct that emphasizes on transparency and consumer protection while using online platforms for availing loans. Customers must be made aware of the things to check & possible traps while using such platforms. One main reason behind people turning to such platforms for loans is because of the inability of the banks to address the needs of borrowers. Addressing such needs to extend credit to even those in the informal sector will go a long way in preventing these frauds.

At the same time, customers also should be watchful while using such platforms. Here are three things one must keep a note of while using such platforms.

- Identity of the Platform: Always find out whether the digital lending platform is a bank or a registered NBFC or an entity partnering with banks or NBFCs.

- Demand the sanction letter with the right logo: Always demand the loan sanction letter on the letterhead of the bank/NBFC actually issuing the loan.

- File a Complaint with the RBI: If you find out that the digital lending platform is dubious, file a complaint with the RBI on the SACHET portal. If you have complaints about a platform that is registered with the RBI, file a complaint on the RBI CMS.

Featured Image: Digital Lending Platform