The RBI recently released the 23rd edition of the biannual Financial Stability Report (FSR) for July 2021. The report notes that the growth in bank credits has slowed down while it has increased in the case of deposits because of the pandemic’s impact. NPA ratios have also decreased by March 2021.

The Financial Stability Report (FSR) is a biannual report published by the Reserve Bank of India (RBI). The report is the collective assessment of the sub-committee of Financial Stability and Development Council (FSDC), with inputs from other financial sector regulators such as RBI, SEBI, IRDAI including the Ministry of Finance. The objective of the report is to review the nature and magnitude of risks and their implications that can affect the macroeconomic environment, financial institutions, markets, and infrastructure. In the report, an assessment of the resilience of financial sector is also conducted through stress tests. Recently, the report for July 2021 was released which focuses on the efforts made to contain the adverse impact arising out of the COVID-19 pandemic.

Globally, economies were forced to take unprecedented measures to deal with the financial risks arising out of the pandemic. The measures have proved to help in curtailing COVID-19’s toll on financial markets and institutions to a great extent. In India too, the FSR has highlighted that the dent on balance sheets and performance of financial institutions in India has been much less than what was projected earlier. The regulatory, monetary, and fiscal policy measures have helped in reducing the solvency risk of financial entities, aided in stabilizing markets, and helped in maintaining financial stability in India. In this story, we focus on the health of Scheduled Commercial Banks (SCBs) in the country which has been assessed on the basis of their recent performance, asset quality, capital adequacy, and risks, as per the FSR. Banking stability is an important function to get the economy back on track.

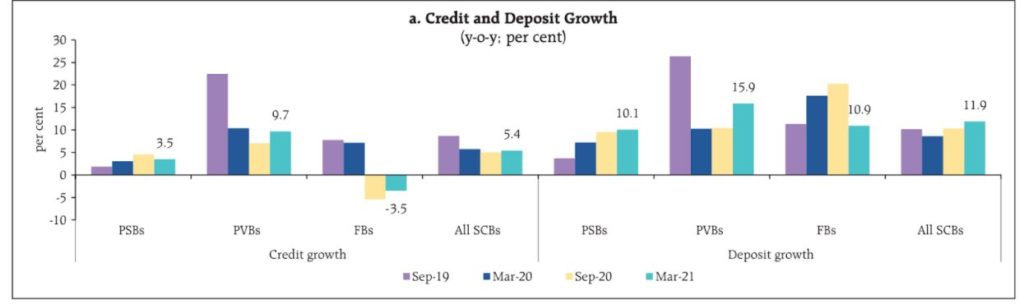

2020-21 recorded the lowest credit growth in four years while aggregate deposits increased

Credit growth year on year (y-o-y), though had increased by 5.4% in 2020-21 as compared to 2019-20, has been lowest in the last four financial years. It remains low even in the first quarter of the financial year 2021-22. According to RBI’s annual report for 2020-21, the slowdown in credit growth of banks was because of weakened demand and risk aversion. Meanwhile, the aggregate deposits of SCBs grew by 11.9% in 2020-21 as compared to the previous year. However, in the first quarter of 2021-22, the growth in deposits has weakened, recording a growth of only 9.7%. This could be because of the precautionary savings behaviour due to the pandemic. It was also observed that the deposits in current and savings accounts grew at a faster pace as compared to term deposits like fixed deposits and recurring deposits, indicating that people tend to hold more cash which can be withdrawn easily during this time of uncertainty.

Supreme Court lifted ban on classification of NPAs in March 2021

In September 2020, the Supreme Court had directed that the accounts which were standard as of 31 August 2020, were not to be classified as non-performing assets (NPAs) until further orders. This move was in favour of borrowers as the declaration of loans as NPA would result in them losing their creditworthiness which would make access to loans difficult in the future. The effective ban on classification of bad loans was later lifted by the Supreme Court on 23 March 2021. Furthermore, the Court ordered waiver of compound interest for all borrowers who availed of the loan moratorium during the pandemic.

