RBI released the 21st issue of the Financial Stability Report (FSR) in July 2020. The report focusses on the impact of COVID-19 on macroeconomic environment, financial institutions etc. The report predicts that the GNPA may increase and that capital erosion may take place in many banks.

The Financial Stability Report (FSR) is a biannual report published by the Reserve Bank of India (RBI). The report is approved by the sub-committee of Financial Stability and Development Council (FSDC), with inputs from other financial sector regulators such as RBI, SEBI, IRDAI including Ministry of Finance. The objective of the report is to review the nature and magnitude of risks, and their implications which can affect the macroeconomic environment, financial institutions, markets, and infrastructure. In the report, an assessment of the resilience of financial sector is also conducted through stress tests. Recently, the report for July 2020 was released which takes into consideration the disruption caused by COVID-19.

A lot of uncertainties exist in evaluating the outcome since the pandemic continues unabated

Both global and domestic deterioration in macroeconomic and financial environment since the pandemic began in December 2019 has affected the credit demand, asset quality, capital adequacy, and profitability of scheduled commercial banks (SCBs). As the pandemic continues to spread, there is still a lot of uncertainty on its effects because of which the exact outcome cannot be evaluated. According to the RBI’s report, financial markets have stabilized because of the latest policy measures. This story focusses on the performance of Scheduled Commercial Banks (SCBs) as presented in FSR.

COVID-19 halted the improvement in credit demand of banks

Credit demand in SCBs was slightly improving in early 2019-20. However, towards the end of the financial year, the improvement was halted as a result of the pandemic. RBI had announced moratorium on repayment of loan instalments, initially for March, April, and May, and later extended it by another three months. According to the report, around 50% of the customers availed the relief measure, which would have implications on the financial health of commercial banks. The moratorium will end on 31 August 2020 assuming no further extension is made. The FSR mentions that the exact impact of the moratorium on banks is yet to be ascertained.

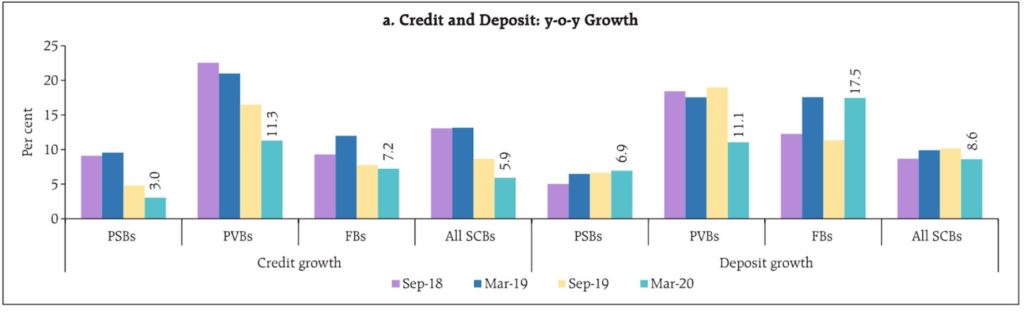

Looking at the performance of SCBs, the already weakened credit growth in the first half of 2019-20, went further down to 5.9% in March 2020 and continued to reduce till early June 2020. The deposit growth also dropped in the latter half of 2019-20. In the initial months of 2020-21, there was an increase in deposit growth because of the precautionary savings behaviour due to the pandemic.

