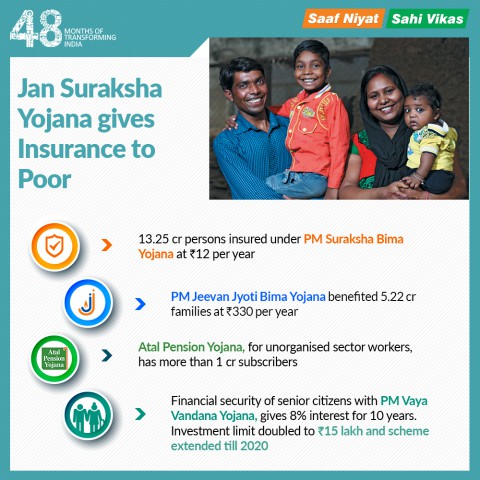

[orc]The BJP government published an infographic on the 48-months portal that makes four claims about the Jan Suraksha Yojana. This article is a fact check of those claims.

The BJP government published an infographic on the 48-months portal that makes four claims about the Jan Suraksha Yojana. This article is a fact check of those claims.

How many people have been insured under the PM Suraksha Bima Yojana?

The first claim is that ‘13.25 crore persons insured under PM Suraksha Bima Yojana at 12 rupees per year’.

The annual report (2017-18) of the Ministry of Finance states that to compliment the national mission for financial inclusion, ‘specific social security schemes have been launched in May 2015, for all eligible account holders. Pradhan Mantri Suraksha Bima Yojana (PMSBY) offers insurance of Rs. 2 lakh against accidental death/permanent disability and Rs. 1 lakh for partial disability due to accident, at annual premium of Rs. 12 for savings bank account holders (18-70 years)’.

The same report also states that ‘the scheme is offered & administered through Public Sector General Insurance Companies (PSGICs) and 8 other General Insurance companies offering the product on similar terms. The initial cover period from 1st June 2015 to 31st May 2016 now stands renewed every year from 1st of June to 31st May the next year. 13.25 crore account-holders have insured themselves for personal accident cover under PMSBY till December 2017’. It also states that a total of 14,292 claims have been paid.

It is also necessary to note that, though not entirely this integrated and not focused on accidents, a similar scheme existed during the UPA government as well. A response in Lok Sabha states that ‘Ministry of Labour and Employment is implementing the Rashtriya Swasthya Bima Yojana (RSBY) to provide smart card based cashless health insurance, including maternity benefit, cover of Rs. 30,000 per annum on family floater basis to BPL families (a unit of five). Apart from BPL families, RSBY coverage has been extended to various other categories of unorganised workers viz. Building & Other Construction workers, licensed Railway porters, Street Vendors, MGNREGA, Beedi workers, Domestic workers, Sanitation workers, Mine workers, Rickshaw pullers, Rag pickers and Auto/Taxi drivers. As on 17.02.2014 more than 3.77 crore families are availing the benefits of the scheme across the country’.

Claim: 13.25 crore persons insured under PM Suraksha Bima Yojana at an annual premium of 12 rupees per year.

Fact: 13.25 crore account-holders have insured themselves for personal accident cover under PMSBY till December 2017, at annual premium of Rs. 12. Hence the claim is TRUE.

How many people benefitted from the PM Jeevan Jyoti Bima Yojana?

The second claim is that ‘PM Jeevan Jyoti Bima Yojana benefitted 5.22 crore families at 330 rupees per year’.

The Annual report (2017-18) of the Ministry of Finance states ‘the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) offers life insurance of Rs. 2 lakh at an annual premium of Rs. 330 for bank account holders (18-50 years) .The scheme was also launched in May 2015’.

The report also further details that ‘PMJJBY offers renewable annual life cover of Rs. 2 lakh to all subscribing bank account holders in the age group of 18 to 50 years, covering death due to any reason, for a premium of Rs.330 per annum per subscriber. The scheme is administered through LIC and 10 other Life Insurance companies offering the product on similar terms at the choice of the Bank / RRB / Cooperative Bank concerned’.

As per the latest information shared by the government in the Lok Sabha, the total enrollment under this scheme is 5.33 crore in 2017-18 and the total number of claims in 2017-18 is 89766.

Claim: PM Jeevan Jyoti Bima Yojana benefitted 5.22 crore families at 330 rupees per year.

