During the first week of the budget session of parliament after the monthlong break, there was extensive discussion on the impact of the abrogation of Article 370 in Jammu & Kashmir, GST compensation to states, in addition to government’s statements on the situation in Ukraine. Here is a review of the first week of the second leg of the budget session.

The Budget session of the Parliament began on 31 January 2022 and is expected to go on till 8 April 2022. The first leg of the budget session went on till 11 February 2022 following which there was a break for about a month. During this period, the Standing Committees examined budgetary allocations for various Ministries and Departments. The second leg of the budget session began on 14 March 2022. Both the Houses sat only for three days in the first week after the month-long break following which the sessions were adjourned because of Holi and the weekend.

The first leg of the budget session began with the President Ram Nath Kovind’s address to a joint sitting of the Lok Sabha and the Rajya Sabha. This was followed by the presentation of the Economic Survey. On the following day, Finance Minister Nirmala Sitharaman presented the Union Budget for 2022-23 on 01 February 2022. Discussions on the ‘Motion of Thanks to the President’s Address’ and the ‘Union Budget’ followed this.

Key Developments during the first week

On the first day after the resumption, the finance minister presented a Rs 1.42 lakh crore budget for the union territory of Jammu and Kashmir for the year 2022-23. She requested the House to suspend rule 205 of the ‘Rules of Procedure and Conduct of Business’ in Lok Sabha, which states discussion on the budget should not be taken up on the same day as it was presented to the House, so as to discuss the Budget for 2022-23 and Supplementary Demands for Grants for 2021-22 of the Government of Union Territory of Jammu and Kashmir. This was opposed by the opposition on grounds that the purpose of the rule was for ‘scrupulous scrutiny of each and every penny that is spent out from the Consolidated Fund of India.’

The lower House then went on to debate the impact of abrogation of Article 370. Nirmala Sitharaman replied that the abrogation was required since the country cannot have two symbols, two Prime Ministers and two Constitutions when we have a constitution. With respect to the situation of employment, she cited the statistics of CMIE asserting that unemployment had dropped to 13.2% over the years. Regarding the tourism industry in the Union Territory, she stated that the highest ever tourist footfall of over 50 lakh was reported in Jammu & Kashmir between October 2021 and January 2022. In December 2021 alone, a tourist footfall of 1.43 lakh was reported from the valley of Kashmir alone, the highest in seven years, as per the finance minister.

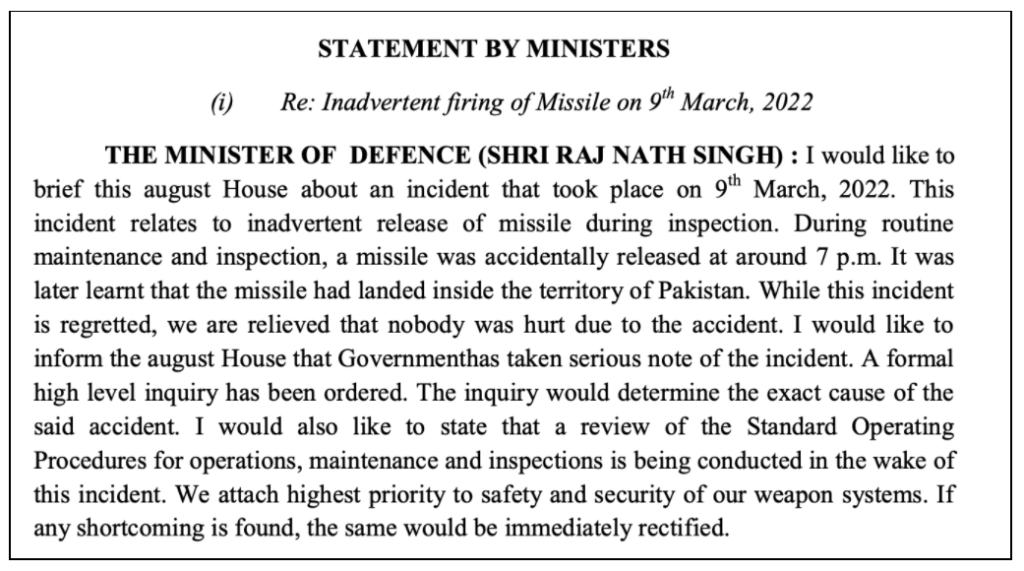

On the second day, Defence Minister Rajnath Singh addressed the House on India’s accidental firing of a missile that landed in Pakistan on 09 March 2022. He stated that the incident took place during the routine maintenance and inspection and that nobody was hurt. He also added that a formal high-level inquiry was ordered to identify the exact cause of the accident.

