A post is being widely shared on social media claiming that the loan of ₹2,212 crores taken by Baba Ramdev’s company Ruchi Soya was waived off. Let’s fact-check the claim made in the post.

Claim: Ramdev baba owned Ruchi soya company’s debt of ₹2,212 crores was waived off.

Fact: According to the RBI report, Ruchi soya’s debt of ₹2,212 crores were technically written off, which means, the lending banks clean up the bad loans from their balance sheet. However, the loan account still stays to continue with the lending bank as they can try to recover it later. Moreover, in December 2017, Ruchi Soya Industries entered the Corporate Insolvency Resolution Process because of its total debt of about ₹12,000 crores. In December 2019, Patanjali Ayurved, co-founded by Baba Ramdev acquired the debt ridden Ruchi Soya for ₹4,350 crores. Hence, the claim made in the post is MISLEADING.

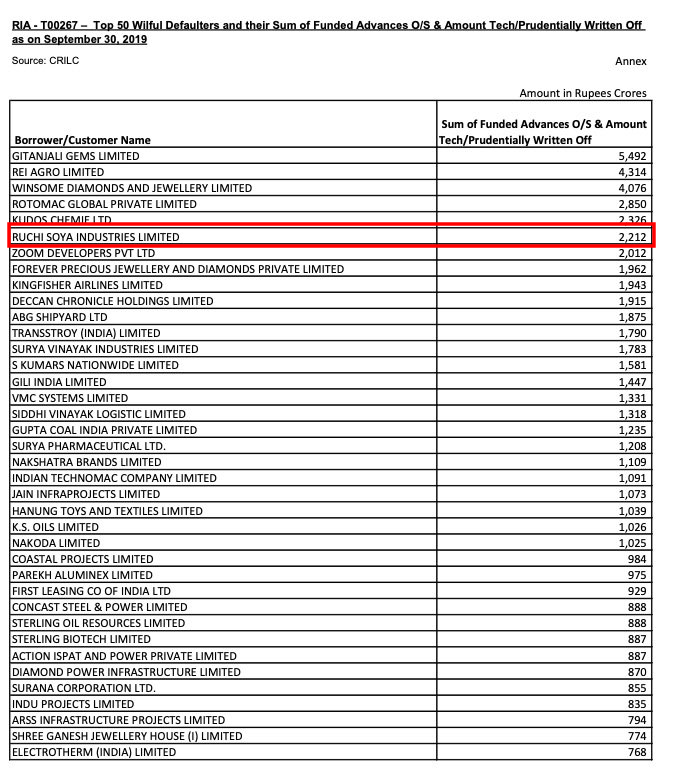

We we searched for the list of the ‘Top 50 Wilful defaulters in India’ and found the details in the Twitter account of Saket Gokhale, a spokesperson for All India Trinamool Congress. He filed an RTI petition on 19 March 2020, seeking the information of ‘Top 50 Wilful defaulters & defaulted amount in Indian banking system as on 16 February 2020’. Upon his query, RBI released the list of wilful defaulters as on 30 September 2019.

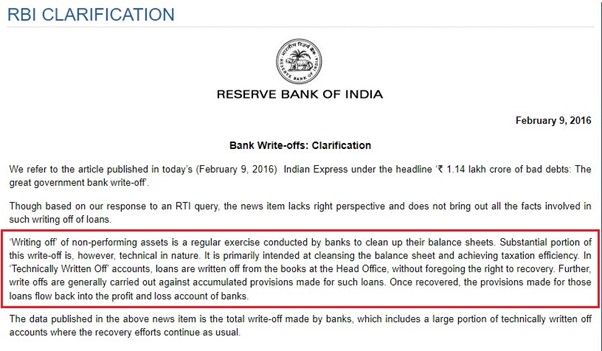

The list shows ‘Ruchi Soya Industries Limited’ whose debt of Rs.2,212 Cr was technically/prudentially written off, which is not same as waived off. As per RBI, write-off just clears the bad loans from the bank balance sheets but these bad accounts still continue to stay in the bank books and the banks try to recover these loans by other means. Writing off a bad loan is not same as waving off.

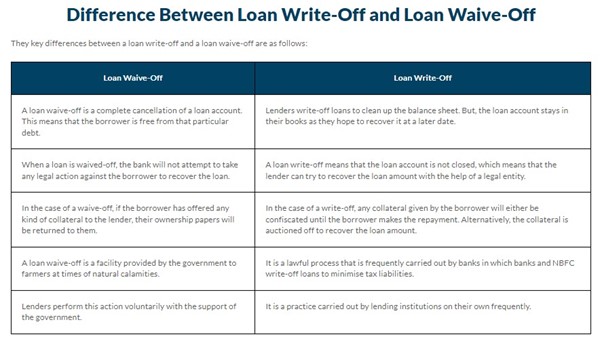

Write-off vs Waive-off:

Writing off a loan is a general practice implemented by banks to clean up their balance sheets. In the case of write-off, the lending banks clean up the bad loans from their balance sheet. However, the loan account still stays to continue with the lending bank as they can try to recover it later. Moreover, if any collateral is attached to the loan, then the lender confiscates them. Whereas, in the case of loan waive-off, the lender completely cancels the loan account, and the borrower is free from the debt. If any collateral is linked to the debt, then it will be returned to the borrower.

Moreover, in December 2017, Ruchi Soya Industries entered into the Corporate Insolvency Resolution Process because of its total debt of about ₹12,000 crores. In December 2019, Patanjali Ayurved, co-founded by Baba Ramdev acquired the debt ridden Ruchi Soya for ₹4,350 crores. News reports regarding this can be found here, here and here.

Hence, it is evident that Ruchi soya’s debt was written off even before its acquisition by Patanjali Ayurved.