A social media post accompanying a Hindi newspaper clip, the title of which loosely translates to ‘banks have waived off loans amounting to 68 thousand crores of 50 wilful defaulters including fugitive Nirav and Mehul’ is being widely circulated as if the news clip is a recent one. Through this article let’s fact-check the claim made in the post.

Claim: Recent News clip – ‘banks have waived off loans amounting to 68 thousand crores of 50 wilful defaulters including fugitive Nirav and Mehul’.

Fact: This is an old news clip, that dates back to April 2020. An RTI response revealed that banks have written-off loans to the tune of Rs. 68,607 crores, and that these write-offs include loans taken by the firms belonging to Nirav Modi, Mehul Choksi, and Vijay Mallya. Even the viral news clip mentioned the same in the article, however, the clip carried a misleading title claiming that these loans are waived-off, which is not true. In case of write-off, banks just clear these loans from the balance sheets, but the accounts still continue in the bank books and the banks may recover these loans in the future. Hence the claim made in the post is MISLEADING.

This is an old news clip that dates back to April 2020, wherein an RTI response revealed that Indian banks have written off Rs. 68,607 crores of debt of top-50 wilful defaulters till 30 September 2019.

Responding to a query filed by activist Saket Gokhale, RBI released the list of the top-50 wilful defaulters and the list includes firms belonging to fugitive economic offenders Nirav Modi, Mehul Choksi, and Vijay Mallya. Several news agencies have reported the news back then and the viral news clip is also one such (here & here). A Congress leader shared the copy of the RTI response on twitter, which can be viewed here.

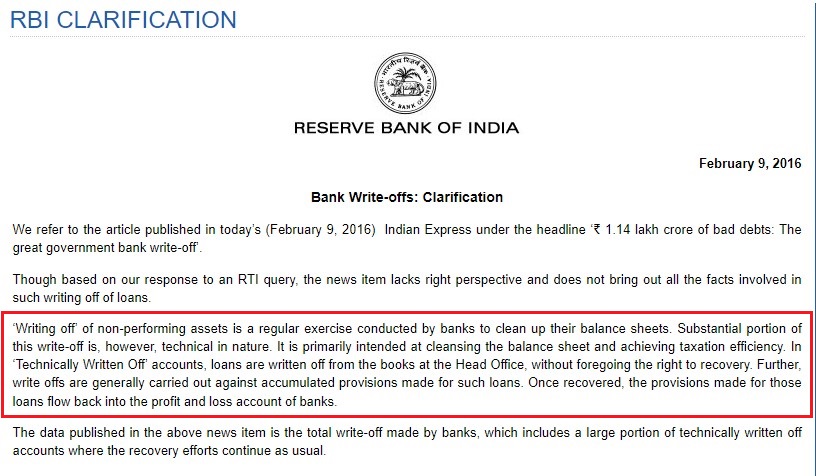

However, it is noteworthy to mention that banks did not waive off these loans but written them off. As per RBI, write-off just clears the bad loans from the bank balance sheets but these bad accounts still continue to stay in the bank books and the banks try to recover these loans by other means. Writing off a bad loan is not same as waving off.

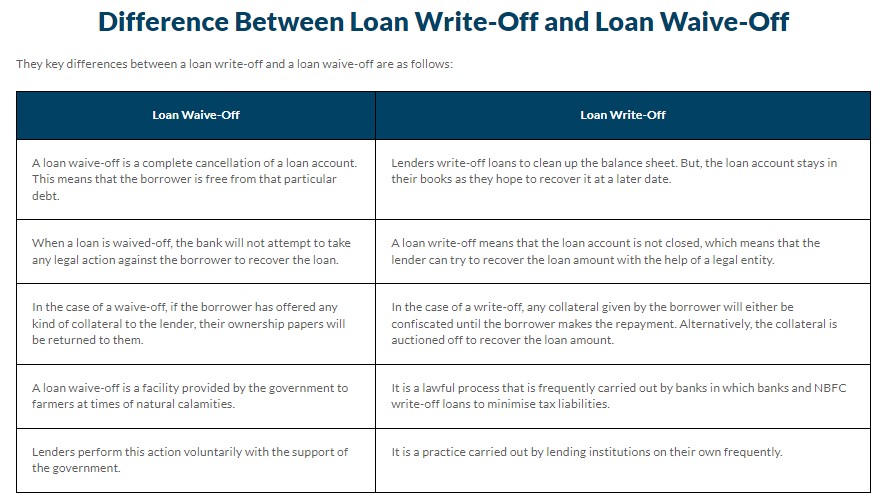

Even the viral news clip clearly mentioned that the loans are written-off, however, the clip carried a misleading title saying the loans were waived-off, which led to the virality of the post. Key differences between waiving-off a loan and writing them off is mentioned below.

Write-off vs Waive-off :

Writing off a loan is a general practice implemented by banks to clean up their balance sheets. In the case of write-off, the lending banks clean up the bad loans from their balance sheet, however, the loan account still stays to continue with the lending bank as they can try to recover it later on. Moreover, if any collateral is attached to the loan, then the lender confiscates them.

Whereas in the case of loan waive-off, the lender completely cancels the loan account, and the borrower is free from the debt. If any collateral is linked to the debt, then it will be returned to the borrower. Thus the banks have just written-off these bad loans and did not completely waive them as claimed in the post.

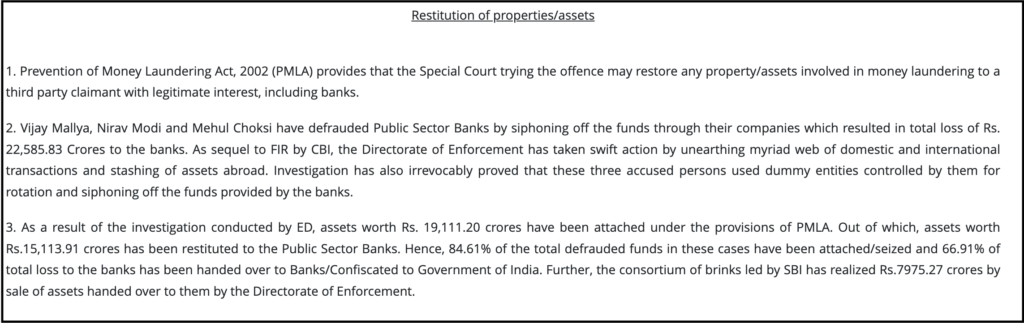

85% of the total defrauded funds have been attached/seized in case of Mallya, Modi & Choksi

Further, the Enforcement Directorate (ED) has recently said that Vijay Mallya, Nirav Modi and Mehul Choksi have defrauded Public Sector Banks which resulted in total loss of Rs. 22,585.83 Crores to the banks. The ED further said that assets worth Rs. 19,111.20 crores have been attached under the provisions of PMLA. Out of which, assets worth Rs.15,113.91 crores has been restituted to the Public Sector Banks. In other words, 84.61% of the total defrauded funds in these cases have been attached/seized and 66.91% of total loss to the banks has been handed over to Banks/Confiscated to Government of India.

To sum it up, old news clip carrying a misleading title about banks writing-off loans of wilful defaulters is being shared as recent.