In April 2021, the Reserve Bank of India (RBI) announced that it has constructed a composite Financial Inclusion Index (FI-Index) based on multiple parameters to reflect the broadening and deepening of financial inclusion in the country. Here is a review of the index and various aspects related to financial inclusion.

‘Financial Inclusion’ has been viewed as a key enabler for achieving inclusive and sustainable development worldwide. ‘Financial Inclusion’, broadly defined, refers to universal access to a wide range of financial services at a reasonable cost. These include not only banking products but also other financial services such as insurance, credit, and equity products.

Financial inclusion plays an important role in the process of economic progress by developing a culture of savings among a large segment of the population and broadening the resource base of financial systems. Further, by bringing low-income groups within the perimeter of the formal banking sector, financial inclusion protects their financial wealth and other resources in exigent circumstances. Financial inclusion also mitigates the exploitation of vulnerable sections by the usurious money lenders by facilitating easy access to formal credit.

Financial Inclusion has been a thrust area for Government, the Reserve Bank, and other regulators, with several steps having been taken and significant progress made over the years. Some of the major efforts made in the last five decades include nationalization of banks, building up of robust branch network of scheduled commercial banks, co-operatives, and regional rural banks, permitting BCs/BFs (business correspondents and facilitators) to be appointed by banks to provide doorstep delivery of banking services, zero balance BSBD (basic savings bank deposit) accounts, Jan Dhan accounts, etc.

On 07 April 2021, the Reserve Bank of India (RBI) announced that it has constructed a composite Financial Inclusion Index (FI-Index) based on multiple parameters to reflect the broadening and deepening of financial inclusion in the country. The FI Index will be published annually in July for the financial year ending previous March. The annual FI-Index for the period ending March 2021 is 53.9 as against 43.4 for the period ending March 2017.

According to the published brief, the FI-Index has been conceptualized as a comprehensive index incorporating details of banking, investments, insurance, postal as well as the pension sector in consultation with the Government and respective sectoral regulators. The index captures information on various aspects of financial inclusion in a single value ranging between 0 and 100, where 0 represents complete financial exclusion and 100 indicates full financial inclusion.

Only cursory information on FI-Index Methodology

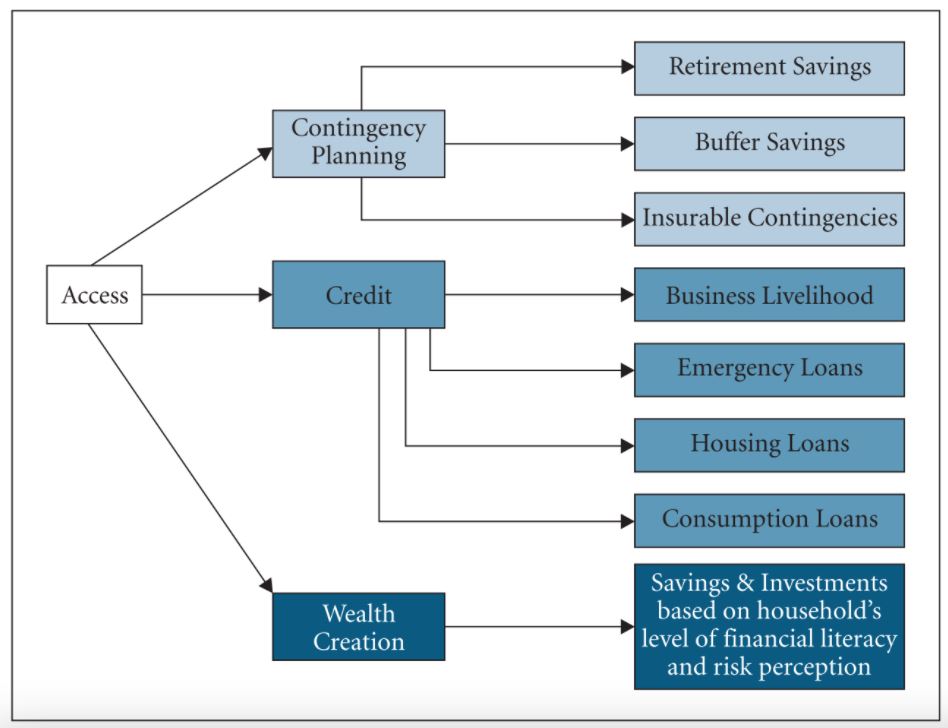

An earlier report of the Committee on Financial Sector Reforms, chaired by Dr. Raghuram Rajan, depicted households’ access to financial services in the following figure.

The RBI brief highlights that the FI-Index has been constructed without any ‘base year’ and as such it reflects cumulative efforts of all stakeholders over the years towards financial inclusion. In terms of methodology, the FI-Index comprises of three broad parameters (weights indicated in brackets):

- Access (35%)

- Usage (45%)

- Quality (20%)

Each of these parameters consists of various dimensions, which are computed based on several indicators. The Index is responsive to ease of access, availability and usage of services, and quality of services, comprising in all 97 indicators. A unique feature of the Index is the quality parameter which captures the quality aspect of financial inclusion as reflected by financial literacy, consumer protection, and inequalities and deficiencies in services.

However, the brief does not elaborate on the nature of these indicators, how they have been measured or the steps being taken to improve these indicators.

