[orc]Making certain claims about the MUDRA scheme, the BJP government published an infographic on the 48-months portal. This article is a fact check of the claims.

Making certain claims about the MUDRA scheme, the BJP government published an infographic on the 48-months portal. This article is a fact check of the claims.

What is the MUDRA scheme?

The Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched in April 2015 for providing loans up to Rs. 10 lakhs to the non-corporate, non-farm Micro & Small enterprises (MSEs). All such loans are classified as MUDRA loans under PMMY. These loans are extended by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online through the portal.

However, it has to noted that the focus on the MSME sector is not a new phenomenon. The first NDA government launched the Credit Guarantee Fund Scheme for MSMEs in August 2000 to provide guarantee cover for collateral free credit facilities extended to micro and small enterprises (MSEs). During the UPA, the Government had constituted a Prime Minister’s Task Force on Micro, Small & Medium Enterprises (MSME) in September 2009, which submitted its report in January 2010. The report had made recommendations in the areas of credit, marketing, labour issues, rehabilitation and exit policy, infrastructure/technology/skill development, taxation and special measures for North-Eastern Region and Jammu & Kashmir.

Among other things, the recommendations of the task force also include advice to the banks to achieve a 20% year-on-year growth in credit to MSEs and a 10% annual growth in the number of micro enterprise accounts. The banks have also been advised that the allocation of 60% of the MSE advances to the micro enterprises is to be achieved in stages viz., 50 per cent in the year 2010-11, 55 per cent in the year 2011-12 and 60 per cent in the year 2012-13. Many other steps were also recommended and some were implemented during the previous government. PMMY being implemented by the current government is a dedicated scheme for MSEs that led to the establishment of Micro Units Development & Refinance Agency Ltd (MUDRA). MUDRA bank is essentially a refinancing institution and does not directly lend loans to end customers. Rather, the loans are given by Commercial Banks, RRBs, Small Finance Banks, Cooperative Banks, MFIs and NBFCs.

How many Women and SC/ST/OBCs have received these loans?

The first claim is that of the total loan accounts, 76% are of women and more than 50% belong to SCs, STs and OBCs.

The PMMY website has year wise performance reports on the website. Data from these reports suggests that out of a total of 12.27 crore loan accounts under the MUDRA scheme between 2015-16 and 2017-18, 9.03 crore belong to women entrepreneurs and 6.71 crore belong to SCs/STs/OBCs. Hence the percentage of loan accounts belonging to women is around 74% while those belonging to SCs/STs/OBCs is around 55%.

Claim: Of the total loan accounts, 76% are of women and more than 50% belong to SCs, STs and OBCs.

Fact: Data from performance reports of PMMY suggests that out of a total of 12.27 crore loan accounts under the MUDRA scheme between 2015-16 and 2017-18, 9.03 crore belong to women entrepreneurs and 6.71 crore belong to SCs/STs/OBCs. Hence the percentage of loan accounts belonging to women is around 74% while those belonging to SCs/STs/OBCs is around 55%. Hence the claim is TRUE. However, it has to be noted that focus on the MSE sector is not a new phenomenon.

How many small entrepreneurs were benefitted under the MUDRA scheme?

The second claim is that collateral free loans were provided for 12 crore small entrepreneurs under MUDRA. The annual report available on the MUDRA Yojana page states that, ‘NBFCs have emerged as the most effective and powerful vehicle for delivering financial assistance to the Micro and Small Enterprises which are otherwise not being catered by the conventional banking system due to reasons of weak documentation, lack of collateral security, shortage of capital, etc. Share of NBFCs in credit to MSME sector rose to 18% in FY 2017-18 from 8% five years ago. The NBFC’s share should expand to 22-23% by March 2022. Further with the deteriorating asset quality of Public Sector Banks and invocation of PCA by RBI against 11 Public Sector Banks, MSMEs will become more reliant on NBFCs for their credit needs’.

According to an answer provided in Lok Sabha in August 2018, over 13.47 crore loans amounting to more than Rs. 6.37 lakh crores have been sanctioned under PMMY as of August 2018. Out of these 13.47 crore loan accounts, 12.23 crore loans were provided under the SHISHU category (loans covering up to Rs. 50,000). In other words, close to 90% of the loans under PMMY were provided to small entrepreneurs.

Claim: Collateral free loans for 12 crore small entrepreneurs under MUDRA.

Fact: Out of these 13.47 crore loan accounts under PMMY till August 2018, 12.23 crore were provided under the SHISHU category (loans covering up to Rs. 50,000). In other words, close to 90% of the loans under PMMY were provided to small entrepreneurs. Hence, the claim is TRUE.

Has the corporate tax rate been slashed?

The last claim is that corporate tax rate has been slashed to 25% for companies with annual turnover up to Rs. 250 crores from the existing Rs. 50 crores.

As stated in a response in Lok Sabha in July 2015, ‘The Government has in Budget 2015-16 announced reduction of the rate of Corporate Tax from 30% to 25% over the next four years along with rationalisation and removal of various kinds of tax exemptions and incentives for corporate taxpayers, which incidentally account for a large number of tax disputes. The reduction in Corporate Tax rate along with the removal of existing deductions and incentives for corporate tax payers shall be implemented through appropriate legislative amendments to be carried out through the Finance Bill’.

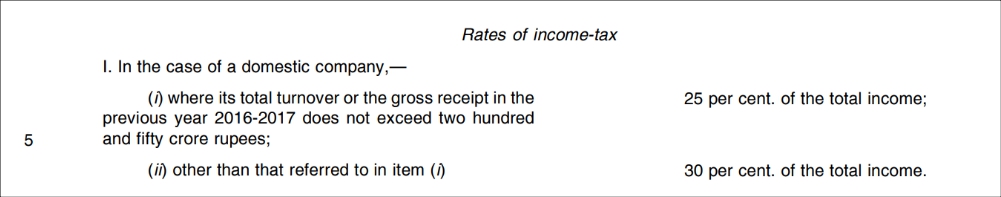

In a more recent answer in Lok Sabha in March 2018, it has been stated that , ‘the Finance Bill, 2018, introduced in the Parliament on 1st February, 2018, proposes to provide for reduced corporate income tax rate of 25 per cent in the case of a domestic company where its total turnover or the gross receipt in the previous year 2016-2017 does not exceed two hundred and fifty crore rupees’.

The Finance Bill 2018 states that, ‘in the case of domestic companies, the rate of income-tax shall be 25% of the total income where the total turnover or gross receipts of previous year 2016-2017 does not exceed Rs. 250 crores and in all other cases the rate of income-tax shall 30% of the total income’.

Claim: Corporate tax rate slashed to 25% for companies with annual turnover up to 250 crore rupees from 50 crore rupees.

Fact: The finance bill of 2018 provides for 25% corporate tax rate for companies whose annual turnover does not exceed Rs. 250 crores in 2016-2017. Hence, the claim is TRUE.