Source: RBI’s Financial Stability Report, July 2020

GNPA ratio of all SCBs had declined in March 2020 as compared to September 2019

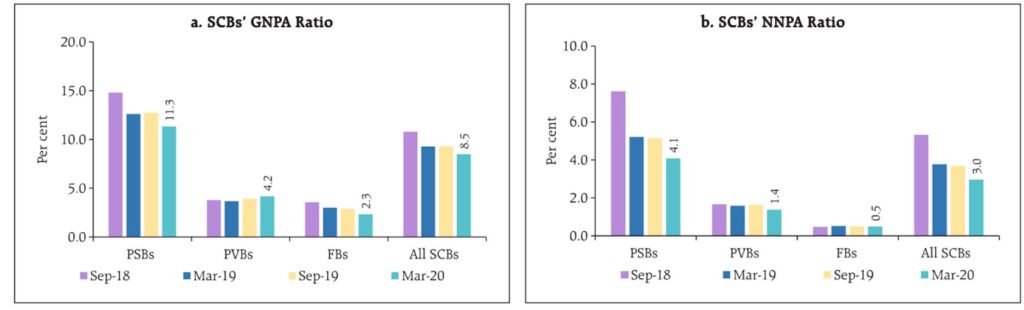

Meanwhile, the Gross Non-Performing Asset (GNPA) ratio of all SCBs which was 9.3% in September 2019 has declined to 8.5% in March 2020. During the same period, the Net NPA dropped from 3.7% to 3%. This indicates that the performance of banks had improved. The Provision Coverage Ratio improved to 65.4% from 61.6% over this period. The capital to risk-weighted assets ratio (CRAR) of SCBs also dropped down to 14.8% in March 2020 from 15% in September 2019.

Source: RBI’s Financial Stability Report, July 2020

Sector wise, it was observed that the quality of bank loans to the service sector had worsened in March 2020. GNPA ratios in the sectors of construction, jewellery, and gems had increased in March 2020 while the sectors of infrastructure, basic metals, and electricity, which have a significant share in the bank credit, recorded a decrease in their GNPA ratio.

The share of large borrowers who accounted for more than 51.3% of the aggregate loan portfolio and 78.3% of GNPAs of SCBs in March 2020, has been declining since March 2018. This means that credit and NPA growth has been occurring among small borrowers.

Soundness, liquidity, and efficiency had dropped in March 2020

Five indices based on the five dimensions of Soundness, Asset Quality, Profitability, Liquidity, and Efficiency, are analysed to assess the impact of underlying conditions and risk factors on the stability of banking sector. SCBs had recorded a decline in the dimensions of soundness, liquidity, and efficiency in March 2020 compared to September 2019, contributing to a decline in stability of the sector, while a marginal improvement in asset quality, and profitability was recorded. The pandemic’s toll on the income loss of banks will be evident only after the first quarter of 2020-21.

