[orc]Most Indians abroad remit money to India for varied purposes, the primary one being family maintenance. As per data available with the RBI, 69.8 billion USD was the total amount of private transfer receipts to India in 2014-15 out of which 44.08 billion USD were inward remittances.

Most Indians living abroad remit money to India for varied purposes. The primary purpose of such remittance is family maintenance. According to the data available with the Reserve Bank of India (RBI), the inward remittance for the year 2014-15 stood at 44.08 billion dollars which is double the annual budget size of some of the larger states.

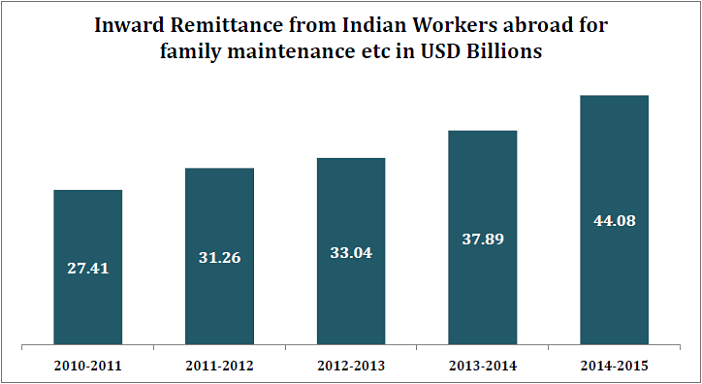

Inward remittances grew by 61% in 5 years

The inward Remittance from Indian Workers abroad for family maintenance etc grew from 27.41 billion USD in 2010-11 to 44.08 billion USD in 2014-15. This is an increase of about 61%. In the last five years, the inward remittances have seen a steady increase. In 2011-12, the remittances stood at 31.26 billion USD followed by 33.04 billion USD in 2012-13. In 2013-14, the inward remittances stood at 37.89 billion USD.

Total Private Transfer receipts at 69.8 billion USD in 2014-15

The RBI counts the following as part of the total private transfer receipts to India.

- Inward Remittance from Indian Workers abroad for family maintenance etc

- Local withdrawals/redemptions from non-resident deposits

- Gold and Silver brought through passenger baggage

- Personal Gifts or Donations to charitable/religious institutions in India

The sum amount of all the above four listed items stood at 69.8 billion USD for the year 2014-15. 63% of this amount was inward remittance while 33% was local withdrawals from non-resident deposits. The remaining 4% was through gold and silver brought through passenger baggage and personal gifts to religious institutions in India.

| Total Private Transfer Receipts (in US $ Million) | |||||

|---|---|---|---|---|---|

| Private Transfer Receipts | 2010-2011 | 2011-2012 | 2012-2013 | 2013-2014 | 2014-2015 |

| Inward Remittance from Indian Workers abroad for family maintenance | 27408 | 31262 | 33038 | 37892 | 44083 |

| Local withdrawals/redemptions from non-resident deposits | 26150 | 32472 | 31951 | 29151 | 23248 |

| Gold and Silver brought through passenger baggage | 36 | 53 | 59 | 148 | 71 |

| Personal Gifts or Donations to charitable/religious institutions | 2024 | 2342 | 2580 | 2447 | 2416 |

| Total | 55618 | 66129 | 67627 | 69638 | 69819 |

While the amount of inward remittances has steadily increased every year, local withdrawals from non-resident accounts saw continuous fluctuation. From 26.15 billion USD in 2010-11, it went up to 32.47 billion USD in 2011-12 only to continuously come down the following years. In 2014-15, the amount of local withdrawals stood at 23.24 billion USD, much less than 2010-11 amount. The amount of gold and silver steadily increased till 2013-14 and came down in 2014-15. The amount of personal gifts to religious institutions increased in the first 3 years starting 2010-11 and later stabilized.

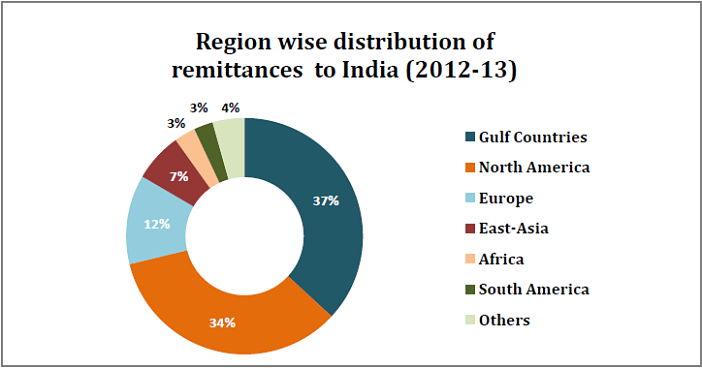

Major source of remittance continue to be the Gulf Countries

The data on region wise (based on source) distribution of private transfers to India is available with the RBI only up to 2012-13. The Gulf Countries have remained the single largest source of private transfers to India. In 2012-13, the total amount from these countries stood at 24.93 billion USD, which is 37% of the total private transfers to India. A close second is North American countries (primarily the USA), with a total of 23.22 billion USD in private transfers or 34% of the total. About 20% of the total private transfers came from Europe and East Asia. The remaining 10% came from from Africa, South America and others.

Featured Image: Image

2 Comments

Pingback: విదేశాలలో ఉన్న మన భారతీయులు ప్రతి సంవత్సరం ఎంత డబ్బు పంపుతున్నారో తెలుసా? ·

Pingback: Blockchain technology and fighting corruption in India – sevottam