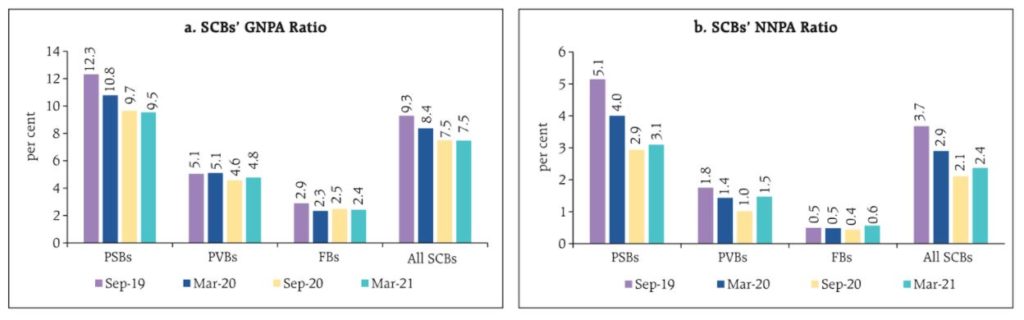

GNPA & NNPA ratios of all SCBs have declined in March 2021 as compared to March 2020

Though the lift in the ban was expected to pave the way to an increase in NPAs because of financial stress in households and businesses, SCBs reported gross NPAs (GNPAs) of 7.5% and net NPAs (NNPAs) of 2.4% by March 2021, which is lower than the GNPA of 8.4% and NNPA of 2.9% reported in March 2020. This indicates that there has been an improvement in the performance of banks. Meanwhile, banks have been careful with restructuring loans by keeping them at less than 1%. The capital to risk-weighted assets ratio (CRAR) of SCBs increased from 14.7% in March 2020 to 16% in March 2021 indicating that the banks may be more able to withstand a financial downturn.

While the GNPA ratios of SCBs for two major sectors- agriculture and industry declined during 2020-21, the same increased for the personal loan sector. Even within the industrial sector, the ratio had declined for major sub-sectors including textiles, food processing, mining & quarrying, vehicles, parts & equipment, construction, infrastructure, and cement & cement products.

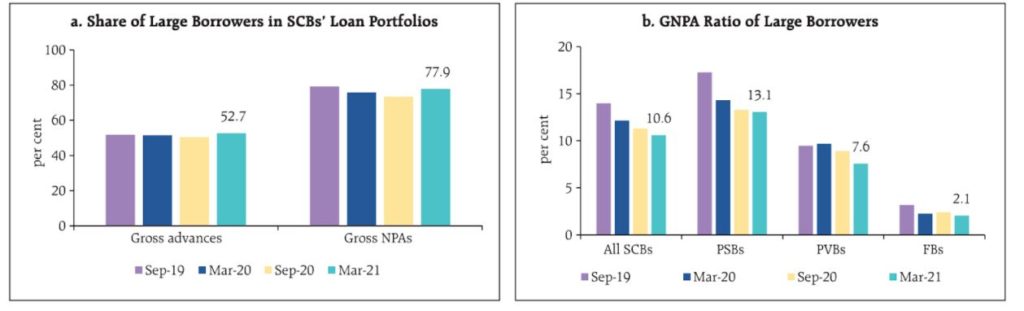

The share of large borrowers who accounted for nearly 53% of the aggregate loan portfolios of all SCBs, accounted for a share of 77.9% of the total GNPAs. Their share of GNPAs was 73.5% in September 2020, and 78.3% in March 2020. This indicates that NPA growth has increased among small borrowers in March 2021 as compared to March 2020.

