RBI recently released a report on municipal finances. This is the maiden report on municipal finances which shall be published regularly on an annual basis. The report highlights the inadequacy of own revenues of Municipal Corporations and their increasing dependence on grants & transfers.

The Reserve Bank of India (RBI) has been publishing reports on financial statistics related to the Central and State Governments on a regular basis. However, despite being a crucial tier in India’s three-tier governance system, data pertaining to the finances of the local governments is not published by the central bank due to the lack of consolidated data on local governments. Local governments include municipal corporations (MCs), municipal councils, municipalities/Nagar panchayats and Panchayati raj institutions. In order to address this gap in data availability, RBI recently released a report on municipal finances. This is the maiden report on municipal finances which shall be published regularly on an annual basis. Going forward, RBI will also be including municipal finances in its general government statistics. RBI has also stated that efforts will be made to broaden the coverage of local governments in the general government statistics on an ongoing basis.

Local self-governance was introduced in India through 73rd & 74th amendment to the Constitution in 1992

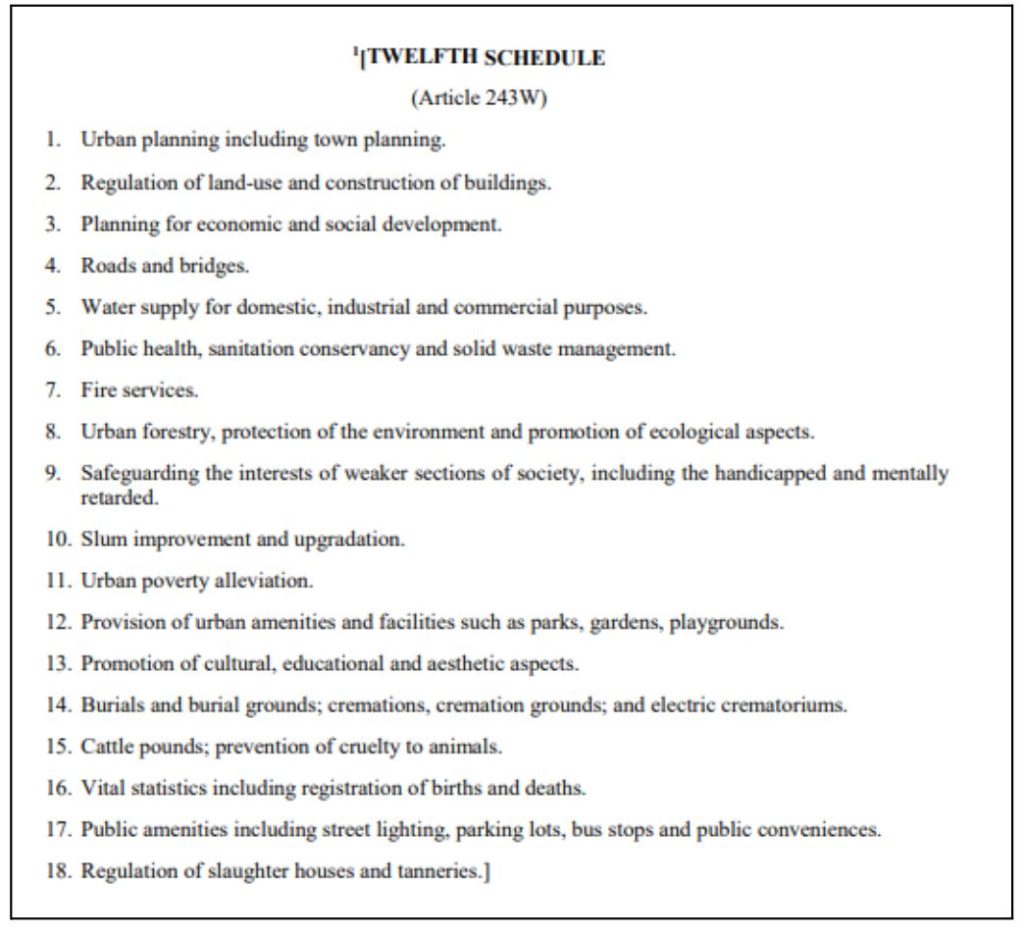

The 73rd and 74th amendments were made to the Indian Constitution in 1992 through which multiple powers & functions were devolved to the local governments. Functions were devolved separately for urban and rural India- Urban Local Bodies (ULBs) and the Panchayati Raj Institutions (PRIs), respectively. Urban Local governments include municipal corporations, municipal councils, and Nagar panchayats. While municipal corporations are for larger urban localities with a population of more than one million, municipal councils and Nagar panchayats govern smaller urban agglomerations and transition areas. Through the 74th amendment, Schedule 12 provides a list of 18 functions that the State governments may assign to the municipalities.