Account ownership increased significantly; Gap between male-female ownership and rich-poor also shrinks significantly

Research shows that countries with deeper levels of financial inclusion— defined as access to affordable, appropriate financial services— have stronger GDP growth rates and lower income inequality. Notably, there are positive consequences of having access to formal saving instruments on increased savings, productive investment, consumption, and overall empowerment.

According to the World Bank’s Global Financial Inclusion Database or Global Findex Report 2017, 80% of Indian adults (age 15+) have a bank account, which is almost double the share of adults with a bank account in 2011 (35%) and significantly higher than Findex 2014 (53%).

The Findex 2017 report also estimates that 77% of Indian women (age 15+) have bank accounts, against 43% and 26% respectively in 2014 and 2011. In 2014, Indian men were 20 percentage points more likely than Indian women to have an account. That gap has shrunk to 6 percentage points in 2017.

Account ownership among adults in the poorest 40 percent of households rose to 77% in 2017, from 44% in 2014 and 27% in 2011. Account ownership among adults in the richest 40 percent of households rose to 82% in 2017 from 59% in 2014 and 41% in 2011. The gap in account ownership between richest and poorest 40% households has shrunk significantly to 5 percentage points, against 15 percentage points in 2014.

In other words, in 2014, adults in the richest 60 percent of India’s households were 15 percentage points more likely than those in the poorest 40 percent to have an account. Since then, account ownership has risen among wealthier and poorer adults alike—narrowing the gap to 5 percentage points.

India accounts for the world’s highest share of inactive bank accounts

Globally, 13% of adults (or 20% of account owners) reported having what can be considered an inactive account, with no deposit or withdrawal —in digital form or otherwise—in the past 12 months. The share of account owners with an inactive account varies across economies, but it is especially high in many South Asian economies.

In India, the share is 48%—the highest in the world and about twice the average of 25% for developing economies.

According to the Global Findex Report 2017, part of the explanation might be India’s Jan Dhan Yojana scheme, developed by the government to increase account ownership. Launched in August 2014, the program had brought an additional 310 million Indians into the formal banking system by March 2018, many of whom might not yet have had an opportunity to use their new account.

India has the world’s second-highest unbanked population; the majority of them are women

According to the same report, about 190 million adults in India do not have a bank account, making India the world’s second-largest nation in terms of unbanked population after China. China and India, despite having relatively high account ownership, claim large shares of the global unbanked population because of their sheer size.

It is important to note that since bank account ownership is nearly universal in high-income economies, virtually all these unbanked adults live in the developing world. Home to 225 million adults without an account, China has the world’s largest unbanked population, followed by India (190 million), Pakistan (100 million), and Indonesia (95 million). In fact, these four economies, together with three others—Nigeria, Mexico, and Bangladesh—are home to nearly half the world’s unbanked population.

The report points out that 56% of all unbanked adults are women. Women make up nearly 60 percent of unbanked adults in China and India—and an even higher share in Turkey. Women are overrepresented among the unbanked in economies where only a small share of adults are unbanked, such as China and India, as well as in those where half or more adults are unbanked (like Bangladesh and Colombia).

Digital financial inclusion is on rise; efforts towards improving financial literacy require a further boost

The concept of financial inclusion has evolved over a period and in recent times, the biggest boost to financial inclusion in the country has come from various initiatives under Digital India, banking facilities, simplification of procedures relating to financial instruments, etc.

As per a World Bank report from 2018 and RBI’s Bulletin from 2020, the total volume of digital transactions in India (including various payment channels and mechanisms, such as net banking, mobile banking, debit cards, credit cards, prepaid instruments, mobile wallets, among others) grew by compound annual growth rate (CAGR) of 30% from 1,142 million in April 2015 to 1,928 million in April 2017. On the other hand, mobile banking transactions grew more than five times, from 19.75 million in April 2015 to 106.18 million in April 2017. Similarly, mobile wallet transactions grew from 11.96 million transactions in April 2015 to 387.6 million transactions worth Rs 15,408 crore in January 2020 (World Bank 2018; RBI 2020).

As a result, anyone with a valid bank account and mobile phone can make quicker and easier payments. On the back of the increased access, India’s UPI (Unified Payment Interface), the country’s real-time payment system which instantly transfers funds between two bank accounts using mobile apps of banks and other third parties (e.g., Google Pay), has gone from processing 17.9 million digital transactions per month in 2016 to 1.3 billion per month in 2020.

Our previous articles have explored the evolution of digital payment systems and the increasing volume of digital transactions in the country in detail. The articles highlight both the adoption of digital payment systems and that the volume and value of digital transactions have significantly increased in the country and continues to grow.

While India has made great strides in the journey towards financial inclusion, recently with the advent of digital payment systems, there are notable digital divide and financial literacy concerns in the country. The most common barriers include lack of skills among the stakeholders to use digital services, infrastructural issues, teething problems between various systems, and low-income consumer’s inability to afford the technology required to access digital services.

In terms of advancing financial literacy, the government’s ongoing efforts under Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) (which aims to train one person per household i.e., 6 crore persons in rural areas on digital literacy) were suffering from a paucity of funds. Against this backdrop, the Parliamentary Standing Committee on IT submitted its report on the review of the National Digital Literacy Mission (NDLM) with a host of recommendations. A detailed review of the committee’s report can be read here, in one of our earlier articles.