[orc]The Finance Minister believes that India should slowly move towards greater use of Plastic Currency. The data available with the RBI shows that the use of Plastic Currency is growing at a steady pace with both transactions & amounts growing at more than 10% in one year. Public Sector Bank State Bank of India leads in ATMs & Debit Card transactions while the private banks lead in POS machines & Credit Card Transactions.

The Finance Minister Arun Jaitley reiterated that India should slowly move towards greater use of Plastic Currency like the developed world while speaking at a conference on ‘Make in India – Indigenisation of Currency’. With greater penetration of the banking system, it looks like India is on the right track. Card transactions grew by over 10% in one year (March 2014 to March 2015).

ATM & POS Penetration

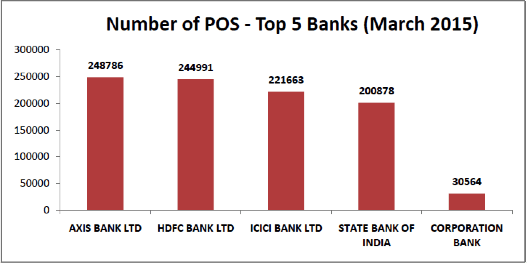

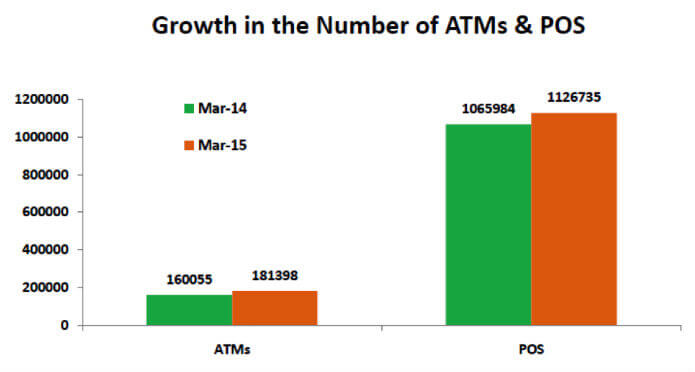

There is close to 13% increase in the number of ATMs & 6% increase in the number of POS (Point of Sale) machines between March 2014 and March 2015. While there were 1.6 lakh ATMs in March 2014, the number went up to 1.82 lakh in March 2015. Similarly, the number of POS machines went up to 11.3 lakh in March 2015 from 10.7 lakh in March 2014.

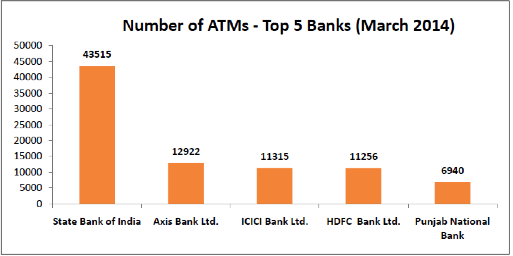

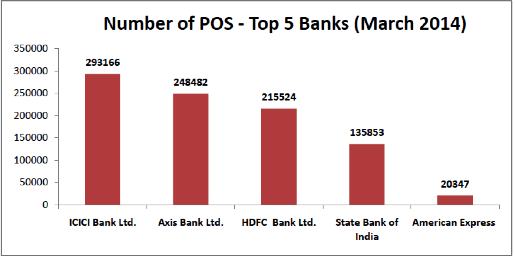

State Bank of India leads the pack with more than 40000 ATMs in both years. This is more than 3 times the number of ATMs of the next bank in the top 5. In fact, the number of ATMs of SBI is more than the combined total of the next four banks in the top 5. While SBI leads the number of ATMs, the private banks lead the number of POS machines with ICICI, HDFC & Axis Bank in the top three. This in a way indicative of the penetration of PSU banks in the rural areas while private banks have expanded their presence in the urban areas.

