A social media post highlighting the alleged discrimination being faced by Hindus when compared to Muslims of the country is being widely circulated. In this context, the post purportedly claims that ‘minorities of the country are paying less taxes, when compared to the majority.’ Through this article let’s fact-check the claim made in the post.

Claim: Minorities of the country are paying less taxes when compared to the majority.

Fact: Neither the corporate tax laws nor the personal income laws of the country provide any exemption on religious grounds. Tax rates varies based on the income levels and every citizen of the country falling in the same tax bracket is subjected to same tax rate, irrespective of their religious affiliation. Even the corporate tax laws do not provide any relief on religious grounds. Hence the claim made in the post is FALSE.

In general, the taxation laws of the country do not provide any exemptions or rebates on the grounds of religion. The tax rates vary based only on the income levels. All individuals falling in the same income bracket are subjected to same tax rate, irrespective of their religious affiliation.

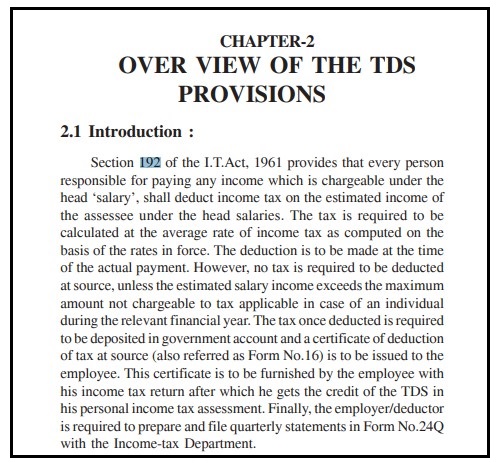

Income tax act, which deals with different rules and regulations that govern the taxation of individuals does not provide any concession based on religion or caste. Section 192 of the Income Tax Act, 1961 provides that every person responsible for paying any income which is chargeable under the head ‘salary’, shall deduct income tax on the estimated income of the assessee under the head salaries.

There is no reference of religion in this particular section which deals with the income tax deduction of every salaried employee of the country, which means there is no religion or caste based exemptions as far as the taxation of an individual is concerned.

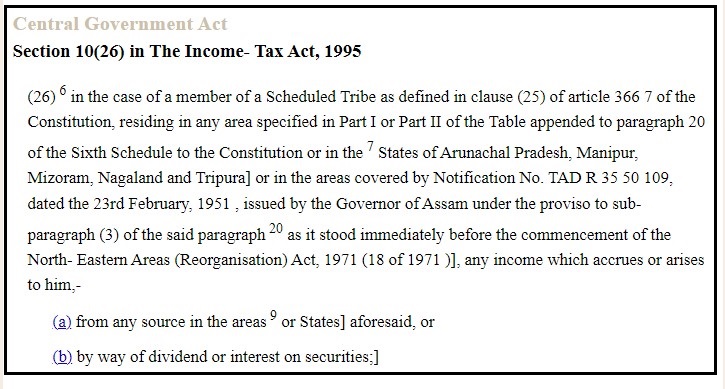

However, this act provides an exemption to tribal community of the north-east, section 10(26) of the Income Tax Act, provides income tax exemption to those belonging to Scheduled Tribes in states of Manipur, Mizoram, Nagaland & Tripura.

Except for the above mentioned exemption, there are no such reliefs provided to any individual on the grounds of religion. Apart from the income tax act which deals with individual income, even the corporate taxation laws of the country do not provide any relief on the grounds of religion.

Thus the question of minorities paying less tax as claimed in the post does not arise. However, as India is a Hindu majority country, the quantum of tax collected from Hindus will obviously be significantly higher when compared to the minorities (especially Muslims).

Further, it is noteworthy to mention that the fertility rate among Muslims is much less than what is claimed in the post. According to a survey conducted by the Union Health Ministry, ‘the fertility rate among Muslims has dropped to 2.3 during the 2019 to 2021 period, from 2.6 recorded in 2015-16’. The findings of the study are in contradiction to the claim made in the viral post.

To sum it up, taxation laws of the country do not provide any relief on religious grounds; Hindus & Muslims are subjected to same tax rates.