[orc]The government made certain claims on the MUDRA & Stand Up India scheme. Here is a fact check.

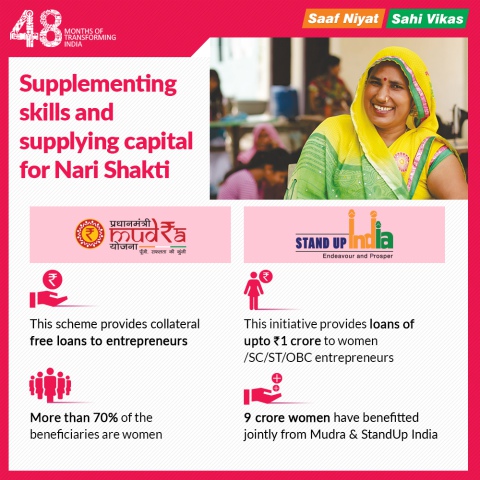

The BJP government published an infographic on the 48 months portal, that has four claims on MUDRA & Stand Up India scheme. This article is a fact check of the claims made.

What is the MUDRA scheme?

The first claim is that ‘MUDRA: This scheme provides collateral free loans to entrepreneurs’.

The Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched in April 2015 for providing loans up to Rs. 10 lakhs to the non-corporate, non-farm Micro & Small enterprises (MSEs). All such loans are classified as MUDRA loans under PMMY. These loans are extended by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through the portal.

The application for loans under the MUDRA scheme require proof of identity, proof of residence, quotation of machinery etc but the Banks are not supposed to take any processing fee and are not supposed to ask for any collateral.

However, it has to noted that the focus on the MSME sector is not a new phenomenon. The first NDA government launched the Credit Guarantee Fund Scheme for MSMEs in August 2000 to provide guarantee cover for collateral free credit facilities extended to micro and small enterprises (MSEs). During the UPA, the Government had constituted a Prime Minister’s Task Force on Micro, Small & Medium Enterprises (MSME) in September 2009, which submitted its report in January 2010. The report had made recommendations in the areas of credit, marketing, labour issues, rehabilitation and exit policy, infrastructure/technology/skill development, taxation and special measures for North-Eastern Region and Jammu & Kashmir.

Among other things, the recommendations of the task force also include advice to the banks to achieve a 20% year-on-year growth in credit to MSEs and a 10% annual growth in the number of micro enterprise accounts. The banks have also been advised that the allocation of 60% of the MSE advances to the micro enterprises is to be achieved in stages viz., 50 per cent in the year 2010-11, 55 per cent in the year 2011-12 and 60 per cent in the year 2012-13. Many other steps were also recommended and some were implemented during the previous government.

The PMMY being implemented by the current government is a dedicated scheme for MSEs that led to the establishment of Micro Units Development & Refinance Agency Ltd (MUDRA). MUDRA bank is essentially a refinancing institution and does not directly lend loans to end customers. Rather, the loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.

Claim: MUDRA: This scheme provides collateral free loans to entrepreneurs.

Fact: PMMY is a scheme launched in April 2015 for providing loans up to Rs. 10 lakhs to the non-corporate, non-farm Micro & Small enterprises (MSEs) without any processing fee or collateral. Hence, the claim is TRUE. However, the focus on credit to the MSME sector is not a new phenomenon.

Are 70% of the MUDRA beneficiaries’ Women?

The second claim is that ‘MUDRA: More than 70% of the beneficiaries are women’.

The PMMY website has year wise performance reports on the website. Data from these reports suggests that out of a total of 12.27 crore loan accounts under the MUDRA scheme between 2015-16 and 2017-18, 9.03 crore belong to women entrepreneurs and 6.71 crore belong to SCs/STs/OBCs. Hence the percentage of loan accounts belonging to women is around 74%.

Claim: MUDRA: More than 70% of the beneficiaries are women.

Fact: Out of a total of 12.27 crore loan accounts under the MUDRA scheme between 2015-16 and 2017-18, 9.03 crore belong to women entrepreneurs. Hence, the claim is TRUE.

What is Stand up India initiative?

The third claim is that ‘Stand up India: This initiative provides loans of up to 1 crore rupees to women/SC/ST/OBC entrepreneurs’.

Government of India launched the Stand Up India scheme in April 2016. Stand Up India scheme caters to promoting entrepreneurship amongst Women, SC & ST category i.e. those section of the population facing significant hurdles due to lack of advice/ mentorship as well as inadequate and delayed credit. The scheme intends to leverage the institutional credit structure to reach out to these underserved sectors of the population in starting greenfield enterprise. It caters to both ready and trainee borrowers. The Scheme facilitates bank loans between Rs.10 lakh and Rs.1 crore to at least one Scheduled Caste/ Scheduled Tribe borrower and at least one Woman borrower per bank branch of Scheduled Commercial Banks for setting up greenfield enterprises in trading, manufacturing and services sector.

To extend collateral free coverage, Government of India has set up the Credit Guarantee Fund for Stand Up India (CGFSI). The scheme is built on the concept of providing handholding support to those borrowers who might have a project in mind but lack the confidence and capability to start up. It also provides for convergence with Central/State Government schemes. Applications under the scheme can also be made online. An online tracking system in the dedicated Stand Up India portal is being utilized. As of December 2018, more than 68000 loans have been sanctioned under the scheme out of which 53,284 are disbursed.

It also has to be noted that there are multiple schemes for the economic development of the Scheduled Castes (SCs) and the Scheduled Tribes (STs) that have been implemented even during the UPA.

Claim: Stand up India: This initiative provides loans of up to 1 crore rupees to women/SC/ST/OBC entrepreneurs.

Fact: The Stand Up India scheme caters to promoting entrepreneurship amongst women, SC & ST category. The Scheme facilitates bank loans between Rs.10 lakh and Rs.1 crore to at least one Scheduled Caste/ Scheduled Tribe borrower and at least one Woman borrower per bank branch of Scheduled Commercial Banks for setting up greenfield enterprises in trading, manufacturing and services sector. Hence, the claim is TRUE.

Did 9 crore women benefit from MUDRA and Stand up India?

The fourth claim is that ‘9 crore women have benefitted jointly from MUDRA and Stand up India’.

The PMMY website has year wise performance reports on the website. The data shows that 9.03 crore accounts under the MUDRA scheme belong to women. The annual report (2017-18) of the Standup India mission shows that 41,639 women have benefitted from the scheme. This means that a total of more than 9 crore women have benefitted from both the schemes.

Claim: 9 crore women have benefitted jointly from MUDRA and Stand up India.

Fact: 9.03 crore women under the MUDRA scheme and 41,639 women under the stand up India were benefitted. Hence, the claim is TRUE.

This story is part of a larger series on the 4-years of the Modi government. This series has been made possible with the flash grant of the International Fact Checking Network (IFCN). Read the rest of the stories in this series here