Municipal finance does not get enough attention despite its significance

Municipal finance refers to the budget, revenue, and expenditure of these municipal corporations. This is an important factor to be considered since it aids the local government to plan, mobilize, and utilize financial resources to provide services for the welfare of citizens, alongside developmental & infrastructural activities. Yet, this is not given enough attention, especially when the role of municipal corporations is becoming critical as India’s urban population is nearing 500 million.

In the RBI report, the budgetary data of 201 municipal corporations for the three years ending 2019-20 has been compiled. The revenue receipts of municipal corporations include tax revenues, non-tax revenues, assigned (shared) revenue, grants-in-aid, loans, etc. The expenditure incurred by the municipal corporations can be classified as Revenue expenditure and Capital expenditure. Revenue expenditure includes establishment expenditures, administrative expenditures, operations and maintenance expenditures and interest payments on loans, etc.

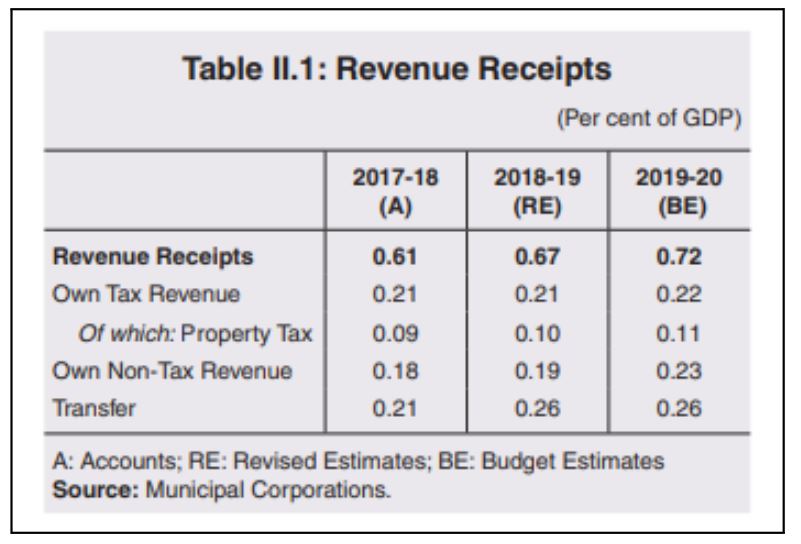

Indian municipal corporations’ revenue receipts are only 0.6 – 0.7% of GDP

According to RBI’s analysis of the sample, the revenue receipts of municipal corporations are estimated at 0.61% of GDP in 2017-18 and increased to 0.72% of GDP in 2019-20.

Own tax revenue, comprising property tax, water tax, toll tax and other local taxes, accounted for 31-34% of total revenue during the three years considered in the study. Further, there were large variations in the municipal corporations in Delhi, Gujarat, Maharashtra, Chandigarh, and Chhattisgarh which collected more tax as compared to other states. Property tax has become a prominent source now as other taxes such as octroi and local body tax (which were the major source of revenue in Maharashtra and Gujarat), have been subsumed in GST.

Non-tax revenue accounted for around 30% of total revenue receipts. Fees and user charges account for the highest share of non-tax revenue followed by income from investment, mainly in the form of interest earned and dividends, rental income from municipal properties, and sale and hire charges.

