Capital Market, Real Estate & Commodities are treated as sensitive sectors because of the inherent risks in fluctuation in prices. Data from the RBI indicates that the share of advances to these sectors of the overall credit has increased from 18.5% in 2014-15 to around 24% by the end of 2019-20. At the same time, share of private sector bank credit to these sectors increased over the last few years at the expense of public sector banks.

On 29 December 2020, the Reserve Bank of India (RBI) released its annual publication “Statistical Tables relating to Banks in India: 2019-20”, which offers insights into the activities of Scheduled Commercial Banks (SCBs).

Among the information published in this report is the data relating to liabilities & assets, income & expenses, advances, etc. relating to the banks. One such key information provided is the information about ‘Exposure to Sensitive Sectors” i.e., the credit extended by Scheduled Commercial Banks to sensitive sectors.

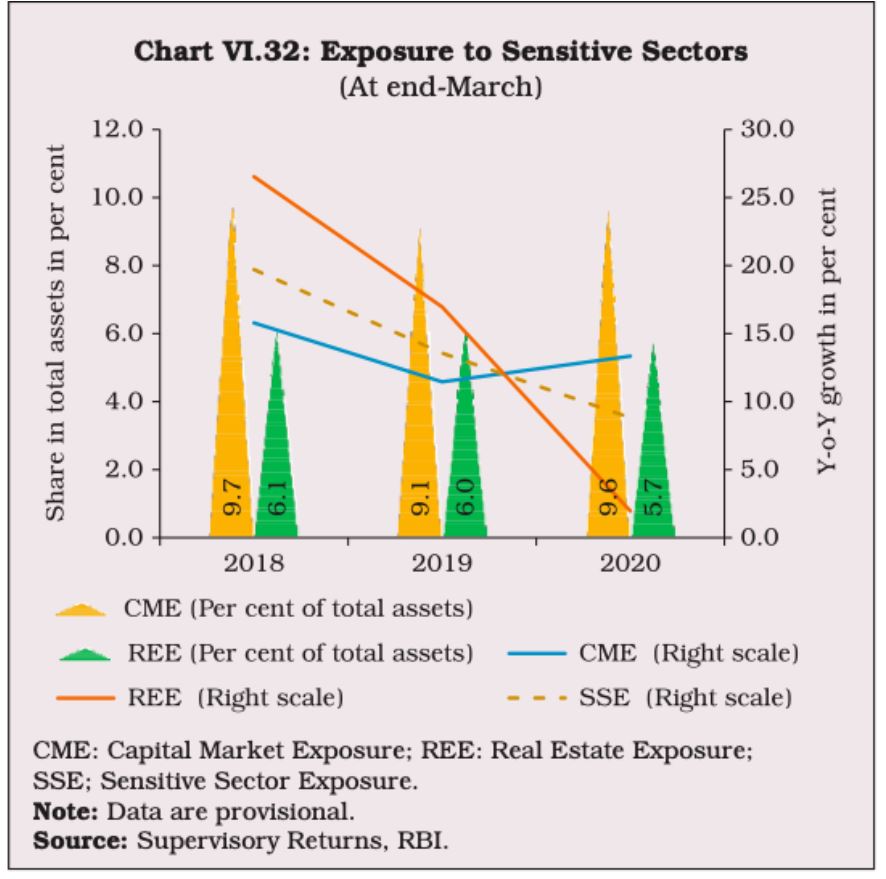

The RBI categorizes three sectors as Sensitive sectors – ‘Capital Market”, “Real Estate” & “Commodities’”. As per the “ Report on Trend & Progress of Banking in India 2019-20”, it is noted that Banks’ exposure to the Capital Market & Real Estate is considered as sensitive in view of the inherent risks in fluctuation in prices.

The report further states that the lending to these sectors has decreased, especially by the PSBs (Public Sector banks) as a precautionary measure due to excess leveraging of the corporates. The report highlights that there was a steep fall in credit extended to real estate in 2019-20, while there is an increase in the credit exposure in Capital Market.

This report was released prior to the COVID-19 pandemic hit India and hence its impact on credit exposure to sensitive sectors was not visible. Its impact for 2020-21 will only be known later in the year.

In this story, however, we take a look at the trends in credit exposure over the past few years based on RBI’s “Statistical Tables relating to Banks in India: 2019-20”.

Increase in the volume of advances extended to Sensitive Sector though growth rate declines

A review of the data since 2005 (as of 31st March of the year), indicates that there has been a consistent year-on-year (YoY) increase in the volume of the advances extended to the sensitive sectors. As per this data, the advance extended for 2019-20 was around 15 times that of the amount in 2004-05. However, the rate of growth has not been even and there have been variances in the margin of growth, with few years recording lower growth than the previous year. As of 31 March 2020, the total advances extended to sensitive sectors was Rs. 24.67 lakh crores i.e., an 8.3 % increase from the previous year. In the previous two years, the growth rate was 12.7% (2018-19) & 14.2% (2017-18).

