The RBI recently released the 2021-22 report on Currency & Finance. The report was obviously focused on the post-pandemic growth and details the structural issues ailing various sectors. It presents a road map while analysing India’s response to COVID. The report also warns of the dangers of indicators going beyond controllable levels.

The recent rate hikes by the Reserve Bank of India (RBI) had come as a surprise to many. This would not necessarily be the case if the central bank’s action plan through various reports were deciphered earlier. It was bound to happen, especially with the inflationary pressures. The signs were always there, and the only missing details were what and when of this rate hike. And of course, no amount of deciphering could be enough to find out what prompted the central bank to hold an emergency Monetary Policy Committee (MPC) meet when it was originally scheduled for June 6-8, 2022.

But what were the signals though? The RBI’s recent report on Currency and Finance released on 29 April 2022 had insights about what is coming next. Even in the previous MPC meet between 06-08 April 2022, the committee had subtly indicated the future course, ‘while the MPC voted to be accommodative by keeping rates unchanged, it is also focussing on withdrawal of this accommodation to ensure inflation is within the specified target while supporting the growth.’

This was made clear in the RBI’s report on Currency and Finance 2021-22, where the RBI talks about the timely rebalancing of fiscal and monetary policy as the first step towards a post-pandemic growth strategy. It went on further to suggest that the primary thing is to withdraw the surplus liquidity overhang in a calibrated manner, as for every percentage increase in the surplus liquidity above 1.5% of the Net Demand and Time Liabilities, average inflation raises by sixty basis points.

The RBI report also talks about India’s strategy for post-pandemic growth. This story looks at the report’s critical insights on India’s economic scenario.

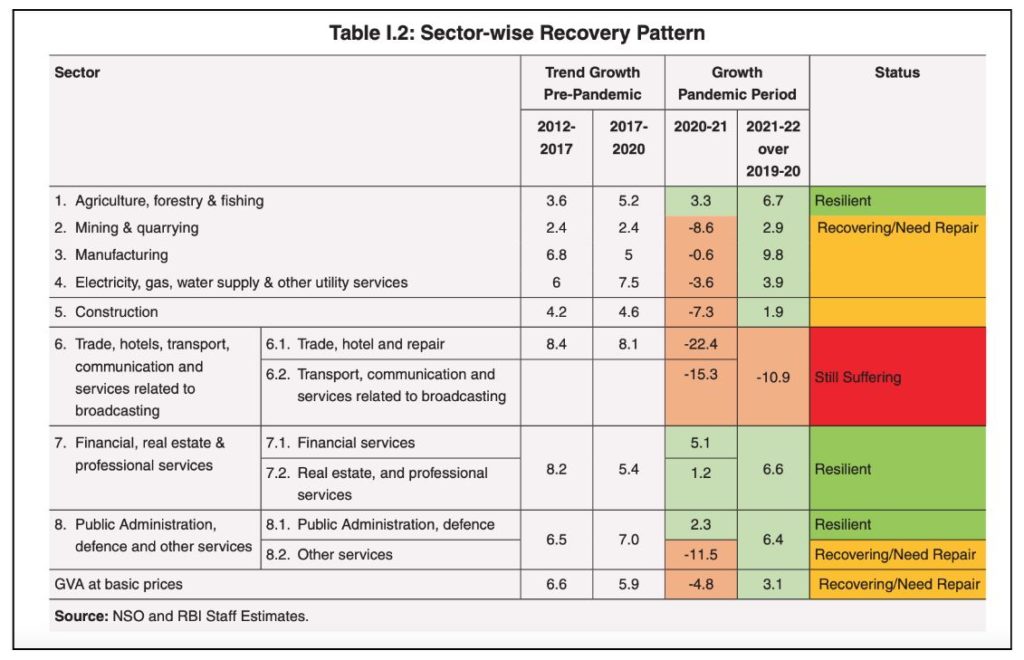

Six out of Eight sectors are fragile and need repair

Economies, both global and regional, were severely impacted by the pandemic. The outcome of this disruption was the spillover of the ill effects to various sectors of the economy. But not all sectors were affected equally. There is a huge variation in the resilience shown by different sectors. Agriculture and allied services displayed a greater resilience to the pandemic. This is followed by the heterogenous resilience displayed by the service sector. The real estate and professional services recovered to a substantial extent; the financial services displayed improved resilience. The manufacturing and construction industry is on the recovery path, while the hospitality industry is still suffering from the pandemic.