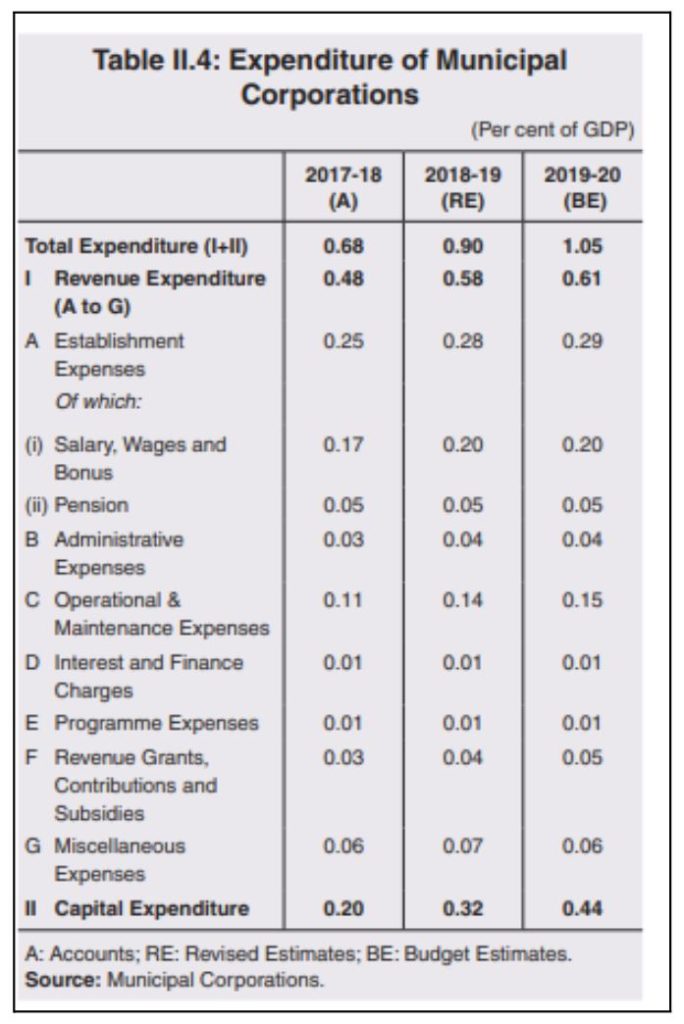

Total expenditure has increased to 1.05% of GDP in 2019-20

The total expenditure of these MCs was 0.68% of the GDP in 2017-18 which increased to 0.9% in 2018-19, and 1.05% in 2019-20. The share of revenue expenditure increased from 0.48% to 0.6% of GDP and the share of capital expenditure increased from 0.2% to 0.44% of GDP. As a share of total expenditure, the revenue expenditure dropped from 70% in 2017-18 to 58% in 2019-20 while that of capital expenditure increased from 30% of total expenditure in 2017-18 to 42% in 2019-20. The share of capital expenditure has huge variations among states- from less than 10% in Delhi to around 80% in Sikkim & Jharkhand.

Borrowings account only for a minute share of GDP

Gross municipal borrowings account for only less than 0.05% of GDP for all municipal corporations. It was around 6% of the total receipts of municipal corporations at the national level. The share of borrowings as a proportion of total receipts was higher in Telangana, Bihar, and Kerala. Again, a large share of these borrowings is raised by a few large metropolitan corporations. For instance, in Telangana, the Greater Hyderabad Municipal Corporation (GHMC) alone accounts for more than 90% of the total municipal borrowings.

India’s Municipal Finances has been unsatisfactory since decades

The state of India’s Municipal Finances has been unsatisfactory since decades. Even after institutional amendments were made in 1992, there has been no considerable improvement in the finance of the municipal corporation. RBI’s analysis of municipal finances for the period 2017-18 to 2019-20 reveals that the combined budget size of the municipal corporations in India is much smaller than that of the Central and State governments. The composition of municipal revenue in India has changed considerably over time, with increased reliance on transfers. Also, the ratio of revenue expenditure to capital expenditure is lower than that of the Centre and States.

India lags BRICS and OECD members with respect to municipal finances

The report also noted that Indian cities are far behind in being able to generate the resources required for providing good quality infrastructure and services to their citizens and lack financial autonomy. India lags the levels achieved by OECD and other BRICS countries. The local governments in major economies like Australia, Belgium, Canada, France, New Zealand, Spain, Sweden, Switzerland, etc. were mainly dependent on their own tax and non-tax revenue sources while those in Austria, Greece, Ireland, Lithuania, Mexico, Netherlands, Turkey, United Kingdom, etc. were dependent on grants from the general government. Switzerland, Iceland, and Australia generated over 80% of their revenue through tax and non-tax sources.

Among the BRICS nations, the local governments in Brazil and Russia depended on general government grants whereas China and South Africa generated their own tax and non-tax revenues. Both China and South Africa generated more than 50% of revenue through tax and non-tax sources while India generated only about 40% through these sources.

The report suggests that the increase in urban infrastructure in India has not been on par with the pace of urbanisation as is evident in the performance of the urban local bodies. The dependence on the devolution of taxes and grants from the upper tiers has risen over the years. Alternative sustainable resource mobilization through municipal bonds may be explored as per the report.

India should invest USD 840 billion over the next 15 years as per World Bank

According to a new World Bank report’s estimates, India will have to invest USD 840 billion over the next 15 years, or an average of USD 55 billion per annum into urban infrastructure to effectively meet the needs of its fast-growing urban population. About 40% of the population is expected to live in cities by 2036 which will add more pressure on the already stretched urban infrastructure and services such as clean drinking water, power supply, road transportation, etc. Furthermore, effective governance of cities is critical to sustainable development as per Sustainable Development Goal 11- Sustainable Cities and Communities. Thus, it is high time that local governments and their finances take prominence in the governance discourse.

Featured Image: RBI’s Report on Municipal Finances