These vagaries are influenced by different rends observed in the three sectors, especially that of Capital markets & Real Estates.

The more recent trends over the two years show a decline in the growth rate. The decline in the growth rate is majorly influenced by the decline in advances to the Capital Market Sector, in 2019-20, which was less than the amount by the end of 2018-19. A YoY decline in the volume of advances extended to the Capital market Sector was also seen in 2011-12.

However, the volume of advances to the Real Estate sector is much higher than the Capital market, and thereby the increase in advances to this sector has a greater influence on the overall advance to sensitive sectors.

Advances to Capital Market Sector by Public Sector Banks have declined

The overall lending to the Capital Market Sector fell during 2019-20 compared to the previous year. This is mainly due to the decline in the advances made by public sector banks. In fact, the credit advances by public sector banks over the past two years have been on a decline, bucking a trend of Y-o-Y increasing credit to Capital Markets by the PSBs since 2012-13.

On the other hand, private sector banks continue to extend increased advances to this sector in continuation of the trend observed since 2012-13. After overtaking PSBs in the volume of credit advances made to this sector in 2013-14, the private sector banks have consistently provided more credit. However, the growth rate for 2019-20 has been less than earlier and could indicate an early sign of even the private banks reducing their credit advances to Capital Markets.

After an increase during the four-year period from 2015-2019, there is a decline in the credit extended by foreign banks to capital markets in 2019-20.

There is a more than double-digit growth in the credit advances made by small finance banks YoY since these banks started providing credit in 2016-17.

Share of Private Sector banks advances to Real Estate sector is increasing

Advances extended to the real estate sector comprise the major portion of the loan advances made to sensitive sectors. The trends of this sector have a significant bearing on the advances to the entire sensitive sectors.

The volume of the total advances made to the real estate sector has consistently increased YoY. As of 31 March 2020, Rs. 23.34 lakh crores worth of loan advances were provided by all the banks towards this sector compared to Rs. 21.37 lakh crores by the end of 2018-19. Unlike the negative growth in PSB lending seen for Capital markets in 2019-20, the loan advances extended by both the PSBs and private banks have increased consistently YoY since 2004-05.

However, there are variances in the growth trends for public & private sector banks. After recording only around 5% growth rate in 2018-19 compared to 12% earlier, the public sector lending has again seen an increase with around 9% growth.

On the other hand, after a period of impressive growth rates (ranging from 18% -27%) during the period 2012-2019, the growth rate of loan advances to real estate by private banks was only around 10% in 2019-20.

However, all through the period, there is an increase in the share of private-sector lending to the real estate sector at the cost of PSB lending. PSBs still have the major share of total loan advances made to the real estate sector with 55.3% of the advances as of 31 March 2020.

Meanwhile, after a high in 2018-19, the advances by foreign banks to real estate has seen negative growth in 2019-20.

Further, in accordance with the restrictions placed by RBI on advances against the Commodities sector, there have been no loans extended to the Commodities sector since 2010-11.

Share of advances to Sensitivity Sectors increased in the last five years

A comparison between 2018-19 & 2019-20 in terms of the proportion of lending to Sensitive sectors out of the total lending, shows a marginal variation, indicating that the overall growth in lending to sensitive sectors (including sector-wise and bank type-wise) is in proportion to the overall lending trends by these banks.

For 2018-19, lending to sensitive sectors constituted 23.5% of the total lending, while for 2019-20 it is 23.9%, a marginal increase. Bank type-wise comparison between the years also indicates no major change for public & private banks. Meanwhile, there is an increase in the proportion of loans extended by Small Finance Banks.

In 2014-15, loans to sensitive sectors comprised only 18.5% of the total loans extended in that year, indicating an increase in the credit exposure to the sensitivity sector over the past 5 years. An increase in lending is generally identified with an increase in demand for investment in housing & real-estate, which in turn is attributed to improving the financial situation. An increase in the advances to the real estate sector in 2018-19 is attributed to the government’s initiative for affordable housing under PMAY and RBI’s initiative to expand the eligibility of housing loan limits.

On the other end, as the definition of Sensitivity Sector indicates, these sectors are more prone to fluctuations and a decline in the economy could have an adverse effect on the recovery of the credit extended to these sectors. While the decreasing growth rate of PSB lending to these sectors shows prudence and caution, the increase in private sector bank lending to these sectors is a cause for concern.

With the COVID-19 pandemic, it is to be seen if the growth in credit to these sectors remains the same.

Featured Image: Private Sector bank Credit to Sensitive Sectors