The Minister of External Affairs, Dr. Subrahmanyam Jaishankar, issued a statement regarding the situation in Ukraine. He stated that about 22,500 citizens returned home safely. He also mentioned about the advisories issued and measures taken for the evacuation of Indians from Ukraine during the conflict. Though advisories were issued in February 2022 to return, the universities were not willing to offer online courses and discouraged students from leaving, which was the reason why students didn’t leave the country. He also stated that India helped in the evacuation of about 150 citizens from 18 countries, including Bangladesh and Nepal, in addition to providing relief material to Ukraine and its neighbouring countries of Poland, Romania, Slovak Republic and Moldova.

Apart from these, discussions were also held on the working of the ‘Ministry of Development of North-eastern Region’, functioning of Railways, GST compensation to states, etc. among other relevant topics in both Houses.

Important Bills introduced

The Jammu and Kashmir Appropriation Bill 2022, The Jammu And Kashmir Appropriation (No. 2) Bill, 2022, which provide for the allocation of funds for the Union Territory from the Consolidated Fund of India, and the Appropriation (No.2) Bill, 2022, and the Appropriation (No.3) Bill, 2022, that provide for excess spending in certain ministries in 2018-19 and for 2021-22 were also introduced and passed.

Reports tabled

The Standing Committee reports on the ‘Demands of Grants for 2022-23’ were tabled by various ministries including the Ministry of Defence, Rural Development, Skill Development and Entrepreneurship, Railways, Tribal Affairs, and Labour And Employment.

Apart from this, the standing committee on Rural Development & Panchayati Raj submitted the action taken on the recommendations contained in the Sixteenth Report on ‘Pradhan Mantri Awaas Yojana –Gramin (PMAY-G). The committee noted that there was a delay and called for faster consultation processes with concerned Ministries for mitigating this delay in the assistance component. It also asked the Ministry to come up with some stringent mechanism for the resolution of issues afflicting the identification of beneficiaries and appropriate exercise of power by the Gram Panchayat.

Action taken report on the observations/recommendations of the committee on the Accelerated Irrigation Benefits Programme relating to the Ministry of Jal Shakthi was also tabled in this past week. The committee noted that there was a huge irregularity in expenditure. It also noted that there was considerable delay in preparation of ‘Detailed Projects Reports’ which resulted in the loss of money.

The Public Accounts Committee, under the Ministry of Micro, Small, and Medium Enterprises submitted its report on ‘Functioning of Credit Guarantee Fund Trust for Micro and Small Enterprises’ in which the Committee noted that no professionalism was developed in the area. It further noted that the institution had not been strengthened even after more than two decades.

Important Questions

A question was raised in the Rajya Sabha on whether the Government had plans to make it mandatory for Indian airlines and airports to play Indian Classical or light vocal and instrumental music to which the Ministry of Civil Aviation replied that only advised the Airlines and the Airport Operators to consider playing Indian music, subject to the regulatory guidelines.

Another question was raised in the Lok Sabha if many freedom fighters like Bhagat Singh, Rajguru, and Sukhdev were given the status of a martyr and if there has been a long-standing demand for giving martyr status and conferring Bharat Ratna on them. The response was that the names of the aforesaid freedom fighters were recorded in the ‘Dictionary of Martyrs of India’s freedom struggle from 1857 to 1947 published by the Ministry of Culture and that their stature was far above any official award or title or status.

In response to a question in the Lok Sabha about Maoists, the Ministry of Home Affairs noted that the incidents of ‘Left-Wing Extremism’ (LWE) violence had dropped by 77% from an all-time high of 2258 in 2009 to 509 in 2021. Similarly, resultant deaths (Civilians + Security Forces) have also reduced by 85% from an all-time high of 1005 in 2010 to 147 in 2021.

In response to another question in the Rajya Sabha, the Finance Ministry noted that 8.13 crore persons had paid income tax in the country during Assessment Year 2020-21 relevant to Financial Year 2019-20. As per the government, the term persons include individuals, Hindu Undivided Family, Association of Persons, Body of Individuals, Firms, Local Authority, Artificial Juridical persons who pay income tax and who have either filed a return for the relevant year or in whose case tax has been deducted at source. On the other hand, the number of taxpayers for the Assessment Year 2020-21 was 8.22 crores (this includes companies in addition to persons).

Featured Image: Parliament Review