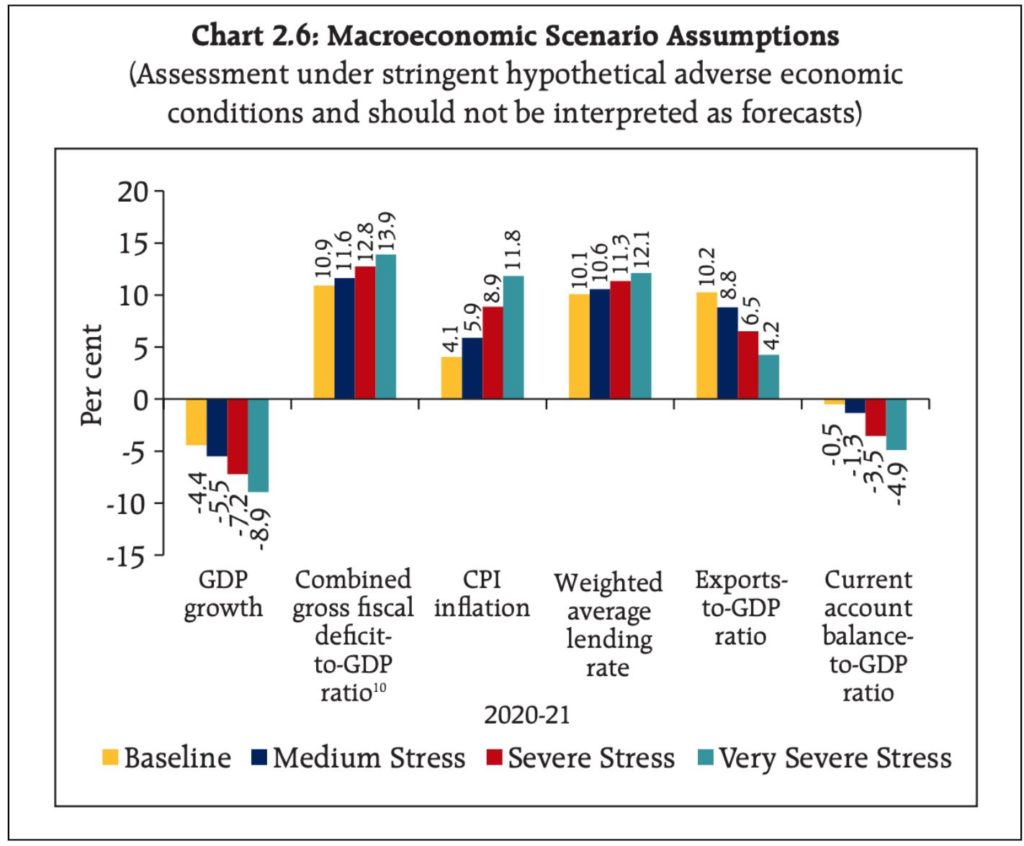

RBI takes into consideration four different plausible scenarios and evaluates a bank’s financial position at these hypothetical conditions which help in decision making within the bank. One is the baseline scenario which is derived from the projected values of macroeconomic variables. The other three adverse scenarios- medium, severe, and very severe, are calculated for worsening macroeconomic indicators as indicated in the chart below.

Source: RBI’s Financial Stability Report, July 2020

GNPA ratio is expected to increase to up to 14.7% in the worst-case scenario

The stress test covering 53 banks revealed that the GNPA ratio of all SCBs may increase from 8.5% in March 2020 to 12.5% by March 2021 under the baseline scenario or the forecasted macroeconomic environment. However, if the environment worsens, in a ‘very severe stressed scenario’, it is expected that the GNPA ratio will escalate to 14.7%. Further, based on the type of bank, GNPA ratio of public sector banks may go up from 11.3% to 15.2% during the same period under the baseline scenario. That is, more loans are in the danger of not being repaid.

Around 20 banks may end up dominating the list of largest capital erosion

The report mentions that capital erosion is anticipated. From 14.6% in March 2020, the CRAR is projected to drop to 13.3% in March 2021 under baseline scenario. It is further expected to drop to 11.8% in the worst-case scenario with five banks failing to meet the minimum capital level. Mergers and recapitalization which will add to resilience have not been considered here. The common equity tier I or CET 1 capital ratio of the banking system might decline from 11.7% in March 2020 to 10.7% under the baseline scenario, and further down to 9.4% under the very severe condition by March 2021. In such situation, 3 banks may not have the minimum CET 1 capital ratio of 5.5% in March 2021. Around 20 banks will find their way to the top in list of banks witnessing large capital erosion with CRAR of less than 7%.

Some industries with higher share of good quality loans, those which have not reported instances of default, such as NBFC’s general purpose loans and housing sector loans, and electricity generation industry loans, were severely affected by the pandemic.

Governor of RBI stated that India’s financial system is sound

In the foreword of the report, RBI Governor Shaktikanta Das stated that India’s financial system was sound, and that priority has been given to the need for financial intermediaries to proactively augment capital and improve their resilience. Financial sector must be stable to boost the confidence of businesses, investors, and consumers. The report added that a combination of fiscal, monetary and regulatory interventions on an unprecedented scale has ensured normal functioning of financial markets and the actions undertaken by financial sector regulators and the government to mitigate the impact of the pandemic helped reduce operational constraints and maintain market integrity and resilience in the face of severe risk aversion. It remains to be seen if the predictions made in the report come true.

Featured Image: Financial Stability Report