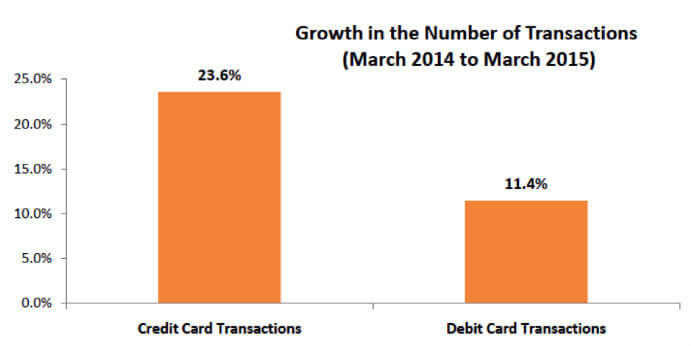

Growth in the Number of Transactions

Both the Credit & Debit card transactions (ATM & POS) grew substantially from March 2014 to March 2015. While the Credit Card transactions grew by 23.6%, Debit Card transactions grew by 11.4% during the same period. In terms of absolute numbers, 5.73 crore Credit Card transactions were made in March 2015 compared to 4.64 crore transactions in March 2014. The Debit Card transactions were far higher than the Credit Card transactions. While more than 70 crore Debit Card transactions were made in March 2015, 62.84 crore such transactions were made in March 2014. In other words, the number of Debit Card transactions was more than 12 times the number of Credit Card transactions in both years.

Volume of transactions follows the similar trend as the number of ATMs & POS. While the State Bank of India leads in the number of Debit Card transactions, private banks leads the number of Credit Card transactions.

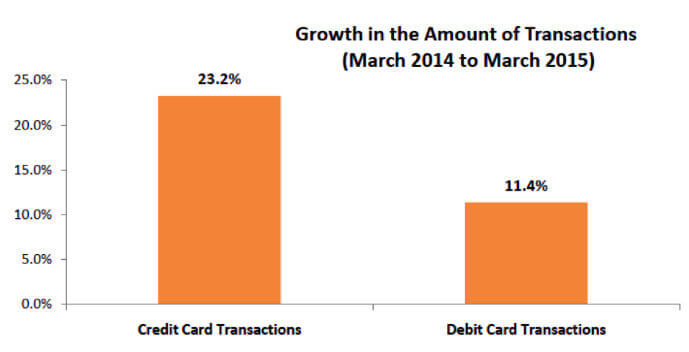

Amount of Transactions

The amount of transactions also follows the same trend as the number of transactions. The amount of Credit Card transactions grew by 23.2% while the amount of Debit Card transactions grew by 11.4%. A total of 14715 crore was the amount of Credit Card transactions in March 2014 while it stood at 18133 crore in March 2015. For Debit Card transactions, the amount was 1,88,187 crore in March 2014 and 2,09,576 crore in March 2015. The individual banks follow the trend similar to the number of transactions.

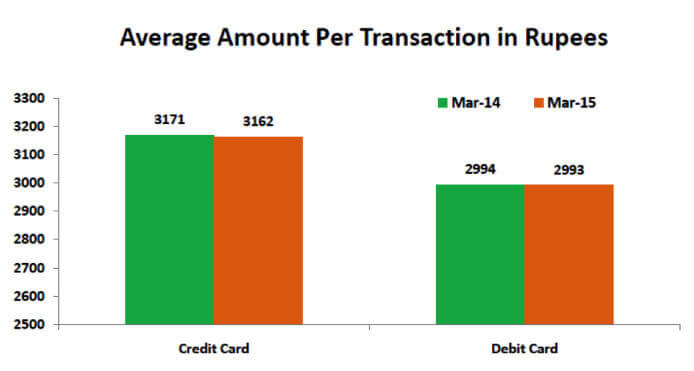

Debit Vs Credit Card

The average amount per transaction for Credit Cards is slightly more than the average amount per transaction for Debit Cards. While the amount for Credit Cards is more than 3100 rupees per transaction, it stands at more than 2990 rupees per debit card transaction.

Source: Data Releases, Reserve Bank of India

Featured Image: wikipedia commons