Post-Pandemic response by India

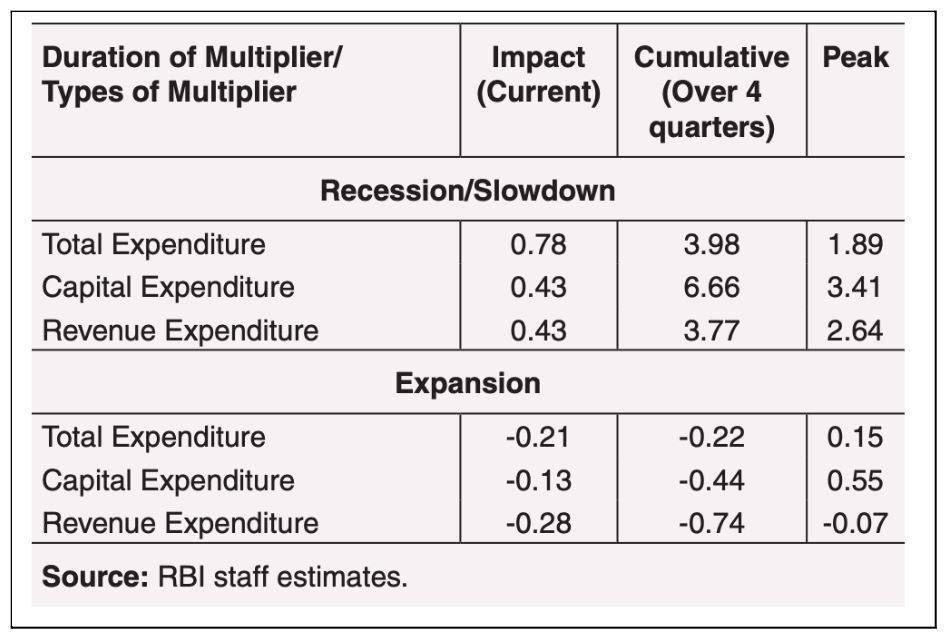

‘It’s not what happens to you, but it’s how you respond to it that defines you.’ This is something that is relevant even to the pandemic response by the countries. No country was spared from the pandemic and it’s how each country chooses to fight this pandemic that defines them. India’s pandemic response had a mix of both fiscal and monetary stimulus. The fiscal activism is justified by the huge uncertainty and the economic slack that the market was going through. But to what extent does this fiscal activism be sustainable? What effect does the fiscal stimulus have on growth under different macroeconomic scenarios?

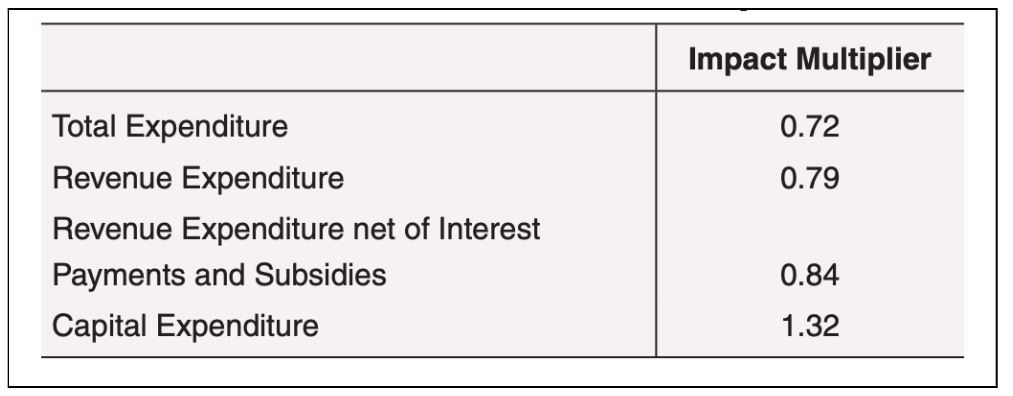

The RBI report states that for the Indian case, public expenditure was found to be more appropriate and supportive than the tax cuts. Similarly, tax hikes seemed more effective than expenditure cutbacks. All types of public expenditure do not generate the same impact. Using a three-variable structural vector autoregression (SVAR) model, it was found that capital expenditure had more impact than the rest.

This also shows how any expenditure other than capital expenditure is limited in its impact, thereby putting a threshold on the success of fiscal activism. Additionally, this fiscal activism also plays out differently based on economic conditions. During an economic slowdown, fiscal activism has a positive impact, while it is the reverse during the period of economic growth.

It is in this context of the detrimental effect of the prolonged expansionary fiscal policy, the RBI had envisaged rebalancing fiscal and monetary policies. But what is this threshold limit, upon which the surplus liquidity turns into a liability? To identify and measure this threshold, the RBI has used the structural threshold vector autoregression model (TVAR). It is found that a net Liquidity adjustment facility (LAF) of a surplus of more than 1.52% could become inflationary. This also varies with time and evolves over time. The impact of liquidity on inflation over the years seemed to have only risen. Up until December 2017, a one percent rise in surplus liquidity increased peak inflation from 5 to 11 basis points, while subsequently, the impact grew to twenty (20) basis points. Even if the liquidity is initially effective for economic recovery, the persistence on surplus liquidity can create ideal conditions for growing inflation.

