[orc]One of the ways to curb the flow of black money is to encourage electronic transactions in India and discourage the use of cash. Towards this, the Government has put out a draft proposal in the public domain proposing ways & means to promote electronic transactions. The government is seeking suggestions from the public on these proposals.

The Finance Minister in his budget speech for the year 2015-16 stressed on the need to discourage transactions in cash as one of the ways to curb the flow of black money. He also said that the government would soon introduce several measures that will incentivize credit or debit card transactions and disincentivize cash transaction. Currently, electronic transactions cost people more than a cash transaction. Most vendors and even government entities like IRCTC charge a transaction/convenience/service fee over and above the actual amount for all electronic transactions. Despite this, the number of electronic (card) transactions has been increasing at a steady pace of 10% per year.

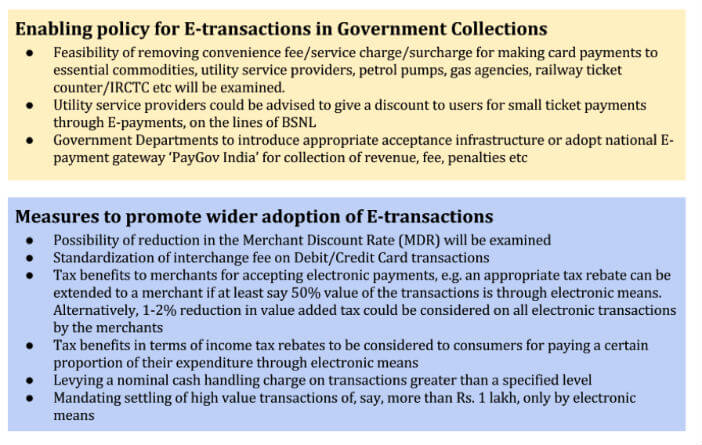

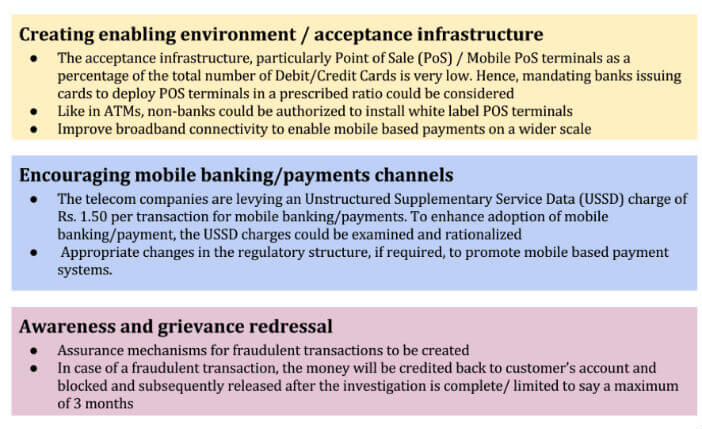

Now the government through policy intervention plans to incentivize electronic transactions. Accordingly, draft proposals for facilitating electronic transactions (E-transactions) have been prepared.

Objectives of the Proposal

The following are the objectives of this proposal.

- Improve the ease of conducting transactions for an individual

- Build a transactions history to enable improved credit access and financial inclusion.

- Reduce the risks and costs of carrying cash at the individual level.

- Reduce costs of managing cash in the economy.

- Reduce tax avoidance

- Reduce the impact of counterfeit money.

What kind of transactions is covered?

Electronic transactions are defined as transactions in which the customer authorizes the transfer of money through electronic means, and the funds flow directly from one account to another. These transfers could be done through means of cards (debit / credit), mobile wallets, mobile apps, net banking, Electronic Clearing Service (ECS), National Electronic Fund Transfer (NEFT), Immediate Payment Service (IMPS), or other similar means.

What does the Government Propose?

The government has come up with these proposals after due deliberations with various stakeholders like the RBI, NPCI, NIBM, public and private sector banks, card service providers, mobile service providers, research institutions, organizations working in this area and various government departments.

How does one share their opinion?

The Proposals mentioned above are only at the draft stage and have been placed in the public domain to elicit public opinion. The proposals do not imply any commitment from the government at this stage. Citizens wishing to share their opinion or suggestions can do so by 29th June, 2015 by 5:00 p.m here.

Featured Image: By Vk40471 [GFDL or CC BY-SA 3.0], via Wikimedia Commons

1 Comment

If RuPay card can be used for international purchases, it would be awesome.