Fact: A total of 5.33 crore families enrolled under this scheme in 2017-18. Since it is a life insurance scheme, enrollment is not equal to receiving benefits. While the number of enrollments is true, the claim that all the enrolled families benefitted is MISLEADING.

How many subscribers does the Atal Pension Yojana have?

The third claim is that ‘Atal Pension Yojana, for unorganised sector workers, has more than 1 crore subscribers’.

The Annual report (2017-18) of the Ministry of Finance states that ‘Atal Pension Yojana (APY) offers guaranteed minimum monthly pension between Rs. 1000 and Rs. 5000 after age of 60 years to subscribers (18-40 years) based on their contribution’.

It goes onto state that ‘Atal Pension Yojana (APY) was launched in May 2015. This aims to provide monthly pension to eligible subscribers not covered under any organized pension scheme. APY is open to all bank account holders in the age group of 18 to 40 years. Under APY, any subscriber can opt a guaranteed pension of Rs 1000 to Rs 5000 (in multiples of Rs. 1,000) receivable at the age of 60 years. The contributions to be made vary based on pension amount chosen. The Central Government would co-contribute 50% of the total contribution or Rs. 1,000 per annum, whichever is lower, for a period of 5 years for those eligible subscribers who joined the scheme between the period 1st June, 2015 and 31st March, 2016 and who are not members of any statutory social security scheme and who are not income-tax payers’.

It is further mentioned that ‘as on 30th December 2017, 79.20 lakh subscribers have been enrolled under APY’. However, a more recent reply in Lok Sabha states that ‘as on 10th December 2018, 1.33 crore subscribers have been enrolled under APY’.

Claim: Atal Pension Yojana, for unorganised sector workers, has more than 1 crore subscribers.

Fact: Atal Pension Yojana (APY) aims to provide monthly pension to eligible subscribers not covered under any organized pension scheme. As of December 2018, 1.33 crore subscribers have enrolled under APY. Hence, the claim is TRUE.

What is the PM Vaya Vandana Yojana?

The fourth claim is that ‘Financial security of senior citizens has been ensured with PM Vaya Vandana Yojana, that gives 8% interest for 10 years and investment limit doubled to Rs. 15 lakh rupees and scheme extended till 2020’.

The Annual report (2017-18) of the Ministry of Finance states that ‘Government has also launched a scheme namely Pradhan Mantri Vaya Vandana Yojana (PMVVY )to protect elderly persons aged 60 and above against a future fall in their interest income due to the uncertain market condition, as also to provide social security during old age. The scheme is being implemented through Life Insurance Corporation (LIC) of India. The scheme provides an assured return of 8% per annum payable monthly for 10 years. The differential return i.e. the difference between return generated by LIC and the assured return of 8% per annum would be borne by Government of India as subsidy on annual basis’.

‘As per the scheme, on payment of an initial lump sum amount ranging from a minimum purchase price of Rs. 1,50,000 for a minimum pension of Rs 1,000 per month to a maximum purchase price of Rs. 7,50,000 for maximum pension of Rs. 5,000 per month, subscribers will get an assured pension based on a guaranteed rate of return of 8% per annum, payable monthly. LIC had conducted soft launch of the scheme in May 2017. The duration of the scheme will be for a period of ten years and the scheme is open for subscription for a period of one year i.e. from 4th May, 2017 to 3rd May, 2018. As of December 2017, a total of number of 1,96,641 subscribers consisting corpus of Rs.9163.93 crore are being benefited under PMVVY’.

A document on the LIC website states that ‘Government of India in the budget speech of 2018-19 has announced the enhancement of maximum limit under Pradhan Mantri Vaya Vandana Yojana to Rs. 15 lakhs per senior citizen. The period of sale for this scheme has also been extended up to 31st March, 2020’.

As per government data, 2.95 lakh persons are covered under the scheme as of July 2018.

Claim: Financial security of senior citizens with PM Vaya Vandana Yojana, gives 8% interest for 10 years. Investment limit doubled to 15 lakh rupees and scheme extended till 2020.

Fact: Pradhan Mantri Vaya Vandana Yojana (PMVVY) provides an assured return of 8% per annum payable monthly for 10 years. The maximum limit under the scheme has been enhanced to 15 lakhs rupees per senior citizen and the period of sale for this scheme has been extended to 31st March, 2020. Hence, the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here