Coming to the Monetary policy, the FRBM act mandates the debt to GDP ratio to be 60%. In 2020-21, this was 89.4% for the Government (Centre & States). Even the best consolidation effects in the future will keep this above 75% over the next five years, as per the report. Having such elevated levels of debt is not sustainable and calls for the reorientation of the strategy. Like the fiscal threshold, the monetary threshold upon which the debt to GDP ratio becomes unsustainable comes to 61%. Growth in GDP can be seen till the debt accumulation reaches 66%, above which one percentage point in an increase in debt to GDP ratio could reduce the GDP growth by 0.01 percentage points. Hence, adequate measures, both on fiscal as well as monetary policy, are the need of the hour.

Structural issues retarding Indian growth

Having seen the limited effectiveness of fiscal and monetary policies in India’s growth, it is imperative to look beyond them. As stated earlier, except for two sectors, all sectors have proved to be fragile, with hospitality being the weakest among all. The report identifies the structural issues that are dampening the growth prospects for the Indian economy. It lists out the factors that determine the structural transformation:

- Income changes – Income elasticity differences across sectors can drive structural changes.

- Relative sectoral price changes – Induces transformation by reallocation of activity.

- Input-output linkage changes– Growing prominence of supply chains in domestic & global sphere.

- Comparative advantages – New opportunities for sectoral reallocation of resources.

It also looks at individual sectors and the structural issues that impede their growth. For the agricultural sector, the following are the issues listed:

- Low capital formation

- Low expenditure on Research & Development

- Total factor productivity growth in India is lower than its peers.

- A significant share of input subsidies squeezing space for gross capital formation.

- Agricultural credit remains stagnant.

For the Industry sector, the report identified the following.

- For Mining, rampant illegal mining is a major challenge. A comprehensive energy planning strategy is the need of the hour.

- For manufacturing, a few capital-intensive businesses have gotten the majority share of physical investment, whereas employment-generating industries and high-demand electronics and computer industries have seen their investment share stagnate or decline over time.

- For the service sector, the growth lagged because of the slowdown in construction, financial services, and transport and communication services. This growth in the construction sector is due to retardation in residential construction.

- For the electricity sector, the gap between the average cost of supply and the average revenue raised needs to be closed. The extent of transmission losses is high compared to other countries and it should be minimized. Along with it, deregulation of electricity pricing is the need of the hour.

- For the telecommunication sector, the lack of an adequate number of players coupled with the lack of available spectrum and minimal broadband penetration are among the major challenges.

These are some of the major challenges these sectors face, which if resolved could transform the Indian economy.

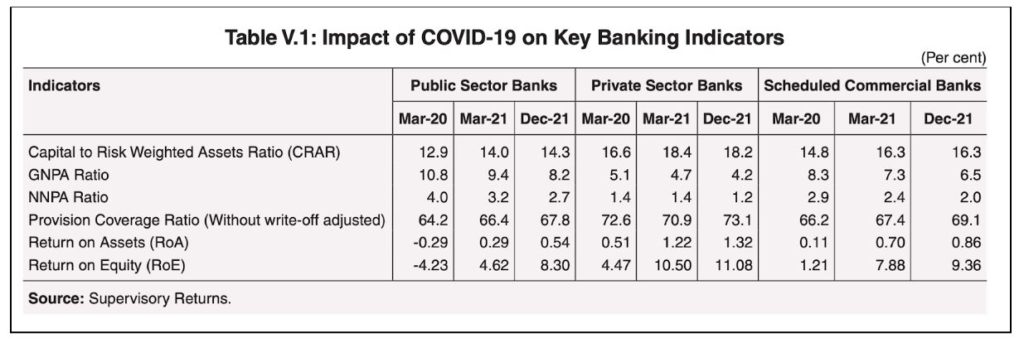

Role of Finance in accelerating growth

Last but not the least, finance is an important overarching aspect that is crucial in determining the success of the pandemic response. The financial sector is also one of the heavily impacted sectors due to the pandemic. The impacts can be seen if we look at the key banking indicators.

The pandemic hit on the pre-existing vulnerabilities in the Indian banking space. India’s credit to GDP gap has been negative since 2014, and the declining savings rate, and the growth in unresolved NPAs are major pre-existing weaknesses in the financial sector. For an effective pandemic response, it is crucial that the banking sector is de-stressed as early as possible. A few policy options like debt restructuring, capital infusion in banks, establishing the development of financial institutions, leveraging digital fintech start-ups and green financing should be explored to reinvigorate credit growth.

In conclusion, this report highlights three key lessons for the future.

- Never again, we should find ourselves unprepared for any crisis in the future.

- Structural transformation is not a one-off event, it is a process. It must be continuous to ensure resilience to future shocks.

- Recovery from these crises should embrace all. The path to recovery should be inclusive, strong, resilient, and durable.

Featured Image: RBI Report on Currency & Finance 2021-22