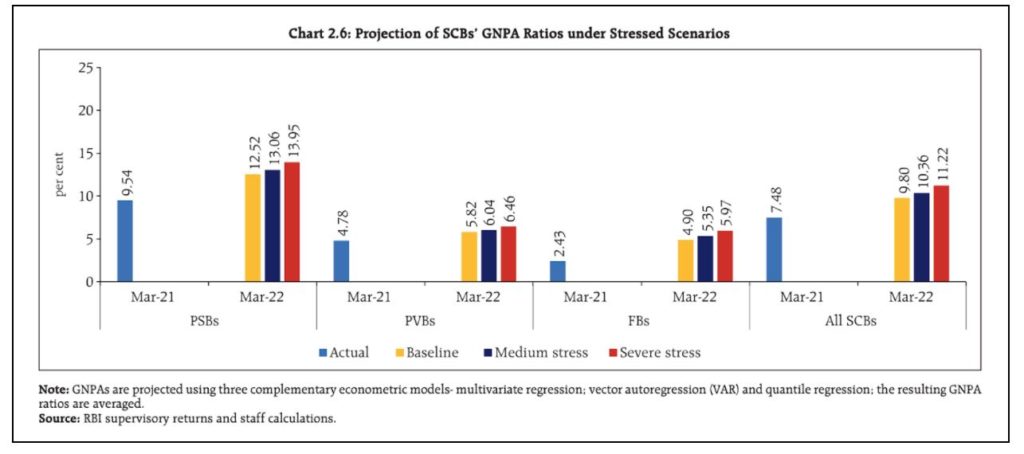

Macro stress test suggests that GNPA may rise to 9.8% by March 2022

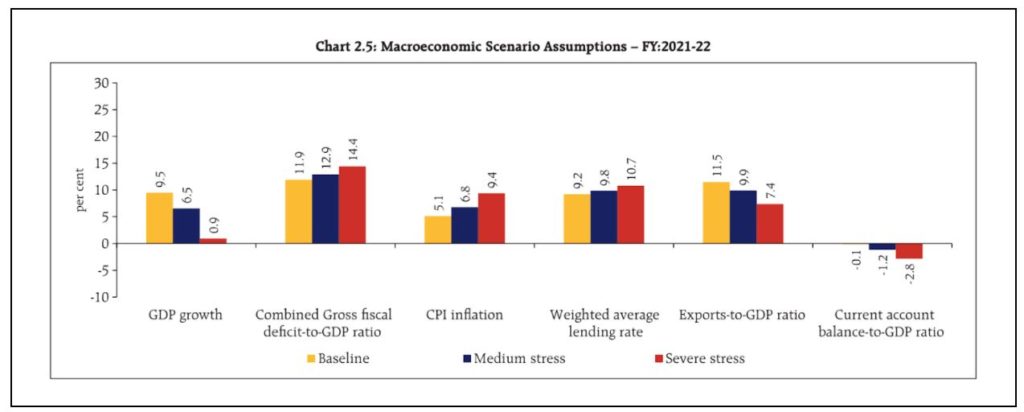

RBI’s macro stress test is used to test how resilient SCBs are to the unexpected changes in the macroeconomic environment. The model outcomes of the test help banks in decision-making. Three different plausible scenarios have been considered here- baseline scenario that is based on steady-state values of six macroeconomic variables (given in chart below) and two adverse scenarios- medium, and severe stress.

According to the stress test, the GNPA ratio of all SCBs would increase from the March 2021 levels due to the second wave of COVID-19. It is estimated that the GNPAs could rise to 9.8% in the baseline scenario by March 2022. It could go further up to 10.36% and 11.22% in medium and severe stress scenarios, respectively even though SCBs have sufficient capital, both at the aggregate and individual level, even under stress. However, this is unlikely as the GDP is assumed to drop to 6.5% and less than 1% in the medium and severe stress scenarios. Going by the past estimations, the FSR for July 2020 suggested that the NPA ratio could rise from 8.4% to 12.5% by March 2021 in the baseline scenario and could go up to 14.7% in the very severe stress scenario while in reality, the GNPA ratio settled at 7.5%, much lower than the test outcomes.

Banks considered in the study are unlikely to face capital shortage in the coming year

Furthermore, the stress test indicates that the capital to risk-weighted assets ratio (CRAR) seems to hold up well. It might drop by 30 basis points (bps) between March 2021 and March 2022 under the baseline scenario. It might drop by 130 bps and 256 bps under the two stress scenarios. Nonetheless, all the 46 SCBs considered for CRAR projections will be able to maintain CRAR well above the regulatory minimum of 9% as of March 2022 even in the worst-case scenario. That is, none of the 46 banks is likely to face a shortage of capital even under a severe macro-stress scenario.

New risks have emerged, and banks should be prepared

The report has also emphasized that though banks and other financial institutions seem to be resilient and balance sheet stress continued to remain moderate during the pandemic, it calls for close monitoring of MSME and retail credit portfolios witnessing high stress. Though the stress tests indicated a limited impact of macroeconomic shocks to the Indian banking sector, downside risks continue to remain. The report suggests that banks prepare contingency strategies to deal with segment-specific asset quality pressures when the regulatory reliefs are eventually rolled back. New risks such as future waves of the pandemic, international commodity prices and inflationary pressures, global spillovers amid high uncertainty and rising incidence of data breaches and cyber-attacks are emerging during the recovery and so, it is important that there is sustained policy support by strengthening capital and liquidity buffers by financial entities.

Featured Image: RBI’s Financial Stability Report